The Impact of the SEC's Tick Regime Proposal on ETFs

Recently we’ve covered the new SEC proposals and the importance of getting ticks right to make trading cheaper for investors and reduce the cost of capital for issuers. Today we highlight how the SEC’s tick proposals impact ETFs.

As we know, ETF spreads are different. Being both a portfolio and a stock, with arbitrage available, a number of ETFs have tighter spreads than a similarly liquid or similarly priced stock. That’s one reason why the SEC’s approach to allocating tick groups based on actual spreads (rather than stock prices) is logical for ETFs. However, it will also mean some similar ETFs will have different tick sizes and different minimum spreads.

Based on today’s data, we show that the different tick sizes won’t really matter to spreads.

That’s because ticks in basis points are what investors should care about, and, as the data shows, most stocks won’t need all their new ticks anyway. Using a single ½ cent tick group, rather than the multiple groups in the SEC proposal, looks sufficient to eliminate the tick constraint for the majority of ETFs.

In fact, what we see is different tick groups make spreads more equal – in basis points – than the current 1-cent-fits-all regime.

How do ETFs trade now (with a 1-cent tick)?

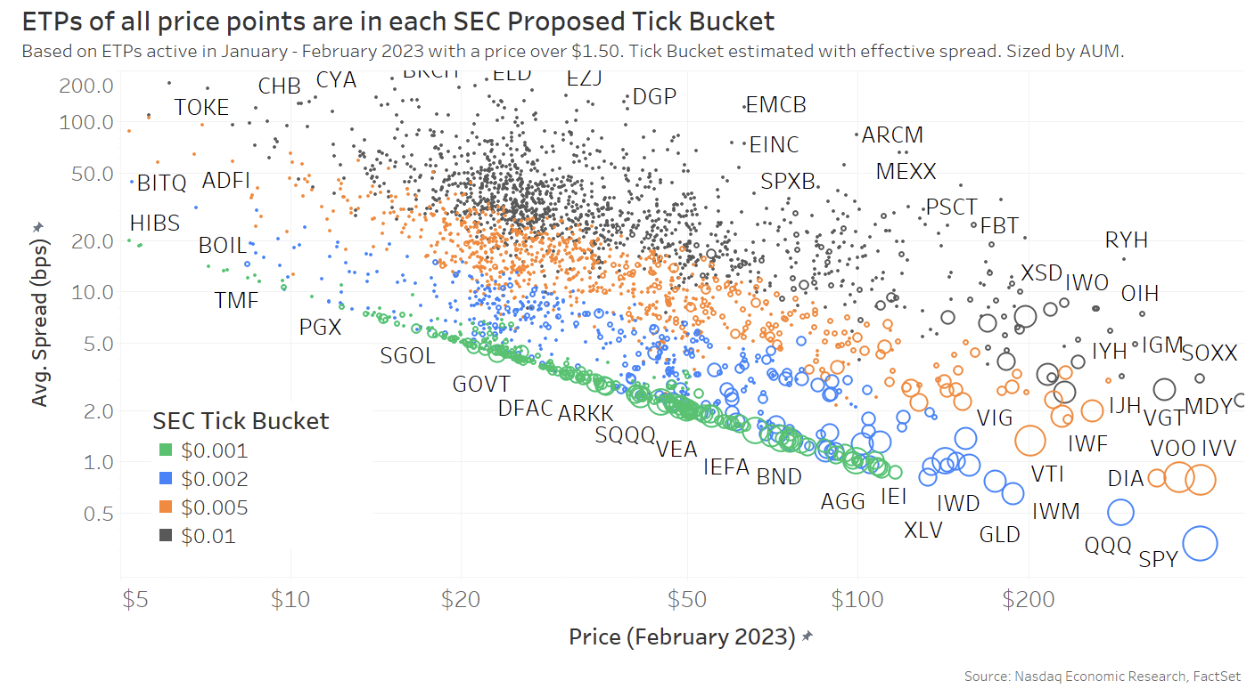

One of the problems with the 1-cent tick is that it becomes a mathematically expensive spread to cross as prices fall, leading to more queuing and longer times to fill. And the more liquid the ETF, the higher the price when that happens. We can see that for all ETFs in the chart below.

Tick-constrained ETFs (green circles, and potentially some of the blue circles, too) are clearly stuck on the diagonal line, where NBBO spreads can’t get cheaper because of the 1-cent tick. Many of those circles are also large, indicating that this is a more common problem for larger, typically more liquid, ETFs.

Chart 1: ETF average spreads and prices now, colored by the SEC’s proposed tick regime

Working out which tick buckets ETFs might fall into

Removing the tick constraint should allow spreads in tick-constrained ETFs to fall.

Working out which tick groups ETFs might fall into requires us to forecast the tightest spread a stock could have - despite quoted spreads (by definition) being limited to 1.0 cent.

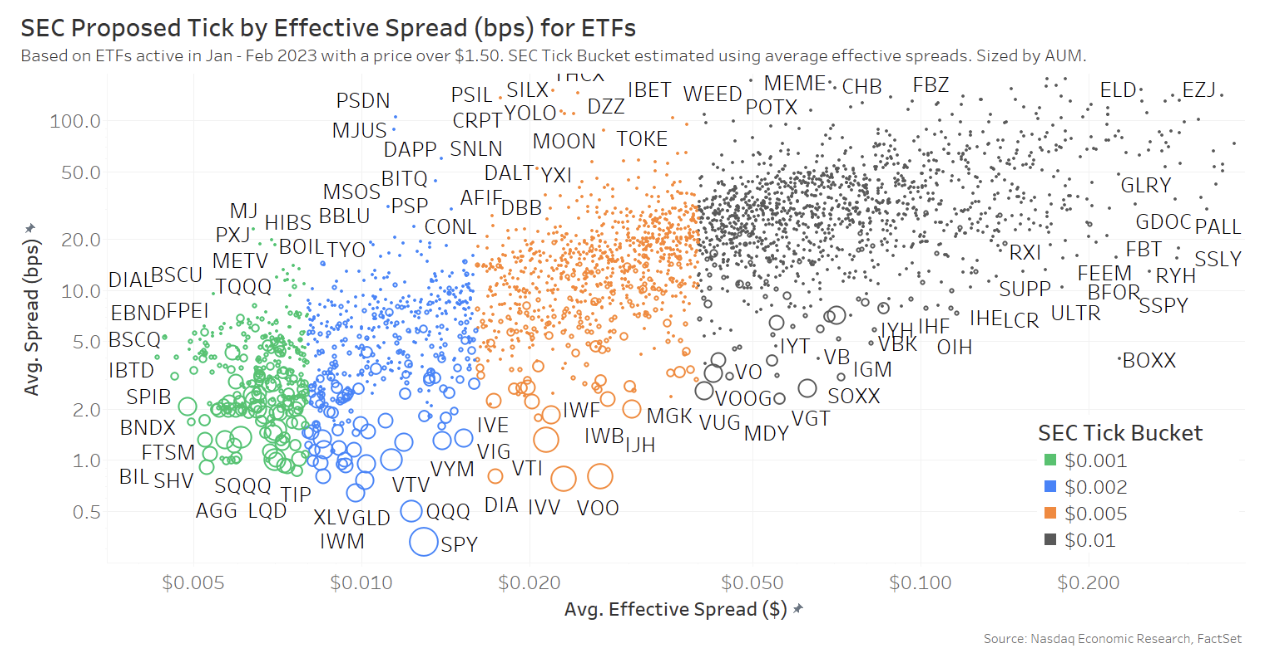

To do that, we look at effective spreads, which already take into account fills inside the NBBO. That gives us a better idea of which tick buckets ETFs might finally trade at. We show the effective spreads (in cents) vs. average spreads (in basis points) in Chart 2 below. We also color by the SEC’s proposed tick groups.

Chart 2: ETF average spreads and effective spreads colored by proposed tick regime

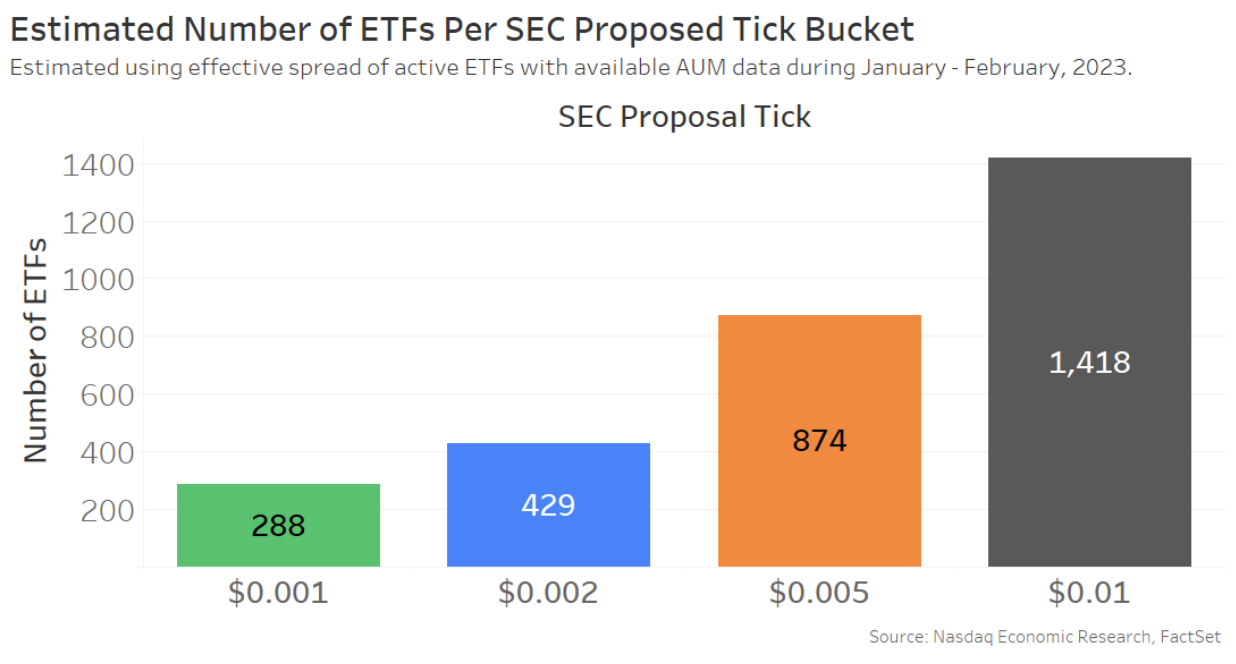

Adding up all the tickers in each color group, we see that:

- 717 ETFs would be placed into the $0.001 or $0.002 tick bucket (meaning they have a spread under 1.6 cents).

- Another 874 ETFs that trade with spreads between 1.6 cents and 4 cents now will have their tick reduced to ½ cent.

- Furthermore, 1,418 ETFs that trade with spreads more than 4 cents wide today will keep their 1-cent tick.

Chart 3: Number of ETFs in each tick group proposed by SEC (based on effective spreads now)

What might sub-penny ticks do to ETF spreads?

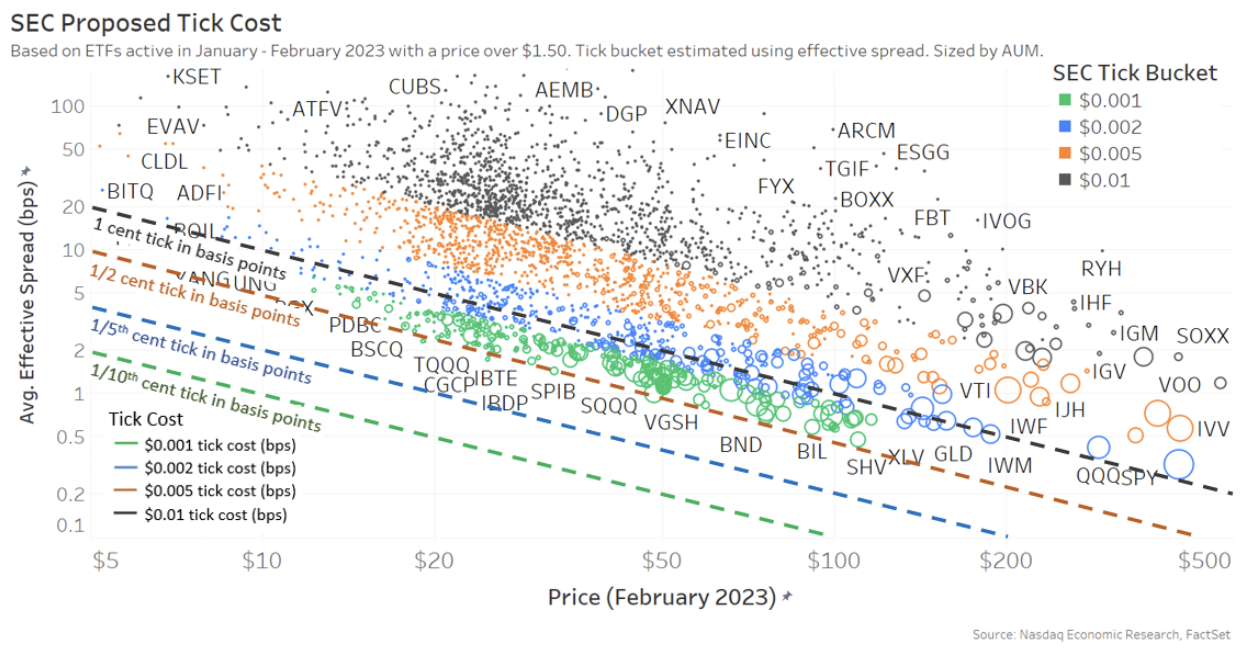

Replotting the data from Chart 1 but using effective spreads, we see what removing the tick constraint might do to ETF trading:

- All the green ETFs are able to fall below the 1-cent tick (black line) that they trade at now. However, very few seem to actually need less than a ½ cent tick (orange line) to trade efficiently.

- Some of the blue ETFs look like they might also trade below the 1-cent tick (black) line. However, none fall below the ½ cent tick (orange) line.

- Interestingly, the data also shows that ETF issuers are much better at “right pricing” their ETFs for trading than corporates seem to be, as most stocks are trading close to their “optimal” spread (Some blue and all the orange dots, with a cluster of dots around $25 giving a 4-basis point spread).

Chart 4: ETF effective spreads by price, colored by proposed new tick groups (with lines showing the effective cost of 1 new tick)

Focusing on specific ETF competitors

We can filter the data from Chart 4 to compare similar ETFs.

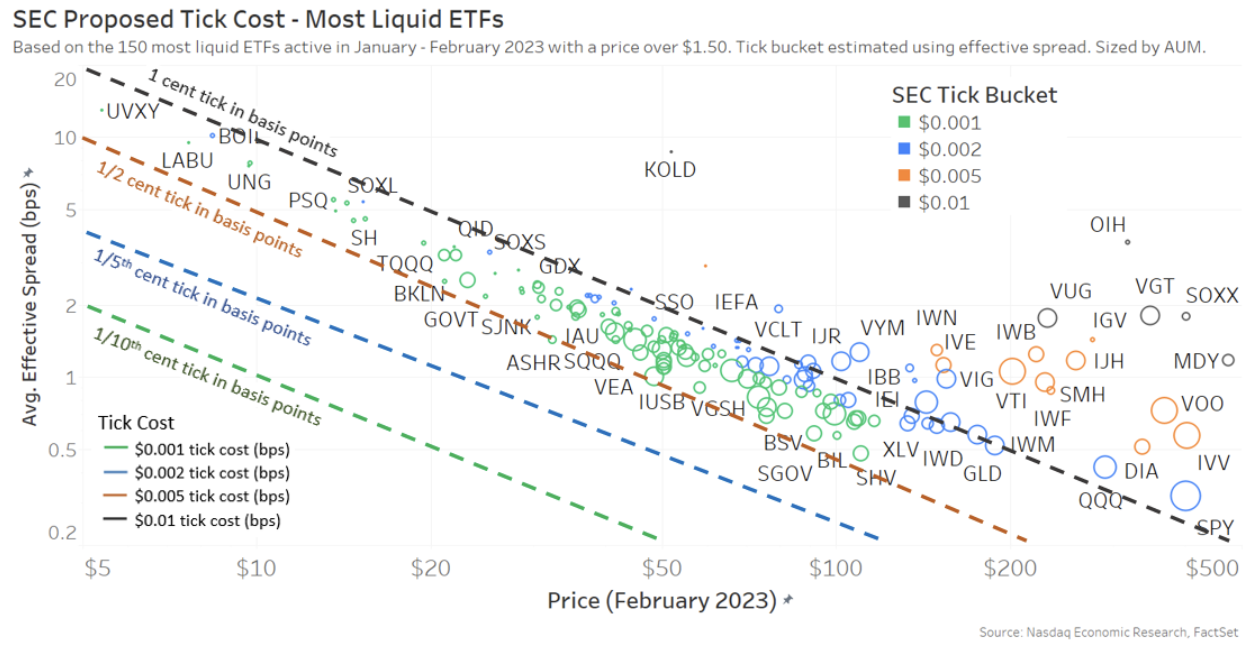

First, let’s look at the 150 most liquid ETFs. What the data shows is that:

- Most end up in the 1/10th cent tick group (green circles), especially those with lower prices. However, none are expected to see spreads fall enough to trade close to a 1/10th cent spread (green line).

That means almost all these ETFs will trade with multiple tick increments inside their NBBO. More increments inside the NBBO should lower the cost of queue jumping (for example, the cost of 1 tick in a $50 ETF falls from 2bps to 0.2bps), but it may also increase the use of odd-lots (even in the new MDI-round-lot regime) and is almost certain to increase message traffic and reduce the resting time of ETF quotes.

- Many of the highest-price ETFs (right side of the chart) only qualify for the 1/5-cent tick group (blue circles). This group includes ETFs like SPY, QQQ, VTV, IWM, and GLD, which are very liquid, but, thanks to higher prices, have very low tick costs even today.

For example, the most liquid stock in the U.S. market, SPY (at $400), sees the cost of 1 tick fall from 0.25bps to 0.05bps, even though its spread now is closer to 0.33 basis points.

Although, we note that many of these are also affected by the acceleration of new round lot rules, where the ETFs above $250 will see a new round lot at 40 shares, which may also tighten spreads.

- Other (mostly high-priced) ETFs which trade with spreads 2-4 cents wide today (well above the black 1-cent line) will be allocated to the ½-cent tick (orange circles). Arguably, these ETFs already have an optimal price and tick today, and the SEC proposal could leave them with “too many ticks” by increasing their spread from 2-4 ticks to 4-8 ticks.

For example, VOO trades at an average effective spread of 3 cents, giving it a 3-tick spread. Under the new regime, VOO will have a smaller ½ cent tick. However, a smaller tick than spread doesn’t help compress the spread now, so we expect its average spread to remain around 3 cents or 6 ticks wide (6 x ½ cent tick = 3-cent spread).

Despite all the new tick groups, data suggests that few ETFs may need less than a ½-cent spread (orange line). Even SPY, the most liquid stock in the world, trades with an effective spread of 0.32 basis points. That is higher than the orange line (1/2 cent) from $100 and above the even the blue line (1/5th cent) above $50.

Chart 5: Liquid ETFs under the SEC’s proposed tick groups

Some ETF issuers are concerned about competitive inequities, thinking some ETFs will have a smaller tick than others, which may make investors and traders prefer the ETF with the smaller tick because it is cheaper to trade.

However, the data seems to indicate that the new ticks actually make markets more equal (as spreads should be able to fall to more similar levels in basis points, regardless of stock price).

For example, if we compare GLD and IAU (both Gold ETFs):

- GLD has a high share price (around $200), giving it a tick that is 0.5-basis points wide. Data suggests it would be allocated to the 1/5th cent tick – giving it around a 0.1-basis point tick. However, trading data suggests it is unlikely to trade much inside a 0.8-basis point spread (or 8 x 1/5 cent ticks = 0.8 basis points).

- IAU has a lower share price (around $40), giving it a tick around 2.5-basis points wide.

Data suggests it would likely be allocated to the 1/10th tick group – giving it a 0.25-basis point tick. That would allow it to trade with a spread as tight as GLD (3 x 1/10th cent ticks = 0.75 basis points). Although trading data suggests, despite that, it might still trade with a 1.5-basis point spread (6 x 1/10 cents wide).

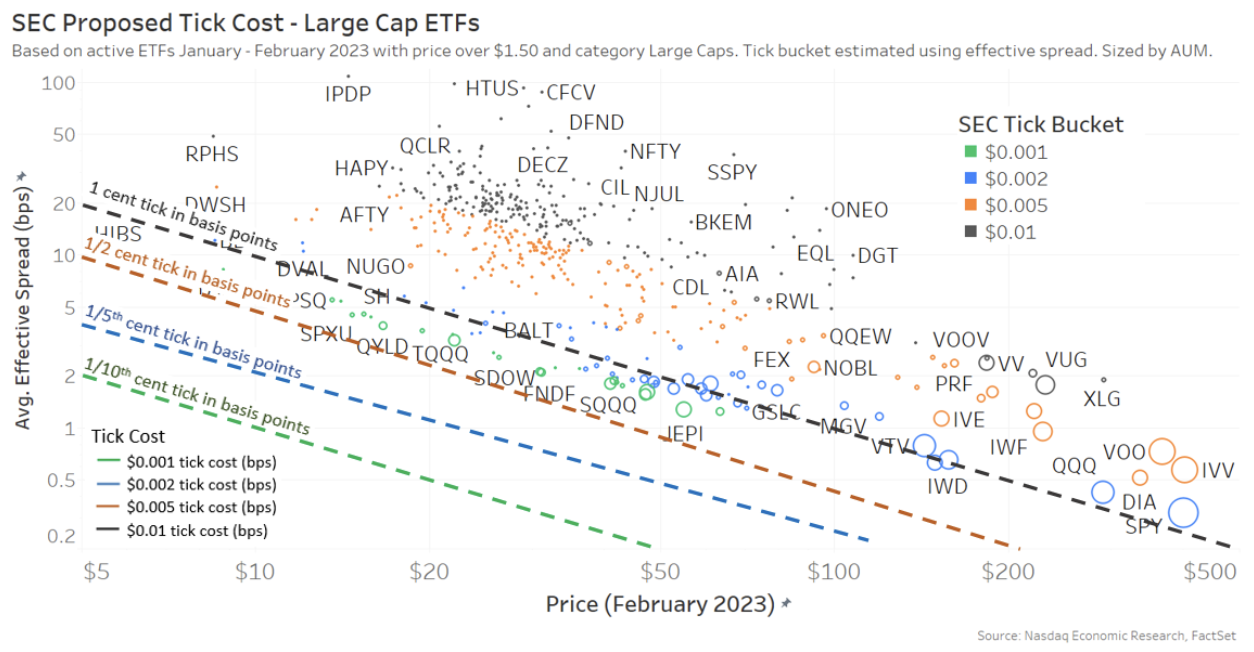

We could also look at these competitive dynamics by comparing all the ETFs investing in large-cap U.S. equities (Chart 6 below).

For example, SPY (blue) will have a smaller tick than IVV and VOO (orange) even though they are all S&P500 ETFs. However, these ETFs all have the same prices and the same 1-cent tick now, indicating the tick constraint does not widen spreads in the orange tickers. Trading data also suggests that none of these ETFs are likely to trade tick constrained even with a ½ cent tick, as none of the circles are much below the black 1-cent line).

So, the fact that the SEC has allocated all three to have ticks smaller than ½ cent seems more likely to leave all of them trading multiple ticks wide. In reality, the result might be similar to how things work now – where all three ETFs have different spreads (in cents) even though all of them have the same tick size (in cents and basis points).

Another way to think about this is to look at SQQQ, TQQQ and QQQ (all Nasdaq 100).

- SQQQ and TQQQ are potentially tick constrained now. With a 0.8-cent effective spread, their green circle sits well below the black 1-cent tick line. However, their lower stock price (around $30) means a 1-cent tick adds to a 3 basis-point tick. The rules suggest they will be allocated a 1/10th cent tick, removing the tick constraint. But trading data suggests they might still only trade down to a 0.8 cent spread (8 x 1/10th cent), giving them a 2.5-basis point spread.

- In contrast, QQQ, thanks to its higher stock price (around $300), now has a tick around 0.7 basis points. Trading data suggests that QQQ will be allocated a 1/5th cent tick but might still trade 1.2 cents wide (6 x 1/5 cent tick).

Despite that, the different tick buckets allow these ETF spreads to become more equal, not less.

Chart 6: Large-cap ETFs under the SEC’s proposed tick groups

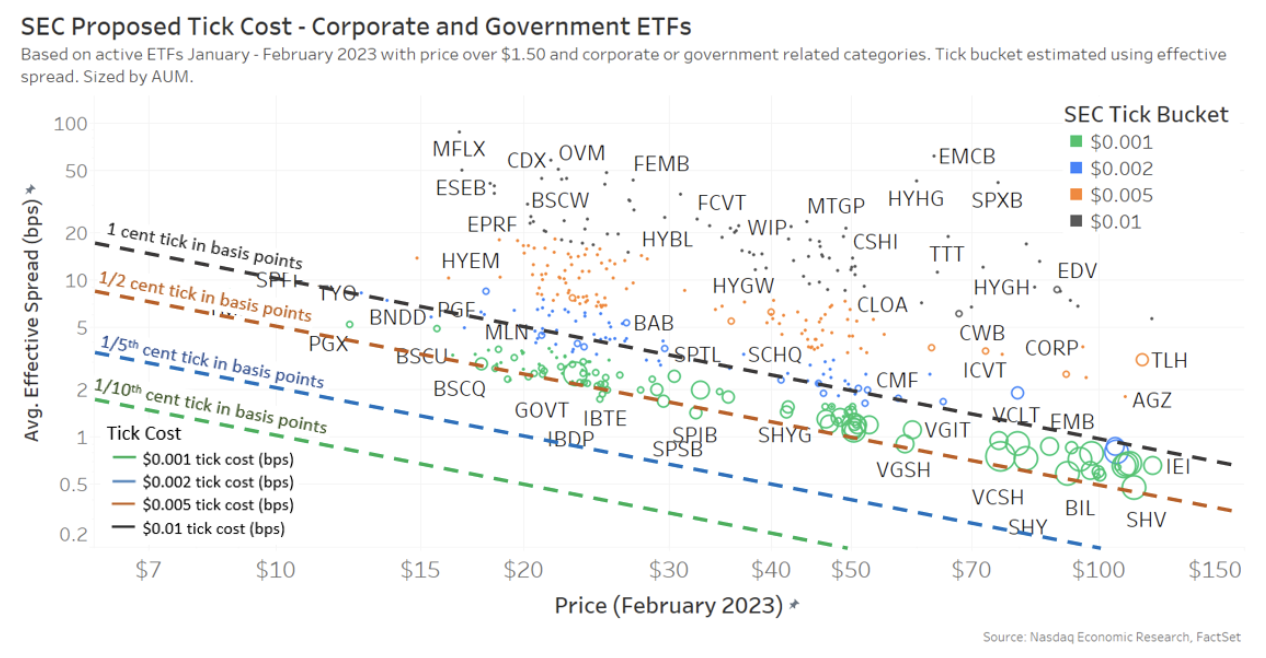

One thing that stands out when comparing Charts 5 and 6 is that many of the green circles from Chart 4 are missing in Chart 6. The reason for that is in Chart 7 below.

The data suggests a lot of the tick-constrained ETFs are bond ETFs.

This makes sense, even though many are priced between $50-$100 (giving them a 1-cent tick = 1-2 basis points), bonds typically have lower volatility, so spreads should be easier to capture for market makers. In a competitive market, that should make spreads tighter (even where the underlying might be more expensive to hedge).

That’s exactly what we see. In fact, it seems that the majority of ETFs that might be tick-constrained at a ½ cent tick – trading below the orange line – are bond ETFs.

Even then, many of the ETFs in the orange group (which trade with spreads 1.6 - 4 cents wide now) are unlikely to trade with spreads tighter than 1 cent in the new environment regardless of having more ticks.

Interestingly, despite many bond ETFs being tick constrained (green), issuers have not done reverse splits (to raise the price and reduce the cost of a 1-cent tick), indicating that investors are not unhappy with a minimum 1-basis-point tick now - black line at $100, where many of the larger ETFs (larger circles) sit.

Notably, this chart also means none of the bond ETFs are impacted by the acceleration of MDI round lots, as none have prices over $250, where round lots shrink to 40 shares.

Chart 7: Corporate and government ETFs under the SEC’s proposed tick groups

Want to learn more?

In short, what we see here is that breaking the tick (by forming different tick groups based on how ETFs trade) might actually make ETFs more (not less) equal.

However, the lines in the charts above also seem to indicate that very few (if any) ETFs need a 1/5th cent tick in order to trade efficiently, despite the fact that ETFs typically have tighter spreads than stocks.

With about 215 different issuers and approximately 3,000 active different ETFs (as of March 2023) in the market now, it's hard to show how all ETFs are impacted (even with all our labeled dot-plot charts above). If you’re an ETF issuer interested in seeing how your suite of ETFs are impacted, contact our ETF team at ETFS@nasdaq.com to find out more.

Nicole Torskiy, Senior Economic & Statistical Research Analyst, contributed to this article.