An investor who can find a stock that goes up 15% annually has found a remarkable thing. The S&P 500 itself goes up roughly 10% per year, and investors who pick individual stocks want to beat this. While there are market-beaters out there, there are relatively few, so it's a big deal when an investor finds one.

Supposing someone invested in a stock that went up 15% per year, it would gain about 300% over the course of a decade. Therefore, a stock that quadruples in value in a single decade is a big deal. But shares of The RealReal (NASDAQ: REAL), Carvana (NYSE: CVNA), and Byrna Technologies (NASDAQ: BYRN) have done this just in 2024.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

In other words, if this trio had quadrupled over 10 years, it would have been significant. But considering they've done it in just one year, each one warrants a closer look.

1. The RealReal: Up 421%

The RealReal has the go-to e-commerce platform for preowned luxury goods that have been authenticated. For a time, its user base was declining, and it was burning cash, dropping the stock to a very cheap valuation. In early 2023, it dropped to below 0.2 times its sales -- stocks often trade between 1 and 2 times sales. And investor Michael Burry took notice.

Burry is famous for his successful (and large) bet that the mortgage space would collapse right before the Great Recession. Since that windfall trade, he's continued to invest in select stocks and gravitates toward stocks that are cheap, such as The RealReal stock in early 2023.

Since initially taking a stake, Burry's hedge fund Scion Asset Management has increased and reduced its position in The RealReal stock, as the table shows. But he still owns 500,000 shares as of the third quarter of 2024.

| Quarter | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 |

|---|---|---|---|---|---|---|---|

| Shares held | 684,442 | 1,500,000 | 750,000 | 654,806 | 1,412,692 | 1,000,000 | 500,000 |

| Percentage change | n/a | 119% | (50%) | (13%) | 116% | (29%) | (50%) |

Data source: Figures from financial filings for Burry's hedge fund Scion Asset Management. Table by author.

Investors can only speculate why Burry likes The RealReal stock, but there are things to like besides its bargain-basement valuation. For starters, the number of active buyers on the company's platform just hit its highest level since the fourth quarter of 2022. Moreover, its take rate for the third quarter of 2024 was at an all-time high of 38.6%. This allowed it to profit $2 million in Q3 free cash flow, which is just the second time it's ever generated positive free cash flow.

These positive developments are why The RealReal stock was one of the best stocks in 2024, and Burry's eye for value helped him buy at an opportune time.

2. Carvana: Up 323%

In 2022, Carvana stock dropped below $4 per share as investors feared bankruptcy. The company renegotiated its debt, mitigating this risk. That sent shares soaring into the stratosphere, including in 2024, as they've more than quadrupled in value.

Carvana takes the common task of buying a car and makes it less strenuous by digitizing the entire process. This has proved undeniably popular with consumers, as evidenced by the company's more than 200% revenue growth in the last five years. So the company does deserve some credit. But there are still financial headwinds.

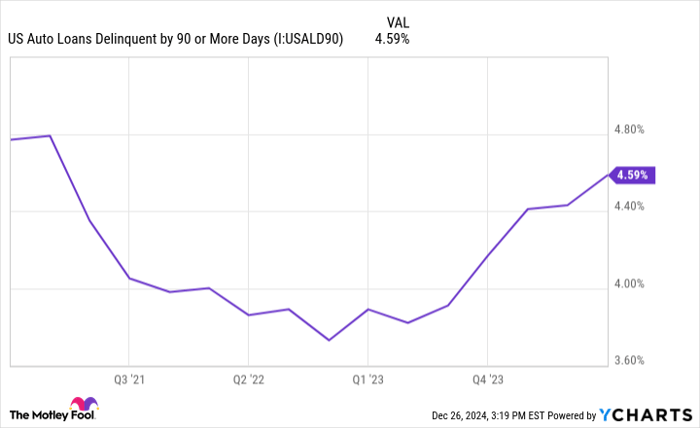

For starters, 2024 has been one of Carvana's best years for sales. But could sales take a step back in 2025? One thing to consider is that auto loan delinquencies are rising fast and are at their highest levels in nearly four years. This could slow things down for Carvana if its financial partners decide to take on less risk by buying fewer of its loans.

US Auto Loans Delinquent by 90 or More Days data by YCharts

Moreover, Carvana made a deal in 2023 to temporarily reduce the interest it paid on its debt. But it could ultimately result in higher payments when it reaches the end of its two-year deal with lenders. Considering it's set to expire in 2025, Carvana could wind up using most of its cash flow to service its debt, which could put a damper on shareholder returns for the foreseeable future.

3. Byrna Technologies: Up 379%

Most people have heard of Carvana. And many investors have heard of The RealReal, thanks to Michael Burry. But almost no one has heard of Byrna Technologies.

This small company makes self-defense devices that look similar to handguns, but deliver less-lethal projectiles filled with chemical irritants or plain hard plastic projectiles. And sales are really taking off.

Byrna calls its primary devices "launchers," and it only launched them in 2019. It's already sold 500,000 as of November 2024. But management believes its market is huge. It hopes to reach 5% of non-gun owners and 10% of gun owners. Management says that this is a $17.5 billion goal, whereas it only has $73 million in trailing-12-month revenue -- that's a lot of potential upside.

Byrna may be small, but its financials still have desirable traits. First, revenue in the third quarter of 2024 jumped 194% year over year to a record $20.9 million. Second, the company has over $3 million in net income through the first three quarters of 2024, compared with a loss of $8 million in the same period of 2023. Finally, it may only have around $20 million in cash, but it also has zero debt, which gives it a relatively strong balance sheet for its size.

Trading at 10 times sales, Byrna stock isn't exactly cheap. But considering it's chasing a big opportunity and is fast-growing, profitable, and debt-free, this little stock could still have a lot of long-term upside, even after quadrupling in value in 2024.

Should you invest $1,000 in RealReal right now?

Before you buy stock in RealReal, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and RealReal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $857,565!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 23, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.