Since its high in November 2021, the Russell Microcap Index has declined nearly 29%, compared to “just” a 6.5% and 15.8% sell off for the S&P 500 and NASDAQ indices, respectively.[1] On the one hand, it makes sense (and has historically been the case) that in a “risk off” environment, like we have had these past 18 months, stocks of very small companies would underperform those of larger more well-known entities. That said, the magnitude of the current disparity is actually quite striking, especially when compared to the changes that occurred during the severe economic collapse of 2008-2009. During that period, when the economy contracted by nearly 5% with 10% unemployment, all three indices were down over 50%. The Russell Microcap Index was down 57.8%, which was only slightly more than the 52.1% and 50.6% declines for the S&P 500 and Nasdaq indices, respectively. In this cycle, microcaps are down over 4x compared to the S&P 500, which makes little sense to us, creating what we believe is a tremendous buying opportunity.

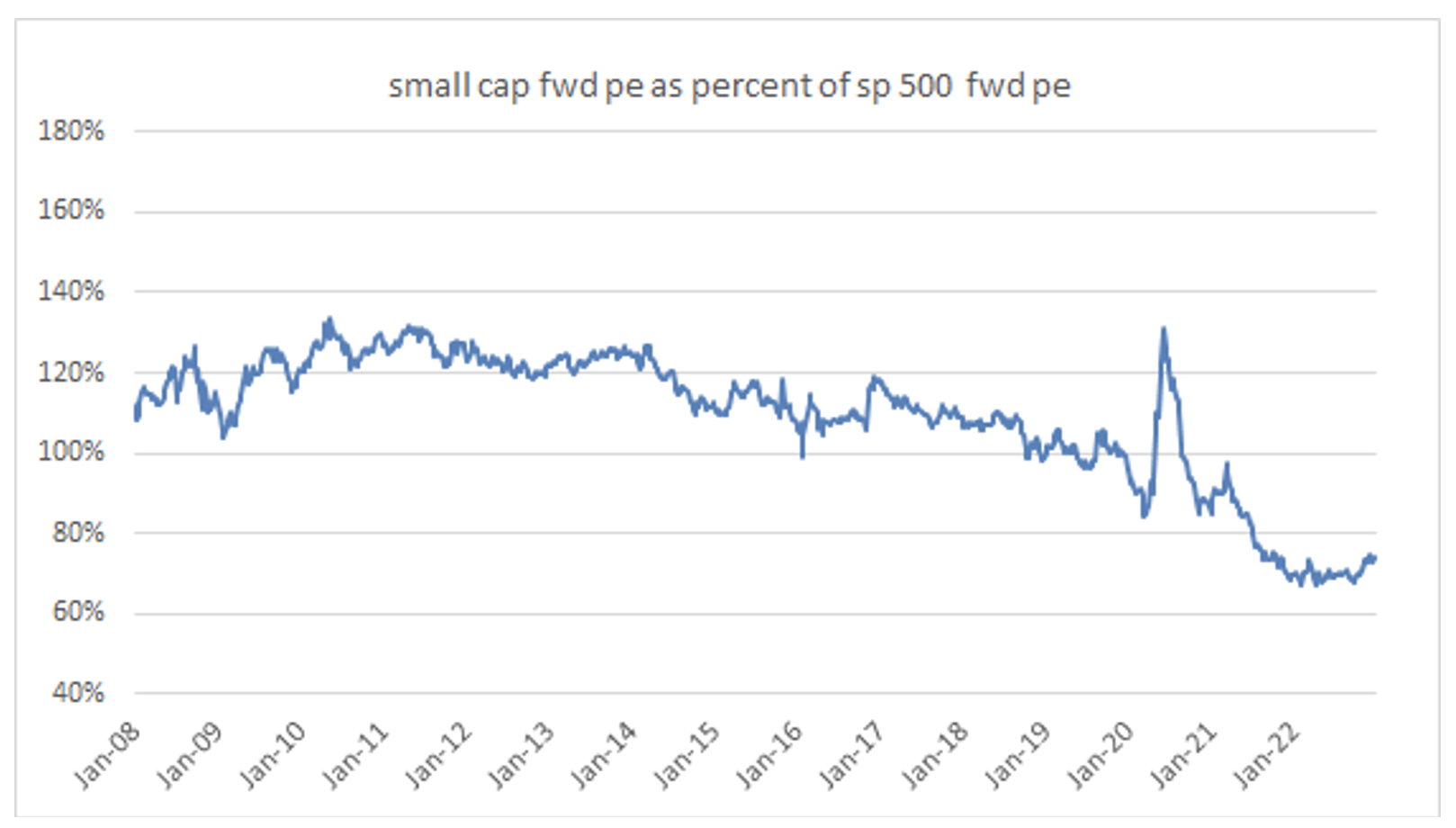

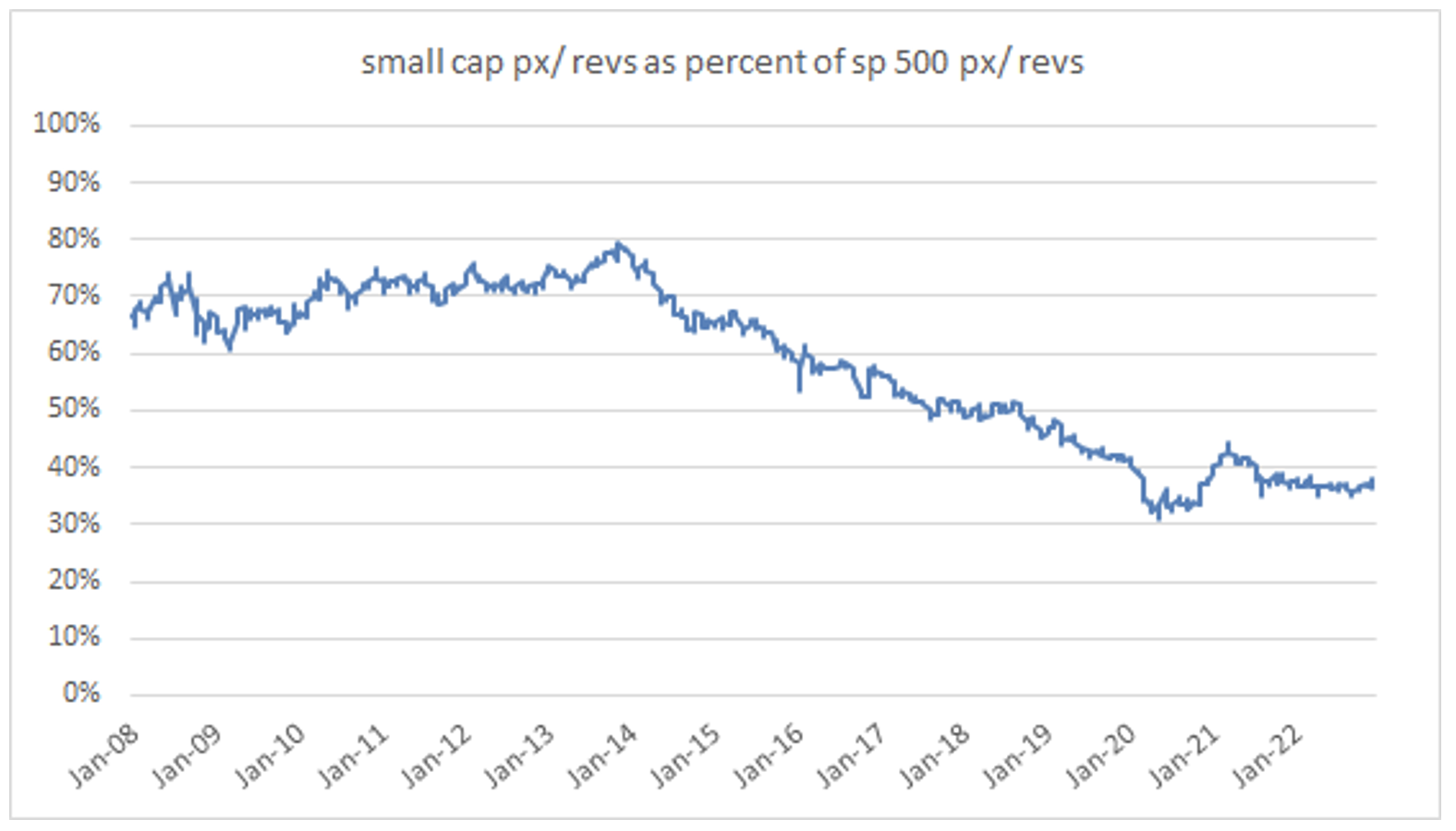

As mentioned above, against the backdrop of an economy that is still growing, albeit sluggishly, along with healthy employment levels, the microcap market has been hit significantly harder than the larger capitalization market. If your assumption is that this is due to underperformance by companies that make up the microcap market when compared to those with significantly larger market caps, you would be surprised to learn that this is, in fact, not the case. The charts below illustrate this point and compare the forward price to earnings ratio and price to revenue ratio of small caps versus the S&P 500. Quite clearly, these charts show that small caps are historically undervalued from a valuation perspective.

Source: Bloomberg

Source: Bloomberg

Since the underperformance isn’t based on the actual earnings performances of these smaller companies, to what do we attribute this action? We believe it can be summed up in a word — “fear”. We believe that the selloff experienced by the microcap market reflects a common reaction by investors to sell smaller, less-liquid investments and to rotate investments to perceived “safer” assets.

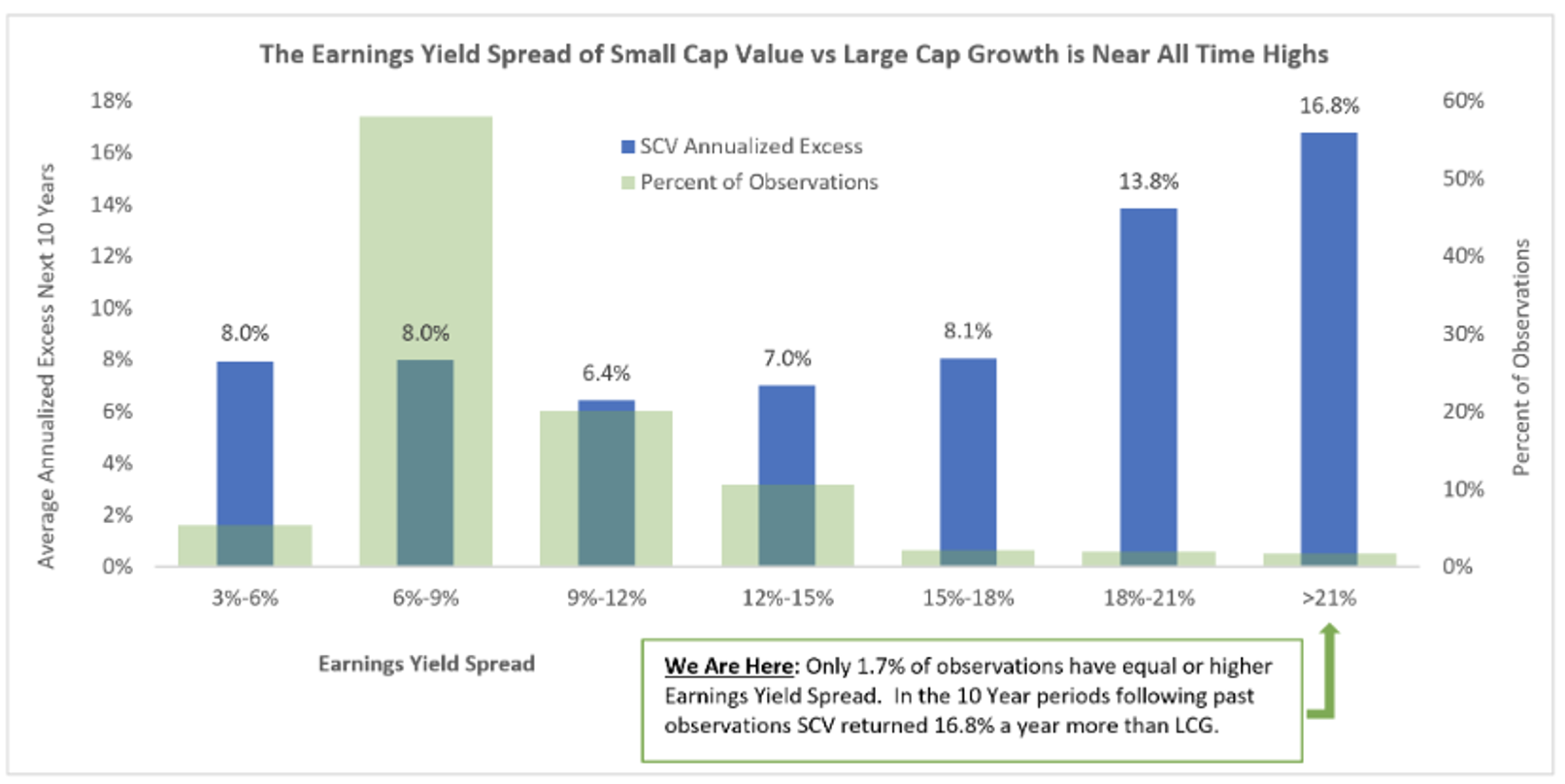

Given the current relative value of the micro/small cap markets vs the mid/large cap markets, we believe that when positive, “risk-on,” market sentiment turns, these markets will significantly outperform on the way up, countering the underperformance they experienced on the way down. Historically, this has been the trend when the small cap market has been significantly undervalued. The chart below looks at the current earnings yield for the small cap value sector versus large cap growth market (currently at 21%). Following extreme periods such as this, small cap value has outperformed large cap growth by 16.8% annualized for the succeeding 10-year period.

Source: https://www.osam.com/Commentary/a-historic-opportunity-in-small-cap

Given these factors, we believe that the small/micro-cap market is poised for a significant rally. The question is how does an investor ascertain when the timing may be best to take advantage of the clear opportunity being presented? We are keeping a close eye on four indicators that we believe, taken together, provide a signal that it could be advantageous to begin engaging in the market generally and, more specifically, in the small/micro-cap market.

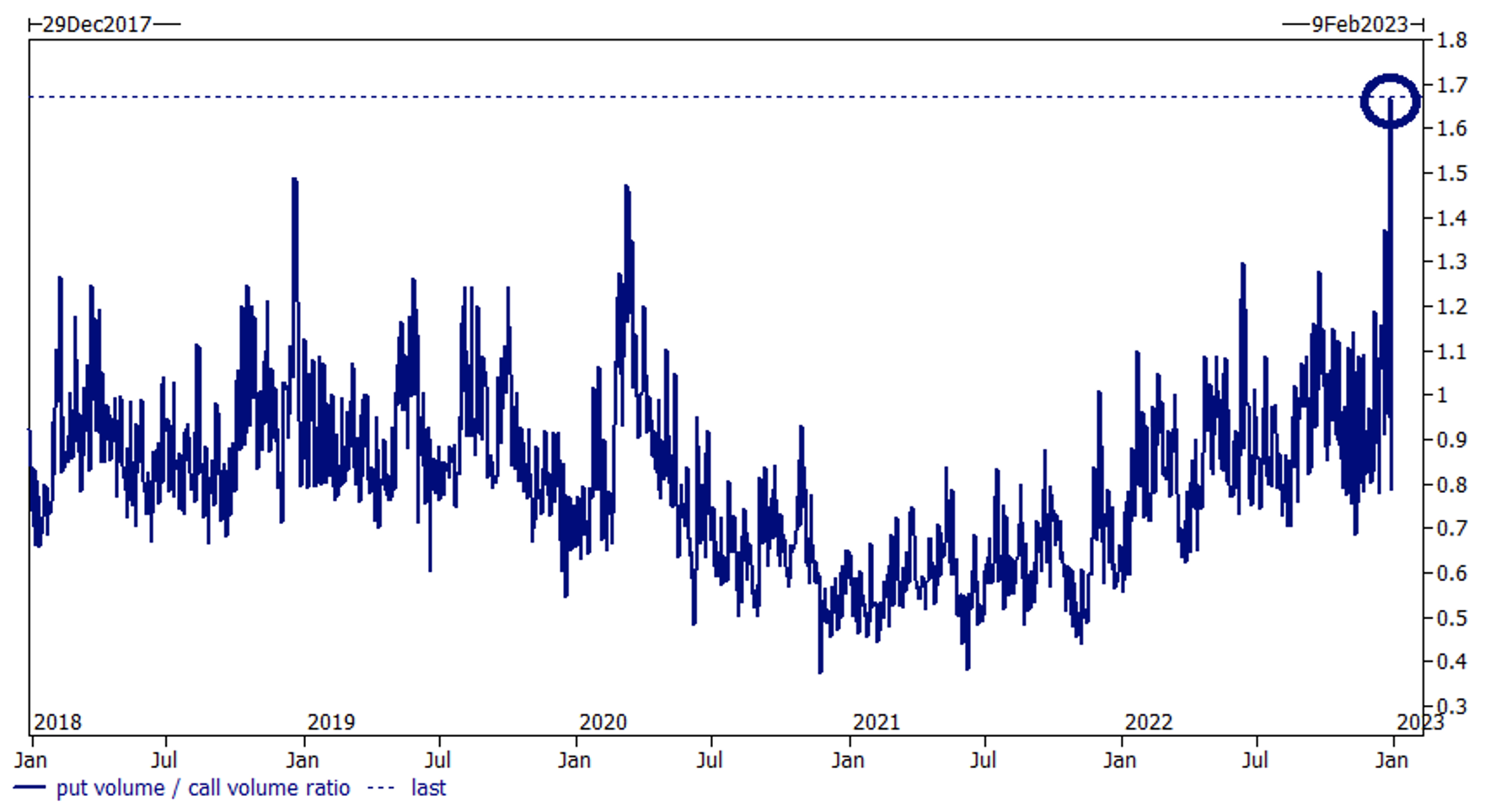

1. Low Investor Sentiment: Historically, one of the best indicators of a buying opportunity has actually been a “contra-indicator”, namely low investor sentiment. Following periods of economic contraction, or even economic slowdowns, and the corresponding drops in the stock market, it has been when sentiment was at or near its lowest that the market has suddenly come to life and started moving higher. The chart below shows put volume to call volume ratios since 2018. When put volume is substantially higher than call volumes, investors are betting on declines in the stock market, thereby reflecting low investor sentiment. This metric is just one of numerous indicators depicting the overwhelming negative sentiment that currently exists particularly for the small/micro-cap market. Historically, there have been few better contra indicators then a bottoming of market sentiment.

Source: Goldman Sachs global markets and banking // Bloomberg data as of 28dec22

2. Nearing the End of a Federal Reserve Tightening Cycle. A second general indicator that is particularly germane right now is the on-going actions of the Fed. For the past 18 months, the Fed has been engaged in a tightening cycle with an eye toward bringing rampant inflation under control. This tightening cycle, which the market has not been forced to deal with for over two decades, has been a major drag on both the economy and the stock market. Once the Fed decides they have achieved their goals and tamed inflation and, therefore, can move to a neutral stance on rates, we believe it will have a very positive effect on the market generally and small/micro-caps to a heightened degree given their greater under performance during the sell off. Currently, there are a number of leading economists who believe we are either at or near the end of the tightening cycle.

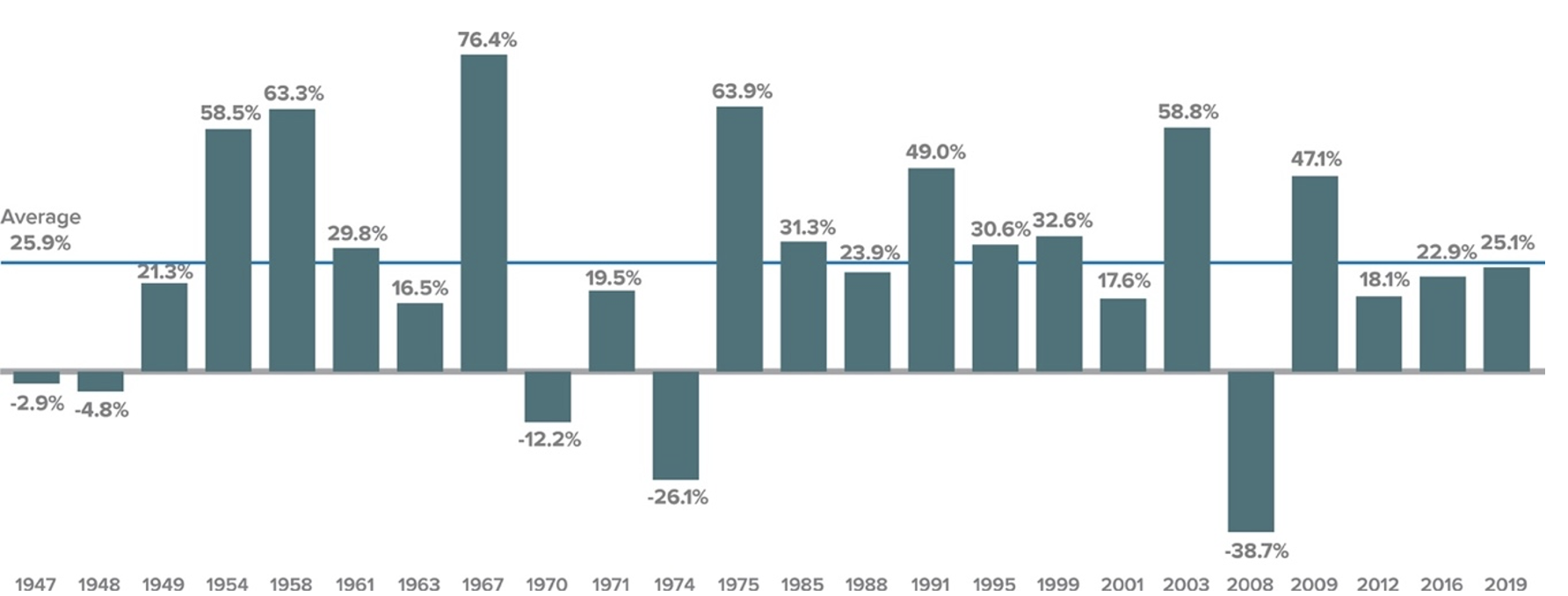

3. Stabilization and Resumption of Economic Growth: As we approach the end of the current rate hikes, many believe we can look for the deterioration in economic growth to stabilize and even begin to show actual growth again. This signal (stronger economic growth) should drive a major uptick in the prices of small/micro-cap stocks. This is because, all the reasons that they underperform in a falling market work in the opposite direction to drive performance when the economy begins to grow again. The combination of recovering earnings expectations and an upgrade in valuation levels once sentiment turns positive have historically driven small/micro-caps to strong absolute performance early in a recovery. The chart below shows this performance over a number of prior recessions.

Source: Bloomberg

4. Strength of the US Dollar: One final indicator that argues for a strengthening small/microcap market is the current dollar strength. Small caps have historically outperformed the larger market when the dollar is at its strongest. Reasons for this are likely due to the fact that small cap companies are largely domestic meaning they do not have to worry about losses related to selling their products overseas in the face of a strong US currency. The chart below depicts this historic outperformance.

In summary, given the significant sell-off that has occurred both in absolute and relative terms, we believe the current entry point for investing in small/microcap stocks is attractive. The combination of current extreme negative market sentiment, the likelihood that Fed tightening is either finished or nearing an end, and the current strong dollar are all positive indicators that the small/microcap market could be poised to begin moving higher. Lastly, it has been the case that the small/microcap market has significantly outperformed on a historic basis as the economy moved from a slowdown/recession to stabilization/growth. We believe that this combination of factors bodes well for the small/micro-cap market over the coming 12-18 months.

Note: The information discussed above is solely the opinion of 180 Degree Capital Corp. Any discussion of past performance is not an indication of future results. Investing in financial markets involves a substantial degree of risk. Investors must be able to withstand a total loss of their investment. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but no representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the information and opinions.

[1] Source: Bloomberg. Data through June 6, 2023.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.