By Goran Damchevski

This article was originally published on Simply Wall St News

Netflix (NASDAQ:NFLX) is in the middle of the streaming wars, and the stock has recently entered into all-time highs, coupled with concerns of peaking membership subscriptions in the US and competitor pressure. In this article we will look at how efficiently is the management team reinvesting into the business, how can that translate into growth, and where can future growth come from.

First, we will analyze the returns of the stock, which gives us an idea as to how smart is management (and their whole team), in utilizing finances from both shareholders and debt. Interestingly, in their latest letter to shareholders, the CEO stated that they probably would not be needing to raise capital from shareholders in the future, which may signal 2 things: the company is on a sustainable level from retained earnings, and the stock price will not go down as a result of dilution. Netflix is also returning about 11% of profits as cash to investors in the form of buybacks, so this can contribute to the gains in the stock price.

Now, let's look at a return measure that takes both debt and equity financing into account.

Return On Capital Employed (ROCE):

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Netflix is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.18 = US$6.1b ÷ (US$41b - US$7.8b) (Based on the trailing twelve months to June 2021).

So, Netflix has an ROCE of 18%.

On its own, that's a standard return, however it's much better than the 10% generated by the Entertainment industry.

Check out our latest analysis for Netflix

We like the trends that we're seeing from Netflix. Over the last five years, returns on capital employed have risen substantially to 18%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 339%.

Above, you can see how the current ROCE for Netflix compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Netflix here for free.

On a related note, the company's ratio of current liabilities to total assets has decreased to 19%, which basically reduces it's funding from the likes of short-term creditors or suppliers. So this improvement in ROCE has come from the business' underlying economics, which is great to see.

Growth Drivers

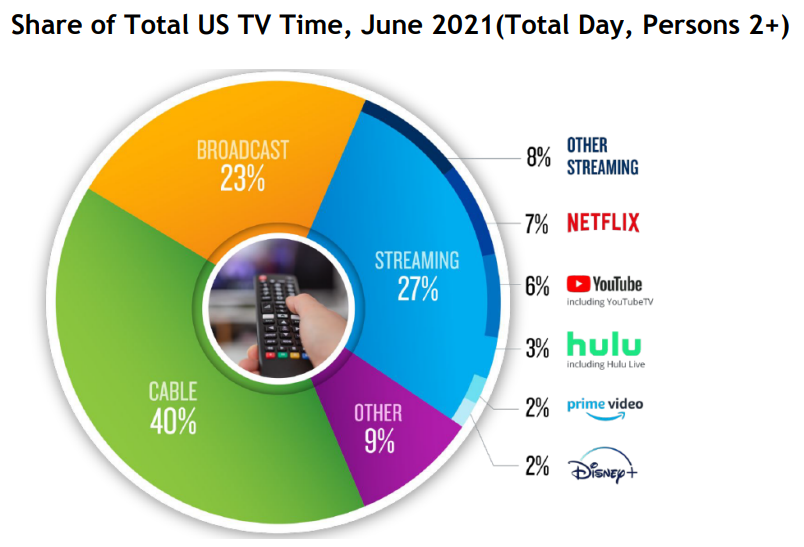

First, let's establish where Netflix stands with regard to Market Share. Their infographic from the last letter to shareholders presents an interesting picture:

From the chart above, we can see that Netflix is the current leader in streaming, but more importantly, that the streaming industry may have a lot more space to expand in. Of course, there will be push back, as older industries fight to retain their market share, but in these battles the better product usually wins over the long run. So let's take a look at the product itself.

Netflix is a platform, streamer and content creator.

As a platform, its goal is to deliver the best user experience while watching. In that regard, we will mention one old and one new feature. The old feature is the recommendation algorithm that, while unnoticed, is one of the key components of user enjoyment in the platform. Netflix pioneered an efficient algorithm, which made watch recommendations for users with a high success rate. In the new feature, we can see how Netflix steps up, by automizing this process with the new "Play Something" feature, which gives the user an option to let the platform chose the next stream after it has picked up that the user can't make up their mind. The utility of this function is that it helps people choose who just want something playing in the background while doing something else.

As a streamer, Netflix is utilizing high storage capacity and quality delivery cloud infrastructure to deliver the highest quality streams with the lowest bandwidth costs and expense. This gives the users an HD experience and presents barriers to entry for smaller competitors that do not have the infrastructure to store and deliver large quantities of content.

Finally, as a content creator, Netflix has revolutionized the industry. They are heavily re-investing in new content and have set their 2021 content investment (inferred from the content amortization number in the last Q2 letter) target to US$12b. The key to their growth strategy is the production of a diversified portfolio of content which will increasingly include unscripted shows such as: "Too Hot to Handle", "The Circle" etc. They also focus on international expansion in the Latin American Region with an accent on Brazil, and in Asia Pacific - since that region represented about two-thirds of global paid net adds in the quarter. This means, that while growth in the US audience may have plateaued, the company is shifting focus to unscripted shows and international expansion, which can give it a few more years of high growth.

Margins

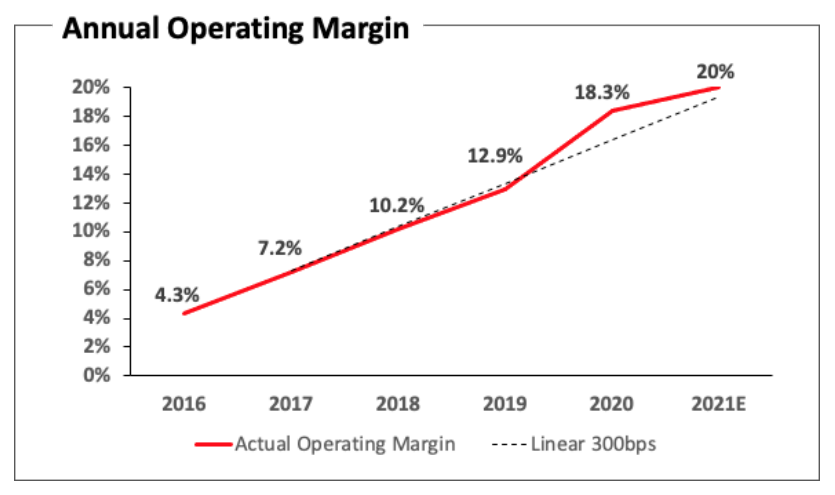

Investors are primarily interested in cash flows, and that is driven by margins to a large extent. We must note, that since 2016, the company has been increasing its operating margin by close to 3% per year consistently.

The chart below outlines the precision of their growth.

It is this increase in profitability that may primarily be responsible for the recent higher valuation of the company - Market Cap at US$261.4b. While unpredictable in future terms, we can see how Netflix might reach an EBIT margin some 5% higher than the US industry average of 19.3%, and lock-in around 25% EBIT margin in a few years. A number beyond that will be hard to justify in the long term, especially in the current high competition environment and the number 1 complaint of users being the price hikes (Ctrl + F: complaint).

In Conclusion

Netflix's current valuation seems to be close to the intrinsic value of the company, and justifiably so.

The company has a multitude of value and growth drivers working in its favor.

The Growth Drivers include:

- International expansion, primarily in Brazil and Asia Pacific

- A high re-investment rate in content

- Diversifying the content portfolio to include originals, TV shows, unscripted/reality shows, animated shows, third party licensed content, gaming content etc

The Value Drivers include:

- A refinement of the recommendation algorithm with the addition of the "Play Something" feature

- Return on Capital Employed at 18%, and announcing the reduction/discontinuing of financing from equity (meaning that Netflix is becoming self sustainable)

- Consistent growth in margins, surpassing the industry average, with the possibility to expand around 25% EBIT margin in a few years

In summary, it's great to see that Netflix can compound returns by consistently reinvesting capital at increasing rates of return, because these are some key ingredients of those highly sought after multi-baggers.

And a remarkable 531% total return over the last five years tells us that investors are expecting more good things to come in the future.

Netflix does have some risks though, and we've spotted 1 warning sign for Netflix that you might be interested in.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.