- Greed is driving the US stock market to new highs

- Fear will eventually replace greed. We provide 10 reasons to be fearful.

- If something cannot go on forever, it will end. The questions are not if but when, and how bad.

Be fearful when others are greedy; be greedy when others are fearful -- Warren Buffett

The Dow Jones Industrial Index reached 30,000 for the first time on November 23, 2020 and then the Nasdaq and S&P500 indexes both achieved new highs soon after.

This continuing rise in the face of a pandemic is crazy. Several explanations have been offered:

- Fear of missing out (FOMO) is the greed explanation

- Hopium is the “drug” that leads investors to see beyond the pandemic to a perceived prosperous future

- Federal Reserve support is seen as a godsend that will continue to fuel the stock market. Will the Fed buy stocks? What is its limit?

- Low interest rates are viewed as beneficial to the stock market for a variety of reasons, not the least of which is that discounted future cash flows are high. Also, it drives investors to take more risk in order to earn returns

10 Reasons to be Afraid

Greed is a powerful motivator, but in the extreme it is cause for fear. In the following we provide 10 reasons to be fearful. You can probably think of more. Please watch our video on this topic for details. There are plenty of opportunities for the Bulls and the Bears, but not the Pigs.

1. The Stock Market is in a Bubble

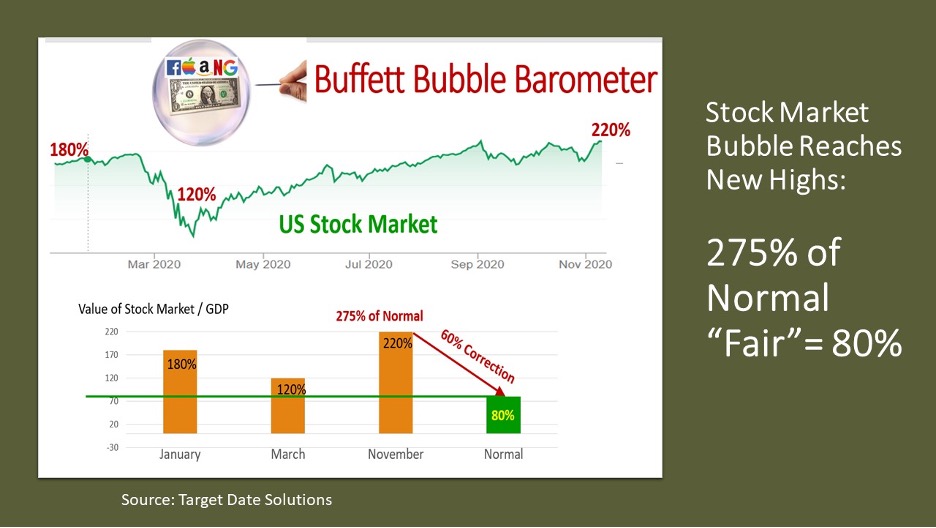

No one knows for sure when we are in a bubble until it bursts, but there have been reliable indicators that forecast bursting bubbles. The issue is what price is too high.

The Buffett Bubble Barometer shown in the following has been a reliable predictor.

The Buffett indicator is the ratio of the value of the stock market to Gross Domestic Product (GDP). This ratio is about 80% in non-bubble times and has never been as high as it is currently, at 275% of “normal.” In other words, an overpricing of almost 3X. It will take a 60% correction to restore the indicator to normalcy. There are other such indicators, like Price/Earnings ratios, that are also at their peaks currently.

Detractors argue that “It’s different this time” because interest rates have never been so low. More on this in the ZIRP (Zero Interest Rate Policy) discussion below.

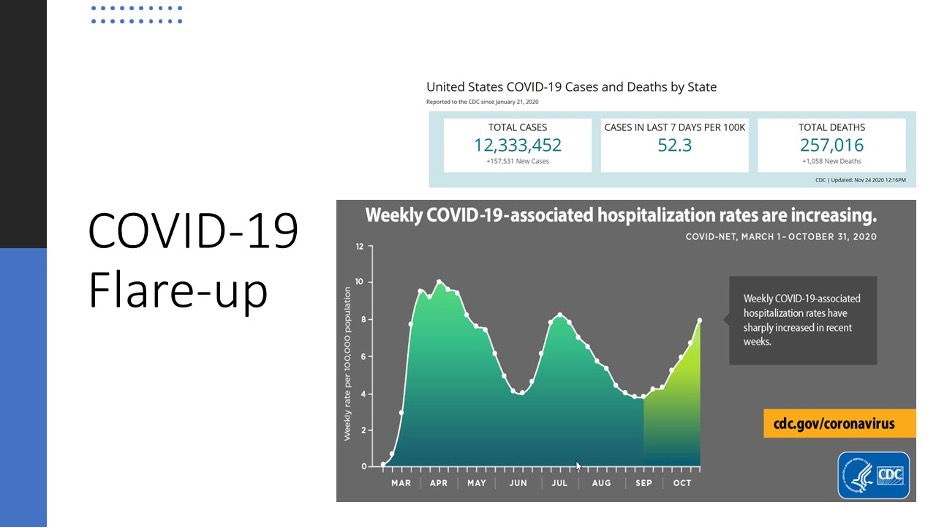

2. COVID-19 is getting worse, not better

The summer months saw a decline in the number of people infected by the virus but that all changed as we entered fall. The virus has mutated to become more contagious, although less deadly. We’ve had a flare-up that is setting the economy back, especially impacting theaters and restaurants.

Some industries are benefitting from the pandemic, like the drug companies who have found a viable vaccine, but it’s mostly the FAANG (Facebook, Apple, Amazon, Netflix and Google) stocks that are driving the stock market. Is Apple really worth more than a trillion dollars? That’s bigger than the entire Canadian stock market. The vaccines are indeed a big deal that will save a lot of lives and bring the economy back toward normalcy, but economists see recovery taking years, not months.

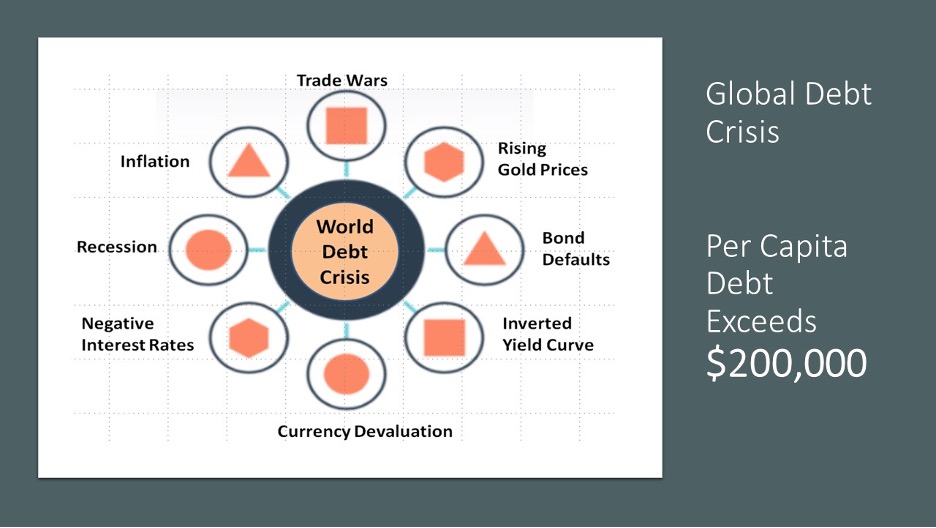

3. The World Debt Crisis

The world is deep in debt. You could say it’s bankrupt except countries can print money, and they are. The problem is that paper money is just paper; that’s why it’s called “fiat currency.” The worth of fiat currency relies on our willingness to provide goods and services in exchange for pieces of paper. The U.S. dollar enjoys a special status because it is the world’s trade currency, but that does not exempt it from devaluation.

Per Capita World Debt Has Surged Above $200,000 and is the source of the problems shown in the graph above. The outcome is likely to be painful, although it could take a long time to reach its ultimate conclusion. Politicians hope it will just go away. Addressing the problem can be political suicide. American theologian James Freeman Clarke said "A politician thinks of the next election. A statesman, of the next generation." That’s why there’s little push-back against continued large deficits around the world.

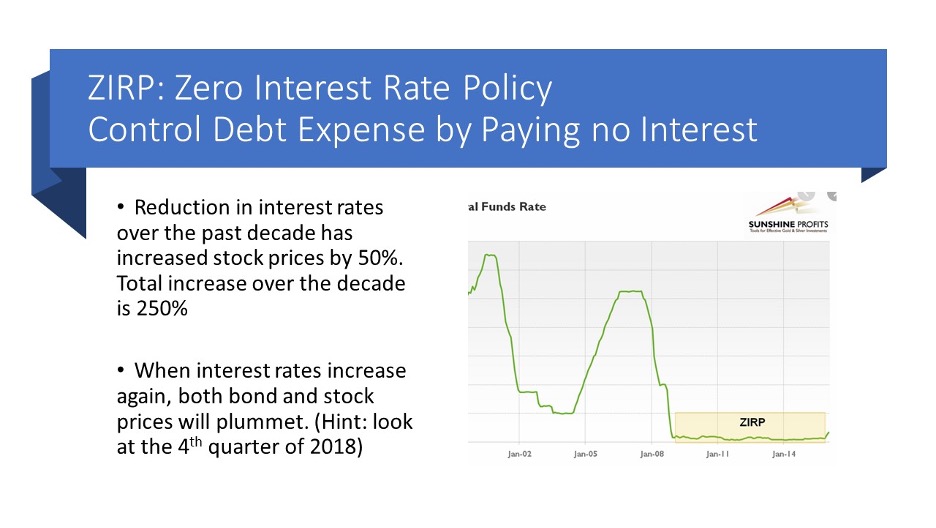

4. Zero Interest Rate Policy (ZIRP)

Anyone who borrows money would love to borrow interest-free, but that’s a special gift reserved for central banks who can, and are, manipulating bond markets to ridiculously low levels of interest. Some are even getting lenders to pay them by bringing interest rates below zero. Are you as astonished as I am? We should be afraid.

Some say that low demand for loans has driven down interest rates, but that misses the needs of lenders. Lenders should demand interest payments that exceed inflation to compensate them for letting someone use their money, but that is not happening because central banks are not allowing it to happen. Could lenders revolt?

The decline in interest rates over the past decade has caused stock prices to increase by 50%, which explains about one-fifth of the 250% increase in stock prices over this time period. The symmetry is worth noting. When interest rates recover to normal levels, bond prices will go down – that’s a given. But stock prices will also go down because discount rates will increase.

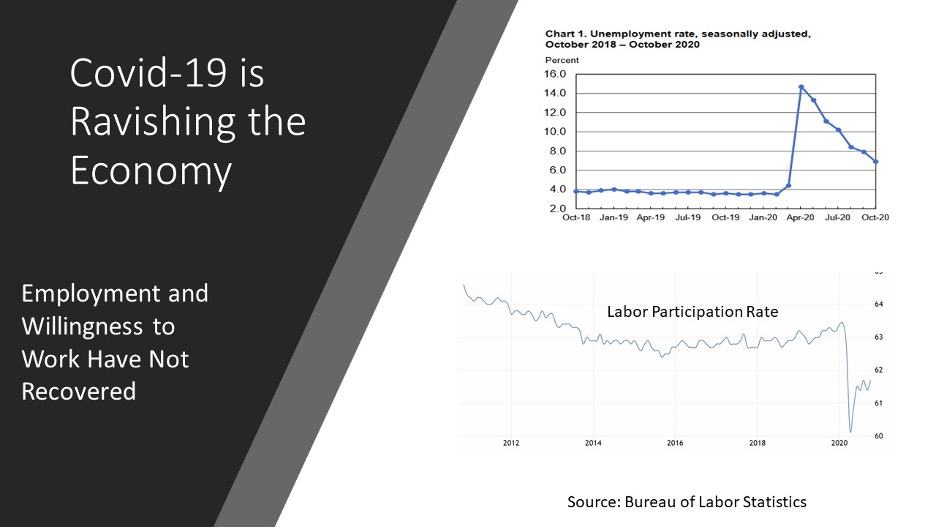

5. The Economy is in Shambles

Economies around the world are suffering from the effects of COVID-19. Recoveries are occurring but are incomplete. Unemployment in the U.S. at 7%, well above the 4% average, plus many have withdrawn from the workforce, bringing down workforce participation.

Most economists believe it will take years to fully recover from the pandemic.

6. A Great Wealth Divide is Causing Social Unrest

Quantitative Easing (QE) has made the rich richer by paying them handsomely for their bonds, which they in turn invested in the stock market. This caused security price inflation, a form of inflation that is not captured by the Consumer Price Index (CPI). Much of the wealth of the wealthy is held in stocks and bonds.

Even though the U.S. remains one of the richest countries on earth, the not-so-rich understandably want more of the wealth of this country. They are not getting what they think is a fair share. The top 10% own 68% of the wealth. Consequently, there have been riots that break into stores for free stuff, and socialism is desired by many. How would capital markets operate under socialism? Can it?

7. Nuclear Threats

The world has lived with nuclear threats since the first bomb was dropped in 1945. One can only hope that “nuclear deterrents” that could blow up the entire world will never be used, but dirty bombs are a real threat. Such devices could contaminate a wide area with radiation and/or lethal chemicals. The results of a dirty bomb would be catastrophic to the world and the capital markets. This is a threat that we think is small, but the consequences are huge.

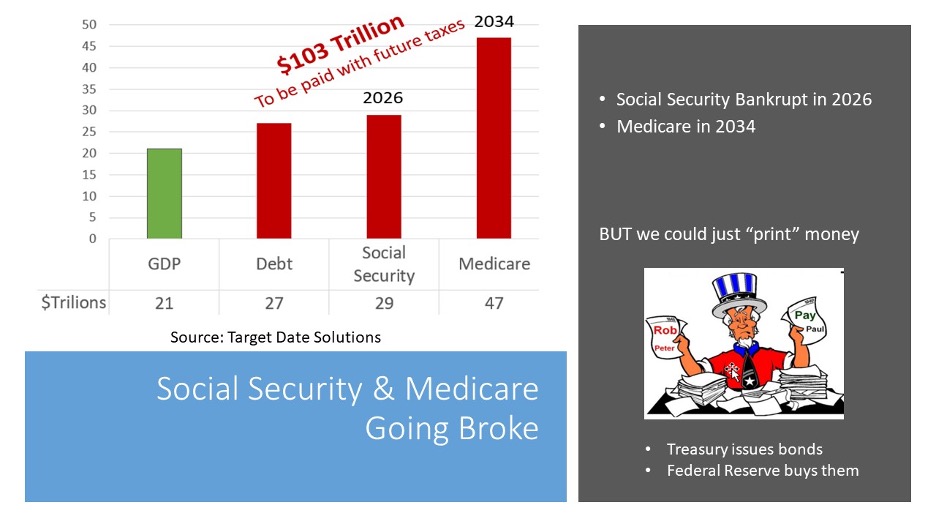

8. Social Security and Medicare Will be Bankrupt Soon

70% of baby boomers – about 55 million people – rely heavily on Social Security, but tax receipts have been insufficient to pay benefits since 2018. The projected liability for Social Security is $29 trillion, which is $2 trillion greater than the official $27 trillion figure.

Even worse, 60 million people are insured by Medicare and that figure is expected to increase to 90 million by 2030. The estimated present value of future Medicare costs is $47 trillion.

All in, the U.S. debt is $103 trillion, which is almost 5 times GDP. It’s enormous.

Some say Social Security and Medicare can’t go broke because we own the “printing press.” It’s helpful to understand how money is “printed.” The U.S. Treasury issues bonds so it can spend. For example, recent COVID relief checks were issued by the Treasury. In good times, U.S. and foreign citizens have been happy to buy these bonds, but they are not paying interest now. Today most of the newly issued Treasury bonds are being purchased by the Federal Reserve. Money is “printed” by the Treasury issuing bonds that the Federal Reserve buys. Which brings us to the next threat:

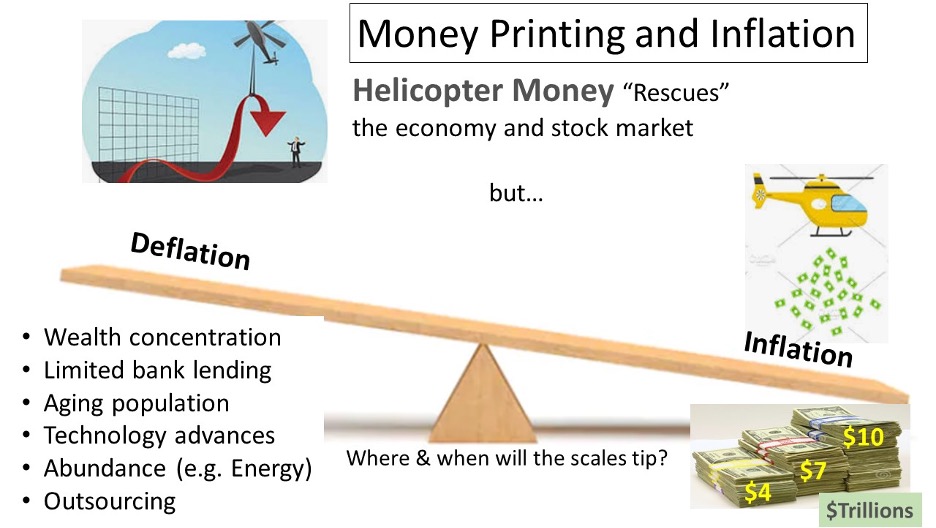

9. Serious Inflation Has Occurred and More is on the Way

Quantitative Easing (QE) of $4 trillion did not create inflation in consumer prices, but it did solve the crisis of 2008 when our economic machinery was grinding to a halt, so QE has been declared a success. But QE has inflated stock and bond prices, making recent gains an illusion, albeit an excellent magic trick. Do you feel richer?

The recent COVID relief of $3 trillion should increase consumer prices because that money is being used to buy groceries and pay rents/mortgages. Plus, another $3 trillion or more is likely. This humanitarian relief is greatly needed, but it will not be free. There will be consequences.

This influx of new money will eventually tip the inflation-deflation scale to inflation. A confluence of factors has brought us disinflation/deflation for a decade, as shown in the picture above, but they can’t permanently ward off the effects of too many dollars chasing too few goods.

10. Target Date Funds do not Protect Those Near Retirement

With $2.5 trillion in target date funds (TDFs), many beneficiaries trust that their lifetime savings are protected, but they’re mistaken. The typical target date fund is 78% in risky assets at the target date, where we define “risky” as equities and long-term bonds. There are a few “SMART” TDFs that are safe, but they do not have much invested in them; it’s a shame.

In 2008 TDFs for those retiring near 2010 lost 35% and beneficiaries were shocked. This catastrophe prompted the first and only joint hearings of the SEC and DOL in June 2009. Regrettably, these hearings changed nothing of consequence. There was $200 billion invested in TDFs in 2008. Today there is more than 10 times that $200 billion in TDFs, and many more people. The next market crash will devastate those near retirement who are invested in TDFs. Most of these people are in TDFs because they cannot decide on their investments; they are financially illiterate and need protection.

Conclusion

I earned an MBA in Finance from the University of Chicago, a big pioneer and proponent of efficient markets, so it’s been called ‘the school where nothing matters.” We were taught that the stock market is always “right” because it captures the collective wisdom of all investors. Yet it’s undeniable that there have been bubbles that, after the fact, show that prices were too high. I am not a permabear as some readers have suggested. I’m concerned and perplexed by the disconnect between the economy and the stock market, and truly wish it were as simple as “the market is always right.”

Ron Surz is CEO of Target Date Solutions, Age Sage, GlidePath Wealth Management, and co-host of the Baby Boomer Investing Show that you can binge watch on Patreon.

Please watch and support our Baby Boomer Investing Show on Patreon and visit our Baby Boomer Libraries, our Target Date Fund blog, and our GlidePath blog.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.