The fourth-quarter 2023 earnings results are so far mostly in line with expectations. As of Jan 24, 83 companies on the S&P 500 Index have reported their financial numbers. Total earnings for these 83 index members are up 0.9% from the same period last year on 3.9% higher revenues, with 78.3% beating EPS estimates and 65.1% beating revenue estimates.

At present, total earnings of the S&P 500 Index in fourth-quarter 2024 are expected to be up 0.6% on 2.3% higher revenues. This follows the 3.8% earnings growth on 2% higher revenues in the third quarter and three back-to-back quarters of declining earnings before that.

Meanwhile, five large-cap (market capital > $10 billion) stocks with a favorable Zacks Rank are set to beat on earnings this month. The combination of a favorable Zacks Rank and a possible earnings beat should drive their stock prices in the near-term.

Our Top Picks

We have narrowed our search to five large-cap stocks that are poised to beat on earnings results this month. Each of these stocks carries a Zacks Rank #2 (Buy) and has a positive Earnings ESP. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our research shows that for stocks with the combination of a Zacks Rank #3 (Hold) or better and a positive Earnings ESP, the chance of an earnings beat is as high as 70%. These stocks are anticipated to appreciate after their earnings releases. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

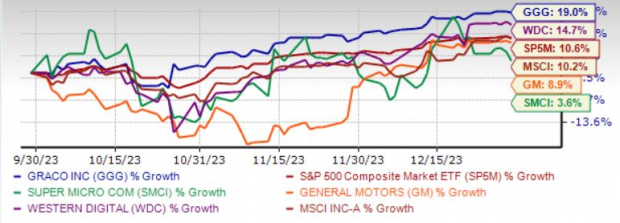

The chart below shows the price performance of our five picks in the last quarter.

Image Source: Zacks Investment Research

Graco Inc. GGG is benefiting from strength in its Industrial segment due to robust activity in the alternative energy, electronics and battery end markets. Continued sales growth in vehicle service and semiconductors is driving GGG’s Process segment. For 2023, GGG predicts organic sales growth (on a constant-currency basis) in low-single digits.

Graco has an Earnings ESP of +4.87%. It has an expected earnings growth rate of 4.6% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 30 days.

Graco recorded earnings surprises in three out of the last four reported quarters, with an average beat of 7.2%. The company is set to release earnings results on Jan 29, after the closing bell.

Super Micro Computer Inc. SMCI designs, develops, manufactures and sells energy-efficient, application-optimized server solutions based on the x86 architecture. SMCI’s solutions include a range of rack mount and blade server systems, as well as components. SMCI emphasizes superior product design and uncompromising quality control to produce industry-leading server-boards, chassis and server systems.

Super Micro Computer has an Earnings ESP of +8.19%. It has an expected earnings growth rate of 45.1% for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 2.5% over the last seven days.

Super Micro Computer recorded earnings surprises in three out of the last four reported quarters, with an average beat of 2.8%. The company is set to release earnings results on Jan 29, after the closing bell.

General Motors Co.’s GM compelling electric vehicle and internal combustion engine portfolio, displaying strong demand for its quality pickups and SUVs bodes well. GM retained the U.S. auto sales crown in 2023. GM plans to roll out 30 fresh EV models by 2025-end.

General Motors’ Ultium Drive system and battery plants in Ohio, Tennessee and Lansing are likely to scale up its e-mobility prowess. Building on the success of its $2 billion cost-reduction plan announced in early 2023, GM will further cut $1 billion in fixed costs over the 2023 to 2024 timeframe. Superior liquidity profile and investor-friendly moves bode well.

General Motors has an Earnings ESP of +3.47%. It has an expected earnings growth rate of 3.2% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last seven days.

General Motors recorded earnings surprises in the last four reported quarters, with an average beat of 23.8%. The company is set to release earnings results on Jan 30, before the opening bell.

Western Digital Corp. WDC has been benefiting from the strong demand for the 26- terabyte Ultra SMR drive. WDC is on track to qualify for the 28-terabyte UltraSMR drive and further expand into the 40-terabyte range. Also, WDC plans to split the HDD and Flash businesses by the second half of 2024 to unlock significant value for its shareholders.

Western Digital has an Earnings ESP of +6.94%. It has an expected earnings growth rate of 13.7% for the current year (ending June 2024). The Zacks Consensus Estimate for current-year earnings has improved 5.5% over the last 30 days. Western Digital is set to release earnings results on Jan 25, after the closing bell.

MSCI Inc. MSCI has been benefiting from solid growth in recurring subscriptions. MSCI is gaining strong demand for custom and factor index modules, recurring revenue business models, and the growing adoption of its ESG and Climate solutions in the investment process. MSCI’s expanding portfolio of real asset solutions is noteworthy.

Acquisitions have enhanced MSCI’s ability to provide climate-risk assessment and assist investors with climate-risk disclosure requirements. MSCI’s new portfolio foot print has extended climate analysis to municipal bonds and securitized products. Moreover, strong traction from client segments like wealth management, banks and hedge funds is a positive.

MSCI has an Earnings ESP of +1.13%. It has an expected earnings growth rate of 12% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.8% over the last seven days.

MSCI recorded earnings surprises in the last four reported quarters, with an average beat of 5.2%. The company is set to release earnings results on Jan 30, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Western Digital Corporation (WDC) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

MSCI Inc (MSCI) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.