Stock picking has long been thought of as an art, but the savvy investor knows that there is also plenty of science to it. And for those willing to embrace the science, TipRanks has the Smart Score, an AI-driven data sorting tool, based on sophisticated natural language algorithms.

The tool gathers the reams of data thrown up by the stock markets – the transactions, the stock movements, the traders’ moves, all of it. The result is distilled down to a simple, easily readable score, a single number on a scale of 1 to 10, showing investors at a glance the likely trajectory for any stock. And the ‘Perfect 10’ stocks are the shares that clearly deserve closer scrutiny.

Right now, Amazon (NASDAQ:AMZN) and Alibaba (NASDAQ:BABA) are setting the pace, boasting the highest Smart Score among large-cap stocks on the ‘Perfect 10’ list. Let’s see what it is about these names that makes them stand out from the pack.

Amazon

We’ll start with Amazon, a company that needs little introduction. This survivor of the original dot-com bubble has expanded from its origin as an online bookseller to become the world’s largest online retailer, dealing in anything and everything – and in the process, also becoming the world’s fourth-largest publicly traded firm, with a market cap of $1.8 trillion and approximately $1.4 billion in daily sales.

Amazon has complemented its mega-cap size and near-endless online retail offerings with a huge brick-and-mortar infrastructure and rapid delivery guarantees. The company has a global network of warehouses and fulfillment centers, with some facilities totaling more than 1 million square feet of storage and workspace. The company can deliver customer orders around the world, and in many locations can offer next-day delivery. As an online retailer, Amazon depends on its website, which is one of the internet’s most trafficked – receiving well over 2 billion site visits every month.

That’s just Amazon’s eCommerce business. eCommerce is the core of the company, but Amazon is branching out, working to diversify the products it offers to ensure that it can meet customer needs in an ever-changing world. The company has a popular cloud computing service, AWS, available by subscription, that has become an important source of revenue. In addition, Amazon offers its customers such widely varied services as online gaming for both kids and adults; home automation; TV streaming; ebooks via the Kindle reader; and even grocery deliveries – the full list of services encompasses these, and many more. The common denominator is putting online retail and subscription models to work in the real world, and in people’s daily lives.

What this comes down to for investors is simple: $170 billion in revenue reported in the last quarter, 4Q23. That represented a near-14% increase from the prior-year period, and was $3.74 billion better than had been anticipated. The company’s bottom line, the firm’s $1 EPS, was derived from a net income of $10.6 billion. AWS proved to be an important driver in the quarterly gains, generating $24.2 billion in revenue, up 13% year-over-year.

For 2023 as a whole, Amazon brought in $574.8 billion in total revenue. Net income for the year came to $30.4 billion, or $2.90 per diluted share. The company boasted a free cash flow of $36.8 billion for 2023, contrasted with a cash burn of $11.6 billion in the prior year.

For Deutsche Bank analyst Lee Horowitz, the key point here is Amazon’s proven ability to continue generating income growth – even on top of its already fast pace. He writes of the company, “Despite outperforming the market by ~60 points over the last year, Amazon remains one of our top picks in our coverage, due to the increasingly compelling operating income growth that the company is slated to deliver in the coming years… Given our constructive outlook on the shape of advertising operating income in the coming years, we raise our 24/25 OI estimates by 10/8%, respectively, and take our price target higher to $210. We continue to believe that GAAP earnings valuation for Amazon screens increasingly compelling…”

This adds up to a Buy rating, of course, and the $210 price target points toward a one-year upside potential of nearly 20%. (To watch Horowitz’s track record, click here)

This tech and retail mega-cap stock has picked up no fewer than 41 analyst reviews in recent weeks – and they are all positive, for a unanimous Strong Buy consensus rating on the shares. AMZN is selling for $175.35, and its $208.48 average target price implies a gain of almost 19% on the one-year horizon. (See AMZN stock analysis)

Alibaba Holdings

Next up is Alibaba, another giant of the online retail industry – and the company that some call ‘China’s Amazon.’ Founded by Chinese tech entrepreneur and billionaire Jack Ma, and based in Hangzhou, the company has been in business since 1999. Alibaba started out as the main online retailer focusing on China’s domestic market and is still the dominant eCommerce player in this country of 1.4 billion people. Alibaba has branched out to the global online marketplace, but China remains the core of its business.

That business core is solid. Alibaba boasts that it can deliver just about any product, to just about any buyer, to just about any location in China – and can guarantee next-day or 2-day delivery. On the global eCommerce scene, Alibaba lists some 200 million-plus products available, across 5,900 product categories, coming from over 200,000 suppliers with delivery to more than 200 countries and territories.

In addition to online retail, both in China and abroad, Alibaba, like Amazon, is branching out into other areas. The company has its hands in several pots, including cloud services and digital media. Retail, however, still makes up the bulk of the company’s business; in fiscal year 2022, the company brought in 67% of its revenue from the Chinese retail sector, with another 5% from international commerce.

In the last reported quarter ending December 31, Alibaba posted total revenue of US$36.67 billion, marking a 5% year-over-year increase and surpassing forecasts by $270 million. The eCommerce giant’s earnings, by non-GAAP measures, came to $2.67 per share, or 3 cents per share better than the estimates. The company generated $7.96 billion in free cash flow during the quarter. Despite these successes, shares in BABA are down 5% so far this year, in somewhat volatile trading over the past 2 months.

The fall in share price has not prevented Truist’s 5-star analyst, Youssef Squali, from coming down firmly on the bullish side for BABA stock. He sees Alibaba well positioned to move forward, and lays out four reasons why: “1) compelling valuation (1x EV/Revs and 4.4x EV/AEBITDA), 2) improving order volume growth at Taobao/Tmall fueled by greater focus and investments, 3) strong FCF generation (11% FCF yield) which is fueling a capital return strategy with larger buybacks and dividends; and 4) prospects for a macro recovery as mgmt strengthens its competitive offerings for TTG, Int’l and Cloud. CY24 will be an investment year for BABA which should keep margins in check near-term, that said we believe that much of it is already reflected in the current valuation.”

Going forward from there, Squali gives BABA stock a Buy rating, and sets a $114 price target that suggests the shares will appreciate by 55% over the course of this year. (To watch Squali’s track record, click here)

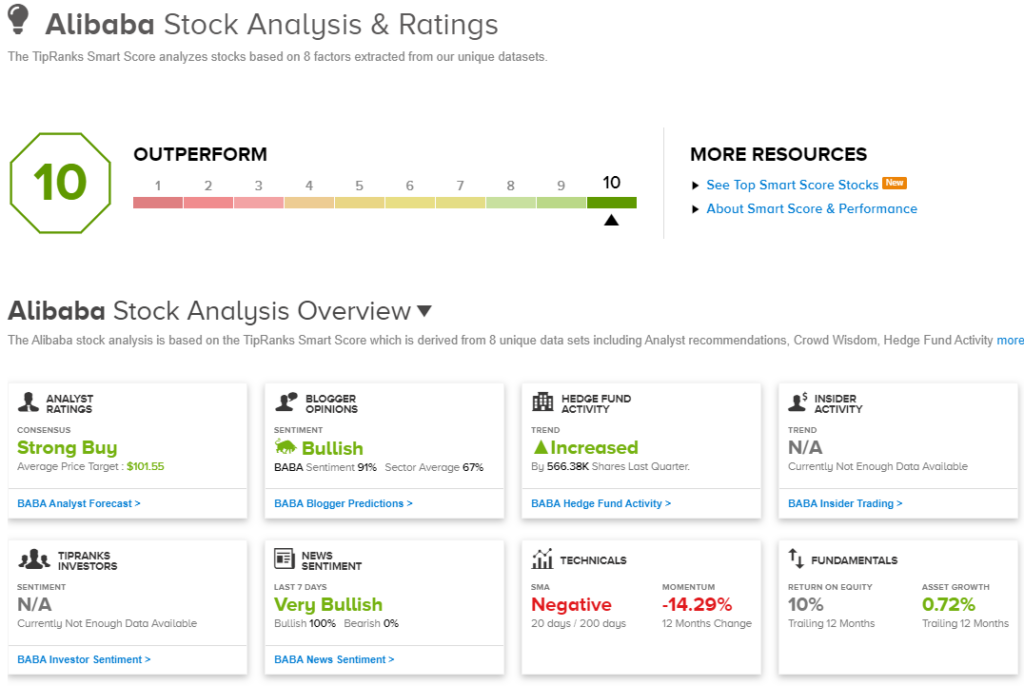

Alibaba’s stock has a Strong Buy consensus rating from the Street, based on 18 recent reviews that include 15 Buys and 3 Holds. The stock is currently priced at $73.55 and its $101.55 average price target implies a 38% upside potential for the next 12 months. (See Alibaba sock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.