Unusual Options Activity in International Game Technology (IGT), DraftKings (DKNG), Tempur Sealy International (TPX)

Unusual Options Activity in International Game Technology PLC (IGT)

Today, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in International Game Technology PLC (IGT), which opened at $23.82.

There was an order sized at 10,000 contracts traded on the $28 strike call option at the ask, dated for October 15th, 2021, representing 1,000,000 shares.

Additionally, there were 2,250 contracts traded on the $30 strike call option at the bid, dated for November 19th, 2021, representing another 225,000 shares.

These orders come after additional unusual options activity we reported yesterday.

Seen above are the noteworthy options orders in International Game Technology from the Unusual Whales Flow.

These orders come after reports earlier this month that IGT has created a dedicated Digital & Betting business unit, comprising its iGaming and sports betting activities.

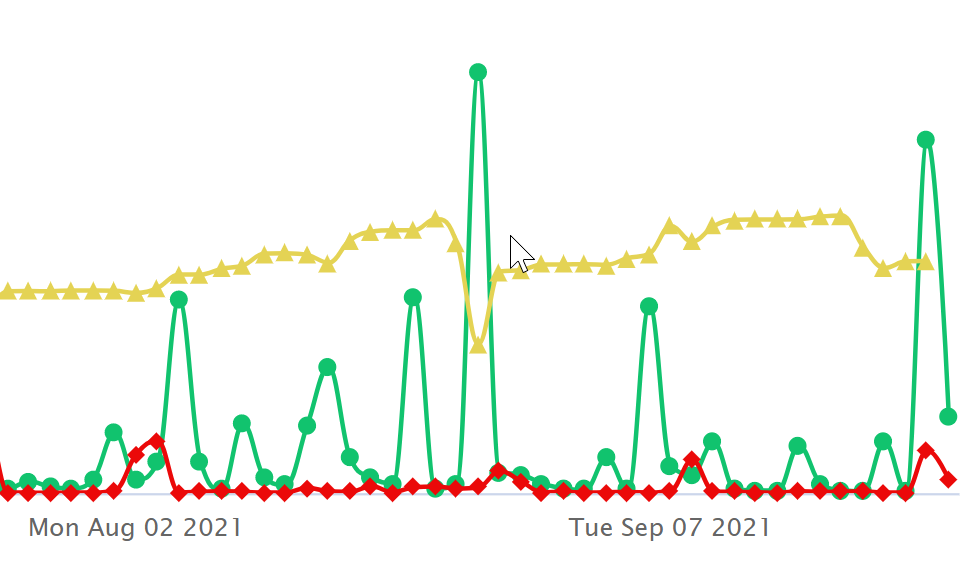

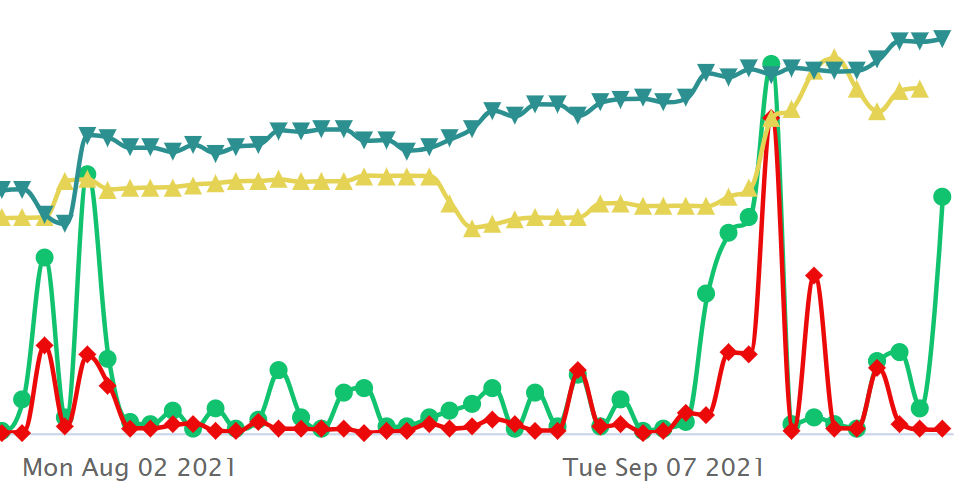

Per the chart above, representing International Game Technology’s daily price, in blue, there was a high today of 25,223 calls volume in green. Call volume has decreased since yesterday’s high of 115,193, however the overall flow remains 54.4% bullish.

To view more information about IGT's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in DraftKings Inc. (DKNG)

Among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in DraftKings Inc. (DKNG), which opened today at $51.58.

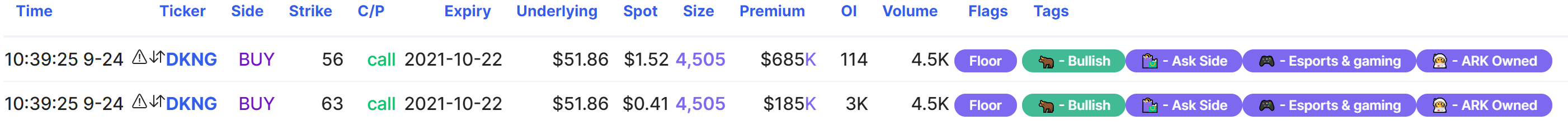

There was an order sized at 4,505 contracts traded on the $56 strike call option at the ask, dated for October 2nd, 2021, representing 450,500 shares.

Additionally, there was an additional lot of 4,505 contracts traded on the $63 strike call option at the ask for the same date, representing another 450,500 shares.

Seen above are the noteworthy options orders in DraftKings Inc. from the Unusual Whales Flow.

These orders comes after more positive reports of DraftKing making a $20,000,000,000 ($20B) order for Entain.

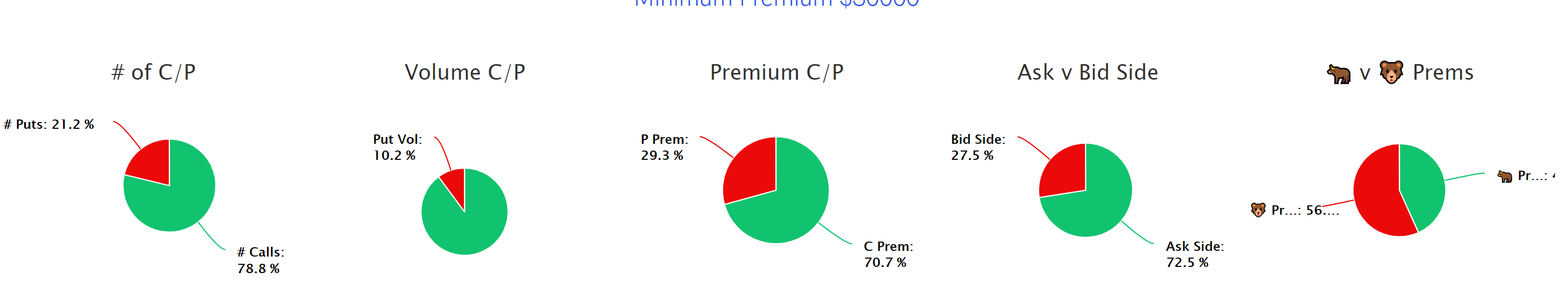

Per the charts above, representing DraftKings Inc.’s option chain breakdown for minimum premiums of $30,000 or more, call premium activity has overtaken puts, along with calls traded volume and their requisite premiums, however, overall, bearish premium still holds 56% of options flow data.

To view more information about DKNG's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Tempur Sealy International, Inc. (TPX)

Finally, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Tempur Sealy International, Inc. (TPX), which opened at $270.00.

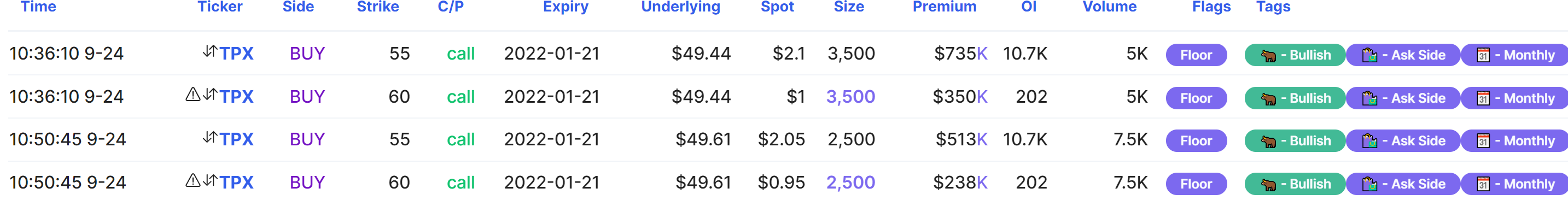

There were a series of 3,500 contracts traded on the $55 strike call option at the ask, dated for January 21st, 2021, representing approximately 350,000 shares for every order.

Additionally, there were a series of 3,500 contracts traded on the $60 strike call option at the ask, for the same date, representing another 350,000 shares for every order.

Seen above are the noteworthy options orders in Tempur Sealy International, Inc. from the Unusual Whales Flow.

These orders come after reports that Tempur Sealy International (TPX) said Tuesday it priced its offering of $800 million of 3.875% senior notes due 2031.

Per the chart above, representing Tempur Sealy International, Inc.’s daily price, in blue, there was a high today of 15,379 call volume in green. That call volume was 930% greater than TPX’s 30 day average call volume.

To view more information about TPX's flow breakdown, click here to visit unusualwhales.com.

For further information on the unusual options activity of IGT, DKNG, and TPX visit unusualwhales.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.