Understanding the Stress on Valuation Resulting from Dividend Policy & ROIC Profile

- By Dan Romito, Nasdaq Advisory

Since the beginning of February 2020, certain pricing and volatility dynamics within the S&P 500 have emerged that may provide valuable insight into potential institutional portfolio adjustments. The economic unknowns resulting from COVID-19 have resulted in unprecedented volatility reminiscent of the Financial Crisis.1 Unfortunately, prioritizing strategic outreach with investors during this type of crisis is difficult because of the degree of irrational activity currently existent within the market. Accordingly, our team’s analysis indicates certain ROIC and dividend payout profiles display greater potential vulnerabilities. Our team’s analysis on trading patterns may be helpful to corporates to address risk among their current investors with possibly a greater degree of efficiency.

As volatility patterns stemming for COVID-19 continue to materialize, it may be increasingly beneficial to understand the respective impacts that are unique to different sectors along with generalists. Our team’s analysis indicates that the ROIC profiles that are more reliant on asset turnover typically correspond with a greater price volatility and lagging performance. Even though this trend is observable, it is worth highlighting this perspective is not yet statistically significant. In other words, our team’s analysis suggests a meaningful trend, but in terms of causation versus correlation, the analysis does not yet statistically make that determination. To be fair, finding rationality during irrational times is probably a stretch to begin with. However, our team’s analysis is intended to identify cautionary trends rather than function as an academic whitepaper. Therefore, this analysis is intended as an actionable extrapolation rather than a comprehensive statistical analysis.

Based on the data, our analysis suggests the trading patterns developing within the S&P 500 Consumer Discretionary sector may potentially characterize unique fundamental vulnerabilities that apply to all sectors. Our perspective is predicated on reviewing daily volatility and median daily price of the sector-based fundamental profiles. “Daily Volatility” is defined as the standard deviation of daily price change over the last forty-five calendar days while “Median Daily Return” reflects the median percent change of price for the same period. Next to Energy & Financials, Consumer Discretionary displays the greatest degree of daily volatility. Further, the only other sector that has performed worse than Consumer Discretionary over the time period evaluated is Energy.

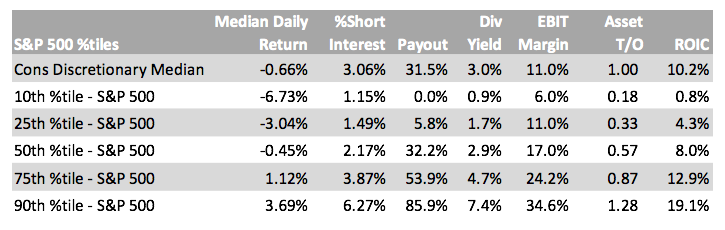

When reviewing the fundamentals and pricing characteristics, the chart below reflects the most recent performance metrics available for each company within the S&P 500.2 The inherent price struggles and volatility displayed by Energy and Financials may not be too surprising, but after reviewing the fundamental attributes of Consumer Discretionary, we feel investors are placing an increased emphasis on payout ratios, asset turnover and operating margin. As previously indicated, we are not claiming these observations are statistically significant. Instead, we are explicitly stating that after evaluating trends within pricing, short interest, investor behavior and fundamental performance, there appears to be vulnerability associated with above-mentioned metrics. We feel corporates should review their own profile to understand the intersection between the vulnerabilities highlighted below and their respective investment thesis.

When Impressive ROIC Potentially Becomes Undesirable

Any interpretation of the fundamentals and pricing characteristics highlighted in the chart above depend on the acceptance of the following key points and assumptions:

- Consumer Discretionary offers “middle of the road” dividend yield, payout and ROIC

- Regardless of these “middle of the road” attributes, Consumer Discretionary also displays the largest median percentage of short interest, the third largest amount of median daily volatility and second worst median daily return since February 1, 2020

- Although some of sector’s drivers are probably intuitive, corporates with a similar dividend payout policy and ROIC mechanics should take notice of the market’s developing perspective on capital deployment

With those points acting as the basis for interpretation, the derivation of ROIC may be more telling than its absolute calculation. In other words, for the purposes of valuation and volatility, how ROIC generated could potentially be more important than the value reflected in the calculation. Conventional finance generally defines Return on Invested Capital as the ratio between Net Operating Profit and Invested Capital. However, if we review the ratio only at face value, we are not necessarily able to understand the particular drivers of respective performance.

Once again, the how may be more important than the what. A higher relative ROIC only (understandably so) implies an attractive degree of capital efficiency – it does not necessarily address the sustainability of the metric. We feel the absolute calculation of ROIC can be somewhat misleading. More importantly, the derivation of ROIC may explain the degree of volatility not only within Consumer Discretionary, but among other companies that display similar performance & capital deployment attributes as well.

Based on our anecdotal experience based on a variety of conversations with the institutional community, we feel many investors tend to weigh the derivation of ROIC, not necessarily the number itself, with greater scrutiny when making investment decisions. In this context, Return on Invested Capital is the product between Operating Margin and Asset Turnover (i.e. Revenue / Assets) as opposed to Operating Profit divided by Invested Capital. Sensitivity of exposure is therefore reliant upon understanding the dynamic between operating margin and the amount of revenue generated per dollar of asset. Based on our analysis, we feel an overreliance, as opposed to a balance, on either component defining ROIC may enhance a portfolio manager’s sensitivity to exposure.

For example, based on the most updated fundamentals available, Consumer Discretionary impressively displays the third highest median Return on Invested Capital (10.2%). However, the composition of ROIC within the sector reveals a fascinating dynamic. Regardless of sector’s impressive ROIC, the respective operating margin compared to other sectors (11%, bottom quartile relative to the overall S&P 500) ranks second to last. Thus, Consumer Discretionary ROIC is reliant upon the amount of revenue generated per dollar of assets. Since we observe that ROIC within Consumer Discretionary is largely dependent on asset turnover, and consequently revenue, we feel the downward effect of distressed future revenues may display a relatively larger impact among those respective companies.

To ensure this dynamic existed beyond Consumer Discretionary, we examined the percentile breakdown of appropriate fundamental metrics for the entire S&P 500. Next, we isolated companies that displayed an ROIC above the market median (8%), but also reflected an EBIT Margin that fell in the bottom quartile (i.e. less than 11%) along with an asset turnover in the top quartile (i.e. above 0.87). As of March 27, thirty-six companies share this trait - 14 Consumer Discretionary, 7 Industrial, 4 Consumer Staples, 4 Healthcare, 4 Information Technology and one each for Real Estate, Materials and Energy. So while Consumer Discretionary dominates the profile, by no means is it solely a sector-specific occurrence. More importantly, the median short interest exhibited for these thirty-six companies over the same evaluated time frame (February 1st to March 27th) is slightly higher than 2.4%, which is not only greater than the market median, but greater than every sector median besides Consumer Discretionary and Energy as well.

We feel this dynamic is not coincidental and provides corporates some valuable intel that may be utilized in a proactive manner when attempting to understand investor behavior. In short, after about a month into COVID-19, we feel issuers displaying the discussed ROIC profile may possess a greater degree of company-specific risk.

When Impressive, But Undesirable, ROIC Negatively Impacts Valuation

Intuitively, our examination also suggests that corporates may want to consider three other key items when deciphering risk and formulating messaging:

- In this current situation, it may be fair to assume that, relatively speaking, margin control, which is difficult, remains easier to manage relative to revenue generation

- Both our analysis and experience reasonably suggests that an ROIC profile displaying a greater reliance on asset turnover may generate a higher degree of volatility and greater difficultly in modeling future “valuation spread,” or the difference between ROIC and cost of capital

- Greater volatility in a valuation spread generally impacts a greater degree of uncertainty in pricing multiples, which would be reflected in both short interest patterns and price fluctuations

The adverse impacts of the ROIC dynamic discussed may be compounded when particular capital deployment strategies enter into mix. Specifically, Consumer Discretionary offers a dividend yield and corresponding payout ratio that closely resembles the market median (300 bps v. 290 bps, respectively and 31.5% v. 32%, respectively). A greater reliance on asset turnover may imply a greater degree of potential stress on payout during this market downturn.

This relative reliance may not only create a greater relative convergence in valuation spread, but also may increase payout ratios to potentially unsustainable levels. This dynamic helps explain both the amount of short interest in the space and poorer relative median daily price performance. Volatility of daily price is in part, the market’s expressing relative difficulty in establishing what future revenue generation rates look like.

Investors also tend to proxy traditional pricing multiples by analyzing the spread between return on invested capital and the corresponding cost of capital. In short, as this respective spread increases, company valuation may increase. Conversely, assuming cost of capital were to remain constant (which is a best-case scenario in this environment), if ROICs were to contract, subsequent valuations would clearly take a hit. Therefore, for dividend-paying corporates that currently display attractive ROIC but lagging margin, it may be helpful to understand the particular vulnerability their investment profile implies.

Our work indicates that payout ratios in-line or above the market median (32%) may be more vulnerable to enhance volatility when combined with above-market median ROIC (8%) and bottom quartile operating margin (11%). It may sound counterintuitive that respectable ROIC could potentially enhance volatility, but as we have observed, the determining catalyst is based on how ROIC has been generated. When asset turnover is compensating for lagging operating margin, the future sustainability of ROIC may be more at-risk, which may also compound the difficulties in supporting the future dividend. For this reason, corporates may want to consider if they may be operating with a false sense of security when displaying higher ROIC.

Nasdaq IR Intelligence is staying focused on helping you engage your investors, understanding the markets and ensuring you have an effective plan for the months ahead. Management and IR teams are constantly assessing the optimal capital allocation strategy for their company. With the market pulling back due to the spread of COVID-19, those capital allocation assessments are becoming more important and commonplace. We’ve recently put together a whitepaper, Anticipating Investor Reactions to Capital Allocation Decisions. Nasdaq Corporate Services’ Strategic Capital Intelligence team leverages unique data and analytics, parsing transcripts and surfacing buy-side insights to assess the capital allocation landscape. Click here to access now.

1. Referring to the Global Financial Crisis of 2007

2. The analysis utilized the most recent available financials as of March 25, 2020

Other Topics

Coronavirus Stocks Investing Dividends Nasdaq Advisory ServicesContact Us