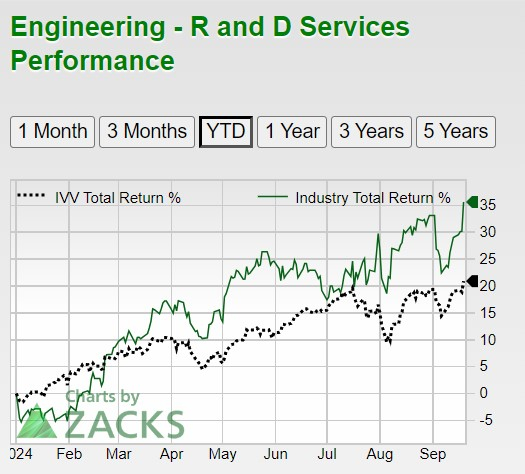

Currently in the top 35% of over 250 Zacks industries, The Zacks Engineering-R and D Services Industry continues to stand out among the industrial products sector.

With a captivating total return of +35% year to date, this industry has impressively outperformed the broader indexes in 2024.

That said, here are a few of the industry’s top stocks that investors may want to consider.

Image Source: Zacks Investment Research

Top Infrastructure Stocks

Coveting a Zacks Rank #1 (Strong Buy), Arcadis ARCAY and Sterling Infrastructure’s STRL stock have been two top contributors regarding the strong price performance of the Zacks Engineering-R and D Services Industry.

Arcadis stock has spiked +33% this year as an international provider of consultancy, planning, and architectural design for buildings among other infrastructure-related activities. Also specializing in infrastructure for building and transportation solutions, Sterling Infrastructure shares have soared nearly +70% in 2024.

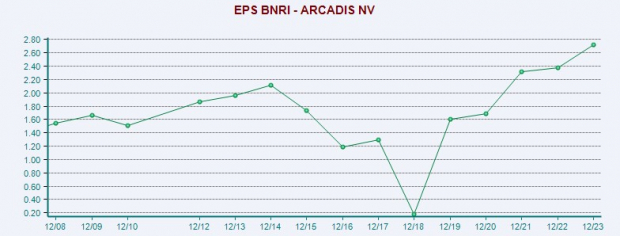

Their stellar rallies could continue as earnings estimate revisions have trended higher making their increased probability and steady top line growth more compelling. Expecting over 20% EPS growth in fiscal 2024 and FY25, Arcadis’ bottom line has expanded significantly since the pandemic.

Image Source: Zacks Investment Research

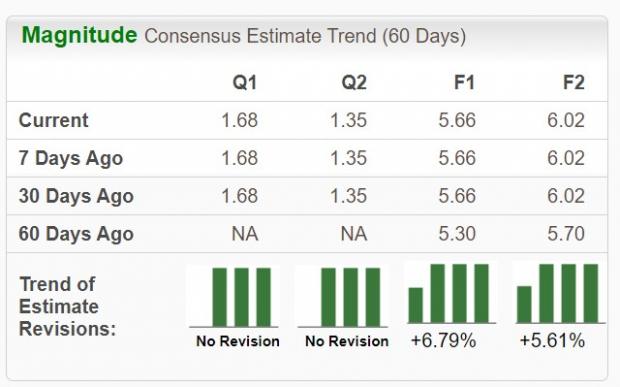

Sterling Infrastructure’s annual earnings have hit new heights as well with EPS expected to increase 26% in FY24 and projected to rise another 6% next year to $6.02 per share. Plus, FY24 and FY25 EPS estimates have risen over 5% in the last 60 days respectively.

Image Source: Zacks Investment Research

Aerospace Engineer Leader

Sporting a Zacks Rank #2 (Buy) is Howmet Aerospace HWM, a provider of engineered solutions for customers in the transportation and aerospace industries. With its reach extending to commercial and defense aerospace markets, Howmet’s stock has shot up +80% YTD.

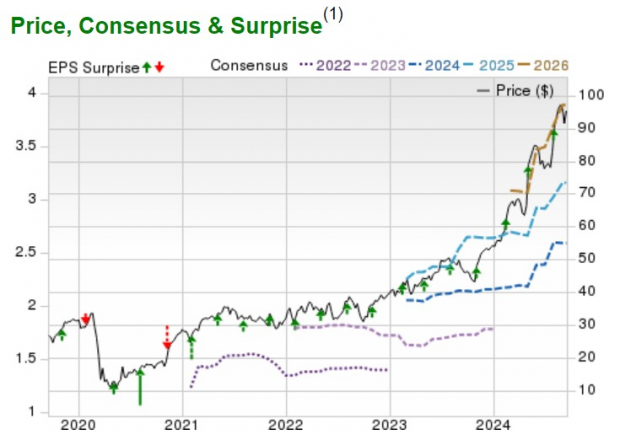

This comes as Howmet has now reached or exceeded earnings expectations for 15 consecutive quarters as illustrated by the green arrows in the EPS surprise chart below.

Image Source: Zacks Investment Research

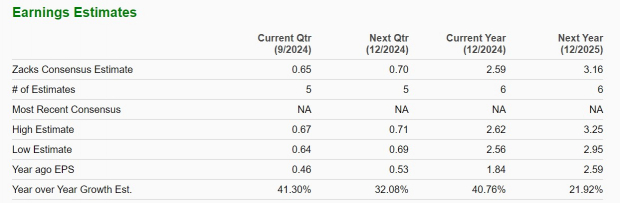

Despite such an extensive rally, earnings estimates have remained higher in the last two months with Howmet’s EPS projected to climb 41% in FY24 and forecasted to soar another 22% in FY25 to $3.16 per share.

Furthermore, Howmet's total sales are projected to increase over 10% in FY24 and FY25 with projections edging toward $8 billion.

Image Source: Zacks Investment Research

Bottom Line

The expansion of these top engineering companies has led to stellar gains for their stocks. Now may be a good time to buy considering EPS estimates are higher with Arcadis, Sterling Infrastructure, and Howmet Aerospace checking an “A” Zacks Style Scores grade for Growth.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpArcadis NV (ARCAY) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.