Changing presidential administrations brings policy uncertainty

With a new presidential administration incoming later this month, there’s been a lot of discussion about potential changes to various policies – from tax to trade to regulation – creating some “policy uncertainty.”

Of course, this type of uncertainty is nothing new when administrations change – nor is it specific to the US. That’s why economists have constructed indexes to track policy uncertainty around the world, often incorporating a count of news article mentions of uncertainty for different policies.

Uncertainty indexes can track broad economic policy or a subset like trade policy

There are a couple types of these indexes that are especially relevant currently – broad economic policy uncertainty and narrower trade policy uncertainty.

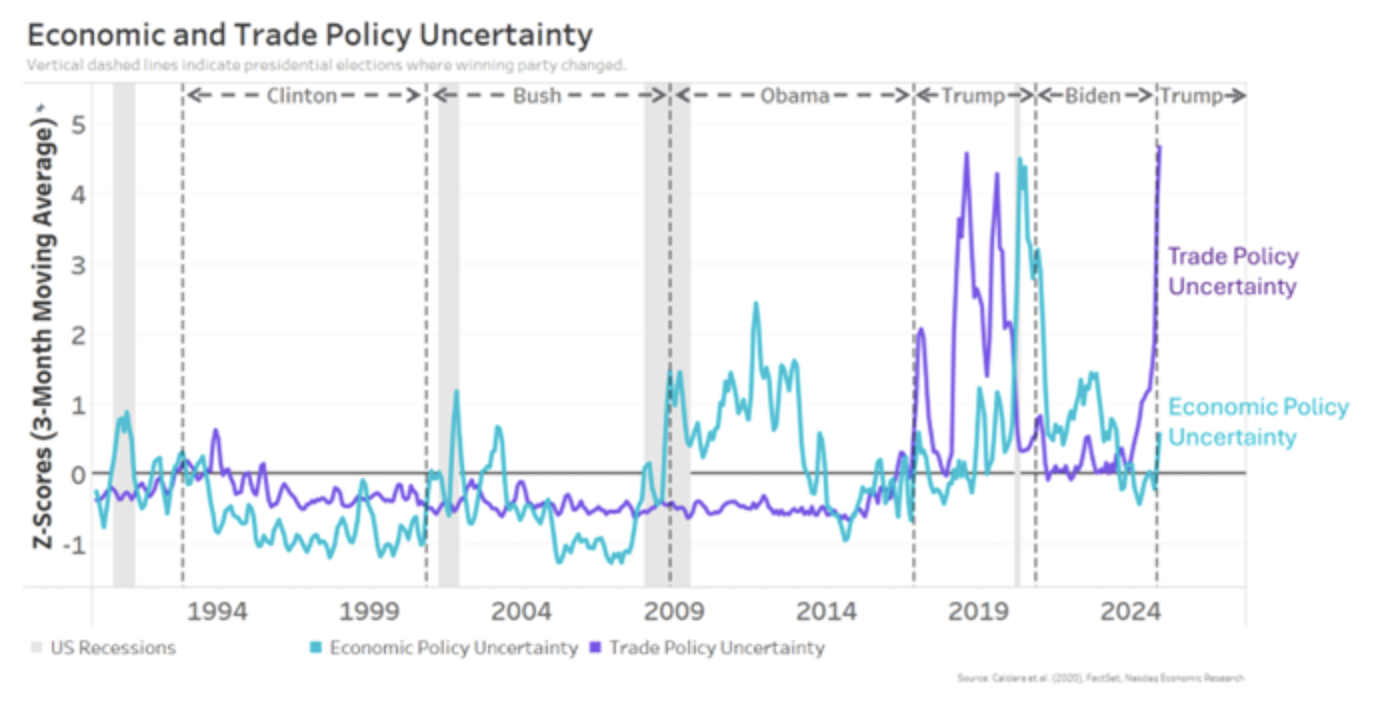

Going back to 1990, economic policy uncertainty (chart below, blue line) has been the more volatile of the two, typically rising around recessions (grey shaded areas) and falling during expansions (white areas). Right now, it remains close to its historic average (zero line) – as it did in President Trump’s first term (until the pandemic recession).

Trade policy uncertainty (purple line), however, saw comparatively mild fluctuations from 1990 until the first Trump administration, when it increased as President Trump reintroduced tariffs. And since the latest election, we’ve seen trade policy uncertainty rise back to the highs last seen in President Trump’s first term.

History shows markets react to economic policy uncertainty, not trade policy uncertainty

Since there’s the old Wall Street saying that “markets hate uncertainty,” you might think this increase in trade policy uncertainty would be bad for markets.

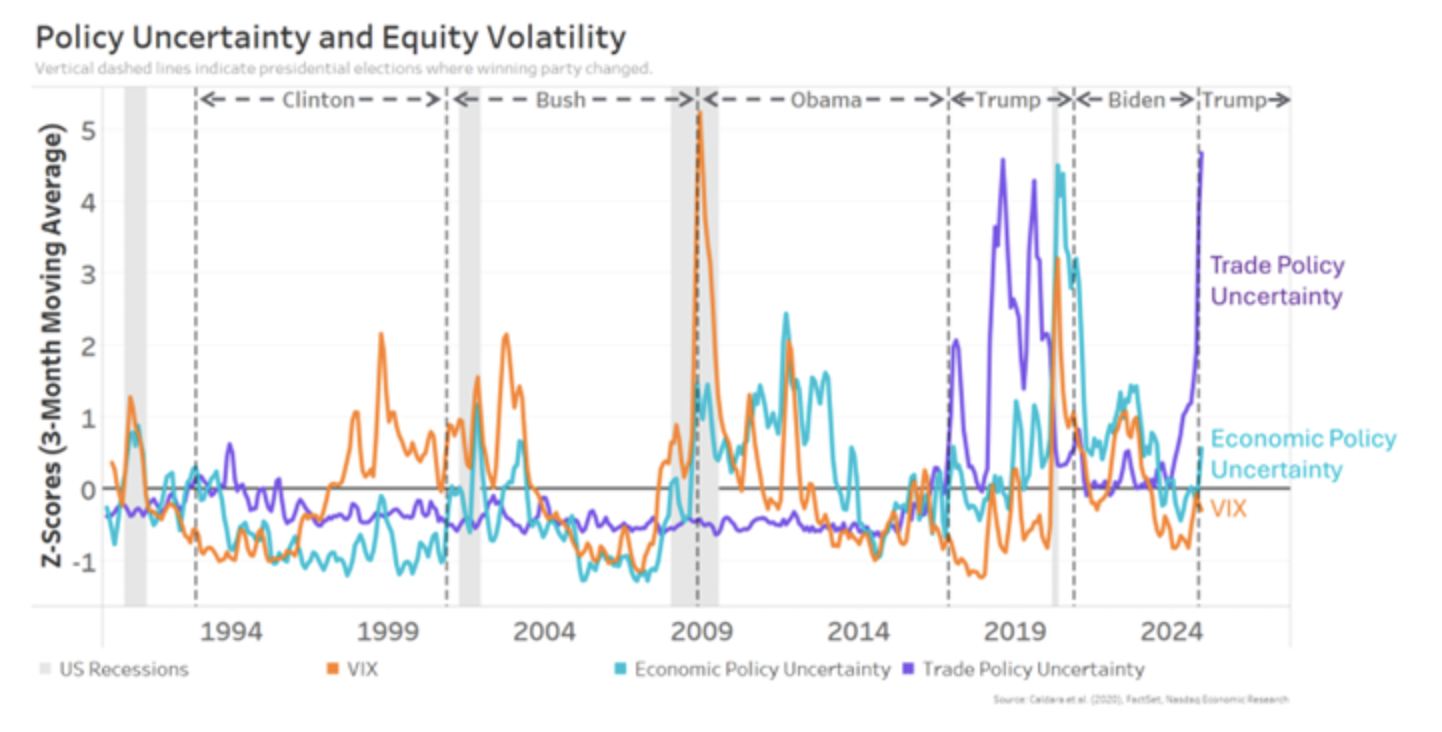

Yet, when you overlay the VIX equity volatility metric (chart below, orange line) with trade policy uncertainty, you can see there’s no real relationship.

When trade policy uncertainty hit historic highs in 2018, 2019, and now, the VIX typically stayed below its average since 1990 (indicated by negative numbers in chart). Not to mention that the S&P 500 and Nasdaq-100 have each hit 10 new record highs since election day.

But the chart does show that markets hate economic policy uncertainty.

When we see jumps in economic policy uncertainty, we also see jumps in the VIX. And when we see above-average economic policy uncertainty (positive numbers), we also usually see above-average VIX readings (positive numbers).

Of course, these spikes and above-average readings go hand-in-hand with recessions, which naturally create uncertainty about how economic policy should respond (especially since last two recessions were historically bad) and drive market selloffs.

Narrower scope of trade policy limits its impact on markets

This gets at the main difference between economic policy and trade policy. Economic policy is broad, while trade policy is narrow, making it less important to the overall health of the economy.

So, if history is a guide, when uncertainty is limited to trade policy, the impact on markets also tends to be limited.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.