Cloud networking solutions leader Arista Networks ANET has been a top-performing tech stock in recent years. Like Nvidia NVDA, Arista has seen its stock more than double since 2023, leading to a stock split.

Implementing a 4-1 stock split on Tuesday, let’s see if now is still a good time to buy Arista’s stock with the company aiming to make shares more accessible to a broader base of investors.

Image Source: Zacks Investment Research

Arista’s Dominance & Consistency

Arista’s strong financial performance and market leadership have been the primary catalyst for its stellar stock performance. This has been enhanced by Arista’s focus on artificial intelligence (AI) infrastructure, becoming a leader in high-speed networking which is critical for AI-driven data centers.

Notably, Arista has collaborated with Nvidia to create AI Data Centers that align compute and network domains to a single managed AI entity. Arista also has strategic partnerships with Meta Platforms META and Microsoft MSFT in regards to building out AI infrastructure.

Remarkably, Arista has still surpassed the Zacks EPS Consensus in every quarter since it went public in 2014 and has exceeded sales estimates for 20 consecutive quarters. Bolstering Arista’s consistency, the company has posted an average EPS surprise of 14.77% in its last four quarterly reports.

Image Source: Zacks Investment Research

Arista’s Valuation & Balance Sheet

Seeing as stock splits don’t affect a company’s financial metrics or valuation, ANET is still trading at around 48X forward earnings but at $106 a share as opposed to a previous price tag of over $400.

Despite rallying more than +80% year to date, ANET doesn't trade at an overly stretched premium to the benchmark S&P 500 and its Zacks Communication-Components Industry average of 25X respectively.

Notably, Arista trades on par with Nvidia’s 49.5X forward earnings multiple. While Arista and Nvidia are commanding quite a premium in terms of price to sales their top line expansion is justifiable of such. In this regard, Arista is expecting total sales to increase over 17% in fiscal 2024 and FY25 with projections edging toward $8 billion.

Image Source: Zacks Investment Research

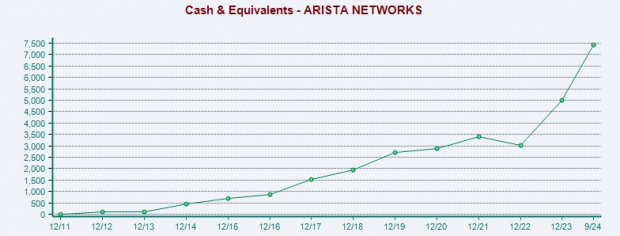

Furthermore, Arista’s cash & equivalents have soared since the pandemic to $7.42 billion at the end of Q3 2024 from $2.72 billion in 2019. Magnifying Arista’s strong balance sheet is that it has $12.84 billion in total assets compared to $3.6 billion in total liabilities.

Image Source: Zacks Investment Research

Positive EPS Revisions

Arista’s annual earnings are now expected at $2.18 per share in FY24 ($8.72/4) compared to EPS of $6.94 last year. Plus, FY25 EPS is projected to increase 10% to $2.39.

Even Better, FY24 and FY25 EPS estimates are nicely up in the last 30 days after Arista was able to comfortably surpass its Q3 top and bottom line expectations in early November.

Image Source: Zacks Investment Research

Bottom Line

Following its 4-1 stock split, Arista Networks sports a Zacks Rank #2 (Buy) in correlation with the trend of positive earnings estimate revisions. To the delight of investors, Arista’s stock is more affordable and should still have more upside.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.