By Goran Damchevski

This article was originally published on Simply Wall St News

I have stayed out of evaluating AMC Entertainment Holdings, Inc. (NYSE:AMC) because the fundamentals are just not there. You will find a massive amount of articles that address the shortcomings of the company, and frankly, that is quite easy to do.

But we are not going to do that today. In this highly speculative article, we are going to take the harder road and look at how AMC might have a chance to be revitalized and turn profitable!

First, we must turn to reality!

AMC is in a very difficult position from multiple aspects. The company has high debt, low revenue - not to mention earnings, possibly an uninterested board and management that has been mostly (if not only) selling in the past 12 months.

Let's start with the financials.

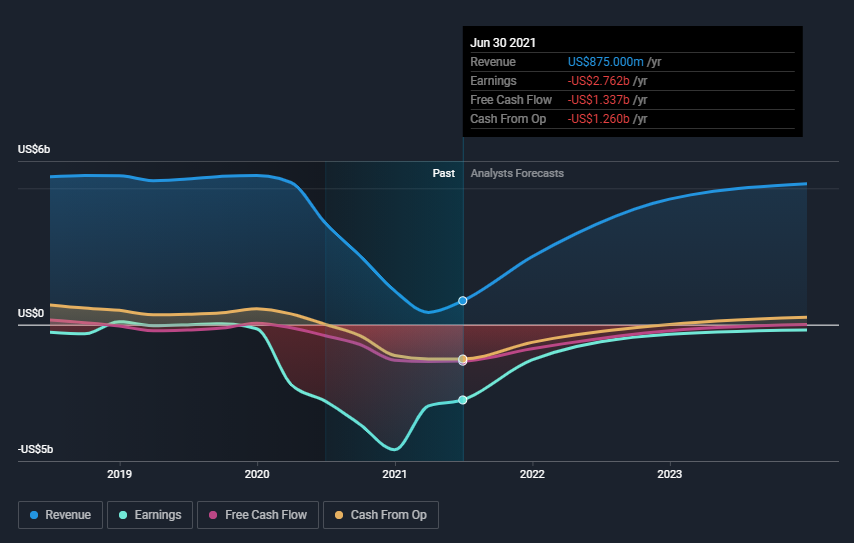

In the last year AMC had a loss before interest and tax, and actually shrunk its revenue by 77%, to US$875m.

The graph is pretty clear that the company is not in a good financial position. Revenues have barely resurfaced, and analysts are making estimates on a recovery with the assumption that the pandemic passes - soon. This might not happen, and people may not take to movie theaters as fast as investors would like. That is the income situation, let's accept it and move on.

Next we look at the balance sheet.

View our latest analysis for AMC Entertainment Holdings

What Is AMC Entertainment Holdings's Debt?

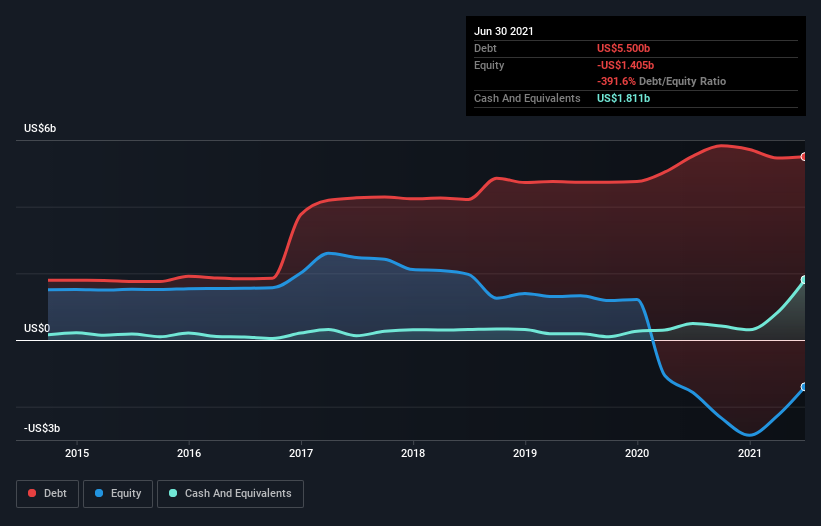

As you can see below, AMC had US$5.50b of debt, at June 2021, which is about the same as the year before.

However, it also had US$1.81b in cash, and so its net debt is US$3.69b.

AMC has a long way to go before reducing its debt levels, and will probably look for restructuring options and tax benefits from running at a loss - every little bit helps.

The latest balance sheet data shows that AMC Entertainment Holdings had liabilities of US$1.56b due within a year, and liabilities of US$11.2b falling due after that. That is quite the gap to fill, but is actually manageable, especially if the company sees an uptick in the stock price and raises some funds from issuing more shares.

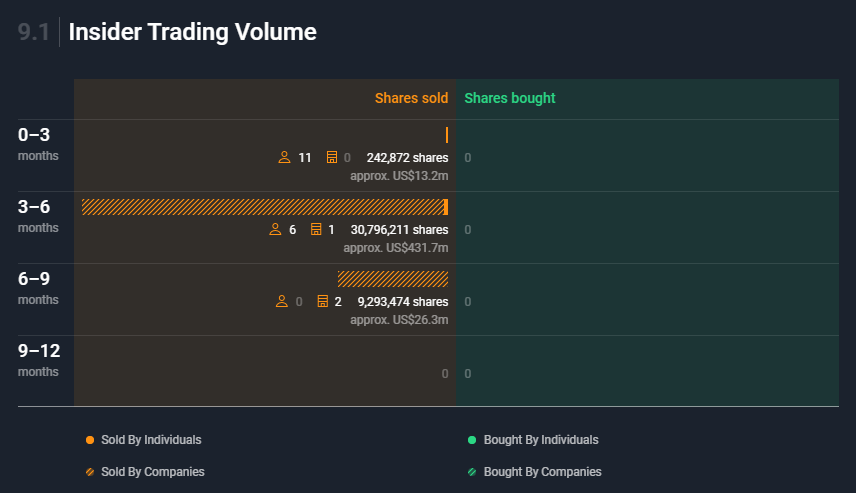

Insider transactions are the last point we will look at before turning to possibilities for the future.

Unfortunately, it seems that insiders have "paper hands", and many board members have sold substantial portions of their positions (Not the CEO). This is an overview of what has been happening in the last 12 months:

If you want a detailed view, go to our analysis HERE.

Management is also not in the best position, or does not have much "skin in the game". The CEO, Mr. Adam Aron has 0.15% stake in the business and serves both as CEO and Chairman at AMC. This usually paints a very negative picture for management, however, since the situation with AMC is anything but usual, we will move on and not go too deep into his history as a professional CEO and increases in total compensation.

Looking at the general picture, it is clear that AMC is fighting an uphill battle, and investors need a lot of things to improve in order to come out on the winning side.

Now, let's turn to the future, and examine what AMC can do to turn things around.

Options for the Future

First, we need to define an endgame. A goal we want to see achieved. There are plenty of things one can choose: the company being acquired, long term stock price growth, a short squeeze that pops the price so that traders can make a profit, etc.

For this analysis, I will choose the goal to be a justification of the US$21 billion Market Capitalization that AMC has at the moment. Basically, I don't want to see the price to go down from here and hope that retail holders will not lose their investment.

This might seem trivial and a low bar, but $21b market cap is very high, especially for a small company like AMC.

Second, we need to examine the long term issues of the company. I came up with the following list:

- Streaming services are taking over the industry

- The company is not digitalized to the extent that it can be closer to clients

- Poor corporate governance

- The company is in a mature mindset, and might find it harder to revitalize

Notice that the financial performance, the pandemic and debt levels are not mentioned. This is because they can be classified (if we want to be charitable) as short(er) term problems.

Now, we move on to the possible solutions for improving AMC as a business.

The first option is acquisition, so let's get that out of the way. This involves a large streaming competitor coming in, and introducing a hybrid business model between streaming and cinema. They would benefit from using the AMC brand name, a positive PR move, and giving their audience a chance to buy cinema tickets for their favorite shows from their platform. Assuming the acquirer does machine learning right, they might be able to use their statistics to show movies that will generate more revenues.

Acquisitions are very risky, and hard to get right. But it might give shareholders the chance to profit on their investment. In some sense, they are buying the favor of the many people that still hold the stock, which may be worth something on its own.

Just imagine what would happen to the stock price if someone announced they want to buy the company.

The second option I will propose is a bit opposite to what management has been promoting lately. Instead of expanding, AMC should look at shrinking to value.

AMC has a lot of theaters in the U.S. and worldwide. The company has some 14 thousand employees. It stands to reason, that not all of these outlets have the same profitability. There is a good chance that management knows very well which theaters are the most profitable, and can consider maximizing value by cutting out the costly ones.

This will make the company more manageable, less risky and more profitable. It will also cut expenses and make cinema a more exclusive activity.

The third option concerns the business model. It is obvious that the company needs to digitalize better - even their main website has some basic bugs that are annoying (some automated guide that cannot be turned off). But the main question is: Is there some alternative way of utilizing theater capacity, that is perhaps cheaper, and will attract more guests?

While it differs among cultures, cinema has been a way to spend leisure time with friends, family and loved ones. If AMC has a specific type of customer that is more prone to going to their theaters, it might consider extra activities that are specifically catered to that type of guest. Perhaps it can do some A/B testing for the ambient and figure out what works on a local level. It can also offer some more supplementary products, like selling board games or quick photo snaps for guests by a professional photographer as part of their AMC experience.

Alternatively, it may try offering some alternative media on the big screen, like e-sports, gaming runs, or movie auctions by popular demand. The last one simply means that people have a local movie wish-list and get notified of a screening once enough people express interest.

Finally, whatever the game plan is, shareholders need to know it. It is on management to paint a clear path to profitability for the company - it does not need to happen tomorrow, but investors need to know what to expect on the long term.

Conclusion

One can argue that revitalizing AMC is comparable to a Herculean effort.

As analysts, we can always point out the bad things in a company, but the hard part in the market, is to find value where others do not. This comes with a caveat though, because it is not enough to think different, we also need to be right when others are wrong, and it is quite hard to be right against the market.

There are at least three options (or a combination of them), which AMC has, in order to revitalize the business and sustain the current $21b market cap:

- Get a technology or streaming company to acquire the business and improve with their help

- Shrink the business and operate theaters that have been or are the most profitable

- Improve the business by digitalization, attuning to local specifications of clients, and trying out other screening activities like e-sports, gaming etc.

We hope that you have a clearer picture both of the challenges that AMC faces, and the possibilities to improve the business over the long run.

AMC is still a risky stock, but people have a right to invest in things that they like and believe in.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.