Performance at Twilio Inc. (NYSE:TWLO) has been reasonably good and CEO Jeff Lawson has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 16 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

How Does Total Compensation For Jeff Lawson Compare With Other Companies In The Industry?

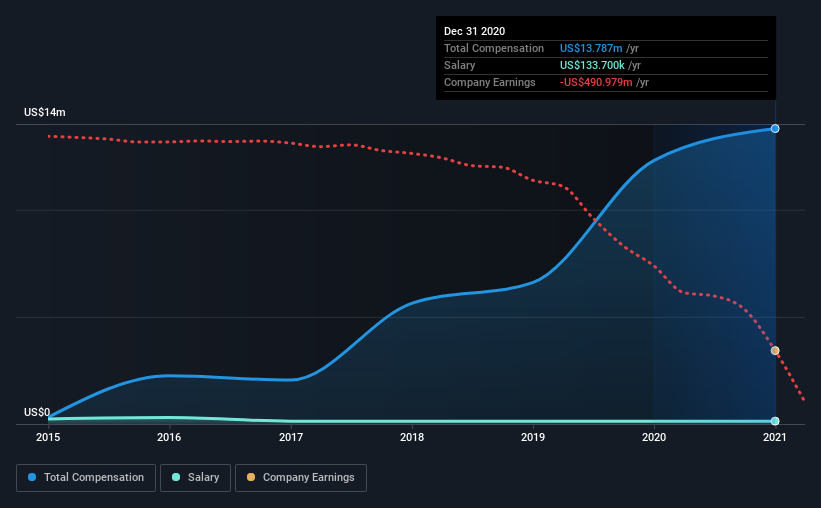

Our data indicates that Twilio Inc. has a market capitalization of US$54b, and total annual CEO compensation was reported as US$14m for the year to December 2020. That's a notable increase of 12% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$134k.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$12m. From this we gather that Jeff Lawson is paid around the median for CEOs in the industry. What's more, Jeff Lawson holds US$1.9b worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$134k | US$134k | 1% |

| Other | US$14m | US$12m | 99% |

| Total Compensation | US$14m | US$12m | 100% |

Speaking on an industry level, nearly 14% of total compensation represents salary, while the remainder of 86% is other remuneration. Investors may find it interesting that Twilio paid a marginal salary to Jeff Lawson, over the past year, focusing on non-salary compensation instead. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Twilio Inc.'s Growth

Twilio Inc. has reduced its earnings per share by 48% a year over the last three years. Its revenue is up 57% over the last year.

Investors would be a bit wary of companies that have lower EPS On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Twilio Inc. Been A Good Investment?

We think that the total shareholder return of 433%, over three years, would leave most Twilio Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Twilio primarily uses non-salary benefits to reward its CEO. The overall company performance has been commendable, however there are still areas for improvement. Despite robust revenue growth, until EPS growth improves, shareholders may be hesitant to increase CEO pay by too much.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 4 warning signs for Twilio that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.