Theravance Biopharma, Inc. (TBPH) reported third-quarter 2023 adjusted net loss of 1 cent per share, which was narrower than the Zacks Consensus Estimate of a loss of 10 cents.

The reported loss excludes share-based compensation expense and non-cash interest expense. In the year-ago quarter, the company had incurred a loss of 9 cents per share.

The bottom line improved owing to higher collaboration revenues from Viatris VTRS and reduced research & development (R&D) and selling, general & administrative (SG&A) cost.

Revenues totaled $15.69 million, which marginally beat the Zacks Consensus Estimate of $15.59 million. The top line was up almost 26% year over year.

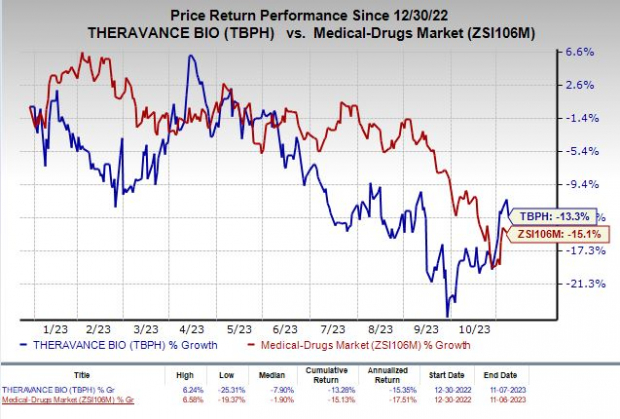

Shares of Theravance have lost 13.3% in the year-to-date period compared with the industry’s decline of 15.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Quarter in Detail

The top line almost fully comprised Viatris’ collaboration revenues in relation to Yupelri (revefenacin) sales. Yupelri collaboration revenues beat our model estimate of $15.1 million.

Theravance and Viatris have collaborated for the development and commercialization of Yupelri.

Viatris and Theravance share U.S. profits and losses received in connection with the commercialization of Yupelri. While Viatris gets 65% of the profits, Theravance receives 35%. Viatris collaboration revenues include Theravance’s 35% share of net sales of Yupelri, as well as its proportionate amount of the total shared costs incurred by the two companies.

VTRS recognizes product sales from Yupelri and also owns a stake in Theravance.

R&D expenses (including share-based compensation) totaled $8.3 million, down almost 16.2% from the year-ago quarter’s level. SG&A expenses (including share-based compensation) declined 1.2% year over year to $16.1 million.

As of Sep 30, 2023, Theravance had cash, cash equivalents and marketable securities worth $134 million compared with $167.5 million as of Jun 30, 2023.

Through September 2023, the company repurchased $294.6 million of stock of the $325 million shares authorized to be repurchased. The remaining $30.4 million worth of shares are expected to be completed by 2023-end.

2023 Guidance

Theravance continues to expect adjusted R&D expenses (excluding one-time restructuring expenses and share-based compensation) in the $35-$45 million range. Adjusted SG&A expenses (excluding one-time restructuring expenses and share-based compensation) are projected between $45 million and $55 million.

TBPH expects to generate adjusted profitability in the fourth quarter of 2023.

Pipeline Updates

Theravance is developing an investigational candidate, ampreloxetine (TD-9855), a norepinephrine reuptake inhibitor for the treatment of neurogenic orthostatic hypotension in patients with multiple system atrophy.

Theravance is currently conducting enrollment in the phase III CYPRESS study, evaluating ampreloxetine in the given patient population. During the quarter, the company continued with the expansion of the study into different geographical locations. The CYPRESS study is expected to complete patient enrollment by the second half of 2024.

Theravance Biopharma, Inc. Price, Consensus and EPS Surprise

Theravance Biopharma, Inc. price-consensus-eps-surprise-chart | Theravance Biopharma, Inc. Quote

Zacks Rank & Other Stocks to Consider

Theravance currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the healthcare sector are Dynavax Technologies Corporation DVAX and MEI Pharma, Inc. MEIP, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Dynavax Technologies’ 2023 loss per share have narrowed from 24 cents to 15 cents. Meanwhile, during the same period, earnings per share estimates for 2024 have improved from 2 cents to 12 cents. Year to date, shares of DVAX have rallied 25.3%.

Earnings of Dynavax Technologies beat estimates in two of the last four quarters while missing the same on the remaining two occasions. DVAX delivered a four-quarter average earnings surprise of 25.78%.

In the past 60 days, estimates for MEI Pharma’s 2023 loss per share have improved from $6.54 to $4.89. During the same period, loss per share estimates for 2024 have narrowed from $5.14 to $4.02. Year to date, shares of MEIP have rallied 52.7%.

Earnings of MEI Pharma beat estimates in three of the trailing four quarters and met the same on the other occasion. On average, MEIP delivered a four-quarter earnings surprise of 53.58%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

MEI Pharma, Inc. (MEIP) : Free Stock Analysis Report

Theravance Biopharma, Inc. (TBPH) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.