By Leland B. Hevner

President, National Association of Online Investors (NAOI)

This is the fourth in a Series of articles that show how the National Association of Online Investors (NAOI) is changing the way portfolios are designed and managed to better cope with modern market volatility. You can access previous articles at this link.

Disclaimer: The information presented here is investing education, not investor advice.

A recent survey by the CFA Institute, found here, shows that only 23% of the investing public trust their financial advisors. At the NAOI we are not surprised. As the market’s leading supplier of objective investor education to the public, we work closely with individual investors on a daily basis. And we know that people are not happy with how the financial services industry is telling them to invest today.

The problem is that people are given portfolios designed based on Modern Portfolio Theory (MPT), an approach to portfolio design introduced in the 1950s. While markets have evolved dramatically since then, the design of MPT portfolios has barely changed at all. And they simply can’t cope with modern, more volatile, markets.

In this Article I introduce a new portfolio type developed by the NAOI that we call Dynamic Portfolios (DPorts). Unlike MPT portfolios that embrace a buy-and-hold management strategy, DPorts are designed with a built-in trading plan. This makes them market-sensitive and capable of capturing the gains of market price uptrends while avoiding the losses of market price downtrends and crashes. You will learn how DPorts work in this Article.

A Quick Review of Previous Articles

Before discussing how DPorts work, I will present a short overview of the previous articles in this Series to provide context. Click the link provided for each article to read it.

Article 1: Why Change Is Needed; Identifying the Problems with Investing Today

In Article 1 of the Series, I discuss the problems resulting from the unquestioned use of Modern Portfolio Theory (MPT) to design and manage portfolios today. MPT dictates that portfolios be designed to match the risk tolerance of each investor and then bought and held for the long-term, regardless of market conditions. As a result they are dangerously vulnerable to stock market crashes that occur on an average of about once every six years. Thus, investors can expect to lose a significant portion of their portfolio value on a regular basis and it can take months or years to recover these losses. In Article 1 I explain why an updated approach to portfolio design is needed to enable individuals to invest with greater confidence and success.

Article 2: Introducing Dynamic Investment Theory

Article 2 of the Series discusses how, following a multi-year research effort, the NAOI found a better approach to portfolio design and management in the form of Dynamic Investment Theory (DIT). DIT defines the logic and methods for the creation of an innovative investment type called Dynamic Investments (DIs) that automatically change the equities they hold based on a periodic sampling of market price trends. DIT is the alternative to, or supplement for, MPT that individuals need to cope with 21st century markets.

Article 3: An Introduction to Dynamic Investments

In Article 3 of the Series I explain how Dynamic Investments work. DIs periodically (e.g. quarterly) sample the price trends of the ETFs they work with and purchase only the one ETF that is trending up in price most strongly. This makes them market-sensitive and capable of producing returns that MPT portfolios can’t touch with lower risk and absolute protection from market crashes. In Article 3, I showed that a very simple DI, working only with a Total Stock Market ETF and a Total Bond Market ETF, for the period from 2008-2019 earned an average annual return of +20.4% with a Sharpe Ratio of 1.05. The NAOI projects that this is the investment type that will usher in a simpler and more profitable future of investing.

Introducing NAOI Dynamic Portfolios

The NAOI began teaching the use of Dynamic Investments to student focus groups in 2016. They told us that this is investment type that they needed to enter, or re-enter, the market with confidence and without fear. But we did encounter several issues that needed addressing.

As discussed in Article 3, while a single DI can be the only investment in an individual’s portfolio, the NAOI knows that allocating 100% of a portfolio’s money to one ETF at a time requires too big of a leap-of-faith to be accepted today by either individuals or financial professionals. So, the NAOI created an innovative investment vehicle that we call Dynamic Portfolios (DPorts). These are traditional MPT-based portfolios that contain one or more DIs as building blocks.

The NAOI Dynamic Portfolio Configuration

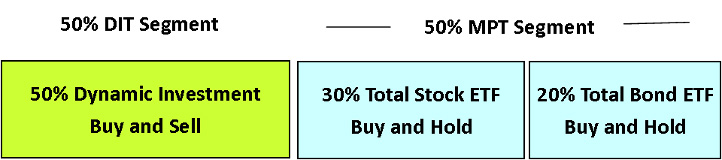

The illustration below depicts a portfolio that contains a DIT-based buy-and-sell Segment and an MPT-based buy-and-hold Segment with a 50% allocation of money to each. In this example the Dynamic Investment rotates only between a Total Stock Market ETF and a Total Bond Market ETF based on the price trend of each; making it extremely simple to implement and manage. This is the default portfolio configuration that the NAOI recommends to of our students.

By adding a DI building block to a static MPT portfolio, it suddenly becomes market-sensitive and capable of automatically changing the equities it holds, and thus its asset allocations, in order to capture gains and avoid losses in all economic conditions.

A “Market-Biased” Portfolio

We refer to above configuration as the NAOI Market-Biased Portfolio. The following diagrams show why. Keep in mind that the DI purchases and holds for one review-period either a Total Stock or a Total Bond ETF depending on which is trending up in price most strongly.

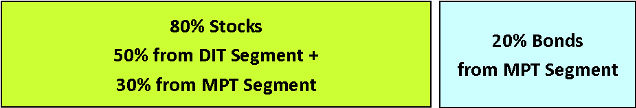

Portfolio Allocation when Stocks are Trending Up:

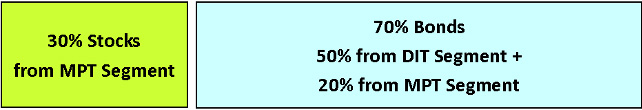

Portfolio Allocation when Bonds are Trending Up:

You can see that this portfolio will always be automatically “biased” toward the asset class that is trending up in price at the time of a review – typically quarterly. And because Stocks and Bonds tend to move up and down at different times, this portfolio is designed to increase in value at all times regardless of economic conditions; even during stock market crashes.

The NAOI Market-Biased Portfolio Performance: 2008-2019

The simple Dynamic Portfolio described above, for the test period from the start of 2008 to the end of 2019, earned an average annual return of +17.7% with a Sharpe Ratio of 1.17. While this configuration averaged a lower average annual return than the single DI used in the example discussed in Article 3, its risk was significantly lower as evidenced by having a higher Sharpe Ratio. And, by holding at least two non-correlated ETFs at all times, we found that individual investors were comfortable owning this high-performance portfolio configuration; which was our goal.

The Market-Sensitivity “Control Dial”

The Default DPort discussed above, with the allocations shown, works for most of our students regardless of their risk profile. However, the portfolio’s sensitivity to market price movements, and thus its expected performance, can easily be changed by adjusting the percentage of money allocated to the DIT Segment. Testing shows that higher DI allocations produce higher performance as illustrated in the table below.

Investors can easily select the allocations for the Market-Biased Portfolio, and thus the level of its performance, to meet their unique goals.

The Advantages of a “Default” Portfolio

As mentioned above, the Market-Biased portfolio is what the NAOI considers to be a “default” portfolio. Its goal is to provide maximum returns with minimal risk in all economic conditions. This is a universal goal that works for all investors, regardless of their risk tolerance. As such, no customization is needed. When this standardized “portfolio product” is made available to the investing public, the world of investing changes at a fundamental level. No longer needed are the error-prone and risky subjective decisions required in today’s portfolio design process. And advisors free up time to help clients with financial planning issues; an area of wealth creation that does not get the attention it deserves today.

A New Portfolio Performance Benchmark

The NAOI Default DPort also provides a valuable performance benchmark that individuals can use to evaluate the effectiveness of any portfolio they are offered. If the historical performance of an advisor-recommended portfolio is not higher than that of the NAOI Default portfolio then why even consider it?

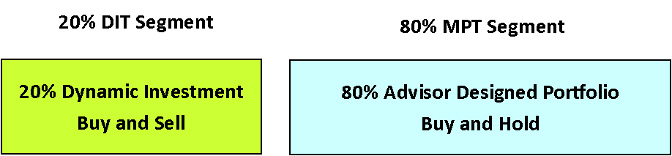

A Non-Disruptive Portfolio Design Approach

The NAOI has been warned by skeptics that the changes we are suggesting here are simply too great in scope for the financial industry to accept. But this is not true. The MPT Segment of a Dynamic Portfolio can be the MPT-based portfolio that an advisor recommends using methods and investing products that they work with today. This DPort configuration is depicted below.

The addition of a Dynamic Investment simply increases the returns and reduces the risk of the advisor MPT-based portfolio with very little time, thought or effort required. As a result, advisors and financial organizations can easily take advantage of DI benefits without disrupting current operations!

It should be noted that the NAOI teaches our students that if an advisor does not agree to work with them to implement the DIT Segment of a Dynamic Portfolio, individuals can easily do so on their own using and online broker and the DIT User’s Manual in addition to other NAOI support services.

Article Summary

In this article I have described NAOI Dynamic Portfolios. This is the first new approach to portfolio design since Modern Portfolio Theory was introduced in the 1950s. As more people learn about the simplicity and high performance of this approach via NAOI classes, books and a planned PR campaign, demand for both DIs and DPorts will grow. Financial advisors and organizations that offer them will have a massive competitive advantage over those that don’t.

Author’s Note: While the Dynamic Investments and Dynamic Portfolios discussed in this article are very simple to understand and use, designing them to provide optimal performance requires a unique set of skills and tools. The NAOI offers both in the form of “Dynamic Investment Design Classes” as described here: https://naoi.org/seminars.

The Next Article: The Benefits of using Dynamic Investments for Individuals.

While higher returns, lower risk and absolute protection from stock market crashes are the most obvious benefits of using NAOI Dynamic Investments and Dynamic Portfolios, there are other equally important benefits that provide individuals with a superior investing experience. The next article in this Series discusses them. Look for it on this Web site in about two weeks from the date of this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.