In a historically-volatile 2022, investors should heavily consider strengthening their portfolio’s defensive capabilities.

How can one achieve this?

Targeting low-beta stocks is an excellent way to strengthen a portfolio's overall defense against volatility.

Still, what even is beta, and what is considered as low?

Beta is a measure of a stock's systematic risk, or volatility, compared to the market as a whole. Generally, the benchmark is the S&P 500, which has a beta of 1.0.

A stock with a beta higher than 1.0 is considered more volatile than the general market. The opposite is also true – stocks with a beta of less than 1.0 are considered “low-beta” and are less sensitive to the market’s movements.

Three highly-ranked stocks with a beta of less than 1.0 – Molina Healthcare MOH, The Kroger Co. KR, and BJ’s Wholesale Club BJ – could all be considerations for investors.

Below is a year-to-date chart of all three stocks with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

Molina Healthcare

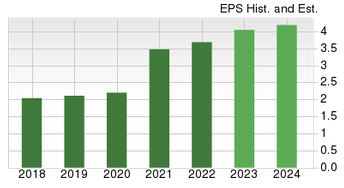

Molina Healthcare is a multi-state managed care organization participating exclusively in government-sponsored healthcare programs. MOH sports a Zacks Rank #2 (Buy).

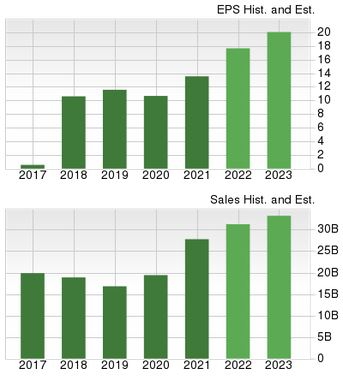

Molina Healthcare’s growth trajectory is impossible to ignore – the Zacks Consensus EPS Estimate of $17.65 for its current fiscal year (FY22) pencils in a stellar double-digit 31% Y/Y uptick. For FY23, estimates are calling for an additional 13.5% of growth.

The projected earnings growth comes on top of forecasted Y/Y revenue growth of 12.5% and 6.3% in FY22 and FY23, respectively.

Image Source: Zacks Investment Research

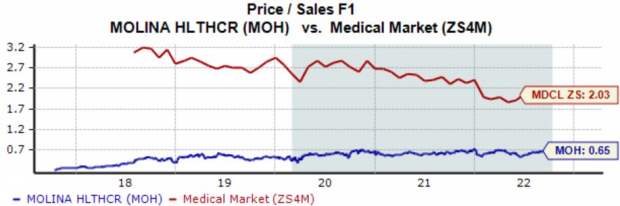

MOH shares could be attractive to value-focused investors, bolstered by its Style Score of an A for Value. The company’s 0.6X forward price-to-sales ratio resides on the low side, reflecting a deep 70% discount relative to its Zacks Medical sector.

Image Source: Zacks Investment Research

The Kroger Co.

Founded in 1883, the long-time retailer operates approximately 2,700 retail stores under various banners and divisions in 35 states.

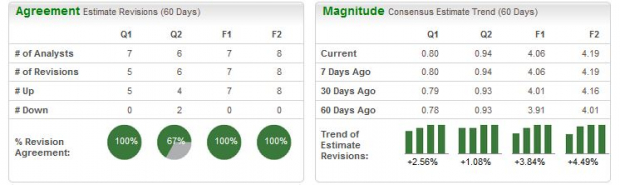

The company’s earnings outlook has turned notably bright over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

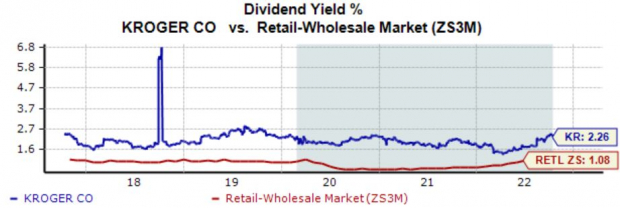

Further, Kroger’s dividend metrics are stellar – the company’s annual dividend yields a respectable 2.3% paired with a sustainable payout ratio of 21% of earnings.

Impressively, the company has upped its dividend payout five times over the last five years, translating to a double-digit 13.2% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

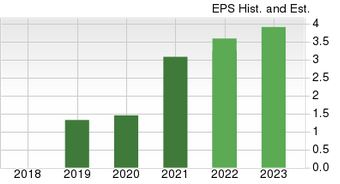

For the cherry on top, KR carries a rock-solid growth profile; earnings are forecasted to soar by a double-digit 10.3% in FY22 and a further 3.2% in FY23.

Image Source: Zacks Investment Research

BJ’s Wholesale Club

Headquartered in Westborough, MA, BJ’s wholesale club operates warehouse clubs on the east coast of the United States.

Like KR, analysts have had a bullish stance on the company’s earnings outlook over the last several months, helping land the stock into a favorable Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

In addition, BJ sports an inspiring growth profile; estimates suggest Y/Y earnings growth of 10.5% and 7.6% in FY22 and FY23, respectively.

Image Source: Zacks Investment Research

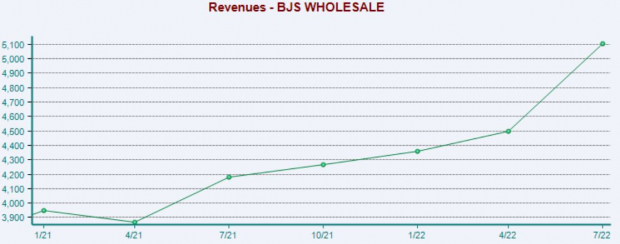

BJ’s Wholesale Club has a mighty strong earnings track record, exceeding the Zacks Consensus EPS Estimate for ten consecutive quarters. Just in its latest print, the wholesaler registered a sizable 28% bottom line beat.

Revenue results have also been robust; BJ has penciled in nine revenue beats across its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

With volatility headlining the market year-to-date, adding low-beta stocks to a portfolio can help soften large price swings.

All three stocks above – Molina Healthcare MOH, The Kroger Co. KR, and BJ’s Wholesale Club BJ – carry a beta of less than 1.0, helping to provide a durable shield against volatility.

Further, all three carry a favorable Zacks Rank, telling us that their near-term earnings outlook has recently improved.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Molina Healthcare, Inc (MOH): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.