The Trade Ideas July 2021 report below comprises:

- The Trade Ideas Trade of the Week for each week in July.

- A summary showing the number of times that HOLLY traded in the industry and what was the

profit or loss associated with those trades. - About Trade Ideas.

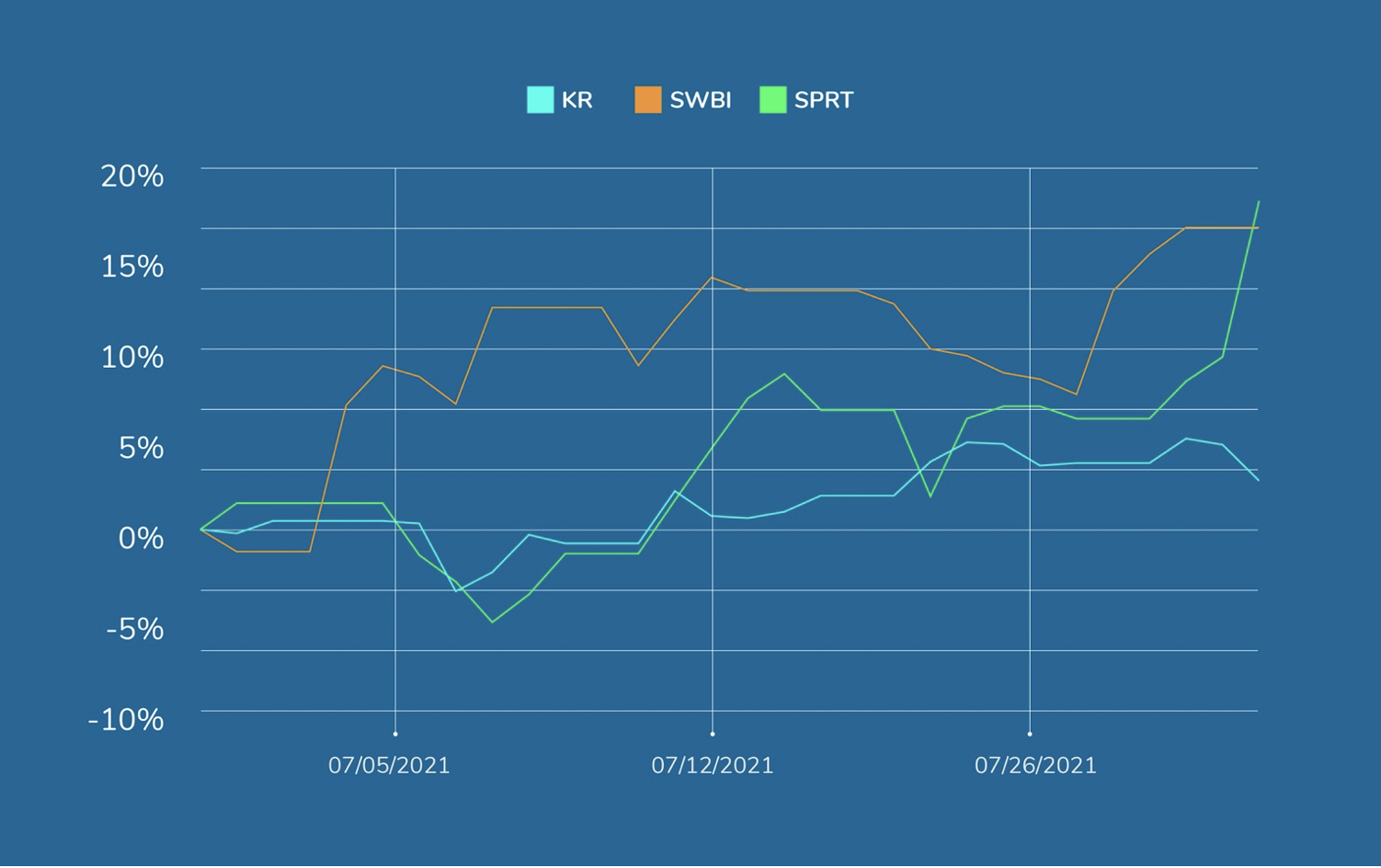

Trade of the Week for July

Support.com (SPRT) Due to a low circulation of shares in the float and a high percentage of short sellers stuck in this nice looking chart, Support.com (SPRT) could indeed have an explosive week ahead. Consider using a position size that allows you to absorb the expected price volatility in this name. Much like POWW from 2 weeks ago, this stock could have some wide price swings but still move quickly in the right direction for us. A decisively strong close emerging from a wedge pattern is something that could trigger the short sellers to buy SPRT back in a hurry this week.

Smith & Wesson Brands, Inc. (SWBI) This week in our trade selection we are focusing on strong stocks that have had significant pullbacks to levels of interest. Using our scan for these setups called “Pullback, Above 50 sma” we noticed Smith & Wesson Brands (SWBI) bouncing off the 20-day sma. For some reason, this sector seems to be strong right now especially after the success of POWW when it was called as the Trade of the Week in late June.

Being in Cash There is not a single chart of interest showing up on any scan this week. Good traders never force a trade just for the sake of having something working. There is no shame in recognizing that being in cash is a position and a tactic unto itself. The Trade of the Week does not look for short selling opportunities. Weak breadth and overbought conditions of the major indexes are making for a high-risk / low-reward environment and we have no recommendations to give this week.

Kroger (KR) This week, the market has given us more of a clue to work with and an opportunity to find something that sets up well for us. The Trade Ideas Strength list that comes out each week for a 17 dollar monthly subscription has given us something to circle back on and take advantage of the timing we need for Monday morning ideas. Kroger (KR) was one such name on the recent Trade Ideas Strength list and we are going to use that timing to our advantage.

Trade Ideas’ Machine Learning AI:

HOLLY, July 2021 Overall Performance

Over the course of July 2021 HOLLY strategized a total of 69 trades down from 84 in June. Overall performance was an increase of 0.3%, compared to the SPY at 2.2%. Overall, HOLLY’s performance in a high volatility and event driven environment continues to fall within acceptable trading scenarios as described below.

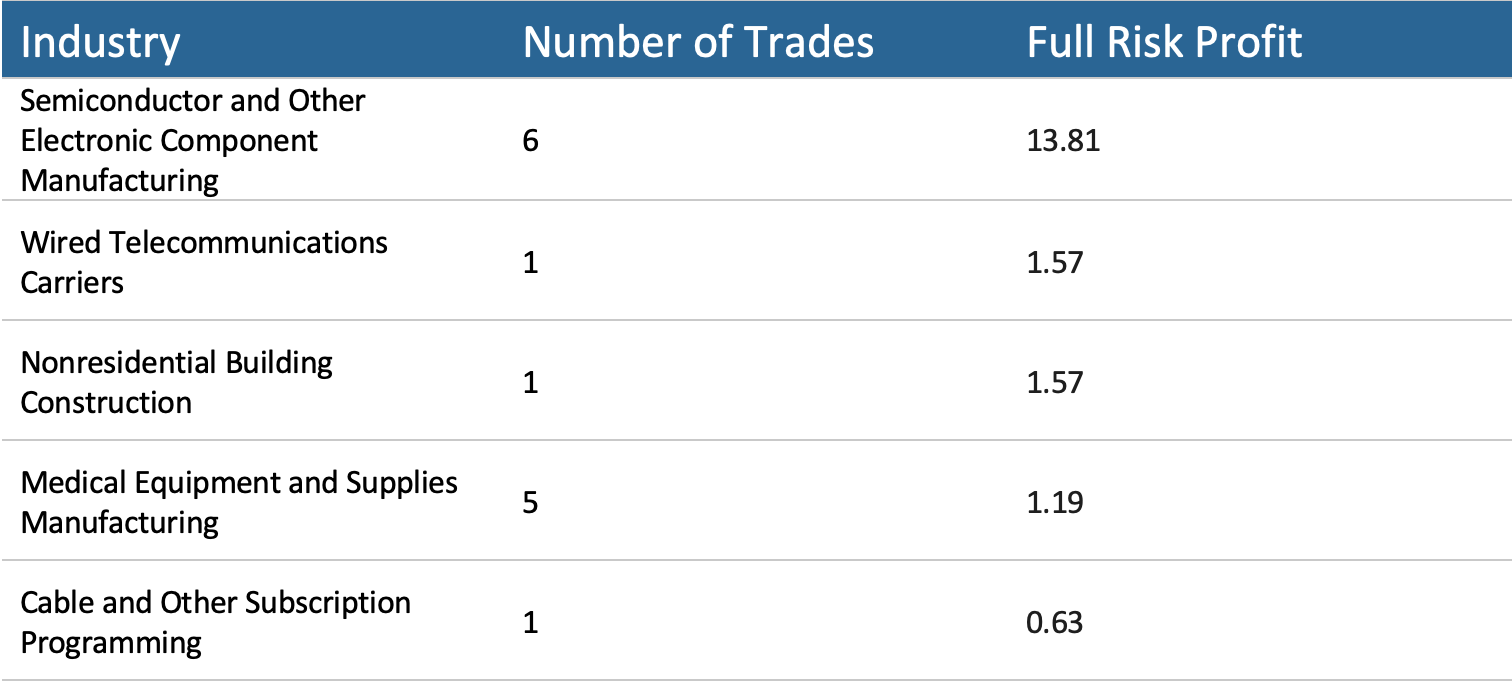

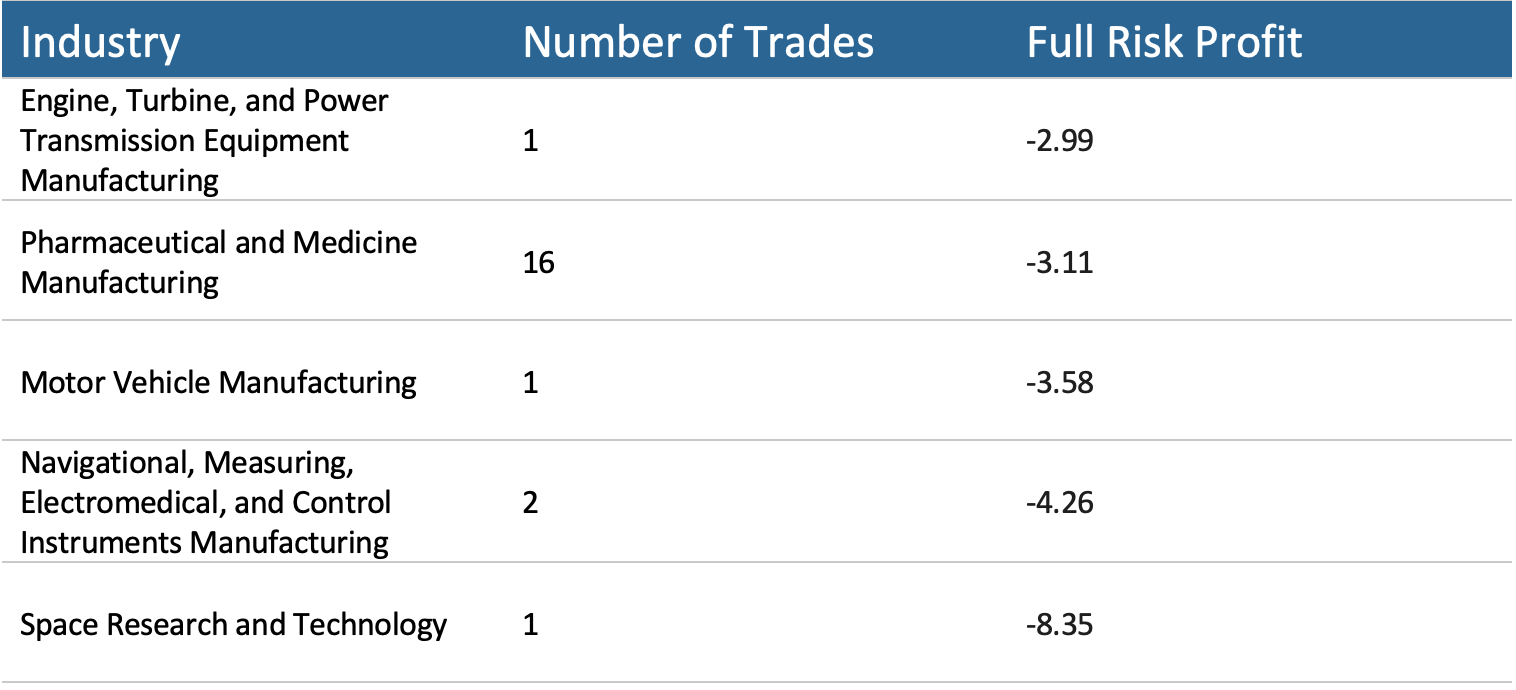

The table below details the Top 5 and Bottom 5 Sectors and the performance in each. The full risk profit is the profit per share of the trade using no stops and holding until just before the market close. Enterprise licensees and subscribers recognize that their hold times vary beyond end of day according to their risk management preferences. The total performance of HOLLY AI for July was 0.3%.

HOLLY Performance by Sector for July 2021

Top 5 sectors by performance

Bottom 5 sectors by performance

Conclusion

Portfolio Managers and Traders who avail themselves of HOLLY gain the ability to increase performance and mitigate risk. HOLLY has no emotional response to market conditions. As has been true since HOLLY’s inception, July 2021 proved out this principle of HOLLY’s effectiveness.

About Trade Ideas

Trade Ideas is an artificial intelligence decision tool that enables portfolio managers and traders to make better decisions in the stock market.

Trade Ideas identifies opportunities to capture alpha before others and in sectors and places within the market where no one else is looking.

Overnight, Trade Ideas artificial intelligence capability, HOLLY, runs massive structured and unstructured data (market activity, news, social media, etc.) on all US equities across some 40 different trading strategies, each of which has multiple algorithms, effectively taking into account tens of millions of simulated trades.

The result is the reporting each trading day of 5-7 trading scenarios which July outperform the market. Risk guardrails are set against each strategy, so traders are alert when up or down limits are reached intraday.

Additionally, each week Trade Ideas publishes it’s free Trade of the Week. Visit the website to sign up.

https://www.trade-ideas.com

https://pro.trade-ideas.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.