4 Trending Health Care Stocks To Consider Adding To Your Watchlist This Week

Booster shots appear to be the magic phrase in the current fight against the coronavirus pandemic. As such, we could see health care stocks coming back into play in the stock market now. For the most part, the matter of booster shots has been a key topic of discussion among health care experts recently. With more variants of concern emerging, boosters would, in theory, provide extra layers of support for the general public. With all eyes on the health care space now, investors may be turning towards top health care stocks in the market.

Notably, the latest update on booster shots came from White House chief medical advisor Dr. Anthony Fauci. Over the weekend, Dr. Fauci revealed that the Biden administration would have booster shots ready by September 20. For now, the current rollout will only consist of Pfizer (NYSE: PFE) and BioNTech’s (NASDAQ: BNTX) vaccine. According to Fauci, Moderna’s (NASDAQ: MRNA) vaccine booster may not receive regulatory approval in time but remains on the list. All in all, the three-dose regimen would serve to uphold protection against the coronavirus. And the protection has been found to decrease several months after the second shot.

Meanwhile, as health care officials address the current resurgence in coronavirus cases, day-to-day health care services remain relevant as well. This would include the likes of Medicare provider Clover Health (NASDAQ: CLOV) and retail pharmacy giant CVS Health (NYSE: CVS). With all that said, here are four health care names making waves in the stock market today.

Best Health Care Stocks To Watch Right Now

- RenovoRx Inc. (NASDAQ: RNXT)

- Novavax Inc. (NASDAQ: NVAX)

- AbbVie Inc. (NYSE: ABBV)

- Adagio Therapeutics Inc. (NASDAQ: ADGI)

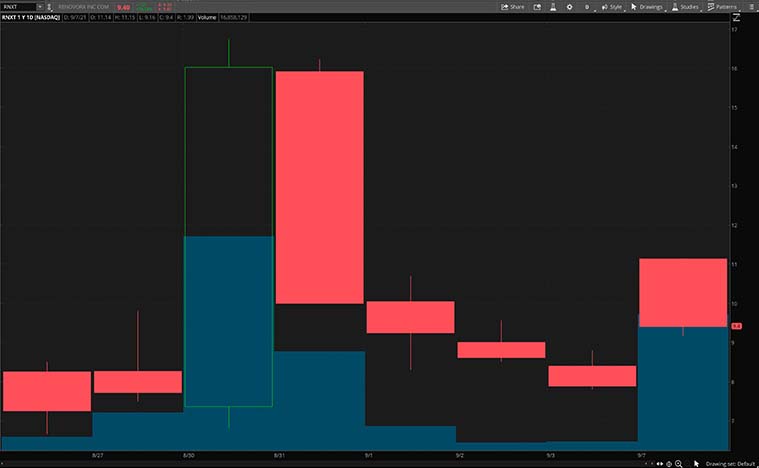

RenovoRx Inc.

RenovoRx is a biopharmaceutical company with headquarters in Silicon Valley, California. Its novel therapy platform, RenovoRx Trans-Arterial Micro-Perfusion, delivers chemotherapy to difficult-to-treat tumors.

Also, this therapy utilizes the company’s lead product candidate, RenovoGem and it has the potential to increase survival and improve the quality of life for pancreatic cancer patients. Furthermore, this platform technology will enable physicians to isolate the anatomy and micro-perfuse targeted tissue with small molecule chemotherapy. RNXT stock is up by over 40% on today’s opening bell and currently trades at $9.26 a share as of 11:30 a.m. ET.

Investors seem to be responding to news that the company has received FDA 510(k) clearance for its RenovoCath delivery system that is designed for targeted treatment of solid tumors. In fact, it is the device component of the company’s initial product, the RenovoGem. This new design provides a more targeted delivery of therapy which the company believes can translate into more effective treatment with fewer side effects. Given this exciting piece of news, will you consider adding RNXT stock into your portfolio of health care stocks?

Read More

- 4 Artificial Intelligence Stocks To Watch Right Now

- Best Lithium Battery Stocks To Buy Now? 4 To Know

Novavax Inc.

Next up, we have Novavax, a biotech company that develops vaccines for serious infectious diseases. To begin with, its recombinant nanoparticles and adjuvant technology are the foundation for groundbreaking innovation. Also, the company is conducting late-stage clinical trials for its coronavirus vaccine. Its NanoFlu is a quadrivalent influenza nanoparticle vaccine, met all primary objectives in its Phase 3 clinical trial in older adults, and will be advanced for regulatory submission. NVAX stock currently trades at $265.81 as of 11:30 a.m. ET and has enjoyed year-to-date gains of over 110%.

In late August, the company announced that the U.S. Centers for Disease Control and Prevention (CDC) has provided updated guidance for those who have been vaccinated with the company’s vaccine candidate in the U.S. In detail, the CDC guidance states that participants in the Novavax PREVENT-19 Phase 3 clinical trial meets the criteria to be considered fully vaccinated two weeks after they have completed the vaccine series.

This would imply that the vaccine is safe and effective, given how it has also demonstrated a 90% overall efficacy and 100% protection against moderate and severe disease. All things considered, will you add NVAX stock to your watchlist of health care stocks right now?

[Read More] Trending Stocks To Buy Today? 3 Retail Stocks To Know

AbbVie Inc.

AbbVie is a biopharmaceutical company that develops and commercializes advanced therapies that improve the lives of people around the world. Its key therapeutic areas include immunology, oncology, neuroscience, and virology among others. In fact, it plans to launch a wide number of products and indications in the upcoming years. ABBV stock currently trades at $108.66 as of 11:30 a.m. ET.

The company’s shares recently received a $131 price target by Mizuho Securities and the analyst firm reiterated a buy rating. The investment bank believes that investors are pricing in a worst-case scenario for AbbVie’s Rinvoq while also missing out on other attractive catalysts for AbbVie.

The company also reported its second-quarter financials in late July. Notably, its revenue for the quarter was $13.95 billion, an increase of 33.9% year-over-year. It also posted diluted earnings per share of $0.42 for the quarter. For these reasons, will you consider ABBV stock a top health stock to watch right now?

[Read More] 4 Robotics Stocks To Watch Amid Rising Shifts To Automation

Adagio Therapeutics Inc.

Following that, we have Adagio Therapeutics. In brief, Adagio is a clinical-stage biotech firm. Furthermore, the Massachusetts-based company primarily specializes in the development and commercialization of antibody-based treatments. Most of which are targeted towards infectious diseases with “pandemic potential”, according to Adagio. Currently, the company’s Covid-19 antibody portfolio revolves around its multiple, non-competing broadly neutralizing antibody cocktail, ADG20. With Adagio’s flagship project undergoing clinical trials, could ADGI stock be worth watching?

For starters, the company’s shares currently trade at $41.66 as of 11:31 a.m. ET. This would be after gaining by over 70% since its initial public offering last month. Overall, I can understand the hype around ADGI stock now. This would be the case with more experts weighing on the possibility of the coronavirus outbreak becoming endemic.

Moreover, should we have to deal with the virus in the long term, treatments would continue to play crucial roles in lessening the current strain on health care systems globally. Given all of this, would you consider ADGI stock worth investing in now?

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.