Tandem Diabetes Care, Inc. TNDM announced that the in-warranty users of the t:slim X2 insulin pump in Canada can now access full compatibility with both Dexcom’s DXCM G7 and G6 Continuous Glucose Monitoring (“CGM”) systems. This follows Health Canada’s sale authorization in July 2024, making t:slim X2 with Control-IQ technology the first and only insulin pump in Canada to be integrated with both systems.

The commercial availability of this new offering reflects the decade-long partnership between the two companies and their shared commitment to continued leadership in advancing AID systems.

TNDM Stock Outlook Following the News

Since the announcement on Dec. 10, TNDM shares decreased 1.5% to close at $34.31 yesterday. On a promising note, the company is driving transformative innovation to help reduce the challenges and create new possibilities for people with diabetes. Given the significant underpenetration in the global diabetes market, the company is furthering its strategy to bring the benefits of its technology to more individuals worldwide. We expect the latest development to positively boost market sentiment toward TNDM stock.

Tandem Diabetes currently has a market capitalization of $2.27 billion. In the past 30 days, the company’s loss per share has narrowed by 2.9% to $1.68 for 2024. In the trailing four quarters, it delivered an earnings beat of nearly 8.3%, on average.

More on TNDM’s Latest Integrated Offering

G7 is Dexcom’s smallest sensor to date and is hailed as the most accurate CGM system available in the market. In December 2023, Tandem Diabetes began offering the t:slim X2 pump with G7 in the United States, the first AID system to work with Dexcom’s latest CGM technology. Now, t:slim X2 users in Canada can experience even more flexibility with CGM compatibility, including the option to spend more time in a closed loop with G7’s 30-minute sensor warm-up time — faster than any other CGM on the market. t:slim X2 users who pair Dexcom G7 with an Apple smartwatch can see their glucose numbers directly from their watch without having to access their pump or smartphone.

Image Source: Zacks Investment Research

Tandem Diabetes will email all in-warranty t:slim X2 users in Canada with instructions on how to add the new compatibility feature free of charge via remote software update. t:slim X2 pumps pre-loaded with the updated software will start shipping to new customers in early January 2025.

Industry Prospects Favoring TNDM Stock

Per a Research report, the global insulin delivery devices market was valued at $16.43 billion in 2023 and is expected to witness a compound annual rate of 7.9% by 2027. Alongside the rising incidences of diabetes, the market is benefitting from technological breakthroughs that enable more effective, less invasive and customized devices. Wearable devices, such as insulin pumps and insulin patch pumps, are becoming more popular for providing continuous insulin infusion conveniently and discreetly.

Other Developments in Tandem Diabetes

In September 2024, Tandem Diabetes’ t:slim X2 insulin pump with Control-IQ was cleared for use with Eli Lilly and Company’s Lyumjev (insulin lispro-aabc injection) ultra-rapid-acting insulin in the European Union. Both companies are working to secure Lyumjev compatibility for the t:slim X2 pump in other regions and also Lyumjev compatibility for the Tandem Mobi pump.

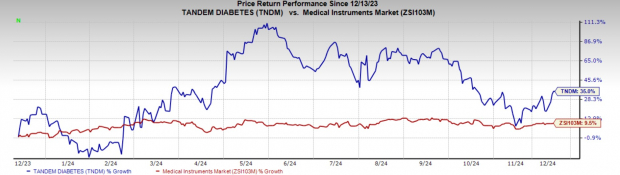

TNDM Stock Price Performance

In the past year, TNDM shares have rallied 35% compared with the industry’s rise of 9.5%.

TNDM’s Zacks Rank and Key Picks

Tandem Diabetes Care currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Penumbra PEN and Phibro Animal Health PAHC, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Penumbra shares have risen 10.5% in the past year. Estimates for the company’s 2024 earnings per share have jumped 0.7% to $2.81 in the past 30 days. PEN’s earnings beat estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 10.54%. In the last reported quarter, it posted an earnings surprise of 23.19%.

Estimates for Phibro Animal Health’s fiscal 2025 earnings per share have increased 2.5% to $1.61 in the past 30 days. Shares of the company have surged 113.5% in the past year compared with the industry’s 17.3% rise. PAHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 25.47%. In the last reported quarter, it delivered an earnings surprise of 52.17%.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is the backbone of our economy. It’s a multi-trillion dollar industry that has created some of the world’s largest and most profitable companies.

Now state-of-the-art technology is paving the way for clean energy sources to overtake “old-fashioned” fossil fuels. Trillions of dollars are already pouring into clean energy initiatives, from solar power to hydrogen fuel cells.

Emerging leaders from this space could be some of the most exciting stocks in your portfolio.

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Phibro Animal Health Corporation (PAHC) : Free Stock Analysis Report

Penumbra, Inc. (PEN) : Free Stock Analysis Report

Tandem Diabetes Care, Inc. (TNDM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.