The Protein Revolution on the American Plate: Food Industry, Take Note

This Saturday, October 16th, is World Food Day, the anniversary of the founding of the United Nation’s Food and Agriculture Organization. Creating a global body to end hunger and feed a global population of over two billion was revolutionary act in 1945 just as the world emerged from World War II. Observances will take place around the world to mark the significance of this day.

There’s a new revolution underway today that’s happening on the American plate involving the proteins we choose to eat. And the revolution is spreading to other parts of the world, while policy makers race to keep up with our changing tastes.

For the first time in two generations, we’re reconsidering and changing our protein choices.

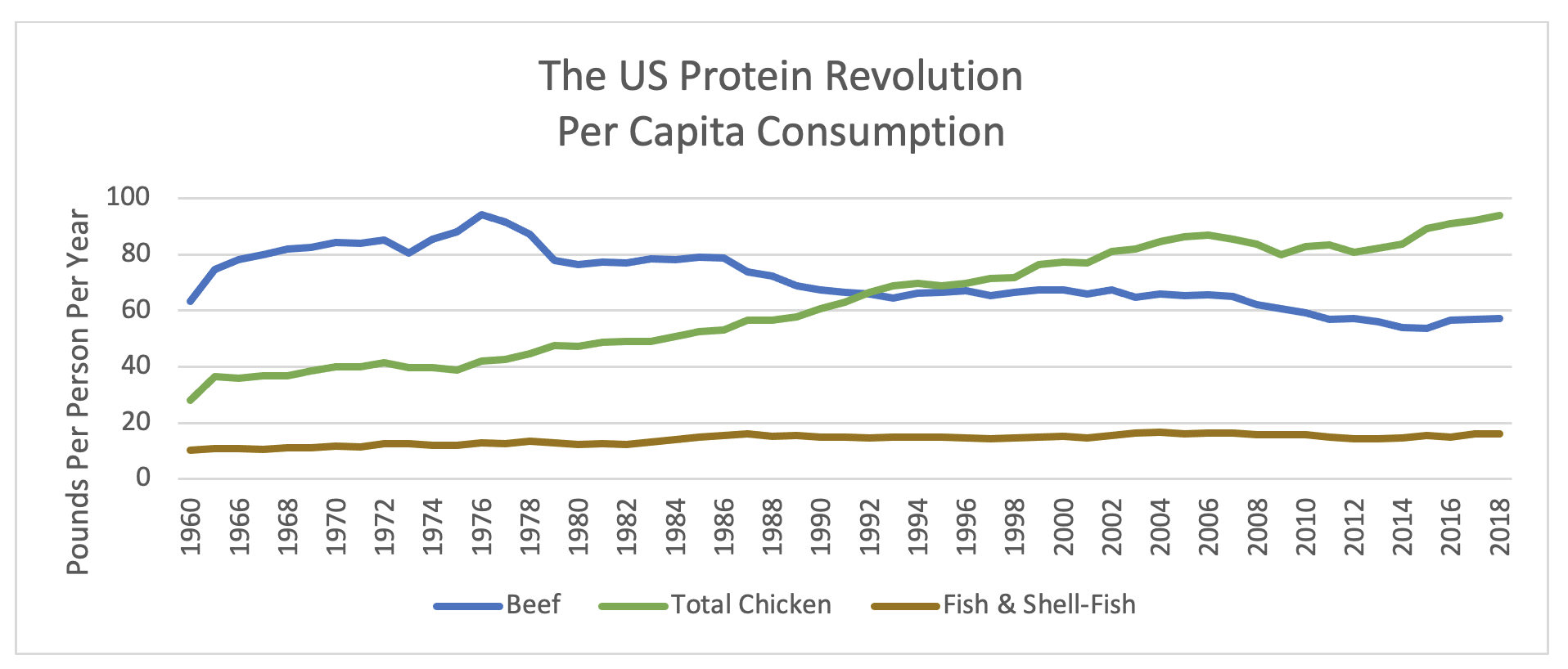

Over the past two decades, Americans have cut back on beef consumption by over 15%. That trend is likely to continue. About a third of American adults intend to eat less meat overall and will do so less often in the coming year or two, according to the latest findings from a series of studies on consumer protein choices that my firm has conducted since 2013. That number has held steady for several years — even during our prolonged period of home cooking as we sheltered from COVID.

Americans are still meat eaters. We just want to eat less of it. The reasons for this are as diverse as the demographic makeup of our country. For boomers, it’s personal health and avoiding chronic lifestyle diseases. For younger generations, concerns about animal welfare and climate change are paramount. Many people are exploring or reclaiming cultural and culinary heritages, which favor foods from the ocean, a main source of protein in many regions of Asia, Latin America, and sub-Saharan Africa.

Over the last few years, what’s changed most is what we’re eating instead of meat, and this revolutionary change is reshaping the food industry.

Planting the Flag

When we first began looking at American’s protein choices, more than a quarter of adults who wanted to eat less meat picked up Occam’s razor along with their knife and fork.

Their preferred choice was to simply eat a smaller serving of meat, and this was reflected in everything from our love of gourmet burgers with more toppings than meat, steak showing up as a “topping” for salads, and a passion for tacos, among other food trends. The culinary profession also began making blended burgers and other plant-forward dishes that reduced beef and increased other ingredients in subtle ways.

About five years ago, our interest in a new generation of plant-based meat replacements grew rapidly. We read about them on social media and in finance publications. Although they weren’t yet readily available in most grocery stores or restaurants, they became the most appealing way to eat less meat.

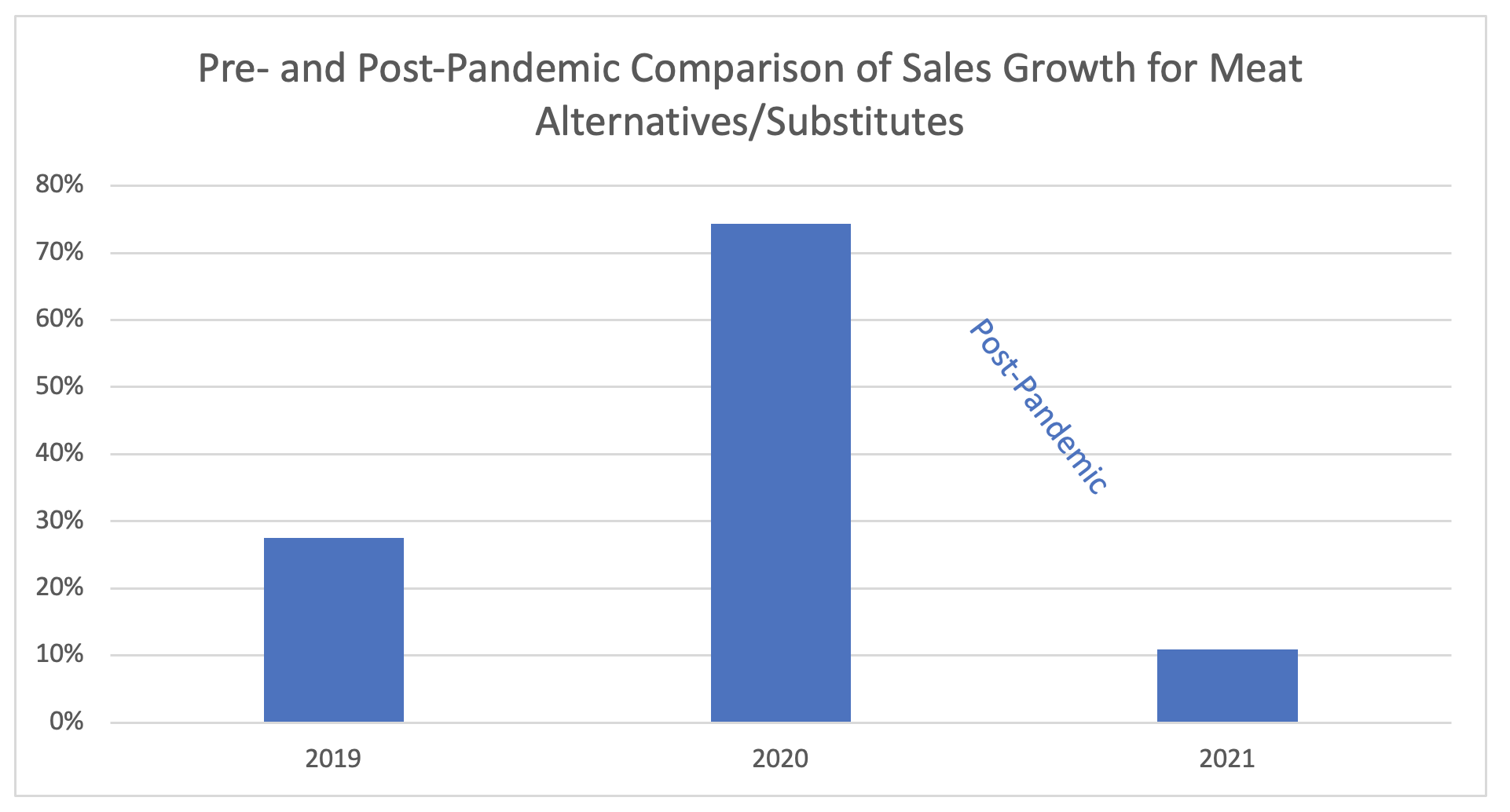

That was an infatuation. During COVID we had the chance to eat them at home. After a year of domesticity, the Food Institute has called out the “decelerating sales” of meat alternatives in grocery retail compared with below pre-COVID levels. Relatively small shares of households are buying them, and they’re likely fated as niche offerings, while sales to restaurants have plateaued, even as diners spend record amounts eating out. I pointed this out in my commentary on Nasdaq previously.

Source: IRI Integrated Fresh, total US Multi-Outlet, YoY ending 9/19/21

Game of Chicken

The new wave of Silicon Valley-backed plant-based meat manufacturers provided the sizzle. But shrinking portions only gets you so far before customers start asking, “Where’s the beef?” As the share of Americans interested in eating less meat continued to grow, we began to replace a few pounds of beef each year with a lot more chicken, eating about 10 pounds more per person over the past decade.

This trend showed up in the rankings and valuations of the largest quick serve restaurants as Chick-Fil-A, which in 2010 was ranked #12 with $3 billion in revenue, rose to #8 in total sales by 2015 and #5 in 2019, just before COVID descended, with more than $10 billion in revenue. It’s average sales per restaurant were higher than any competitor and about double that of competitors offering hamburgers, in addition to their own latecomer chicken offerings.

Meanwhile, the nation’s largest beef producers seamlessly became some of the largest poultry producers and the world’s largest protein suppliers. Tyson, Cargill, and JBS are the country’s top three beef producers and three of the four largest poultry producers, following JBS’s acquisition of Pilgrim Brands.

American consumers are signaling we may have reached “peak chicken.”

Two if by Sea (or at least more if by sea)

For decades, history teachers have quoted Henry Wadsworth Longfellow’s “two if by sea,” when teaching us about Paul Revere’s historic ride during the American revolution.

For decades, nutrition experts have taught us we should eat two servings of fish each week. That hasn’t happened yet. But Americans are now poised to eat more fish and seafood.

For the past two years, the third of American adults who said they intend to eat less meat over the next year have indicated they want to replace it with fish and seafood rather than poultry, plant-based meat replacements, smaller servings, and other strategies.

However, they are hesitant and have concerns.

Just like chicken a decade ago, fish and seafood is powered by a halo of health. Now, the seafood industry must wrestle with the same set of issues that poultry manufacturers faced: antibiotic use, animal welfare, labor conditions, and environmental concerns. The difference being that for fish this includes ocean health issues like microplastics and industrial contamination instead of pesticides and GMOs.

For a sector that has watched the protein revolution from the sidelines — with fish and seafood consumption bumping up about a pound-and-a-half per person over the past decade, while chicken consumption has soared about ten times as much — the reward for aligning business practices with consumer values is substantial.

The prize also extends beyond America’s borders and reaches across the Atlantic to Africa which is forecast to be the center of global population growth as well as growth in the food sector over the next few decades. For many on the continent, both freshwater and ocean fish and seafood are the preferred protein and are a larger part of culinary traditions than the typical western protein assortment, including for over half of those living in sub-Saharan countries Some of America’s most common farmed fish — like tilapia — originated in Africa, like many other foods we often think of as “American.”

The largest protein companies are realizing the next driver of growth in foods is from the ocean. JBS was the most recent entrant to the aquaculture market with its August purchase of a south American salmon producer, while Tyson and Cargill continue to spend on expanding their ocean farming capacity, including producing fish feed, duplicating a profitable play from their poultry operations.

The revolution on the American plate reaches across, and into, the oceans as the source of our protein and is being led by the biggest players in the food business. American consumers are primed if their concerns are met through sustainable production. Africa is poised to be an even bigger prize as we look to get more of our food from the ocean. This World Food Day, the revolution that is changing tastes is upon us.

Arlin Wasserman is the founder and managing director of Changing Tastes and creator of the plant-forward culinary strategy. He served as the first vice president for sustainability at Sodexo and developed and served as inaugural chair of Menus of Change, an executive training program in sustainability and nutrition for the Harvard Chan School and the Culinary Institute of America.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.