The Virus That Threatens Growth And The Euro

Trade disputes, Brexit, US poitics…it’s all disappeared. The market is now dominated by the novel coronavirus COVID-19 and its potential impact on the Chinese economy in the first instance and from there, the spillovers to the global economy.

So far, the view has been that it’s likely to be like the SARS virus in 2003 – a short, sharp shock that’s over quickly with few if any lasting effects. The SARS virus, to refresh your memory, lasted from November 2002 to July 2003 and resulted in 774 deaths, mostly in China and Hong Kong. We’ve heard talk like this from several central banks recently:

- Reserve Bank of Australia (4 Feb): Another source of uncertainty is the coronavirus, which is having a significant effect on the Chinese economy at present. It is too early to determine how long-lasting the impact will be

- US Fed: (7 & 11 Feb): …possible spillovers from the effects of the coronavirus in China have presented a new risk to the outlook… we are closely monitoring the emergence of the coronavirus, which could lead to disruptions in China that spill over to the rest of the global economy.

- Reserve Bank of New Zealand (12 Feb): …the COVID-19 (coronavirus) outbreak is an emerging downside risk. We assume the overall economic impact of the coronavirus outbreak in New Zealand will be of a short duration, with most of the impacts in the first half of 2020…There is a risk that the impact will be larger and more persistent.

- Riksbank: (12 Feb): The effects of the coronavirus are expected to reduce global growth in the short term, but it is difficult at present to fully assess the economic consequences.

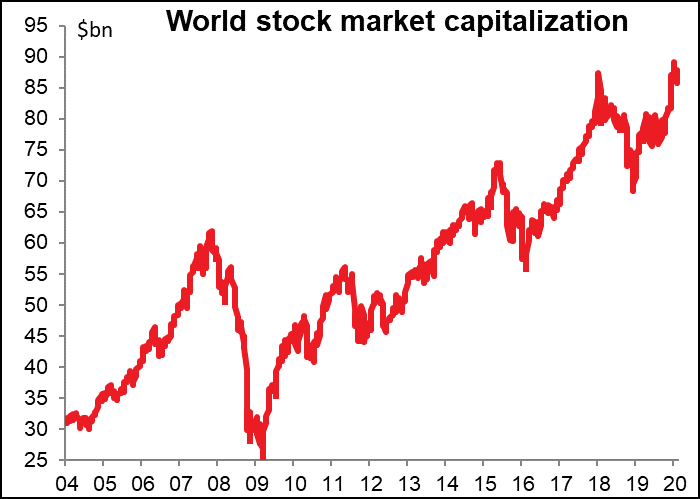

It’s clear that the market shares the central banks’ assumptions about the virus. Global stock markets are near a record high, which they probably would not be if people were expecting a re-run of the Spanish Flu of 1918.

Prices of some industrial commodities that are sensitive to Chinese economic activity have already started to recover, as are Shanghai stocks, indicating some optimism that the worst is over.

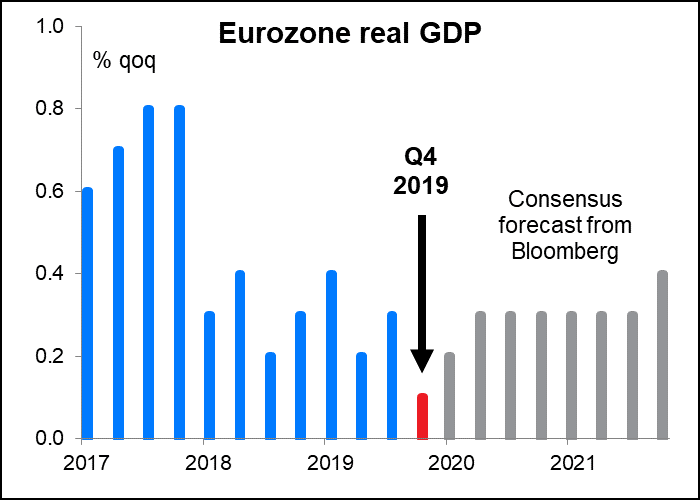

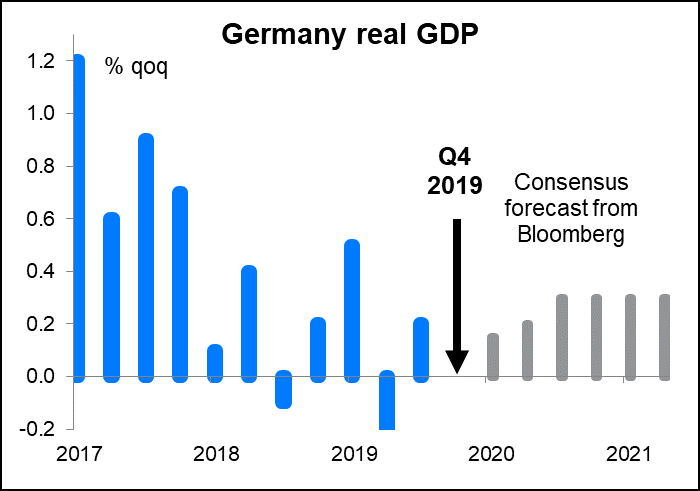

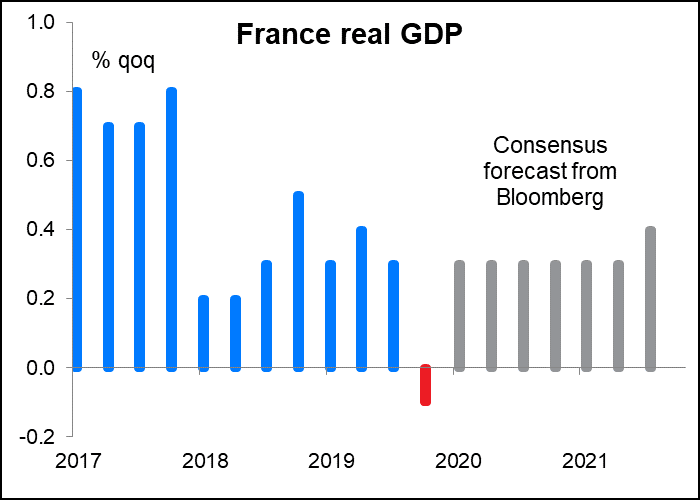

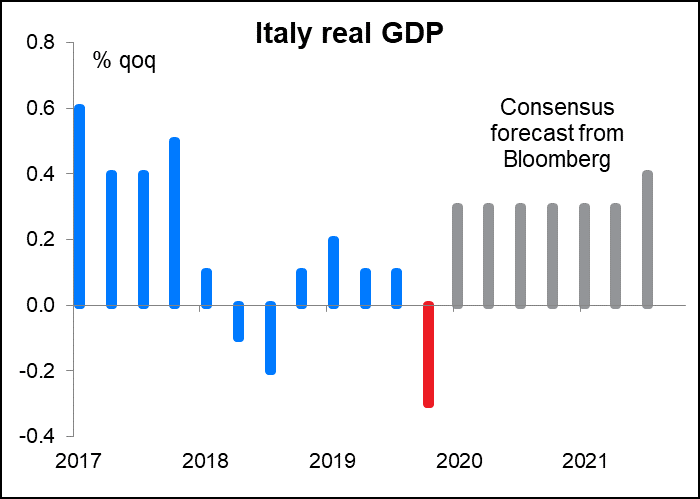

So far, economists’ forecasts are based on pretty much the same assumptions that the central banks are making. Looking at the forecasts for growth, particularly in the Eurozone, investors are assuming that Q4 was the trough and growth will rebound during 2020. That wouldn’t be the case if they were expecting a big, long-lasting hit to global demand.

But recent news has called this rosy scenario into question, even before the coronavirus came on the scene. This week’s EU industrial production figures for December showed that if anything, the downturn was accelerating as 2019 ended.

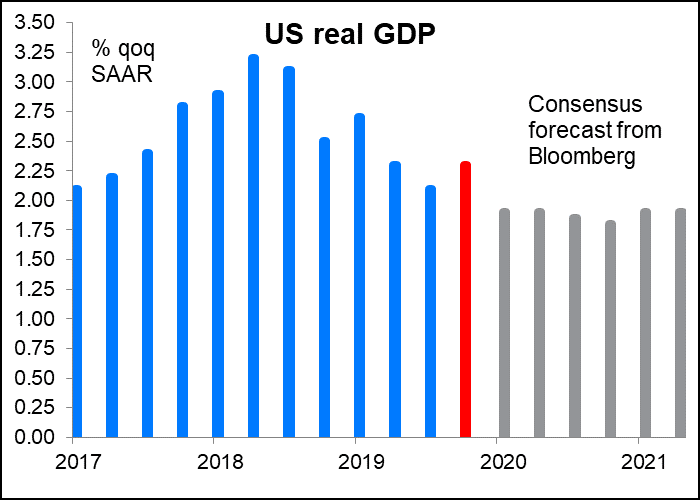

In contrast, US growth accelerated slightly in Q4 and is expected to moderate somewhat in 2020.

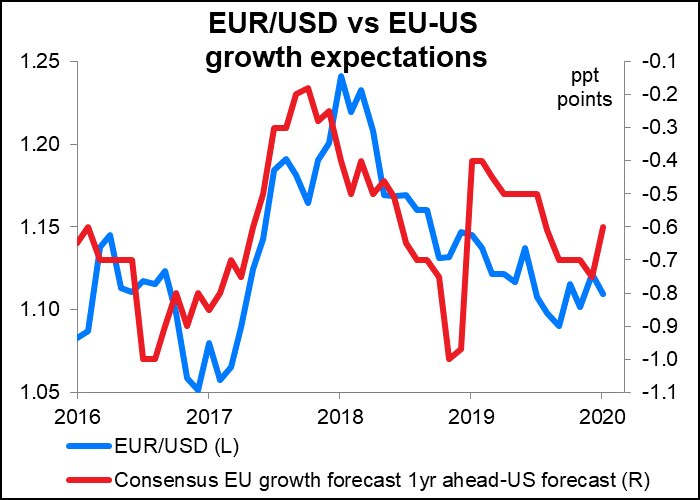

Recent indicators have shown this “economic performance divergence” – US outperformance and EU underpeformance -- continuing. US indicators have increasingly been beating expectations, while EU indicators have been coming up below expectations. Even before the effect of the coronavirus spills over into global markets, it appears that investors may have to revise up their forecasts for US growth and revise down their forecasts for EU growth.

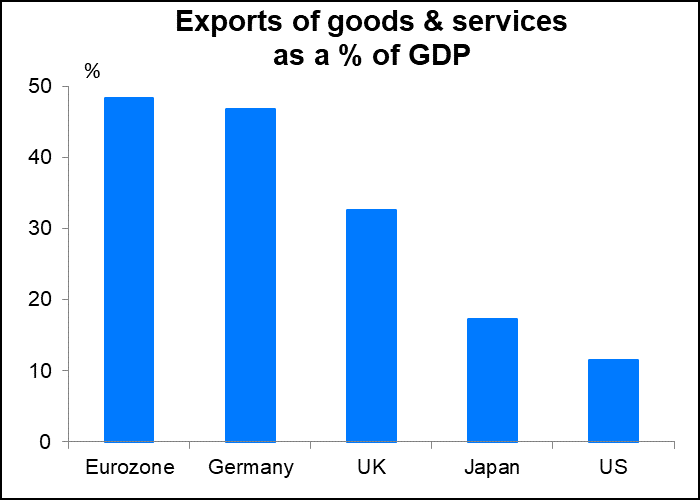

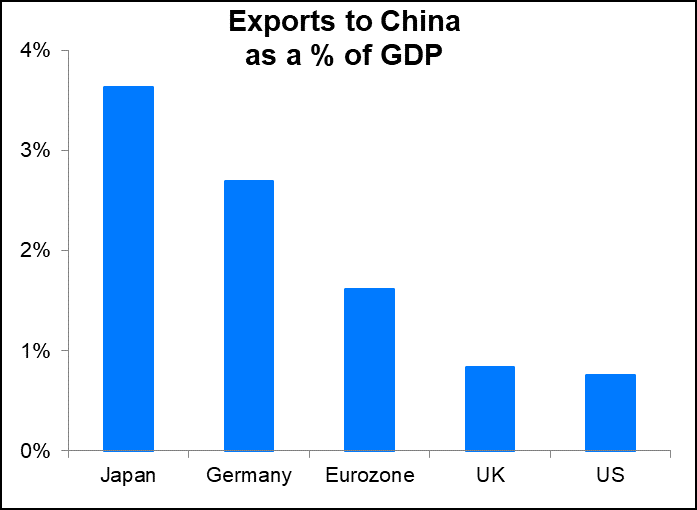

And that’s before the impact of the coronavirus, which is likely to dampen growth in China and, if it continues, growth worldwide as well. The impact of the virus will only increase the divergence between the EU and the US, because the EU is much more dependent on exports than the US is, including exports to China. To make matters worse for the EU, Germany’s significance in overall Eurozone growth is about double what its weight in the Eurozone economy is, which makes overall Eurozone growth more sensitive to exports than even these numbers would suggest.

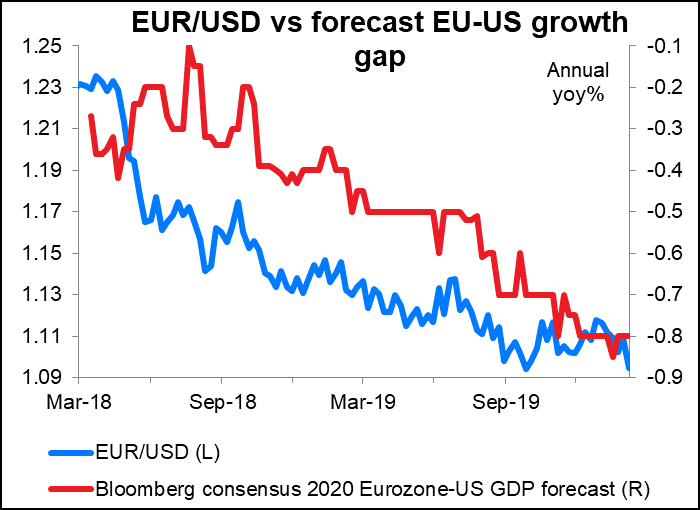

The relative growth in each region matters greatly for the currency market, because EUR/USD tends to track the expected difference in growth between the Eurozone and the US over time. If EU growth gets revised down relative to US growth,then it’s likely EUR will fall further relative to USD. In this respect, next Friday’s preliminary purchasing managers’ indices (PMIs) for the major economies will be extremely important to watch (see below).

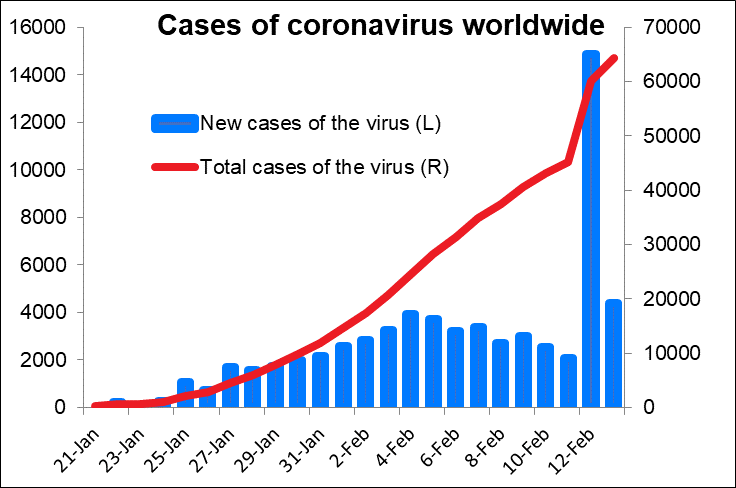

As mentioned above, the markets and economists have been expecting the impact of the coronavirus to be over relatively quickly. One reason for these expectations was that the number of new cases appearing every day had peaked on 4 February. So while the epidemic was continuing, it looked like the worst was already over and China’s incredibly strict measures might have worked.

However, on Wednesday Hubei Province, the epicenter of the outbreak, revised its definition of people who are affected to include those who are “clinically diagnosed” with the virus. This change increased the number of confirmed cases by a staggering 14,890 people in one day. The market may now have to reconsider its views on the likely progress of the virus.

There are other reasons as well for the euro to weaken.

The political problems in Germany may also be weighing on the currency. German Chancellor Merkel’s heir apparent, Annegret Kramp-Karrenbauer, Monday resigned as the chair of Merkel’s Christian Democratic Union (CDU) party, leaving the leadership of the ruling coalition in Europe’s leading economy in disarray. The problem is not just who will succeed Merkel, but indeed whether the CDU/CDS coalition will even remain in power after the next federal elections, which are scheduled for September 2021 (but could be called earlier).

Furthermore, the euro’s use as a funding currency is depressing its value. More and more US companies are raising money in euros and moving it back to the US. This is in addition to speculators using EUR as a funding currency in carry trades.

I think these problems are likely to continue to weigh on the euro and the single currency may decline further over the next few months.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.