Trade Ideas | June 2021 AI Dashboard: Monthly Sector Transactions and Rotations

The Trade Ideas June 2021 report below comprises:

- The Trade Ideas Trade of the Week for each week in June

- A summary showing the number of times that HOLLY traded in the industry and what was the profit or loss associated with those trades

- About Trade Ideas

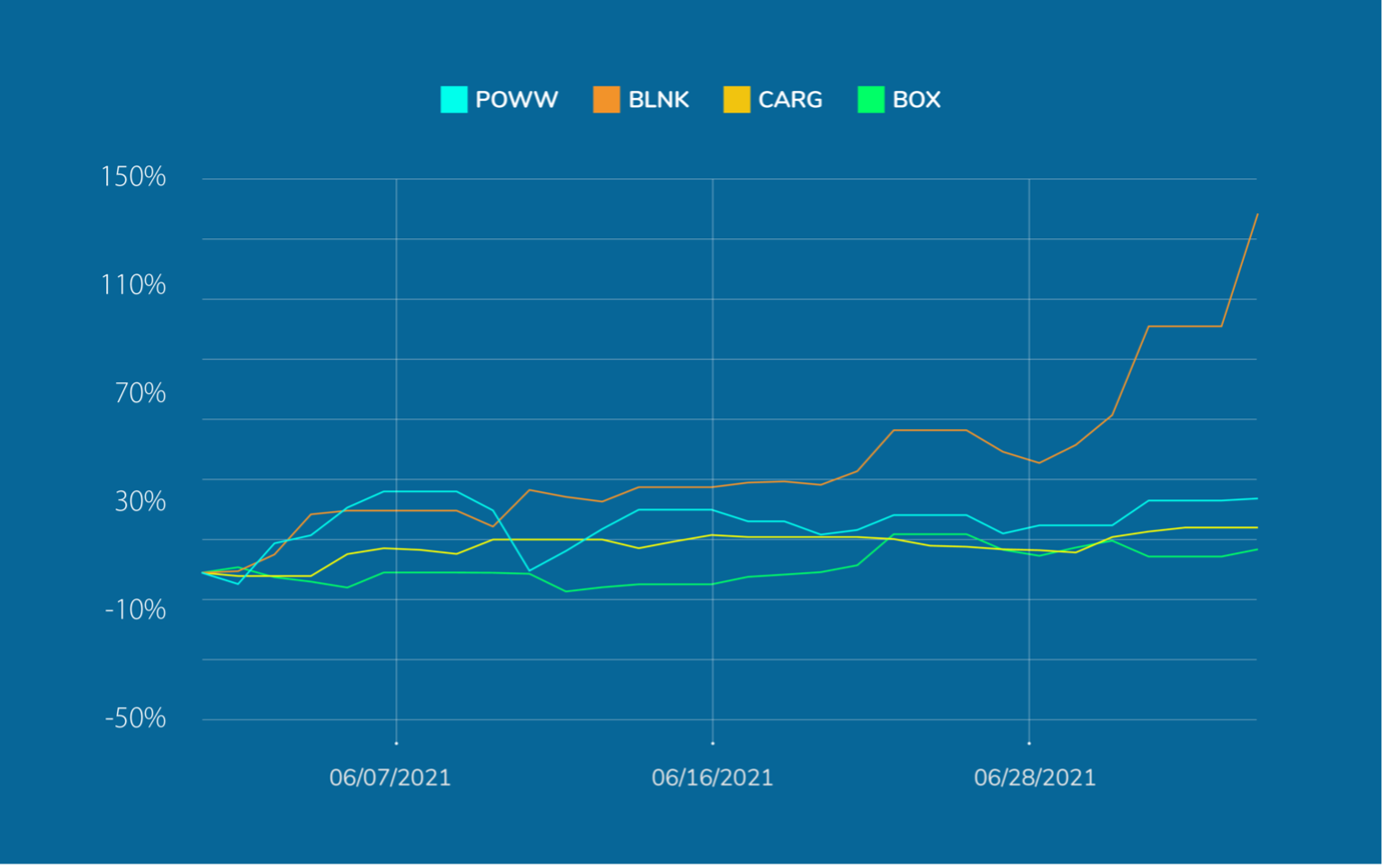

Trade of the Week for June

BOX, Inc (BOX) Many times in our webinars, we talk of the need to see a counter move before the real move higher. Oftentimes this counter move will start with a jam down to touch the moving averages before the quants and market makers decide to reverse course. Box has that look about it. On Friday, BOX had a morning shakedown to the 50-sma before reversing course and closing strong with above average volume on the day. BOX has been on the radar for many traders here at Trade Ideas and we have been waiting for the right moment. We feel the right setup is now here again for BOX to make a move higher up and out of this recent consolidation.

CarGurus, Inc. (CARG) We have spoken many times about the solid support of the 50-day simple moving average. This moving average has basically held up the SP500 over the last year. CarGurus had earnings back in May. Since then, the consolidation of price seems to be testing the weak hands by pulling back to the 50-day moving average and bouncing with a nice bottoming-tail candle on Friday. These types of entries seem to be safer than cheering for a breakout of sideways consolidation these days.

Blink Charing Co (BLNK) We use Trade Ideas to help narrow down the field of high short float candidates. It always comes down to a matter of timing when selecting the Trade of the Week. Last week, we noticed the data points on Blink Charging but the chart had gotten ahead of itself and the timing was not right. This week, BLNK sets up perfectly in terms of timing. The action in BLNK last week was mostly consolidation, which allows us the opportunity this week with a great chart setup. The float of BLNK is only 36 million shares and 37% of that number is supposed to be held by short sellers. Any short covering stock buy-backs in this Electric Vehicle play could produce rapid moves higher with such amount of shares in circulation.

AMMO, Inc. (POWW) Many times people become enamoured with the business model or some recent news of the company. But when it comes right down to it, the only thing that matters is what the chart and the price action look like. The footprints in the sand tell us the real story. Last Friday, Smith and Wesson (SWBI) crushed their earnings and had a giant move higher. There have also been many recent stories about ammunition shortages for retail consumers. Couple these two recent revelations and a company like AMMO starts to seem attractive in concept. But, does the chart confirm the story? Yes it does.

Trade Ideas’ Machine Learning AI:

HOLLY, June 2021 Overall Performance

Over the course of June 2021 HOLLY strategized a total of 84 trades down from 241 in May. Overall performance was a decrease of 2.0%, compared to the SPY at 4.58%. Overall, HOLLY’s performance in a high volatility and event driven environment continues to fall within acceptable trading scenarios as described below.

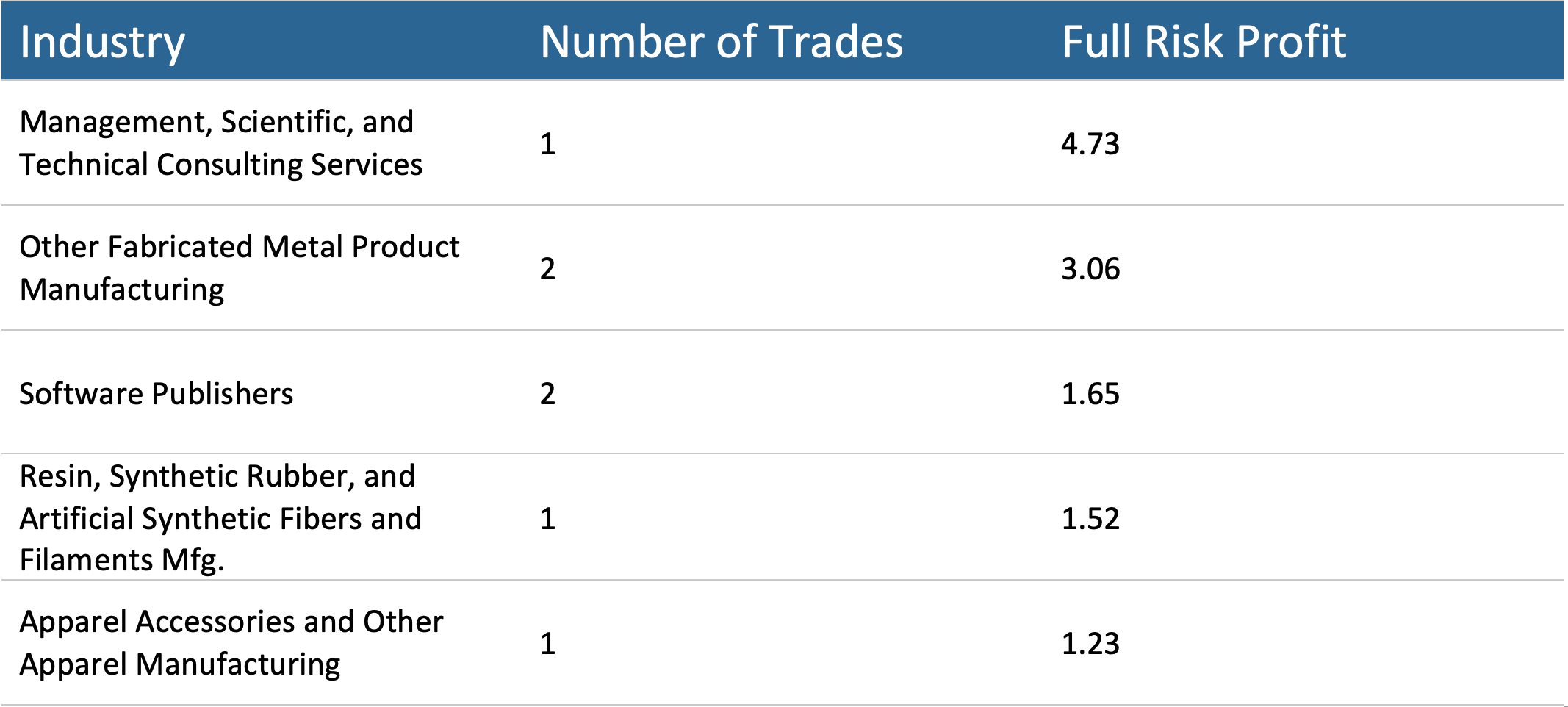

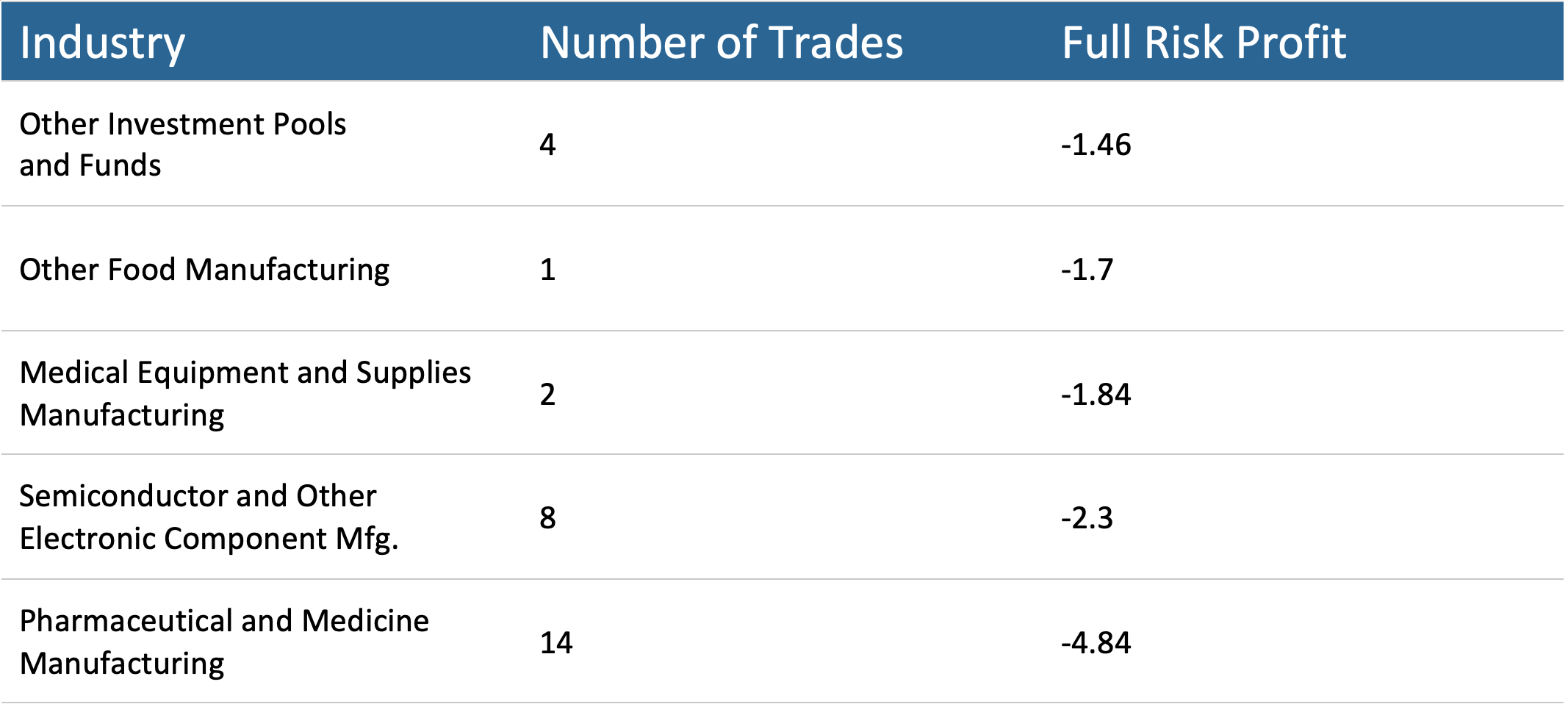

The table below details the Top 5 and Bottom 5 Sectors and the performance in each. The full risk profit is the profit per share of the trade using no stops and holding until just before the market close. Enterprise licensees and subscribers recognize that their hold times vary beyond end of day according to their risk management preferences. The total performance of HOLLY AI for June was 2.0%.

HOLLY Performance by Sector for June 2021

Top 5 sectors by performance

Bottom 5 sectors by performance

Conclusion

Portfolio Managers and Traders who avail themselves of HOLLY gain the ability to increase performance and mitigate risk. HOLLY has no emotional response to market conditions. As has been true since HOLLY’s inception, June 2021 proved out this principle of HOLLY’s effectiveness.

About Trade Ideas

Trade Ideas is an artificial intelligence decision tool that enables portfolio managers and traders to make better decisions in the stock market.

Trade Ideas identifies opportunities to capture alpha before others and in sectors and places within the market where no one else is looking.

Overnight, Trade Ideas artificial intelligence capability, HOLLY, runs massive structured and unstructured data (market activity, news, social media, etc.) on all US equities across some 40 different trading strategies, each of which has multiple algorithms, effectively taking into account tens of millions of simulated trades.

The result is the reporting each trading day of 5-7 trading scenarios which June outperform the market. Risk guardrails are set against each strategy, so traders are alert when up or down limits are reached intraday.

Additionally, each week Trade Ideas publishes its free Trade of the Week. Visit the website to sign up.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.