Selling goods and services is the fundamental bedrock of the global economy. And what helps guide people on where to spend their money? Advertising. Therefore, it shouldn't come as a surprise that businesses spend enormous amounts of money on ads; according to estimates, global ad spending will surpass $1 trillion next year.

The advertising industry continues to shift from printed media and broadcasted radio and television to digital formats like the Internet and streaming. Meta Platforms and Alphabet (Google's parent company) have gobbled up a chunk of the digital ads market via their social media and Internet search dominance, but there is room for others.

That's where The Trade Desk (NASDAQ: TTD) comes in. The company has enjoyed prolonged success that has fueled market-beating investment returns since the stock's IPO in 2016.

Want to outperform the market? You must find winning stocks, and The Trade Desk has proven itself worthy. But that's half the battle; you must pay the right price. Is The Trade Desk priced right for investors today?

Here is what you need to know.

You don't need to win; you only need to win enough

The Trade Desk is a demand-side advertising technology company that sells programmatic ad inventory autonomously. In English, it matches advertisers to their ideal audience. For example, suppose you want to advertise tailgating equipment. The Trade Desk uses data such as demographics, Internet browser histories, etc., to show that ad to those most likely interested in tailgating equipment. The Trade Desk does this automatically and in real-time, placing ads with over 400 digital media partners, from websites to streaming services.

It's important to emphasize that The Trade Desk is a small fish in a big pond. Last year, customers spent $9.6 billion on The Trade Desk's platform. That's barely one percent of global ad spending and a fraction of what Meta Platforms and Alphabet do. The catch with these big technology companies is they have all the control and leverage over their customers. Do you want to advertise on these dominant, closed-loop social media or Internet Search ecosystems? You have to play by their rules. What if a company advertising on Google Search (just an example) competes with another part of Alphabet? That could be a conflict of interest.

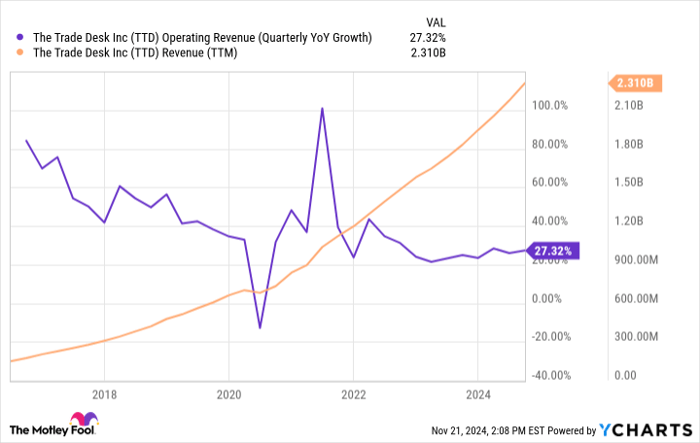

The Trade Desk tries to be more transparent and give ad buyers more control over their data and advertising campaigns. It's more like a partnership, and it turns out that there's a market for that. The Trade Desk has been profitable since 2013 and continues to grow revenue at nearly 30%:

TTD Operating Revenue (Quarterly YoY Growth) data by YCharts

Will The Trade Desk ever surpass these big technology companies that dominate digital advertising? Perhaps not. But it doesn't need to; it's doing just fine in its niche.

Shares have almost doubled over the past year

The Trade Desk has a lot going for it right now. Revenue growth began accelerating around Q2 of last year, a recovery from an industrywide ad spending pullback following the COVID-19 pandemic. The company's better performance and the Fed's recent growth-stock-friendly interest rate cuts have fueled the stock's roughly 90% gains over the past year alone.

The good news is that The Trade Desk's small size relative to the totality of global advertising means it could maintain strong growth for the foreseeable future. The company is launching a streaming TV operating software next year, which could eventually help it capture television ad spending. The bad news is that Wall Street is well aware of how good a business The Trade Desk is, and the stock price already reflects high expectations for the future.

Shares currently trade at a forward P/E ratio of 75. Meanwhile, analysts estimate the company will grow earnings by an average of 25% annually over the next three to five years. Using the PEG ratio to compare the stock's valuation to its anticipated growth, the current ratio of about 3.0 is steep, even for a high-quality business like this one.

Is The Trade Desk a buy now?

In reality, stocks of growing, profitable companies like The Trade Desk rarely come cheap. Ideally, one would have scooped up shares back when the stock traded at 35 to 40 times earnings, which happened a few times over the past couple of years. While you can't predict stock prices, they tend to go up and down over time, so there's a good chance investors will see better buying opportunities at some point.

Investors can nibble on shares to get their foot in the door, but I would probably be cautious at these high valuations. The wise move is holding onto some cash for that next buying opportunity. Until then, most investors should consider the stock a hold, not a buy.

Should you invest $1,000 in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $869,885!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 18, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and The Trade Desk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.