Kudos to Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) for looking at opportunities beyond search engines and search-based advertising. YouTube and its cloud computing service arm have been smashing successes, driving at least some of the stock's gains in recent years. These businesses have also smoothed out potential revenue bumps from one quarter to the next.

Just for the record, though, the company's biggest revenue-generating business is still search ... by far. Both Alphabet and its investors should ensure that this remains the focal point, even as it expands its presence in other areas.

Image source: Getty Images.

It's still all about search

Don't misread the message: YouTube and Google Cloud are knocking it out of the park. The former's ad-based revenue jumped 48% year over year for the quarter ending in March, as the platform became a surprising destination for entertainment-starved consumers during the pandemic. As it turns out, people like access to a universe of short-form video content. Google's cloud-based revenue improved 46% during the same quarter, as corporations resumed their migration toward the much more flexible storage and computing format. Search ad revenue only improved 30% year over year for that three-month stretch.

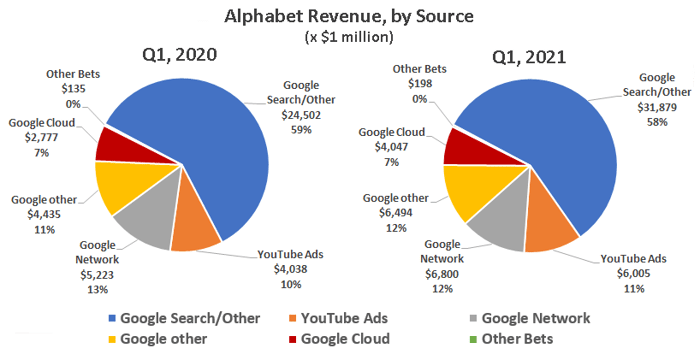

Keep things in perspective, though. Search still accounts for a little over 58% of Alphabet's revenue, down only slightly from its proportion in the first quarter of 2020. The pie charts below offer a visual summary of the company's revenue mix:

Data source: Alphabet. Charts by author.

There are some footnotes to add to the discussion.

Take traffic acquisition costs as an example. They're incurred by Google to direct people using the web to its affiliated websites, where those users are then monetized in different ways. The company can somewhat throttle ad revenue by spending more or less on web traffic. But traffic acquisition costs (TAC) aren't completely consistent as a percentage of search and related revenue. Last quarter's TAC reached $9.7 billion, or 19% of Google Services revenue, versus 22% in the same quarter a year earlier. Sometimes these costs can change for the worse, though.

Chief among the noteworthy footnotes, however, is the fact that while Alphabet publishes a detailed revenue breakdown, it doesn't provide the same breakdown for operating income. All we know for sure is that Google Services -- which encompasses search, YouTube, Android, and apps -- is profitable, while the company's cloud business and "other bets" continue to lose money. Compare Alphabet's Q1 operating profit breakdown from this year and last year:

Data source: Alphabet. Charts by author.

The good news is that the company's cloud loss is clearly shrinking. At its current rate of progress, Google Cloud may even work its way out of the red and into the black within a year or so. The bad news is that while we don't know for sure whether YouTube is a profitable venture, if it is, it's not likely to be wildly profitable.

Analysts and industry insiders are conflicted on the YouTube profitability question, and their collective consensus loosely suggests an operation that's near breakeven, although the average has a wide standard deviation. Even if YouTube is firmly profitable, its revenue still only accounts for less than 14% of Google Services' revenue, and less than 11% of Alphabet's total revenue. Indeed, if every bit of YouTube's revenue was converted into profit (which it isn't -- not even close), it would still be a minority of Alphabet's total income.

In other words, it's not a game-changer.

The bullish thesis stands, even if for a different reason

Many investors are surprised to learn just how minimally YouTube and Google Cloud affect Alphabet's fiscal results. That's the point of summarizing this reality in the simple graphics above. And to be fair, while both operating units are relatively small now, they're both growing nicely, and at a much faster clip than the company's traditional search advertising business.

If you're a shareholder, though, this visual analysis also shows the importance of Alphabet's core business. The profits made on search and advertising helped fund the expansion of YouTube en route to self-sufficiency, and they are still funding the establishment of Alphabet's cloud computing operation. Investors will need some further evidence that the time, resources, and innovation put into the cloud segment of its operations is truly helping the bottom line if Alphabet is to remain the cash-cow juggernaut it currently is.

This is just some food for thought. I believe the stock's still a buy either way.

10 stocks we like better than Alphabet (A shares)

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Alphabet (A shares) wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of June 7, 2021

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. James Brumley owns shares of Alphabet (A shares). The Motley Fool owns shares of and recommends Alphabet (A shares) and Alphabet (C shares). The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.