In a world where the number of people needing healthcare is growing faster than the number of people who can provide their care, adopting new technology is more imperative than ever. This bodes well for the robotic-assisted surgery (RAS) industry, which remains largely underpenetrated, with significant investment upside.

In 2020, nearly one million robotic-assisted surgeries were completed in the U.S. alone according to the National Institutes of Health, a number that has only grown in recent years. Minimally invasive robots have the power to transform the way that we experience surgery. Thanks to the degree of extreme precision possible when operating a robotic arm, patients see reduced pain and scarring, faster recovery times, and shorter hospital stays. Despite the potential of this technology, the healthcare industry has yet to fully appreciate and integrate surgical robots on a massive scale, creating a ripe growth area for investors.

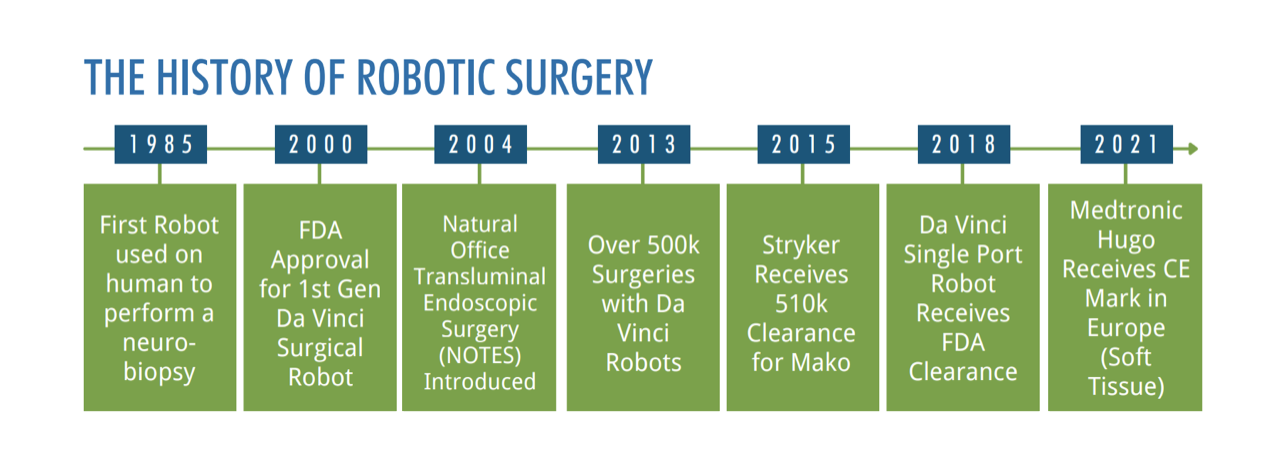

[caption id="attachment_517746" align="aligncenter" width="624"] The History of Robotic Surgery[/caption]

The History of Robotic Surgery[/caption]

THE MEDTECH MARKET CLIMATE & INTUITIVE SURGICAL’S POSITIVE SURPRISE

After a sluggish start to the year, the medtech environment has improved significantly in recent weeks following a string of better-than-expected reports from Johnson & Johnson and Abbott Laboratories. The most positive surprise, however, came from ROBO Global Healthcare Technology & Innovation Index (ticker: HTEC) member Intuitive Surgical.

Intuitive Surgical is the world’s leading provider of surgical robotics with more than 7,700 DaVinci robots installed in hospitals globally. Intuitive’s revenue rose more than 14% year over year in the first quarter of 2023 to $1.7 billion, with robotics procedure growth of 26%, more than 12 percentage points higher than expectations, and 312 system placements, also a double-digit beat. This is a stark contrast to management’s outlook just three months ago. We’ve seen solid momentum on procedure growth as it led to an upgraded outlook for the year to a revised 18%-21% growth, up from a previous 12%-16% expectation.

The potential doesn’t stop there with Intuitive having several additional growth drivers in place. First, a new indication for its Single Port robotic surgical system (benign prostatic hyperplasia). Second, the CE Mark for its Ion system for minimally invasive biopsy in the lung. Third, international expansion, with now more systems sold internationally than in the US.

INVESTING IN SURGICAL ROBOTICS COMPANIES

While we have high conviction that Intuitive will maintain its market leadership for the long term, the vast market opportunity for surgical robotics and healthcare technology companies as a whole makes the industry attractive for new entrants, and there is plenty of room for other companies to compete.

With this string of beat and raise from large medtech companies, we expect investors will be increasingly willing to consider smaller-cap companies, which have largely fallen out of favor over the past year. The ROBO Global Healthcare Technology and Innovation Index is one way for investors to tap into the entire universe of healthcare tech rather than making concentrated bets or trying to pick the winners and losers in the space.

By: Jeremie Capron, Director of Research at ROBO Global

For more news, information, and analysis, visit the Disruptive Technology Channel.

VettaFi recently acquired the ROBO Global Healthcare Technology and Innovation Index, which is tracked by the ROBO Global Healthcare Technology and Innovation ETF (HTEC). The ETF launched in 2019 and has approximately $100 million in assets.

Read more on ETFtrends.com.The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.