Fintel reports that on August 3, 2023, Truist Securities maintained coverage of Costco Wholesale (NASDAQ:COST) with a Buy recommendation.

Analyst Price Forecast Suggests 2.17% Upside

As of August 2, 2023, the average one-year price target for Costco Wholesale is 564.35. The forecasts range from a low of 469.65 to a high of $666.75. The average price target represents an increase of 2.17% from its latest reported closing price of 552.35.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Costco Wholesale is 249,005MM, an increase of 6.24%. The projected annual non-GAAP EPS is 14.82.

What is the Fund Sentiment?

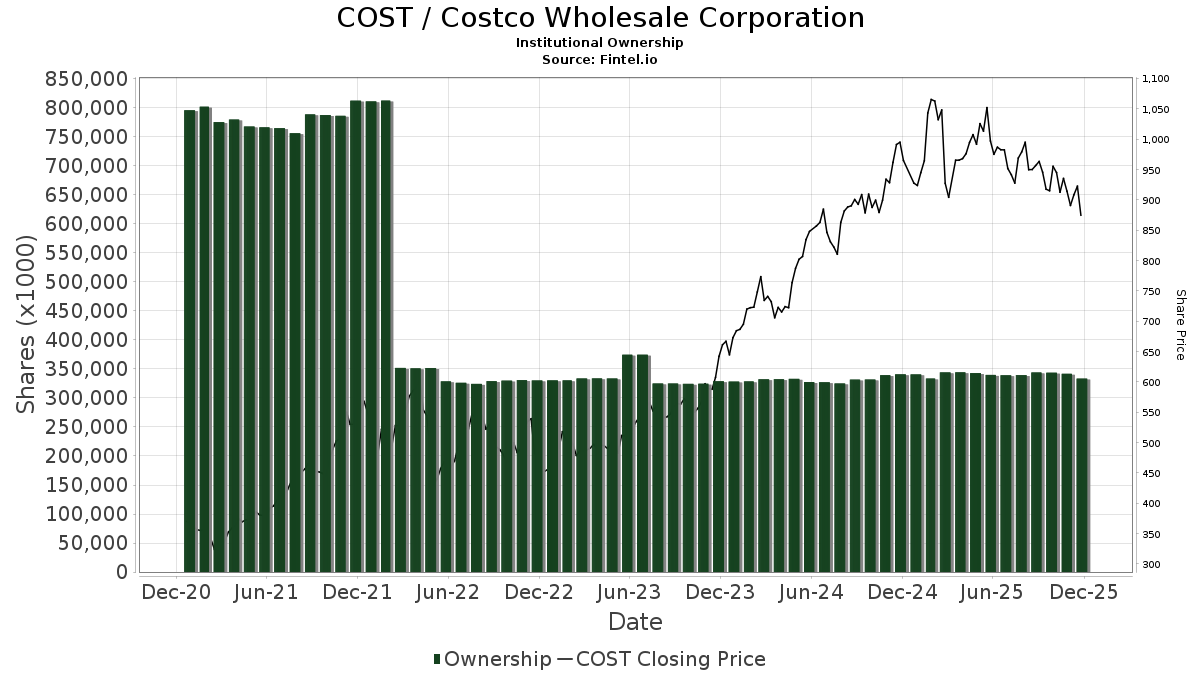

There are 4093 funds or institutions reporting positions in Costco Wholesale. This is an increase of 10 owner(s) or 0.24% in the last quarter. Average portfolio weight of all funds dedicated to COST is 0.78%, an increase of 7.22%. Total shares owned by institutions decreased in the last three months by 2.67% to 324,887K shares.  The put/call ratio of COST is 1.25, indicating a bearish outlook.

The put/call ratio of COST is 1.25, indicating a bearish outlook.

What are Other Shareholders Doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 13,735K shares representing 3.10% ownership of the company. In it's prior filing, the firm reported owning 13,453K shares, representing an increase of 2.05%. The firm increased its portfolio allocation in COST by 2.61% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 10,354K shares representing 2.34% ownership of the company. In it's prior filing, the firm reported owning 10,232K shares, representing an increase of 1.18%. The firm increased its portfolio allocation in COST by 2.15% over the last quarter.

Geode Capital Management holds 8,210K shares representing 1.85% ownership of the company. In it's prior filing, the firm reported owning 8,099K shares, representing an increase of 1.36%. The firm increased its portfolio allocation in COST by 2.04% over the last quarter.

Bank Of America holds 8,124K shares representing 1.83% ownership of the company. In it's prior filing, the firm reported owning 7,770K shares, representing an increase of 4.36%. The firm increased its portfolio allocation in COST by 2.62% over the last quarter.

Bank of New York Mellon holds 5,852K shares representing 1.32% ownership of the company. In it's prior filing, the firm reported owning 5,596K shares, representing an increase of 4.38%. The firm increased its portfolio allocation in COST by 8.75% over the last quarter.

Costco Wholesale Background Information

(This description is provided by the company.)

Costco Wholesale Corporation is an American multinational corporation which operates a chain of membership-only big-box retail stores. The company offers sundries, dry groceries, candies, coolers, freezers, liquor, and tobacco and deli products; appliances, electronics, health and beauty aids, hardware, garden and patio products, sporting goods, tires, toys and seasonal products, office supplies, automotive care products, postages, tickets, apparel, small appliances, furniture, domestics, housewares, special order kiosks, and jewelry; and meat, produce, service deli, and bakery products.

Additional reading:

- Statement of Eligibility of Trustee.

- COSTCO WHOLESALE CORPORATION REPORTS THIRD QUARTER AND YEAR-TO-DATE OPERATING RESULTS FOR FISCAL YEAR 2023

- COSTCO WHOLESALE CORPORATION ANNOUNCES AN INCREASE IN ITS QUARTERLY CASH DIVIDEND

- Eleventh Amendment to Citi, N.A. Co-Branded Credit Card Agreement

- COSTCO WHOLESALE CORPORATION REPORTS SECOND QUARTER AND YEAR-TO-DATE OPERATING RESULTS FOR FISCAL YEAR 2023 AND FEBRUARY SALES RESULTS

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.