“The only way you get a real education in the market is to invest cash, track your trade and study your mistakes.” ~ Jesse Livermore

What is a Post Analysis?

What do Tom Brady, Ted Williams, and Jesse Livermore share in common? Each of these legends studied the past extensively (conducted a post analysis) to become the best in their respective fields. A deep knowledge of football strategy and off-field work allowed Tom Brady to lead his New England Patriots to a record seven Super Bowl victories. Though Brady had no unique “intangibles” (a slightly above-average arm but was very slow), his off-the-field study set him apart from his competitors. Meanwhile, baseball legend Ted Williams achieved a batting average of .400% by studying his past performance in detail. In fact, though swinging a baseball bat may seem straightforward, Williams wrote a whole book titled “The Science of Hitting.”

Like the sports legends mentioned above, Jesse Livermore became the most prolific person in his field through extensive self-study and post-analysis. While most investors hyper-focus on finding the next hot stock, Livermore focused just as hard on studying himself in addition to the market. Livermore took self-analysis so seriously that during the last Friday of December, he gathered all his trades for the year and made the bank manager lock him in the vault for the entire weekend so that he could analyze every trade he made in excruciating detail. Livermore is not the only industry legend who has done an extensive post analysis. I also got to witness the importance of conducting an extensive post-analysis during my time working for legendary investor William O’Neil.

Below are five steps to conduct a post analysis:

1. Record your Best & Worst Trades of 2024

Navigate to the “Gain/Loss” section of your brokerage account. Next, sort by “$ Gain” and “$ Loss” and record your ten best and worst trades of 2024.

2. Mark Up Your Trades

Mark on the chart where you bought and sold each stock. Then, do your best to detail why you took the trade from a technical, fundamental, industry, or market perspective. Below is an example of my best trade from 2024, a 257% gain in MicroStrategy (MSTR) in two months.

Image Source: TradingView

3. Industry Analysis

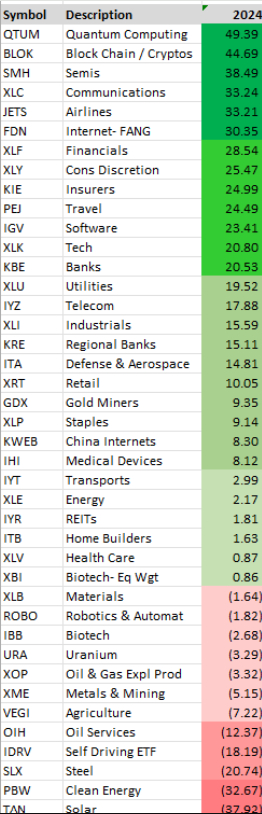

Analyze the strongest and weakest industries of the year and read about what drove each move. Strong 2024 industry groups included crypto, quantum computing, artificial intelligence, and commercial airlines. Weak 2024 industry groups included clean energy, steel, and biotech.

Image Source: Christian Fromhertz

4. Stocks Missed

Sort your trading universe by 2024 performance to monitor which stocks performed the best. Savvy investors understand that trends tend to persist much longer than most ordinary investors anticipate. In other words, the most straight-forward way to find the next stock to double is to monitor stocks that already have. Remember, on Wall Street, strength begets strength. Below is a list of 2024’s top performers in the S&P 500 Index, which include names like Palantir (PLTR), Vistra (VST), Nvidia (NVDA), and United Airlines (UAL).

Image Source: Zacks Investment Research

5. Keep a Trader Journal in the Future

If you did not keep a journal in 2024, be sure to do so in the New Year. A trading journal does not need to be overly complex, record where you bought the stock, where you sold, and what was the idea behind the trade. You can use a spreadsheet like Microsoft Excel to record your trades. The more detail, the better, but consistency beats complexity.

Bottom Line

Though tedious, a post-analysis is a worthwhile endeavor for investors of all levels. Like a football player must study tape to improve their mental game and strategy, a savvy investor must do the same. Take some time during a weekend in January to conduct a 2024 post-analysis – you won’t regret it.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.