Abstract

The financial markets have been very challenging over the past couple of years with few strategies generating alpha. Dispersion trading is one of the few strategies that have worked in this difficult market environment. This is a complex strategy that involves several moving parts. However, in this paper, we discuss combining options on the top ten stocks in the Nasdaq-100 with NDX index options to implement a dispersion strategy.

Introduction

Over the past few years, the equity markets have been challenging with many strategies employed by active managers turning in subpar results. One approach that has been offering up solid results is dispersion trading. A dispersion trade is similar to a traditional spread trade where one asset is overvalued versus another that is undervalued. However, the valuation difference in this case is options on an index versus option on the constituents of an index.

Dispersion Trade Basics

A dispersion trade is a method of taking advantage of the difference between expected volatility priced into index options and the volatility expectations priced into options on the components of the index. Typically, the implied volatility for index options is lower than the implied volatility priced into stock options. However, this spread is not consistent, creating opportunities to take advantage of the fluctuations of the spread.

Over the past few years dispersion trading strategies have gained more attention as traders continue to search for methods of generating alpha. The literature on dispersion trading often makes the topic overly complex.

Nasdaq-100 And Dispersion Trades

The Nasdaq-100 (NDX) is comprised of one hundred of the largest stocks that have their primary listing on the Nasdaq stock market. The index is capitalization weighted which means larger companies will have a bigger influence on the day to day NDX change. The following table lists the ten largest NDX components at the end of 2020.

The top ten stocks in the NDX typically represent about half the total capitalization of the index. The total NDX capitalization on the table above is 51.30%. This large representation of just a few stocks in the NDX is a major reason the NDX is a perfect index for implementing dispersion trades.

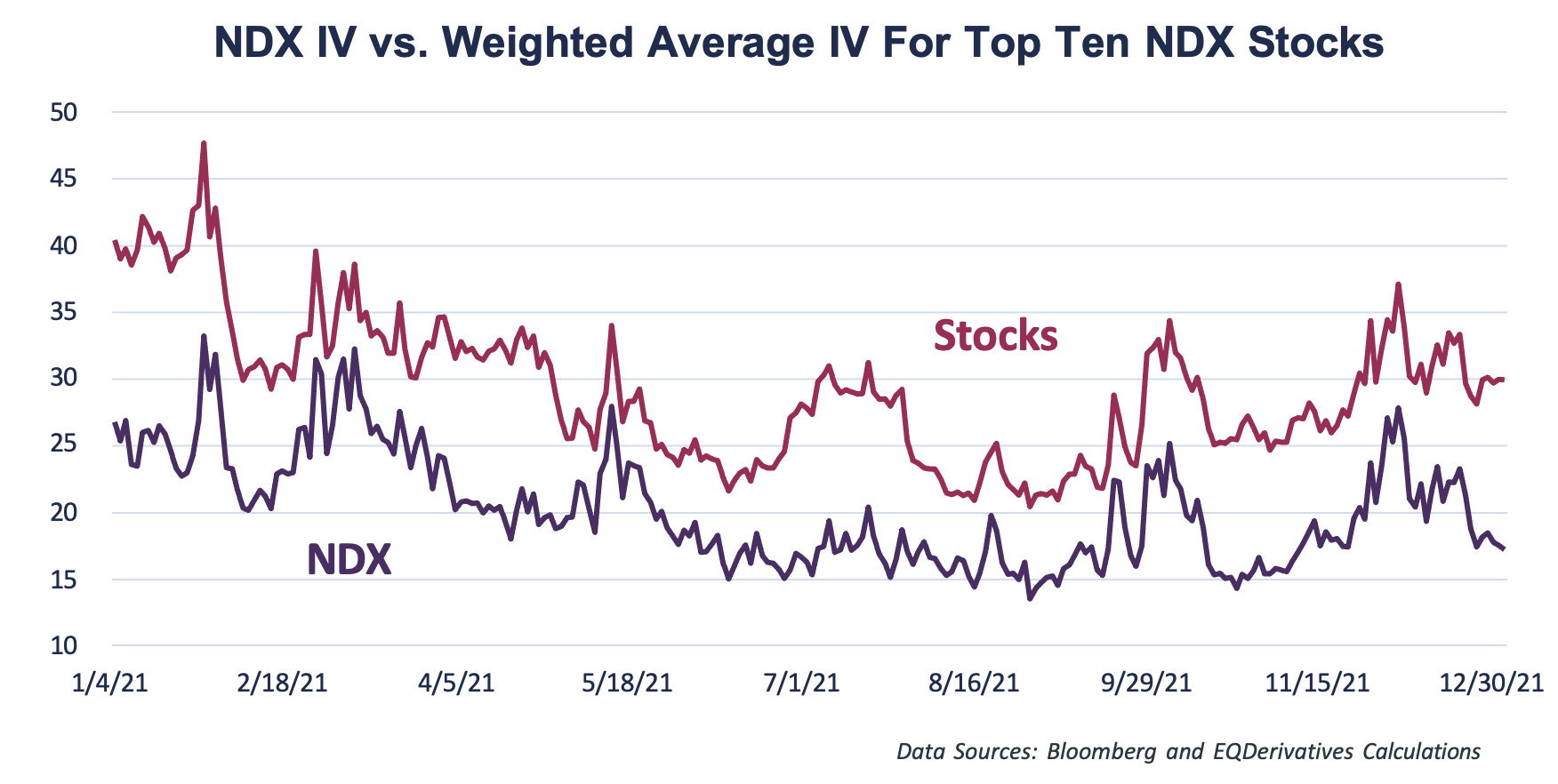

Another reason traders should be looking to NDX and large NDX components for dispersion trading opportunities relates to the relationship between volatility expectations. The chart below shows the average 30-day at the money implied volatility for the ten largest components and NDX as of the last day of 2020. The component volatility figure is determined using a weighted average based on the market capitalization of each individual stock. The chart covers all trading days in 2021.

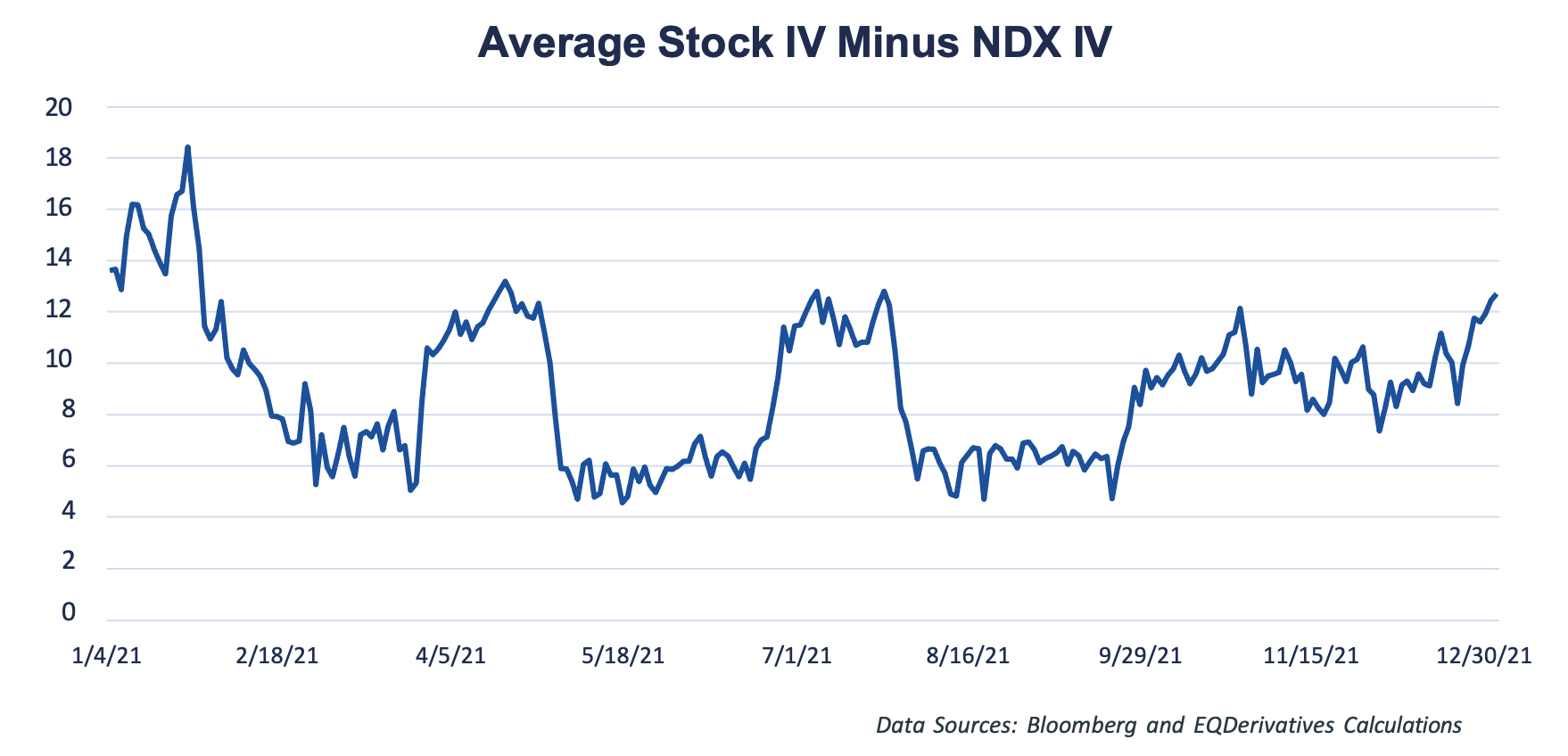

The average of the component implied volatility is consistently higher than that of the NDX. They do appear to move in sync with each other, but that is not the case as the spread between the average component implied volatility and index volatility diverges over the course of the year. The following chart shows the spread between a consistent weighted average at-the-money implied volatility for the top ten stocks in the Nasdaq-100 and NDX implied volatility.

The spread between individual stock and NDX implied volatility averaged just over 9.00 in 2021, with the widest spread being 18.41 and narrowest spread at 4.56. This is an admittedly simple method of comparing stock and index volatility, but it is a good illustration of how this relationship offers trading opportunities.

Trading Examples

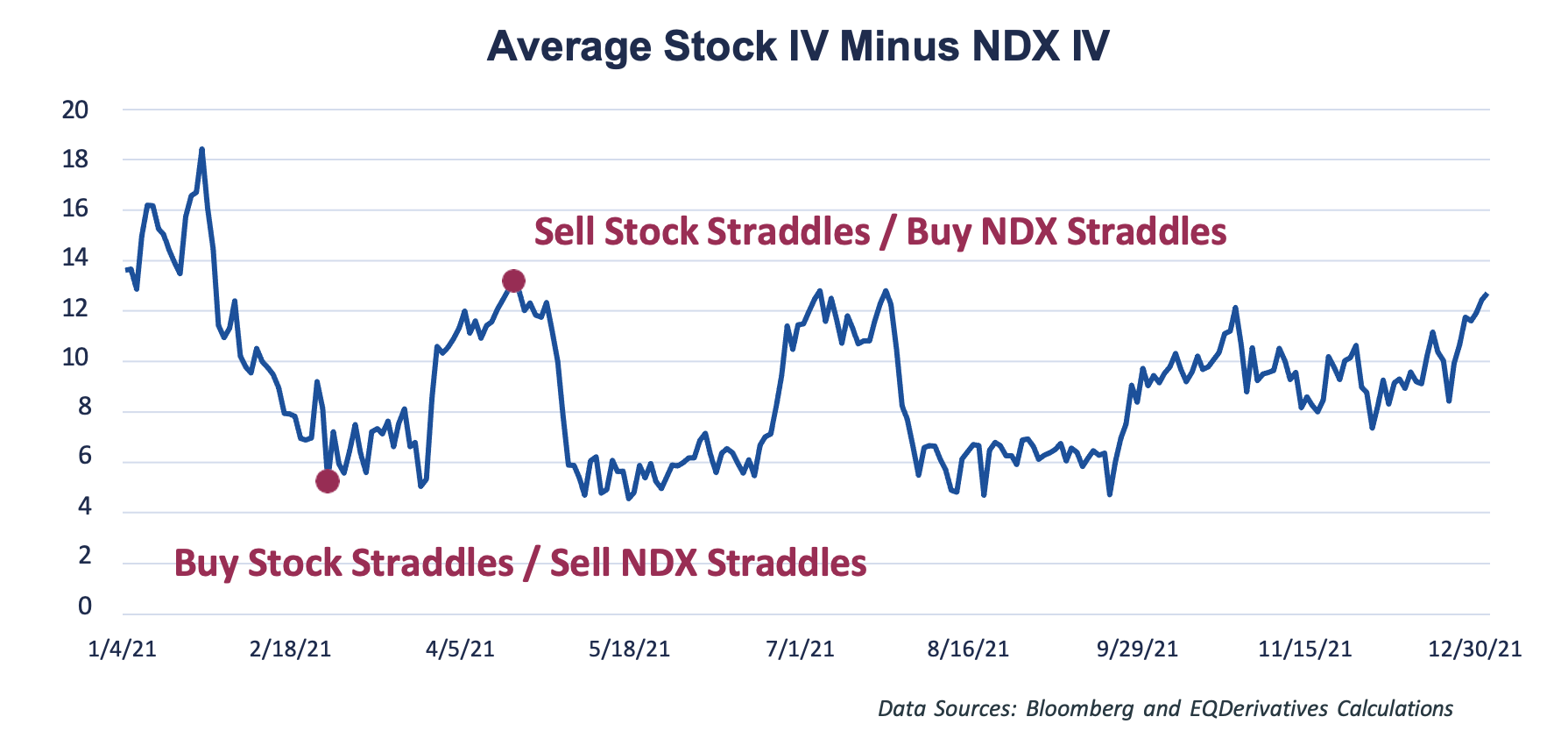

Dispersion trades can involve shorting individual stock volatility and purchasing index volatility or buying individual stock volatility and shorting index volatility. A common method of putting on a long or short volatility trade is through purchasing or shorting an at-the-money straddle. To demonstrate how to implement each version of a dispersion trade we refer back to the Average Stock IV Minus NDX IV chart.

When the line on the chart above it near the high end of the range a dispersion trader would sell at-the-money straddles on the individual stocks and purchase an at-the-money straddle on NDX. Conversely, at the low end of the range, straddles on the individual stocks would be purchased and a straddle sold on NDX.

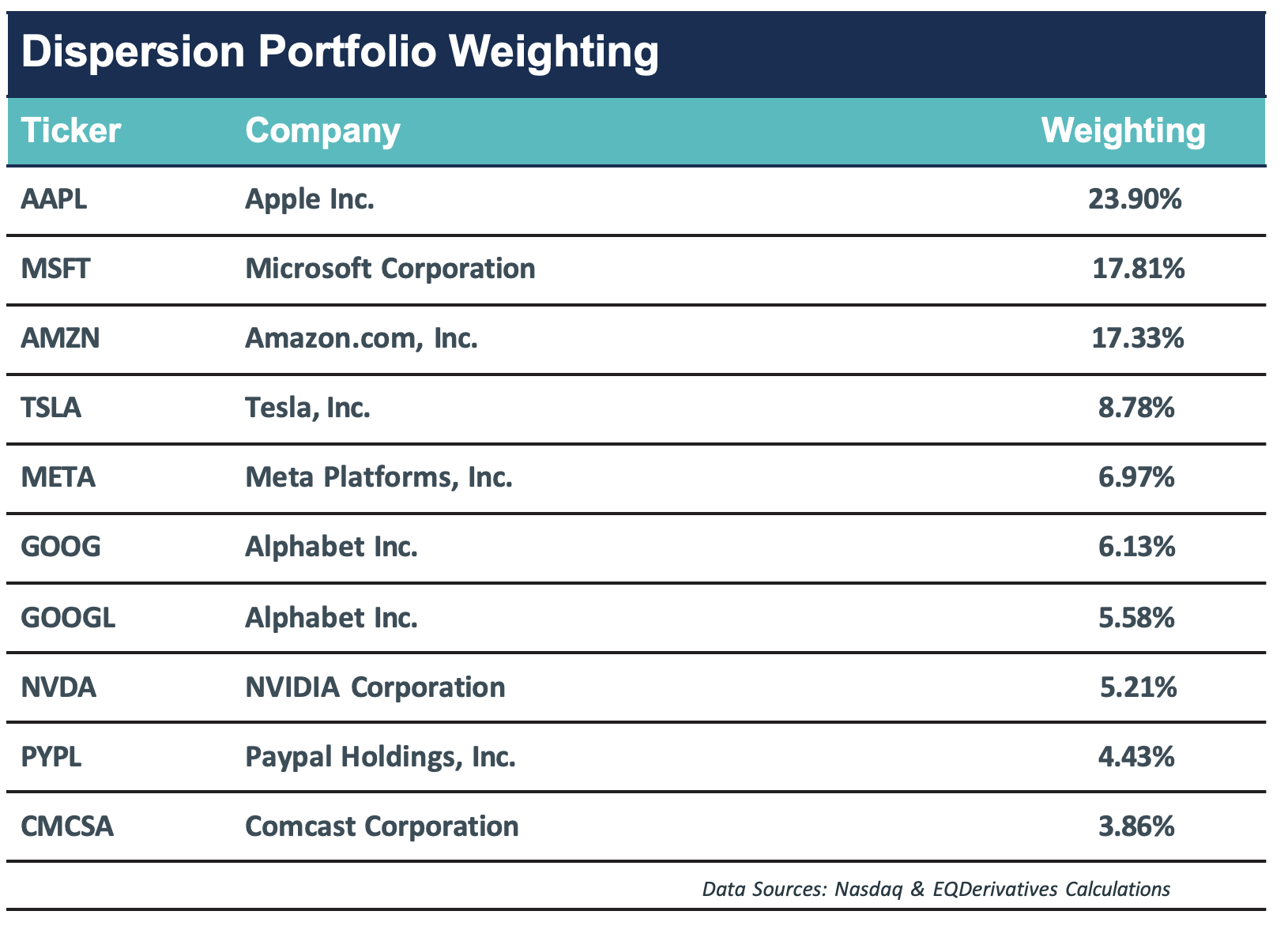

A first step is to determine the weighting of each stock in a portfolio for the dispersion trades. Based on the December 31, 2020 market cap for each stock the portfolio weighting is calculated on the table below.

Apple, Microsoft, and Amazon dominate this portfolio as collectively they represent 59% of the portfolio that is traded against NDX. In order to determine the number of options on each stock, the option strike price that is closest to the stock price will be compared to the NDX strike price utilized in the trade. In order to include options on each of the ten stocks in the portfolio, the minimum number of NDX straddles to be traded is two. The following examples utilize two NDX contracts and an appropriate number of individual stock options based on the weightings in the table above.

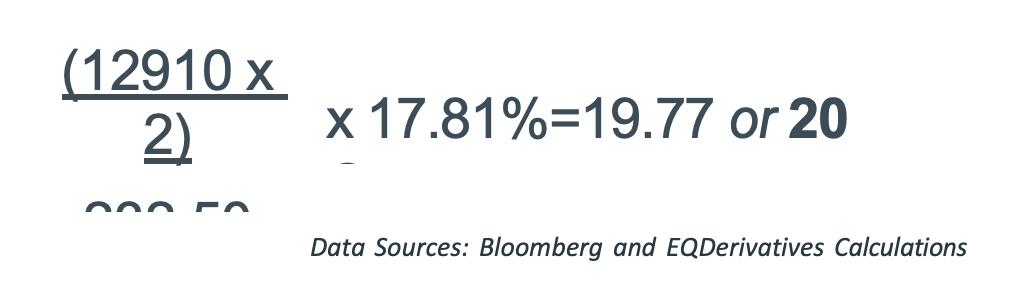

As an example of determining the appropriate number of straddles on the individual stocks, consider MSFT on February 26, 2021. The stock closed at 232.38 and NDX closed at 12909.44. The nearest strike price to MSFT is 232.50 and NDX is 12910. Therefore the number of MSFT straddles on that date is calculated below.

As a reminder the 17.81% is the weighting for MSFT for the portfolio of options that will be traded against the NDX straddle.

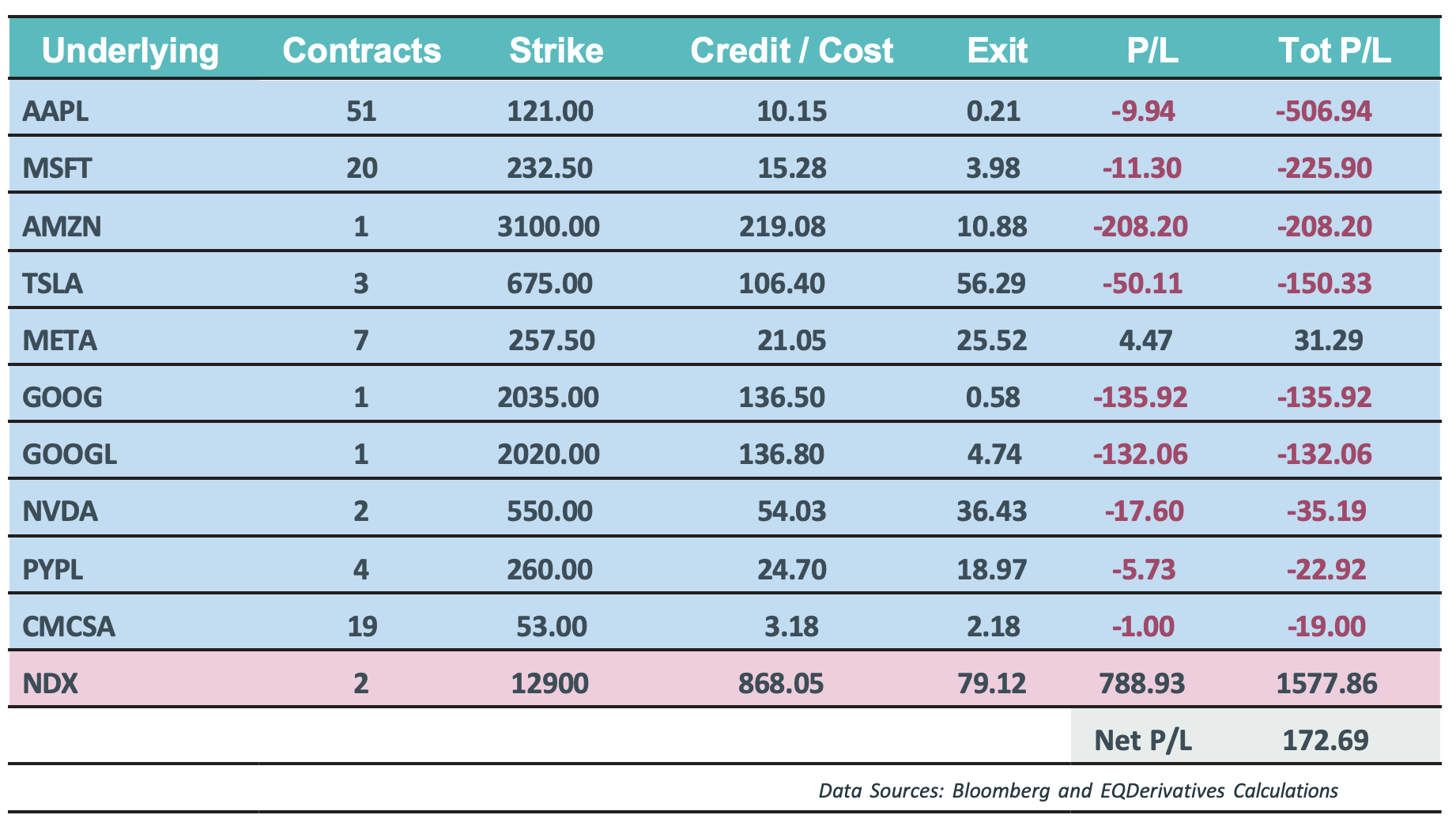

Long Stock / Short NDX Volatility

The first trade example occurs on February 26, 2021. This date is highlighted on the marked up Average Stock IV Minus NDX IV chart. The spread between NDX and stock implied volatility is 5.26, which is very close to the low end of the chart. Recall the chart is based on 30-day at-the- money implied volatility so to match up with that time frame we use weekly options expiring Friday, March 26, 2021. This is also a Friday where NDX options settle on the close. The table below shows all relevant information for the long stock and short NDX straddles.

The equity straddles are all purchases which is highlighted in blue, while the NDX straddle is highlighted in red indicating a sale. The profit or losses are indicated by the closing prices for each market on the close March 26, 2021. Note, the long equity straddles are net losers on the table above with only META realizing a profit on the long straddle. However, the short straddle on NDX shows a profit which is much greater than the losses incurred on the individual stock straddle purchases. When trading spreads a trader should not focus on each leg’s profit or loss, just the net P/L. In this case the net profit of all combined positions is 172.69.

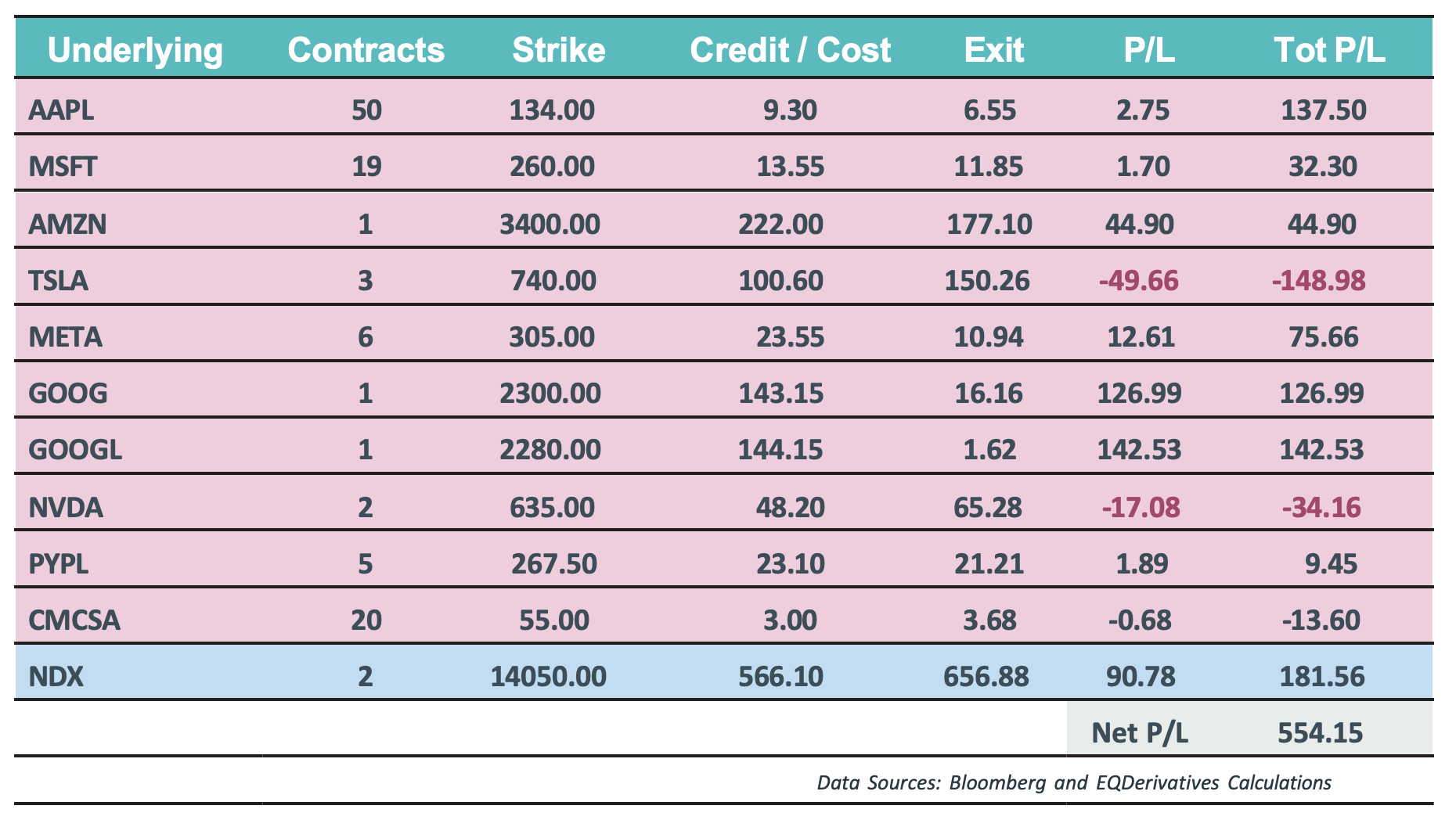

The other date highlighted on the Average Stock IV Minus NDX IV chart is April 16, 2021. On this date the spread between the portfolio and NDX implied volatility is 13.18, near the higher end of the range. In this case an NDX straddle is purchased and straddles on the individual component are sold.

This trade worked out quite well with both the long NDX straddle and portfolio of short equity straddles making a profit. The net result, at expiration for all options is a gain of 554.15.

The process for timing the dispersion trades above involves comparing the implied volatility of a portfolio of stocks that is similar to the index. It is by far not the only method of deciding the time is right for a dispersion trade. There are many more complex methods of dispersion trading and holding the positions through expiration is not common. However, the examples in this paper demonstrate how the difference between expected stock and index volatility is traded. Finally, since just a few stocks comprise such a large part of the Nasdaq-100 index, this market is ideal for dispersion trades.

About EQDerivatives

EQDerivatives is the premier provider of volatility derivatives and alternative risk premia news, research and event content for investors, portfolio managers and service providers. We connect and educate the leading thinkers in the space globally by delivering the latest strategies from the practitioners buying and structuring investments. EQD’s data reports are recognized as the definitive source of market intelligence across derivatives markets, quantitative investing and ESG. Through a curated network of portfolio managers, execution traders, CIOs and heads of asset allocation at institutional investors, EQD can map global markets and products through the lens of the buyside.To learn more, visit https://eqderivatives.com/research/derivatives-data.

Copyright EQDerivatives, Inc. 2022.

Content published by EQDerivatives, Inc. may not be copied or otherwise reproduced, repackaged, further transmitted, transferred, disseminated, redistributed or resold, or stored for subsequent use for any commercial purpose, in whole or in part, in any form or manner or by any means whatsoever, by any person without EQDerivatives’ prior written consent.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.