I am English and have found that when that becomes apparent to people in America, they tend to make certain assumptions about me. I sometimes have fun pointing out (particularly to my more liberal friends) that this is almost the definition of racism and bigotry but, fortunately for me, many of the character traits ascribed to me based on where I was born are positive. They may think I am a bit arrogant, for example, but somehow, how I speak makes me knowledgeable and trustworthy in their eyes. It also means that I must have a great sense of humor apparently, with a particular appreciation for irony.

Maybe that is why I am finding the GameStop (GME) story so fascinating. It is just dripping with irony.

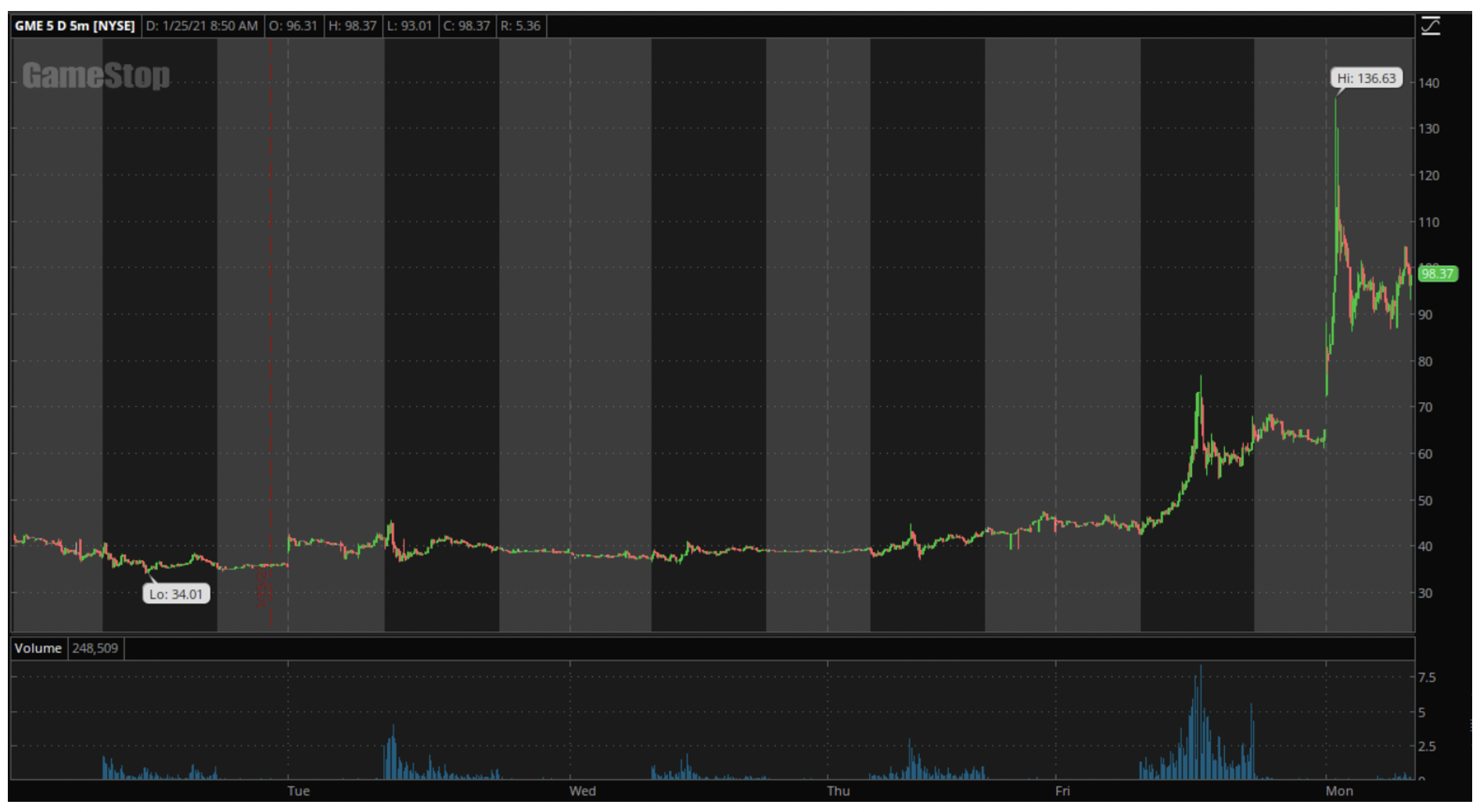

In case you missed it, the story is that GME has been acting strangely for a couple of weeks, culminating in some really spectacular moves over the last couple of days. The stock hit a high of over $136, having traded in the $30s as recently as Thursday with a low of $2.57 back in April.

As is usually the case when this kind of thing happens -- absent a takeover or some such thing -- what we are seeing here is a short squeeze. That is when traders recognize that there are a lot of people sitting short of a stock and buy to force the price up. That forces those who are short and must buy the stock back at some point to do so, forcing others to buy back which forces the price up more, etc., etc.

The problem with short stock positions (selling something you don’t own to profit if it goes down) is that the potential losses are infinite. If you buy a stock for $5, the most you can lose is 100% of your $5 if the company goes bankrupt.

On the other hand, if you sell a stock short when it is $5, and the price jumps to $55, you have lost $50, or 1000% of your investment.

For that reason, when you sell short, your broker will demand a margin payment, money that is taken from your account to offset any possible losses. As those losses grow, so do the size of the required payments, eventually forcing the sellers to buy the stock back before they completely run out of money.

Sometimes, when a bear case is obvious or massively hyped, the short selling gets to ridiculous levels. Not long ago, for example, GME reached a situation where over 130% of the available stock was tied up in short positions. That makes it just about impossible for anyone to borrow more to sell to counter a rise in price, so it is relatively easy for traders to force the price up, then let momentum and panic take care of the rest.

That is what happened here, and the irony comes from the reaction from one short seller in particular: Citron Research.

Short selling is what Citron is best known for. They have, in the past, highlighted situations where companies have something suspect about their earnings or prospects. I say “highlighted” rather than revealed because it seems that what Citron usually does is take information that is available elsewhere, draw conclusions from it, then run it through the megaphone of their publications.

Let me make something clear right away here. They are very open about the fact that they or their clients may already have short positions in the stocks concerned and as I said, most of what they say is publicly available information. Clearly, they are not doing anything illegal, or even underhand. They have been sanctioned a few times by regulatory authorities and lost legal battles overseas but, as founder and Executive Editor Andrew Left has frequently pointed out, they have never lost a significant court case in America.

In fact, they have frequently highlighted fraud elsewhere, providing a valuable service to investors.

Basically, what Citron does is to use public opinion to their benefit. They bring publicity to a negative story about a stock, then wait for the public to sell and force the price lower. However, in the case of GME, that backfired. The public, in the form of a couple of groups on Reddit and on other social media platforms, fought back against the narrative that GME was going down, and the squeeze we saw ensued.

The bearish story is pretty obvious. GameStop is a brick-and-mortar video game seller in an era when games are sold and downloaded online. The company's revenue and profits have been falling for a while. Recently, however, they appointed three new board members proposed by investor and Chewy CEO, Ryan Cohen, including Cohen himself. That led to a feeling that they could expand their e-commerce business and turn things around. That alternative narrative, and the massive, short positions in the stock, prompted a squeeze of epic proportions.

Now Left is complaining that the squeeze is the action of an “angry mob” that has forced him to stop publicizing the bear case for GME. In other words, somebody else used public opinion and “organized” trading to make his position a losing one. If you don’t see the irony in that, then you certainly aren’t English.

Left claims that the “mob” has overstepped the mark and harassed him and even his family in a way that is actually illegal. If that is true, shame on them, and those involved should be prosecuted. This must be condemned without hesitation; nothing excuses that type of behavior. Online harassment of those with different opinions, particularly in pursuit of profit, is disgusting and becoming all too common, and standing up against it is important. That said, there is an obvious irony to someone who has made a fortune by using the mob mentality of traders, labelling himself a victim of that very same thing, and my English self cannot help but notice it.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.