Trade Ideas February 2021: AI Dashboard, Monthly Sector - Transactions and Rotations

The Trade Ideas February 2021 report below comprises:

- The Trade Ideas Trade of the Week for each week in February.

- A summary showing the number of times that HOLLY traded in the industry and what was the

profit or loss associated with those trades. - About Trade Ideas.

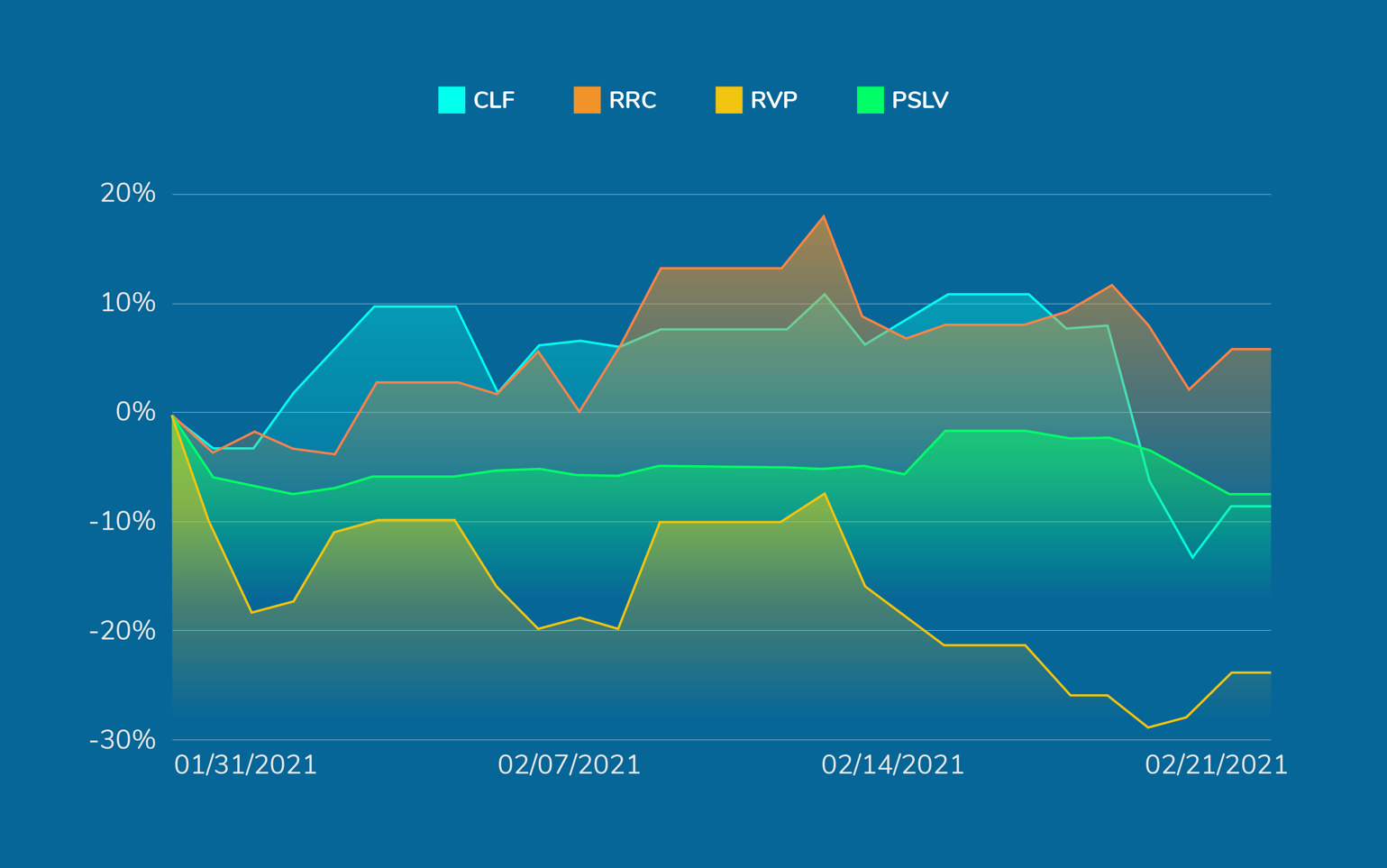

Trade of the Week for February

Week 1

Sprott Physical Silver (PSLV) This idea is not entirely original and it just might be the darling of the YOLO (You Only Live Once) Reddit crowd this week, so play at your own comfort level of share size. We cannot convey this enough! PSLV is the ETF that is tied to a physical inventory of silver unlike its counterpart SLV. The banks that hold silver on paper as shorts may have a long week ahead of them.

Week 2

Retractable Technologies, Inc. (RVP) | As many of us have learned recently that a stock with a high short float and a strong chart, has the potential for a ‘short squeeze’ higher as the short sellers run for cover and buy back the shares they borrowed to go short. As long as this market dynamic continues, we will look to exploit it. RVP has a very low float of 14 million shares and 30% of them are currently held by short sellers who are likely losing money. Let’s see if the buyers can spook them.

Week 3

Range Resources Corp (RRC) | Range Resources Corp (RRC) has been loitering on the A Table Jr scan for a while now when many of its sector counterparts (such as AR) have been moving higher. It seems it took an extra week for RRC to shape up and make a second attempt at 52-week highs on the chart. For whatever reason, RRC still has a contingency of short sellers (14.2%) that will need to cover, or buy back shares at higher prices.

Week 4

Cleveland-Cliffs, Inc. (CLF)We often talk about timing the ‘jump rope’ of our watchlist or scans. This week is a perfect example of this. It just so happens that Cleveland-Cliffs, Inc. (CLF) on Friday’s close had the nicest looking consolidation of all the “A Table Jr.” candidates we examined. Remember, we don’t like to chase stocks, but rather identify consolidation of strong stocks, then anticipate a move so we can participate in those names once again.

Trade Ideas’ Machine Learning AI:

HOLLY, February 2021 Overall Performance

Over the course of February 2021 HOLLY strategized a total of 244 trades up from 243 in January. Overall performance was an increase of 2.1%, compared to the SPY at 1.7%. Overall, HOLLY’s performance in a high volatility and event driven environment continues to fall within acceptable trading scenarios as described below.

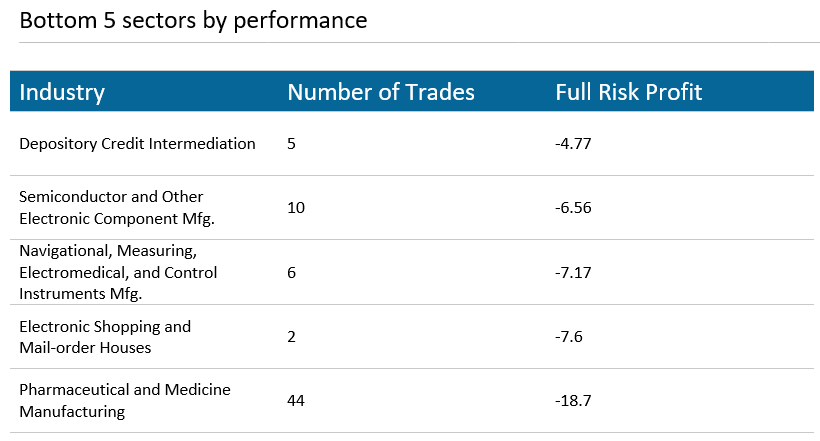

The table below details the Top 5 and Bottom 5 Sectors and the performance in each. The full risk profit is the profit per share of the trade using no stops and holding until just before the market close. Enterprise licensees and subscribers recognize that their hold times vary beyond end of day according to their risk management preferences. The total performance of HOLLY AI for February was -1.63%.

HOLLY Performance by Sector for February 2021

Conclusion

Portfolio Managers and Traders who avail themselves of HOLLY gain the ability to increase performance and mitigate risk. HOLLY has no emotional response to market conditions. As has been true since HOLLY’s inception, February 2021 proved out this principle of HOLLY’s effectiveness.

About Trade Ideas

Trade Ideas is an artificial intelligence decision tool that enables portfolio managers and traders to make better decisions in the stock market.

Trade Ideas identifies opportunities to capture alpha before others and in sectors and places within the market where no one else is looking.

Overnight, Trade Ideas artificial intelligence capability, HOLLY, runs massive structured and unstructured data (market activity, news, social media, etc.) on all US equities across some 40 different trading strategies, each of which has multiple algorithms, effectively taking into account tens of millions of simulated trades.

The result is the reporting each trading day of 5-7 trading scenarios which may outperform the market. Risk guardrails are set against each strategy, so traders are alert when up or down limits are reached intraday.

Additionally, each week Trade Ideas publishes

it’s free Trade of the Week. Visit the website to sign up.

https://www.trade-ideas.com

https://pro.trade-ideas.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.