When you retire, your investment goals are likely to change in a material way, going from building a nest egg to living off of one. For most retirees, income investments, like dividend-paying exchange-traded funds (ETFs), will suddenly become your best friends.

But what if you want to keep your life simple so you can spend your time enjoying things like family, travel, and recreation? Here are two ETFs that you can use to create a high-quality, income-producing balanced portfolio, containing a mix of high-grade stocks and bonds.

The equity component is key: Schwab U.S. Dividend Equity ETF

When it comes to building a balanced portfolio, it is vital to pay attention to the equity component, which should probably make up at least 60% of assets early in retirement (maybe up to 80% for really aggressive investors). The growth equities provide will help your portfolio keep up with inflation over time.

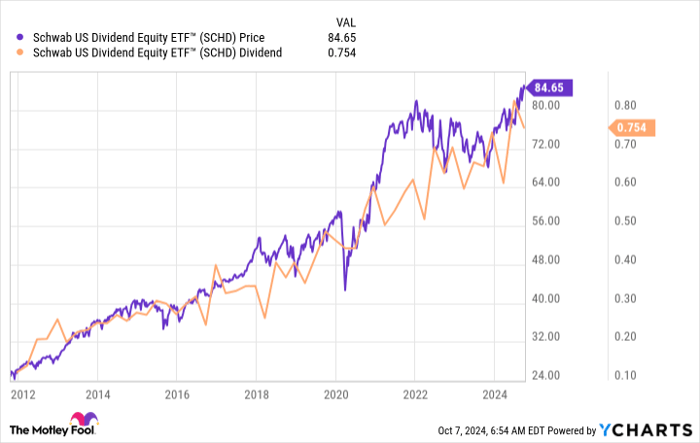

But you also want something that generates income and is relatively conservative. That's exactly what you get with Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD).

Image source: Getty Images.

Schwab U.S. Dividend Equity ETF only looks at companies (but not real estate investment trusts, or REITs) that have increased their dividends annually for 10 years or more. Thus, it starts out with a focus on high-quality, growing companies. But it doesn't stop there.

After getting the list of reliable dividend payers, Schwab U.S. Dividend Equity ETF then creates a composite score with which it ranks the stocks from best to worst. The score includes cash flow to total debt (a financial strength measure), return on equity (which highlights the strength of a business), dividend yield (income), and the company's five-year dividend growth rate (income growth).

As noted, companies are lined up from the highest to lowest score, with the top 100 scoring companies included in the ETF. Basically, Schwab U.S. Dividend Equity ETF is building a portfolio that is balancing company quality, yield, and dividend growth. That's exactly what a retiree would want.

All of this selection effort comes fairly cheaply, with an expense ratio of just 0.06%. That's not free, but on Wall Street, it is pretty darn close to it. The dividend yield is a touch under 3.5%. That's not huge on an absolute basis, but it is more than twice the yield on offer from the S&P 500, which is down at just 1.2%.

And because of the selection criteria, the portfolio is fairly well diversified. That means you can supplement Schwab U.S. Dividend Equity ETF with other higher-yielding equity investments (perhaps REITs or utilities, neither of which are material exposures in the portfolio), or just sit back and spend your time on other things.

Balance equities with bonds for stability: Vanguard Intermediate-Term Bond ETF

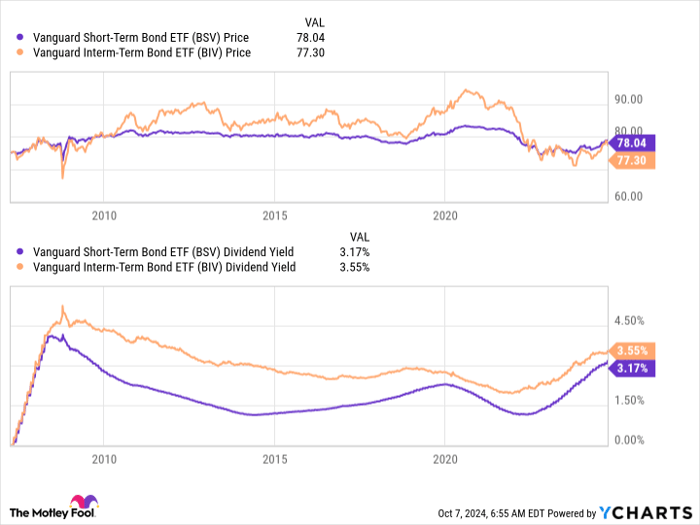

Equities provide growth and income, but they also increase the volatility of a portfolio. That's why a balanced fund includes bonds, which provide stability. For really conservative types, the best bond choice will be a short-term bond fund.

But if you can handle just a little more risk, you'll get a higher yield from an intermediate-term bond fund like Vanguard Intermediate-Term Bond ETF (NYSEMKT: BIV). The expense ratio is an ultra-low 0.04%.

What you are getting, to simplify things, is a diversified portfolio of high-quality bonds that have maturities that fall between five and 10 years. The list includes U.S. government bonds, investment-grade corporate bonds, and investment-grade international bonds that are denominated in U.S. dollars. There are more than 2,200 bonds in the portfolio, which is market-weighted, so the largest bonds are the main drivers of performance. U.S. government bonds make up roughly 55% of assets.

Vanguard Intermediate-Term Bond ETF's dividend yield is about 3.5%. That's roughly 40 basis points higher than what you'd collect from Vanguard Short-Term Bond Index ETF (NYSEMKT: BSV), which would be a more conservative choice. Cash would be the most conservative non-stock investment option, of course.

But for the extra boost in yield, the added risk of intermediate-term bonds is likely to be worth it over the long term. And, like with Schwab U.S. Dividend Equity ETF, you can layer in some higher-yielding bonds, if that's something you wish to do.

Two ETFs equals one solid portfolio

At the end of the day, with just two ETFs, Schwab U.S. Dividend Equity ETF and Vanguard Intermediate-Term Bond Index ETF, you can create a well-diversified, high-quality, income-producing balanced portfolio. And there's ample room within this framework for you to add higher-yielding securities if you are willing to take on the extra work and risk. Once a year, rebalance your portfolio back to your preferred stock/bond mix, and you'll be all set!

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF and Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.