The end of a year is a time to look back at the year that’s just passed and look forward to the next 12 months. The second part is a lot harder, but you may have a greater chance of success if you do the first part honestly and learn from what occurred. It has often been said that the only thing we learn from history is that we do not learn from history. So, here are the three most important lessons that investors should take away from 2021.

1. Don’t allow your politics to influence your investing decisions

Coming into 2021, where you stood on the prospects for the new year like so much in America these days, largely depended on your political affiliation and where you got your news. If you were a Democratic adherent of MSNBC, you may have believed that Covid would disappear when a President who knew what he was doing took charge and the market would soar with a less bombastic approach to business and international relations. On the other hand, if you listened to Fox News, you may have believed that the “socialist” Joe Biden and his even further left Vice President were coming for American businesses and for your stock portfolio.

Both of those politically motivated sets of “predictions” turned out to be no more than bias-confirming, ratings gathering BS. The world just isn’t that simple. Trump’s on-again, off-again approach to China and other trade partners unsettled them as much as it did Democrats and thus proved quite effective as a negotiation tactic, for example, and a return to a more conventional politician meant a return to American disadvantage. Also, the Trump-era claw back of regulations and massive tax cuts for businesses and wealthy investors certainly benefitted stocks and reversing them was/is bound to have a negative impact.

On the other hand, to describe Biden, a 50-year Washington veteran known for compromising to get things done, as a socialist is simply laughable. There was no government takeover, no mass closures of police departments and certainly no stock market collapse.

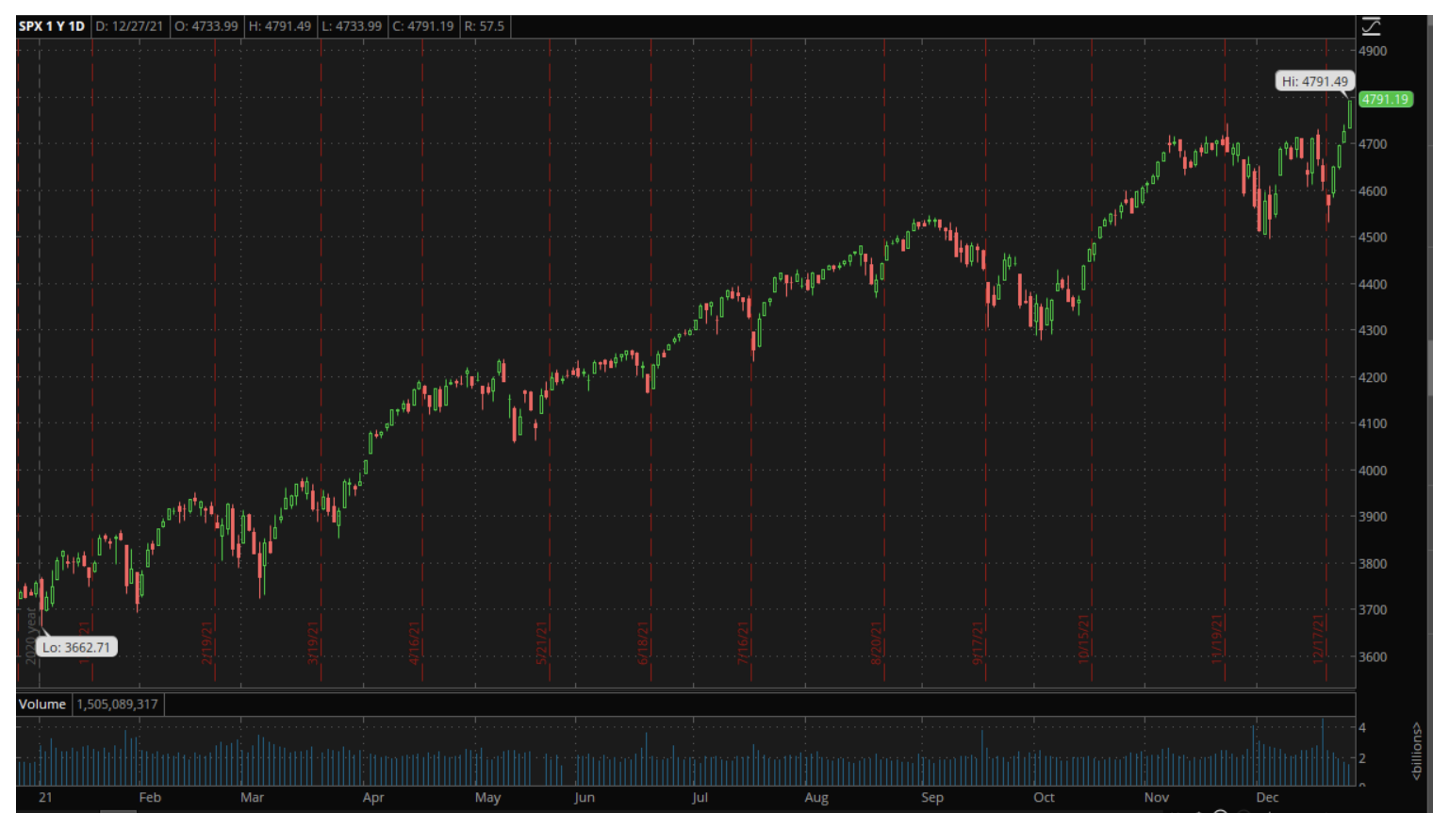

The S&P 500 closed for the Christmas break at a record high of 4791.19, 27.5% higher than it closed in 2020.

Still, Covid didn’t care about the party of the man in the White House and has returned in two big waves over the last year. Vaccination seems to give good protection against hospitalization and death, which is of course a good thing, but it hasn’t stopped the spread of the disease, nor the emergence of mutant strains.

In short, as I have said here many times, the economy cares very little about who is in the White House, and it seems that a pandemic cares even less. The differences between the parties may seem stark in some ways, but Republican and Democratic Presidents alike want to see strong economic growth and market gains. Given that, investing based on your politics is crazy. Those that sold when Trump was elected got hurt, as did those who sold in anticipation of a Biden led attack on capitalism. Understand that we all have biases, accept them, and put them aside when investing.

2. When it comes to the market, people power is now a thing

H.L Mencken was proven to be wrong when he said that “no one in this world has ever lost money by underestimating the intelligence of the great masses of the plain people,” because that is exactly what happened to many on Wall Street in 2021, the year of the meme stock.

Shorting stock in companies that are experiencing problems is a common Wall Street practice. It serves a purpose in terms of the efficient allocation of capital but can be a problem when it comes in response to issues that are temporary by their nature. In that scenario, forcing the stock lower can turn those temporary problems into existential ones and force a bankruptcy onto a company that otherwise might have been saved.

Whatever the pros and cons are though, aggressively shorting stocks is something that funds will think twice about after 2020.

It started early in the year with GameStop (GME). A group of small, individual investors, chatting on Reddit and reportedly originally motivated by a nerdish love of the video gaming store, ganged up on Wall Street. They realized that by using the leverage available to investors in the new, democratized world of investing, they had enough power to force the then thinly traded stock up and squeeze out the big boys who were short. That kind of squeeze creates yet more buying pressure as the shorts rush to get out. And when the buyers that caused the move refuse to sell their now massive holdings, you get what we saw in January -- a 2,740% jump in the GME stock.

That wasn’t the only time small investors got the better of the big boys this year, with names like AMC Entertainment (AMC) following suit in the spring, when it gained around 3,500% from where it started the year. Those are the most famous instances of people power emerging in 2021, but there have been many more. The U.S. Justice Department is also reportedly investigating some prominent short sellers, another deterrent to selling stock short in the future.

3. Stocks trend upwards

This is the most important lesson of 2021. In a year when Covid mutated and struck back, when inflation took hold and when the Fed began to reverse the loose monetary policy that had provided so much support for the stock market, the S&P 500 gained 27.5%. Along the way, there were several pullbacks that brought the perma-bears back into the spotlight but as is nearly always the case, they were wrong. With hindsight, those pullbacks were all great buying opportunities.

As we move into 2022, remember that. It is quite possible that as the Fed actually does start to raise rates, particularly if that is too late to stop inflation really taking hold, we will see a scary drop in stocks at some point next year. Or it could come should Covid keep mutating and surging, or should China move back away from free markets, or for any other myriad of different reasons. However, when it comes, know this -- stocks will at some point be higher than they were before the fall began.

If you are saving for your retirement or some other long-term goal and you learn nothing else from what has proven to be an eventful year, make sure you take that lesson to heart.

Do you want more Articles and analysis like this? If you are familiar with Martin’s work, you will know that he brings a unique perspective to markets and actionable ideas based on that perspective. In addition to writing here, Martin also writes a free newsletter with in-depth analysis and trade ideas focused on just one, long-time underperforming sector that is bouncing fast. To find out more and sign up for the free newsletter, just click here

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.