Unusual Options Activity in Advanced Micro Devices (AMD), Pinterest (PINS), and Shake Shack (SHAK)

Unusual Options Activity in Advanced Micro Devices, Inc. (AMD)

Today, October 13, 2021, in the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Advanced Micro Devices, Inc. (AMD), which opened at $106.28.

There were 1,832 contracts traded on the $125 strike call option, dated for September 16th, 2022, representing approximately 183,200 shares.

Seen above are the noteworthy options orders in Advanced Micro Devices, Inc. from the Unusual Whales Flow.

These orders would be considered LEAPs, or long-term equity anticipation securities, the type of which we have presented analysis on already.

These orders come in after InvestorPlace’s report revealing that: “Out of 15 analysts on TipRanks, 11 have a “buy” rating with an average price target of $116.21.”

The charts above represent Advanced Micro Devices, Inc.’s option flow data with regards to premiums greater than $30,000.

As seen, bullish premium accounts for 78.8% of whales’ trading. Call premium represents 92.8% of premium traded, as well as 85% of the volume of options flow.

To view more information about AMD's daily flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Pinterest, Inc. (PINS)

In the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity today in Pinterest, Inc. (PINS), which opened at $51.80.

These orders were possibly related, having came in together:

- There were 10,070 contracts traded on the $57.5 strike call option, sold at the bid, dated for November 19th, 2021.

- Additionally, there were another 10,070 contracts traded on the $42.5 strike put option, bought at the ask, for the same date.

These orders came in as a cross trade, meaning a broker executed the orders by matching buy and sell orders across different accounts and then reported them on a singular exchange; because of this, it does not necessarily mean that a singular entity has taken this exact position.

Seen above are the noteworthy options orders in Pinterest, Inc. from the Unusual Whales Flow.

These orders come after reports where Mr. Matt Frankel of The Motley Fool has opined that: “Pinterest has done a great job increasing monetization recently.”

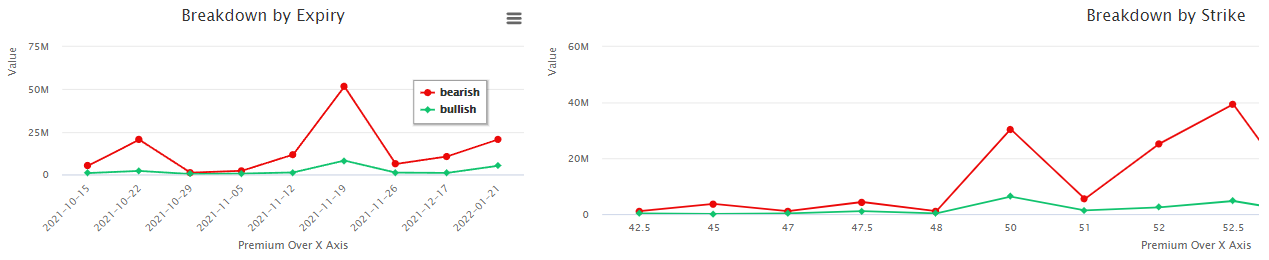

The charts above represent Pinterest, Inc.’s chain breakdowns of $1,000 premium whales, with expirations on the left and strikes on the right.

As can be seen, in spite of an overall bullish sentiment by analysts, the majority of betting is short-term, dated for November 19th, 2021, with bearish premium overtaking bullish $51 million to $8 million respectively; the most popular strikes are $52.5 and $50, with $52.5 having $39 million of premium betting compared to just $4.6 million of bullish betting.

To view more information about PINS's flow breakdown, click here to visit unusualwhales.com.

Unusual Options Activity in Shake Shack Inc. (SHAK)

Finally, within the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity today in Shake Shack Inc. (SHAK), which opened at $75.14.

Seen above are the noteworthy options orders in Shake Shack Inc. from the Unusual Whales Flow.

These orders come just after October 11th reports that Piper Sandler adjusted their price target on Shake Shack to $100 from $131 and maintained an overweight rating.

The charts above represent Shake Shack Inc.’s option flow data with regards to premiums greater than $1,000.

As seen, bullish premium represents 77% of the options traded, ask-side orders at 54%, with calls making up 60% of the volume and 48.8% of the premium traded.

To view more information about SHAK's flow breakdown, click here to visit unusualwhales.com.

For further information on the unusual options activity of AMD, PINS, and SHAK visit unusualwhales.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.