Unusual Options Activity & Dark Pool Volumes on Globalstar (GSAT), Katapult Holdings (KPLT), and Skillz (SKLZ)

Unusual Options Activity & Dark Pool Volumes on Globalstar, Inc. (GSAT)

Today, among the underlying components of the NYSE American, we saw unusual or noteworthy dark pool and options trading volumes and activity on Globalstar, Inc. (GSAT). These orders come before a rumor that Globalstar, Inc. has been named as a "likely partner" for Apple's (Symbol: AAPL) new iPhone 13, which is expected to support satellite calling.

In the chart below is Globalstar, Inc.’s historical price, in blue, since July 20th, 2021, and its requisite dark pool volumes seen in gray. There was noteworthy dark pool volume of 963,299 units on August 19th, highlighted below, and 475,420 units seen thus far today, August 30th.

Per the chart below, there has been 183,915 call volume today, August 30th, as compared to the high around June 22nd of 149,884 call volume. Open interest, seen in yellow, has remained at a mean of 535,068 as of Friday’s close. GSAT’s average three day call volume is 4,800, meaning this is an approximate 3832% increase over its three day average.

For more information about GSAT’s unusual options or dark pool activity, visit unusualwhales.com.

Unusual Options Activity & Dark Pool Volumes on Katapult Holdings, Inc. (KPLT)

Additionally, among the underlying components of the NYSE, we saw noteworthy dark pool trading on Katapult Holdings, Inc. (KPLT).

Seen below is Katapult Holdings, Inc.’s historical price, in blue, since July 20th, 2021, and its requisite dark pool volumes seen in gray. There was also noteworthy or unusual dark pool volume highlighted today, August 30th, amounting to 93,058 units traded, compared to the previous dark pool volume on August 17th amounting to a volume of 111,434 units. Katapult Holdings (KPLT) shares have risen 37% as of this morning, adding to Friday's gains.

Per the chart below, there was a regional high of 33,235 call volume, represented in green, on August 10th. Open interest, in yellow, has decreased to 78,819 as of Friday, the 27th, from 131,574 on August 20th, 2021. At the time of this writing, today’s call volume is 83,102, with volume of calls now at 68.3% compared to puts at 31.7%; call premium is 66.5% and put premium is 33.5%.

For more information about KPLT’s unusual options or dark pool activity, visit unusualwhales.com.

Unusual Options Activity & Dark Pool Volumes on Skillz Inc. (SKLZ)

Additionally, among the underlying components of the NYSE, we saw noteworthy dark pool trading on Skillz Inc. (SKLZ).

Seen below is Skillz Inc.’s historical price, in blue, since July 20th, 2021, and its requisite dark pool volumes seen in gray. There was also noteworthy or unusual dark pool volume highlighted August 18th, 2021, amounting to 3,295,317 units traded, compared to the previous dark pool volume high on August 10th amounting to a volume of 2,767,086 units.

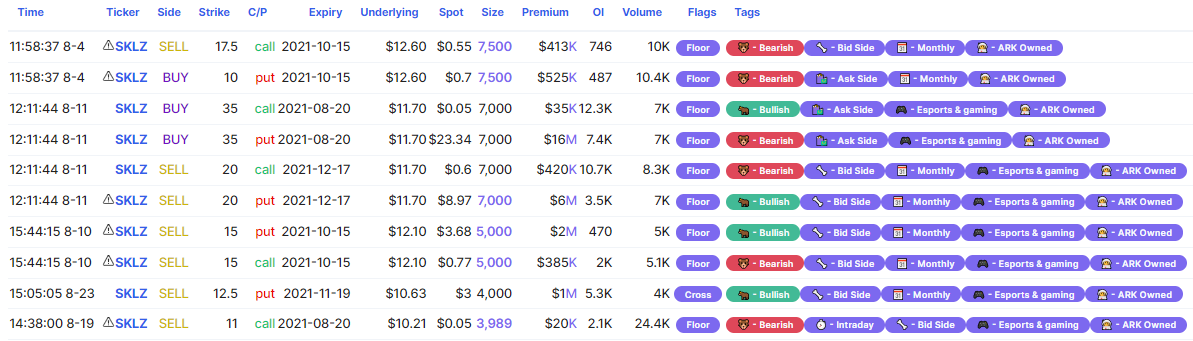

There has been and remains significant betting on call option contracts, with a put-call ratio of approximately 1:3. The most active chains are the September 3rd, 2021 $11 strike call option, the October 15th, 2021 $12.50 strike call option, and the September 3rd, 2021 $11.50 strike call option, with respective volumes of 2,486, 1,828, and 1,302 today, as of this writing. Seen below is Skillz Inc.’s historical option flow data, sorted by the size of the orders.

Click here to view these orders on unusualwhales.com.

In the charts below, Skillz Inc.’s chain breakdowns of premium are visualized by expiration, on the left, and strike, on the right.

On the September 17th, 2021 expiration, there is now approximately $2,303,012 bullish premium traded, in green, compared to the bearish premium, in red, totaling approximately $2,075,082. On the right chart, it is seen that the most active strike is now at the $12.5 strike with similar premiums, bullish of $2,572,695 in green, and bearish of $2,595,388 in red.

For further information on the unusual options and dark pool activities of GSAT, KPLT, and SKLZ, visit unusualwhales.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%2C%20Katapult%20Holdings%20(KPLT)%2C%20and%20Skillz%20(SKLZ)%20%7C%20Nasdaq&_biz_n=1&rnd=838611&cdn_o=a&_biz_z=1742243782244)

%2C%20Katapult%20Holdings%20(KPLT)%2C%20and%20Skillz%20(SKLZ)%20%7C%20Nasdaq&rnd=851627&cdn_o=a&_biz_z=1742243782248)