A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

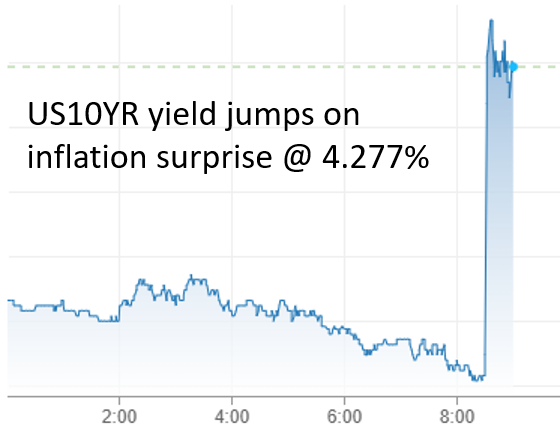

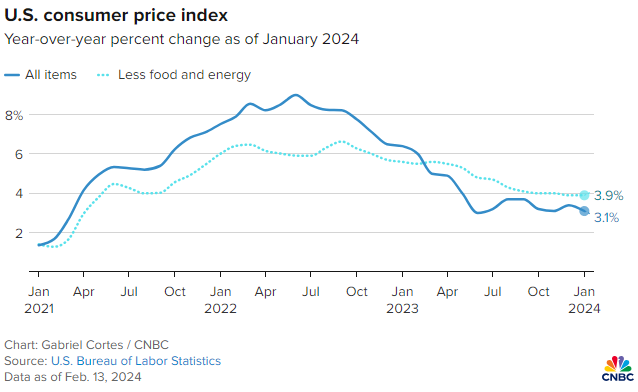

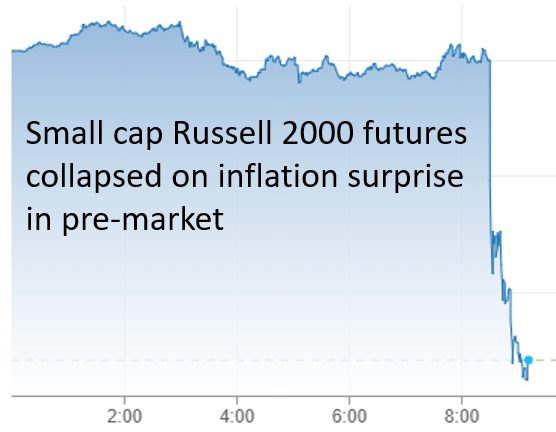

#marketseverywhere | job unfinished | Consumer prices +0.3% in Jan, >expected, annual rate moved to 3.1% ... Shelter prices accounted for much of the increase -CNBC

* source: CNBC

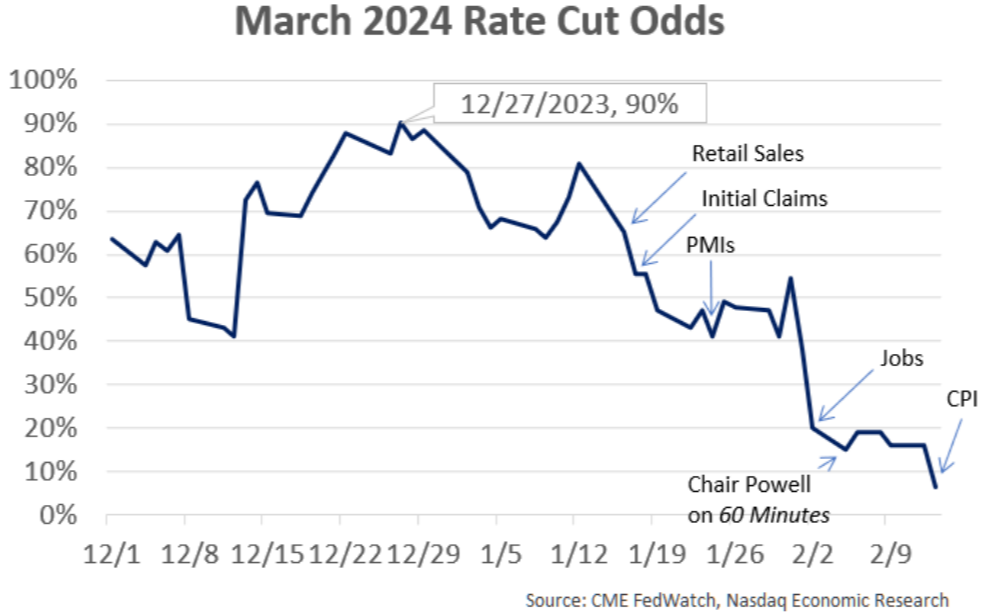

goodbye March rate cut!

odds fell from over 90% to under 10%

* source: Nasdaq Economic Research, Michael Normyle

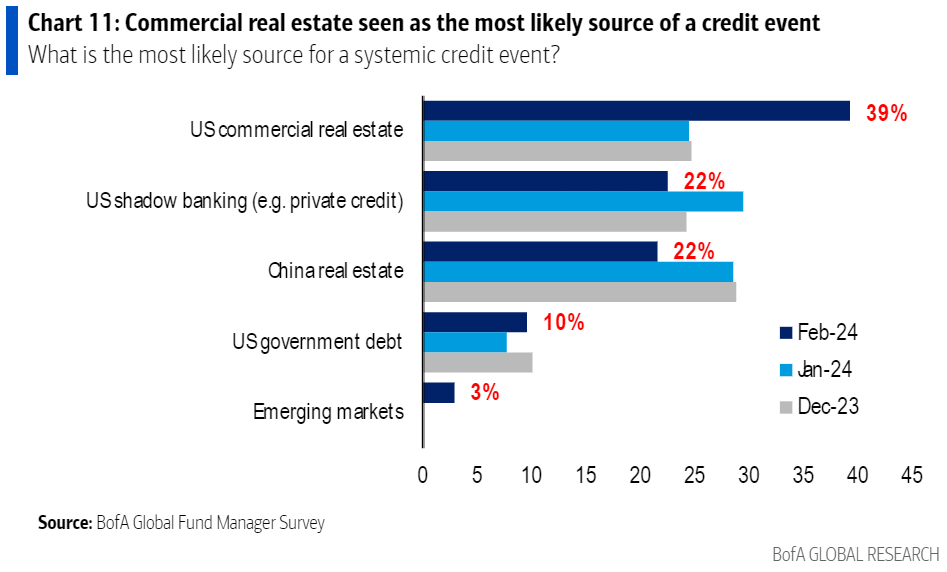

| BofA's Global Fund Manager: biggest tail risks to market:

* source: BofA's Global Fund Manager Survey, Michael Hartnett

| Stocks Flash Sell Sign After S&P Tops 5,000, Piper Sandler Says -BBG

"To be clear, we are not bearish on the stock market. However, due to the persistent “bad breadth,” the market, particularly large-cap stocks, may experience a pullback ranging from 5% to 10%"

-Craig Johnson, Piper Sandler

* source: Piper Sandler, Craig Johnson

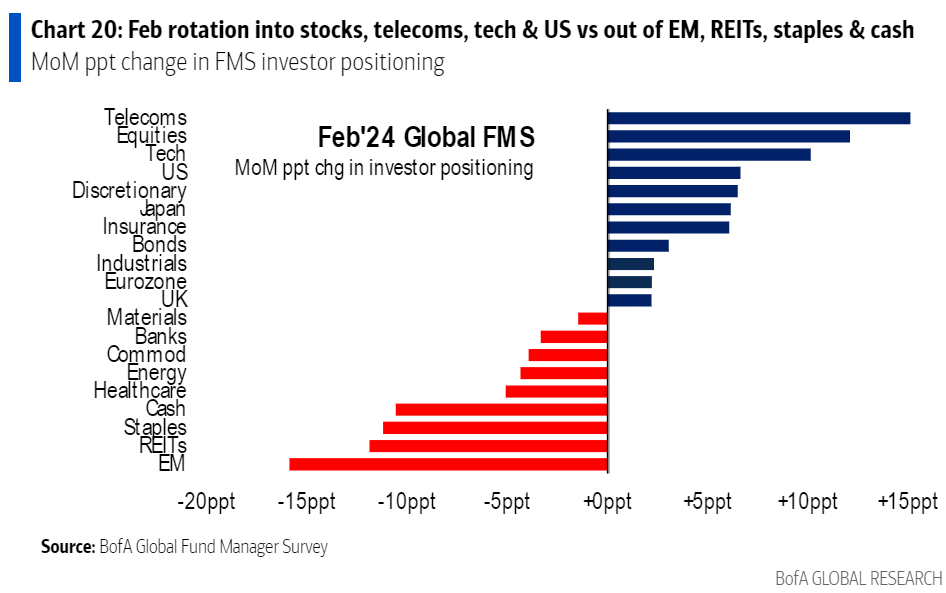

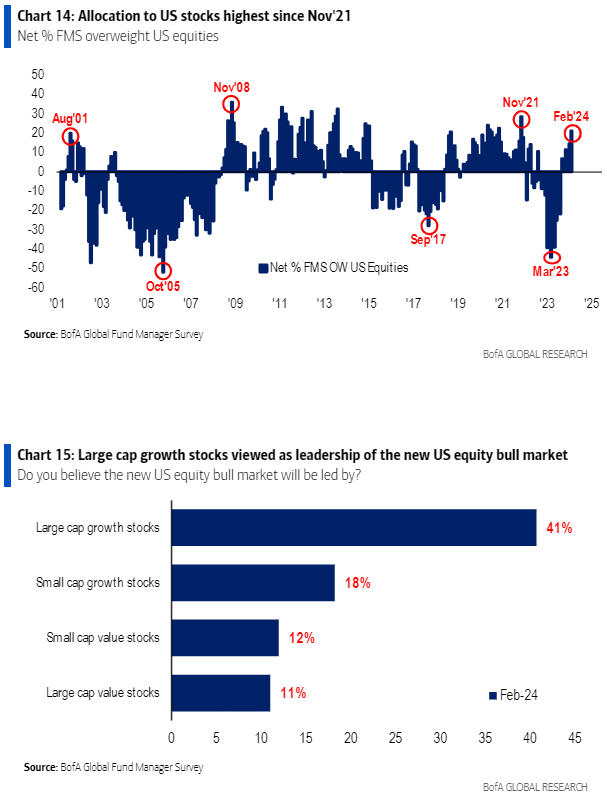

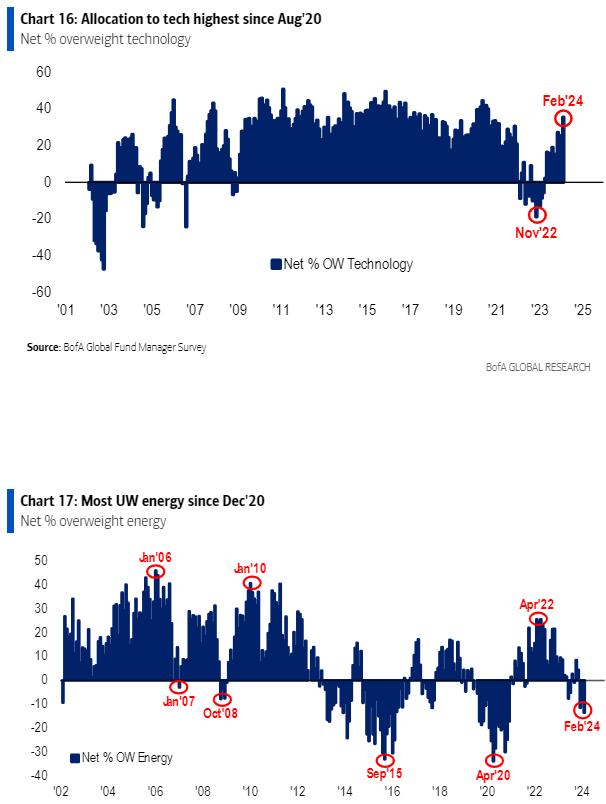

| Investor positioning as per BofA's Global Fund Manager Survey

In February, FMS investors rotated into telecom, stocks, tech, and US…

and out of EM, REITs, staples, and cash.

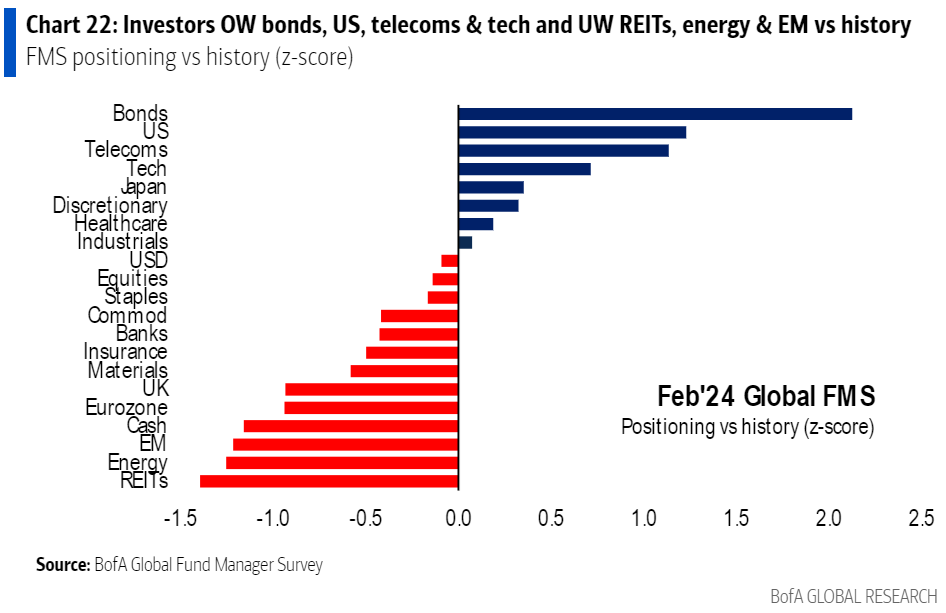

Relative to 20 year history...

investors are long bonds, US, telecom & tech…

…and are underweight REITs, energy, and EM.

other tidibts...

* source: BofA's Global Fund Manager Survey, Michael Hartnett

* source: CNBC

* source: BofA's Global Fund Manager Survey, Michael Hartnett

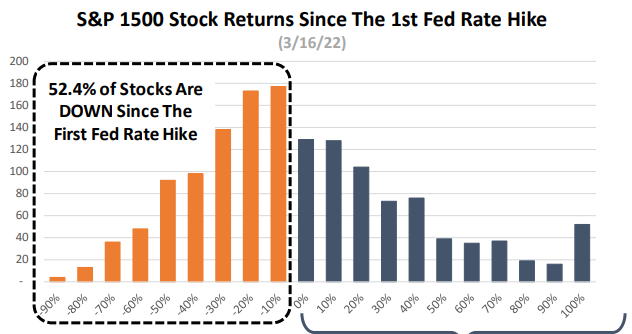

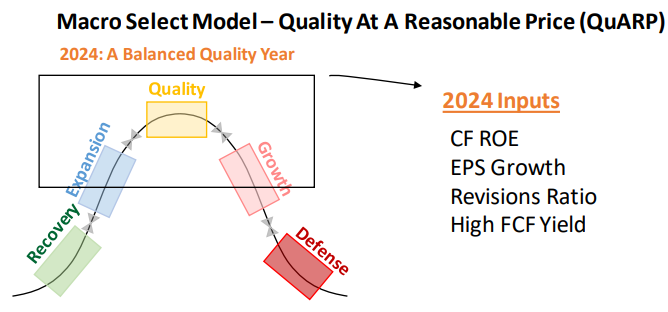

| most stocks are down since the first rate hike...what has worked?

under the surface most stocks are not faring as well as the index. In fact, the majority of stocks in the S&P 1500 (52.4%) are down since the Fed started hiking rates in March 2022. While the majority of losses have been concentrated in small caps during this period...

"stocks with high quality fundamentals have actually produced absolute positive returns in all cap ranges since the first hike."

* source: Piper Sandler, Michael Kantrowitz

1) KEY TAKEAWAYS

1) Equities MIXED / TYields + Oil + Gold LOWER / Dollar + HIGHER .

-Germany’s ZEW Expectations Index rose to the highest level in a year

DJ -1.1% S&P500 -1.5% Nasdaq -1.9% R2K -3.6% Cdn TSX -1.3%

Stoxx Europe 600 -1.0% APAC stocks HIGHER, 10YR TYield = 4.271%

Dollar HIGHER, Gold $1,993, WTI +1%, $77; Brent +0%, $82, Bitcoin $48,636

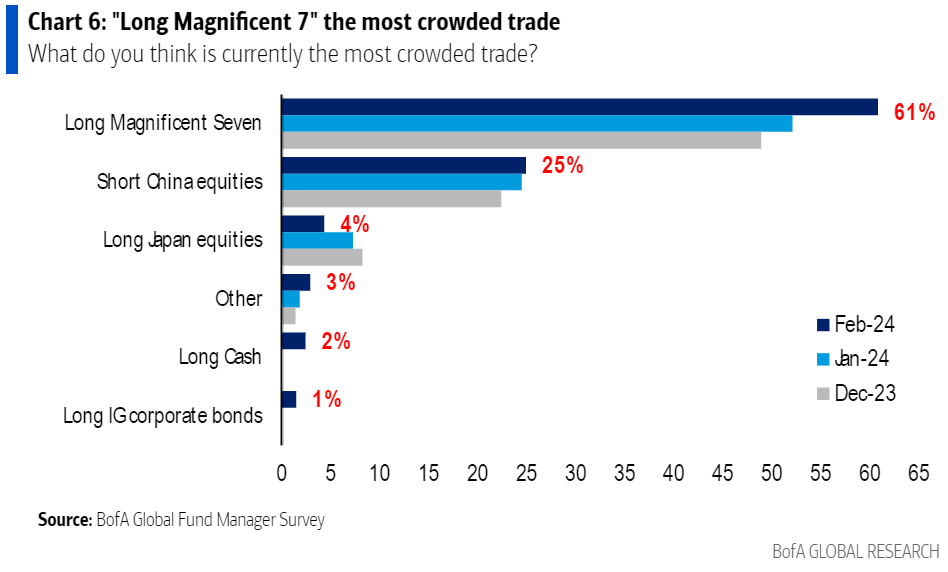

2) BofA's Global Fund Manager Survey:

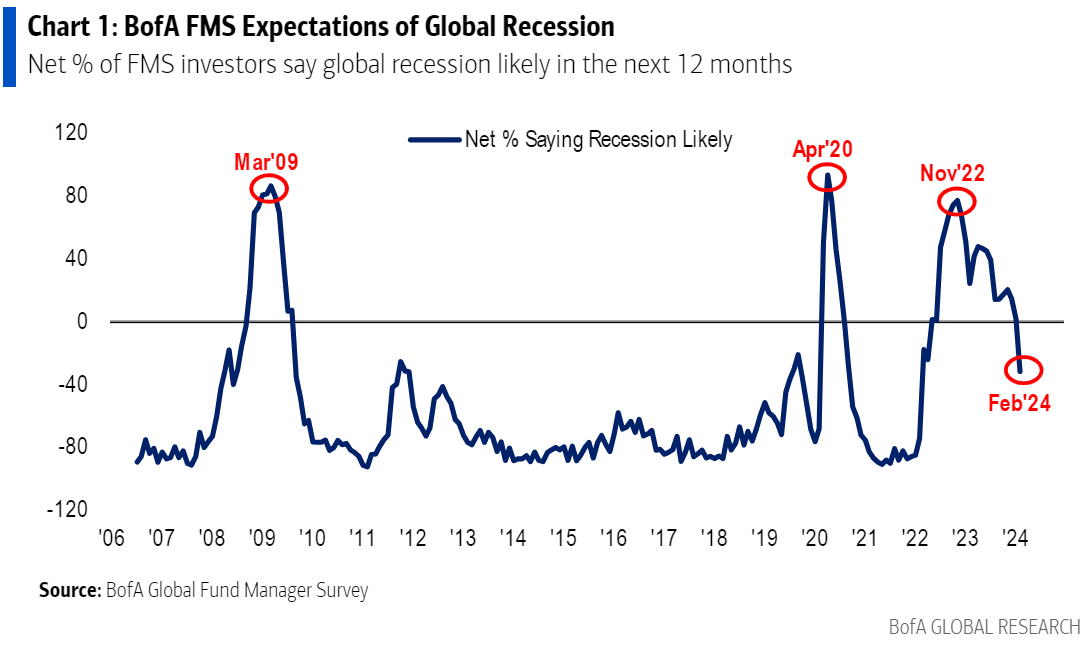

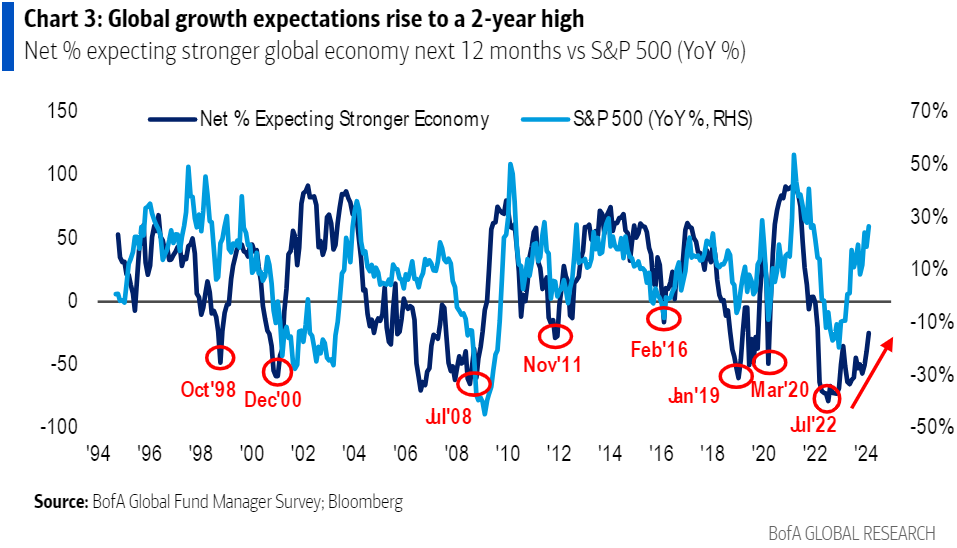

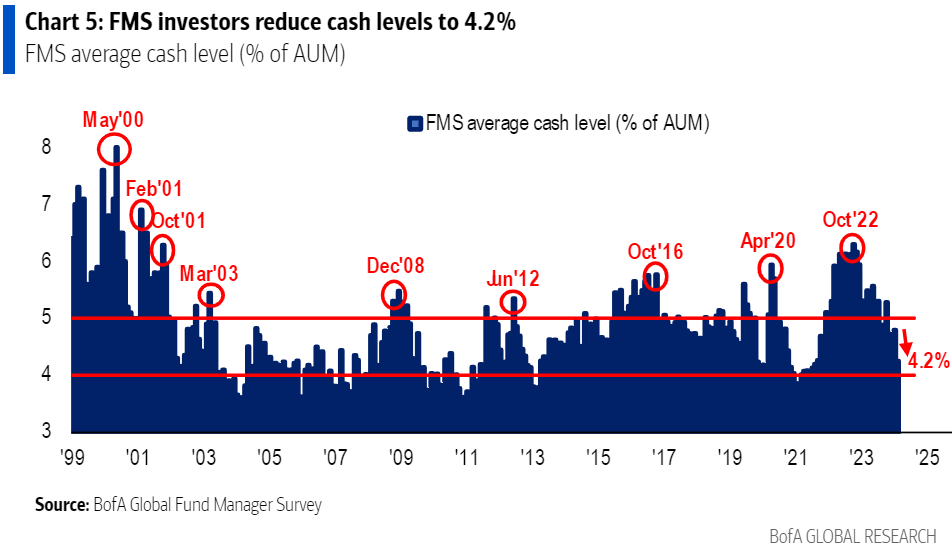

most bullish in 2 years | cash sharply cut to 4.2% as investors stop predicting global recession for 1st time since Apr'22

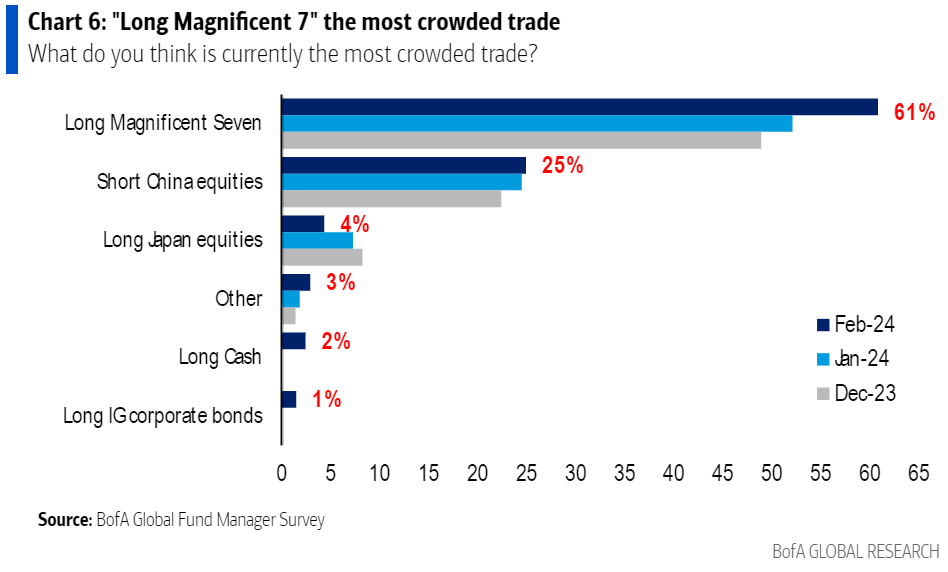

Allocation to US stocks highest since Nov'21 | to tech sector highest since Aug'20 | "long Magnificent 7" extremely "crowded"

* source: BofA Global Fund Manager Survey

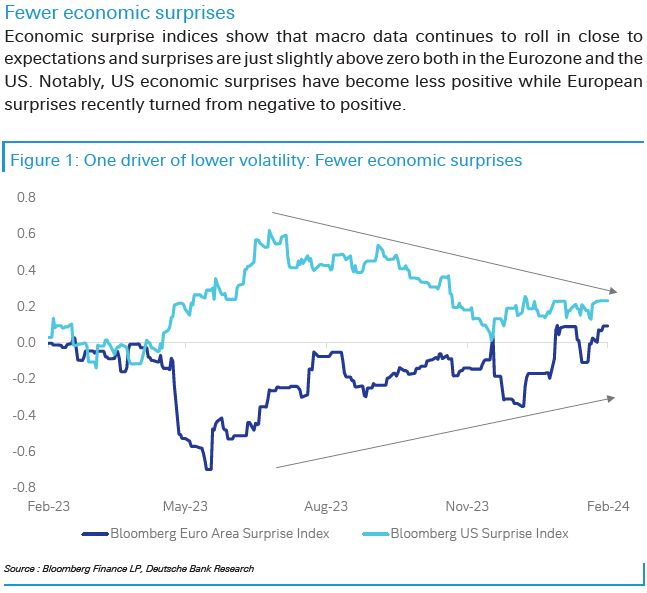

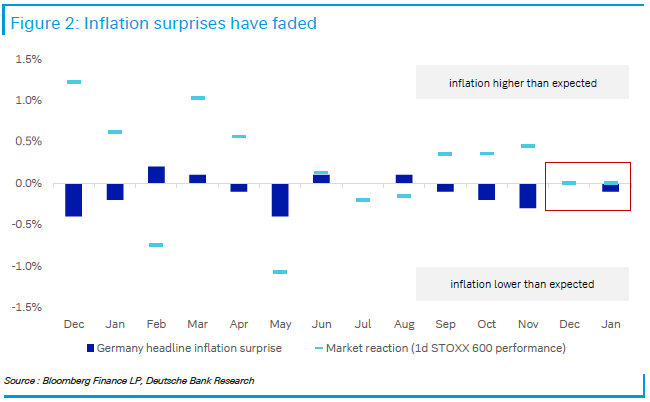

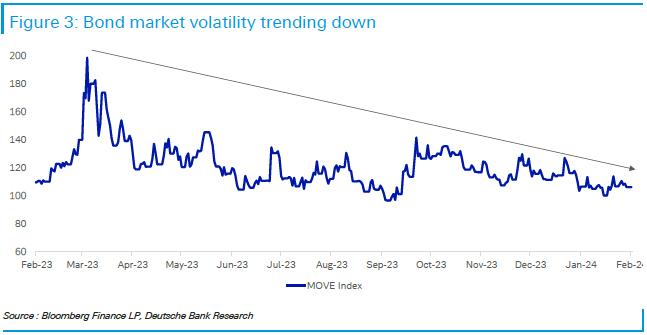

3) Deutsche Bank: 3 drivers of the lower volatility environment

1) fewer economic surprises, 2) lower rates volatility, 3) realistic short-term earnings expectations

* source: Deutsche Bank

4) Small business optimism index |

“Small business owners continue to make appropriate business adjustments in response to the ongoing economic challenges they’re facing.

In January, optimism among small business owners dropped as inflation remains a key obstacle on Main Street.”

-NFIB Chief Economist Bill Dunkelberg.

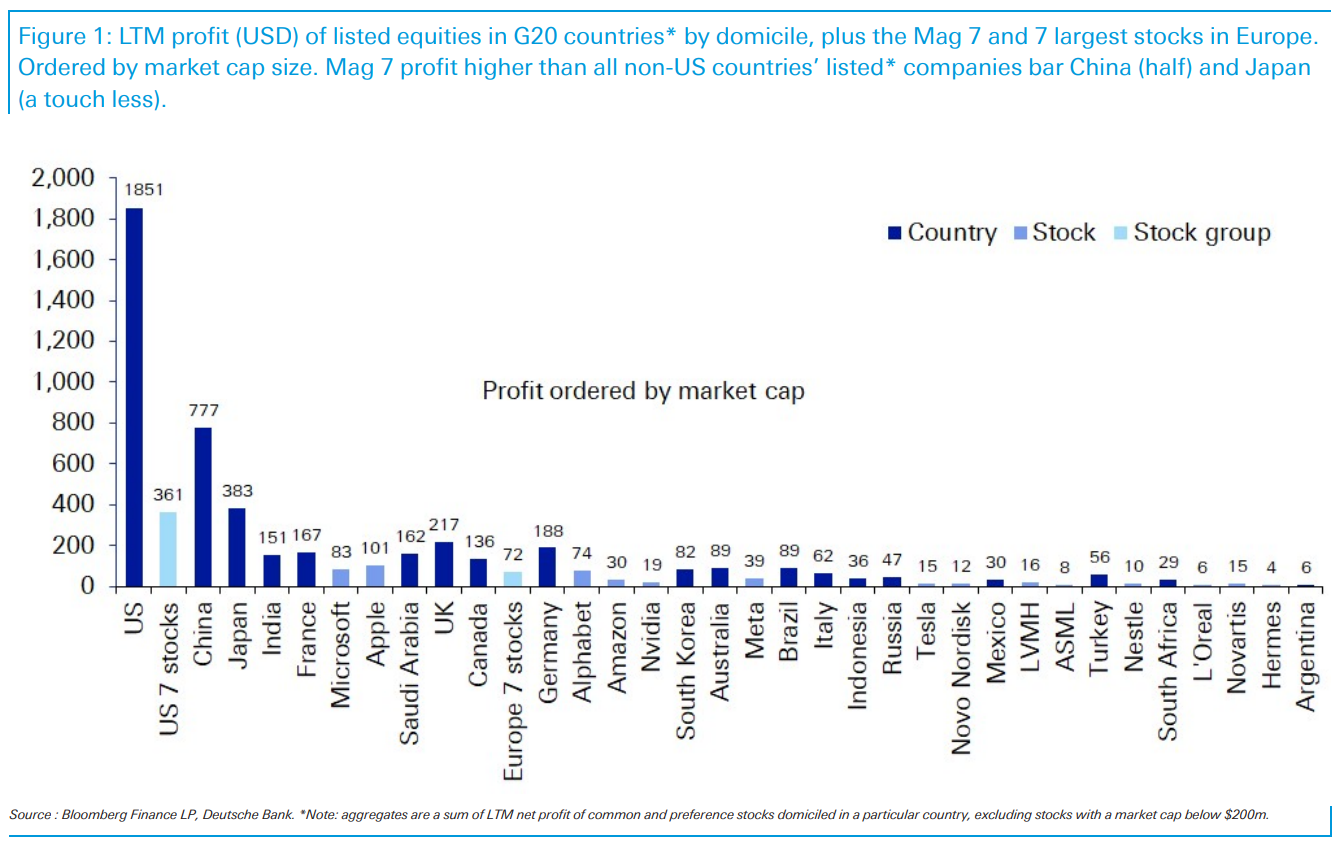

5) Food for thought:

The Mag 7 combined make more profit in one year than our very broad cohort of listed securities in all non-US countries other than China (just under half) and Japan (only a touch below).

The Mag 7 combined mkt cap alone would make it 2nd largest country stock exchange in the world, double that of Japan on fourth.

France, Microsoft, Apple, Saudi Arabia and UK market caps are all very similar.

Apple annually makes c.60% of the profits of a very broad index of French stocks or over 50% of German ones.

The Mag 7 are countries and not companies in both size and importantly profitability.

* source: DB's Jim Reid

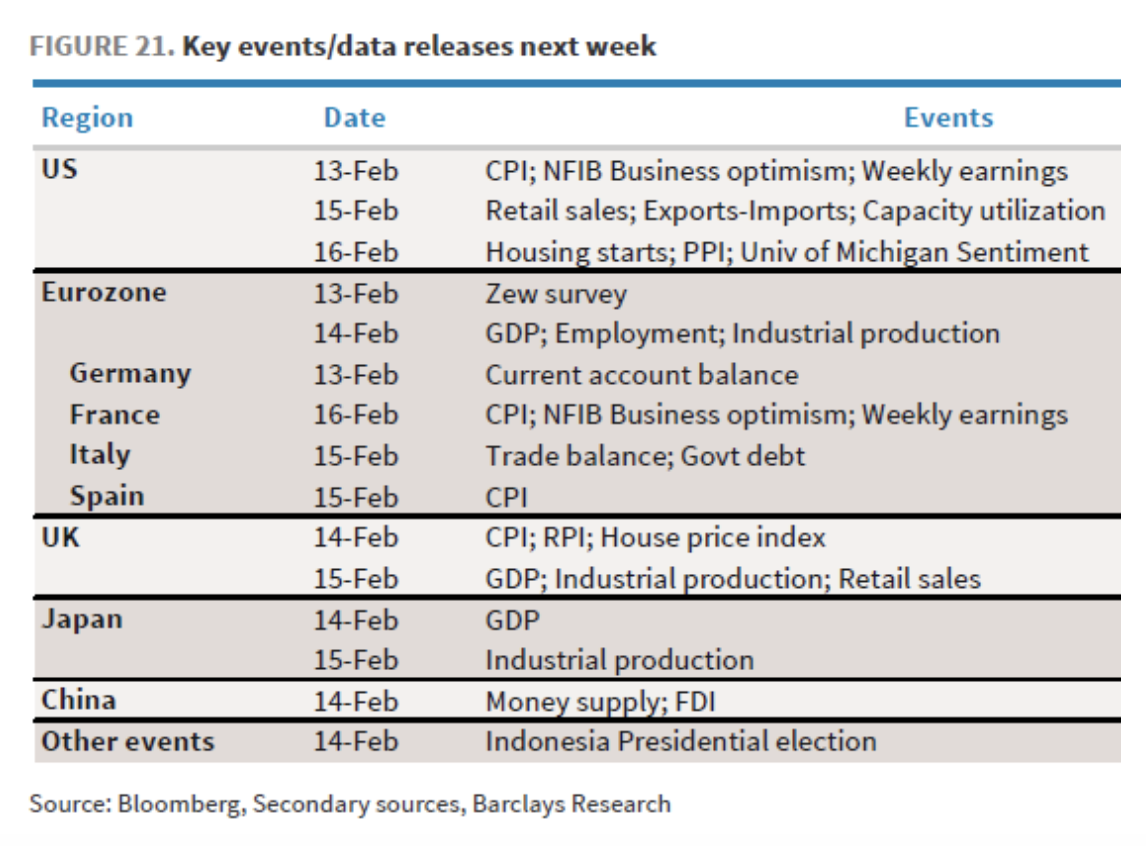

6) THIS WEEK:

US: inflation + retail sales

Europe: all eyes on inflation + the labor market + growth indicators in the UK

China: inflation data

Earnings: Coca-Cola, Kraft Heinz, Cisco, and Applied Materials.

* source: Barclays' Emmanuel Cau

2) ESG, COMPILED BY NATHAN GREENE

Three COP summit hosts unite to raise climate ambitions - Reuters

-The United Arab Emirates, Azerbaijan and Brazil, said on Tuesday they would team up to push for more ambitious emissions-cutting goals.

-The UAE's COP28 presidency said on Tuesday the summit hosts would form a three-way "troika" to focus on ensuring that more ambitious CO2-cutting pledges are made ahead of a deadline at 2025's COP30 summit in Belem, Brazil.

European Firms Nearly Doubled Purchase of Clean Power in 2023 - BNN

-Globally, 451 companies agreed to purchase a record 46 gigawatts, a 13% jump, according to a report by BloombergNEF. Buying in the US, the biggest market, dropped by 15% due to weaker economic conditions and rising interest rates, the report found.

3) MARKETS, MACRO, CORPORATE NEWS

- Cleveland Fed survey: CEO inflation expectations declined in 2024:Q1-CLEV

- Commercial-property loans coming due in US jump to $929 billion-BBG

- Resilient UK wage growth gives BoE new grounds for caution on rate cuts-FT

- Swiss franc falls to 9-week low vs dollar after Swiss CPI-RTRS

- ZEW: German economic sentiment rises in February-BAHA

- NY Fed survey finds stability in January inflation expectations-RTRS

- Japan GDP set to confirm slip to world’s fourth-largest economy-BBG

- Australia business conditions ease as households see improvement-BBG

- Exports fall 14.6 pct from Feb. 1-10-YNA

- BofA survey shows investors are all in on US tech stock rally-BBG

- Money markets show impact of ECB’s liquidity drain, BofA says-BBG

- Nvidia rally is fueling FOMO in the overall market, Julian Emanuel warns-CNBC

- Australia’s services inflation to cool only gradually, RBA says-BBG

- Traders see New Zealand policy error risk in rate-hike bet-BBG

- US Senate lurches toward possible early passage of Ukraine aid bill-RTRS

- CIA and Mossad chiefs to hold talks on Hamas hostage deal-FT

- EU’s top diplomat slams US for sending arms to Israel Gaza deaths mount-POL

- Germany’s Scholz fires back at Trump-POL

- Bitcoin extends its gains, breaking through the $50,000 level-CNBC

- Manchester United climbs as tender offer extends to Friday-BBG

- Carlos Slim says he’ll consider increasing his stake in Talos Energy-BBG

- Ørsted chief vows to fight ‘with everything I’ve got’ to revive fortunes-FT

- Woodside seeks deals after Santos failure in push for LNG-BBG

- KAP of South Africa considers $317 million logistics sale-BBG

- FrontView REIT working with advisers on IPO this year-BBG

- Sientra files for Chapter 11 bankruptcy in Delaware-BBG

- Senex covets Incitec’s fertiliser biz; board may opt for higher offer-AFR

- JetBlue shares jump 15% as activist Carl Icahn reports stake-CNBC

- TripAdvisor forms committee to explore possible deals-MSN

- Cadence Design expects lower 1Q revenue hardware sales normalize-MSN

- Uber, Lyft, DoorDash drivers in the U.S. to strike Valentine’s Day fair pay-CNBC

Oil/Energy Headlines: 1) Investors dump oil after US refinery shutdown-RTRS 2) US oil output from top shale regions to rise in March -EIA-RTRS 3) Oil industry, green groups challenge Biden offshore drilling plan-RTRS 4) Saudi Aramco starts trading US crude that helps set Brent oil benchmark-RTRS 5) Aramco chief sees ‘robust’ global oil demand growth this year-BBG 6) US shale production growth seen sputtering after last year’s boom-BBG

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.