Over recent years, a profound shift has been unfolding in the world of capital markets and alternative investing that has caught the attention of issuers and investors. This transformation has seen a surge in capital raised for private investment offerings and rising investor interest in alternative assets. As the traditional investment landscape undergoes significant changes and investors seek new avenues for diversification, the allure of higher return profiles that private investment opportunities can offer has gained strength. In this article, we will discuss the growing interest in private investment opportunities that reflects the shifting preferences of issuers and investors for new capital sources and new investment opportunities.

Four Times More Capital is Raised in Private Offerings than in the Public Markets

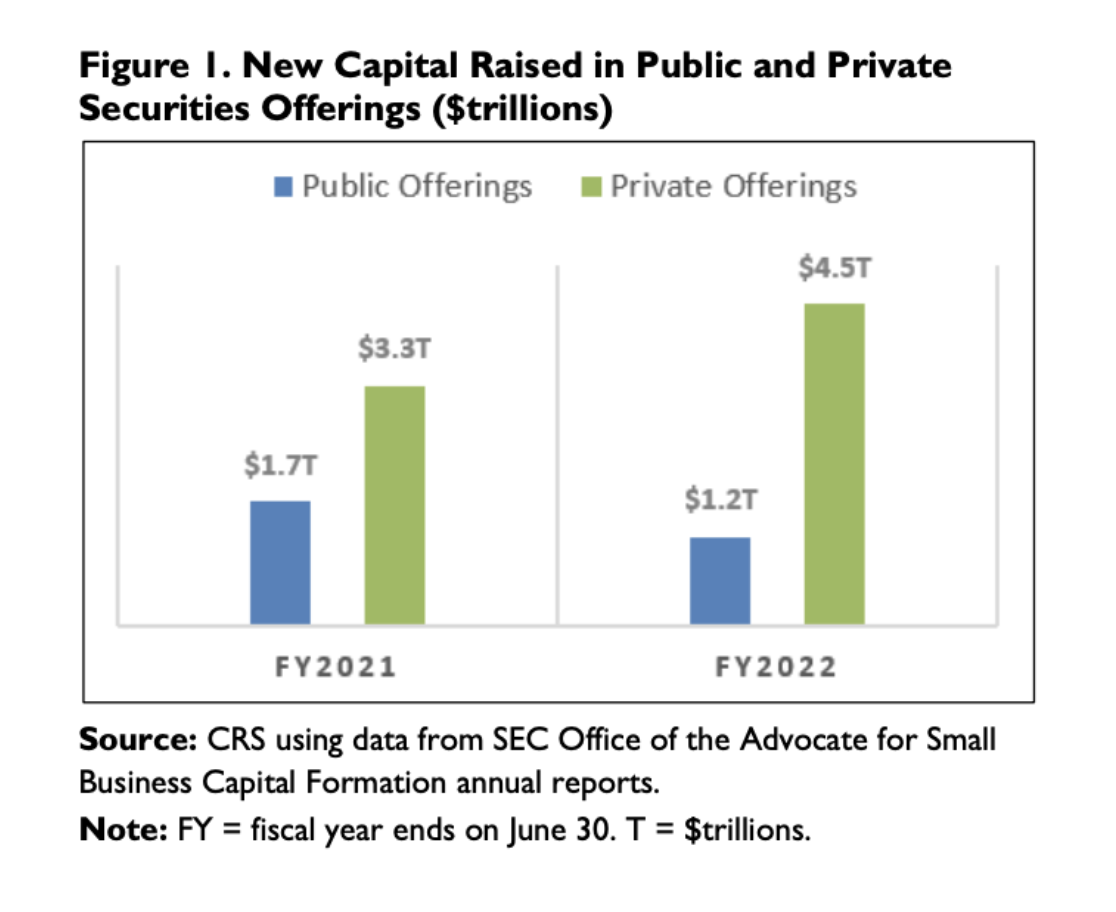

The increased dominance of private offerings over public market fundraising signifies a notable trend in companies’ fundraising preferences and their growing confidence in private markets as a robust platform for capital. For example, the period from mid-2021 to mid-2022 marked a substantial uptick in capital raised through private vs. public channels. Companies opting for private offerings accumulated a staggering total of approximately $4.5 trillion. In contrast, the public markets accounted for a comparatively modest sum of $1.2 trillion in capital raised during the same period. This significant discrepancy underscores the growing prominence and effectiveness of private offerings as a preferred avenue for companies to secure capital. The chart below indicates how popular private securities are becoming among issuers and investors.

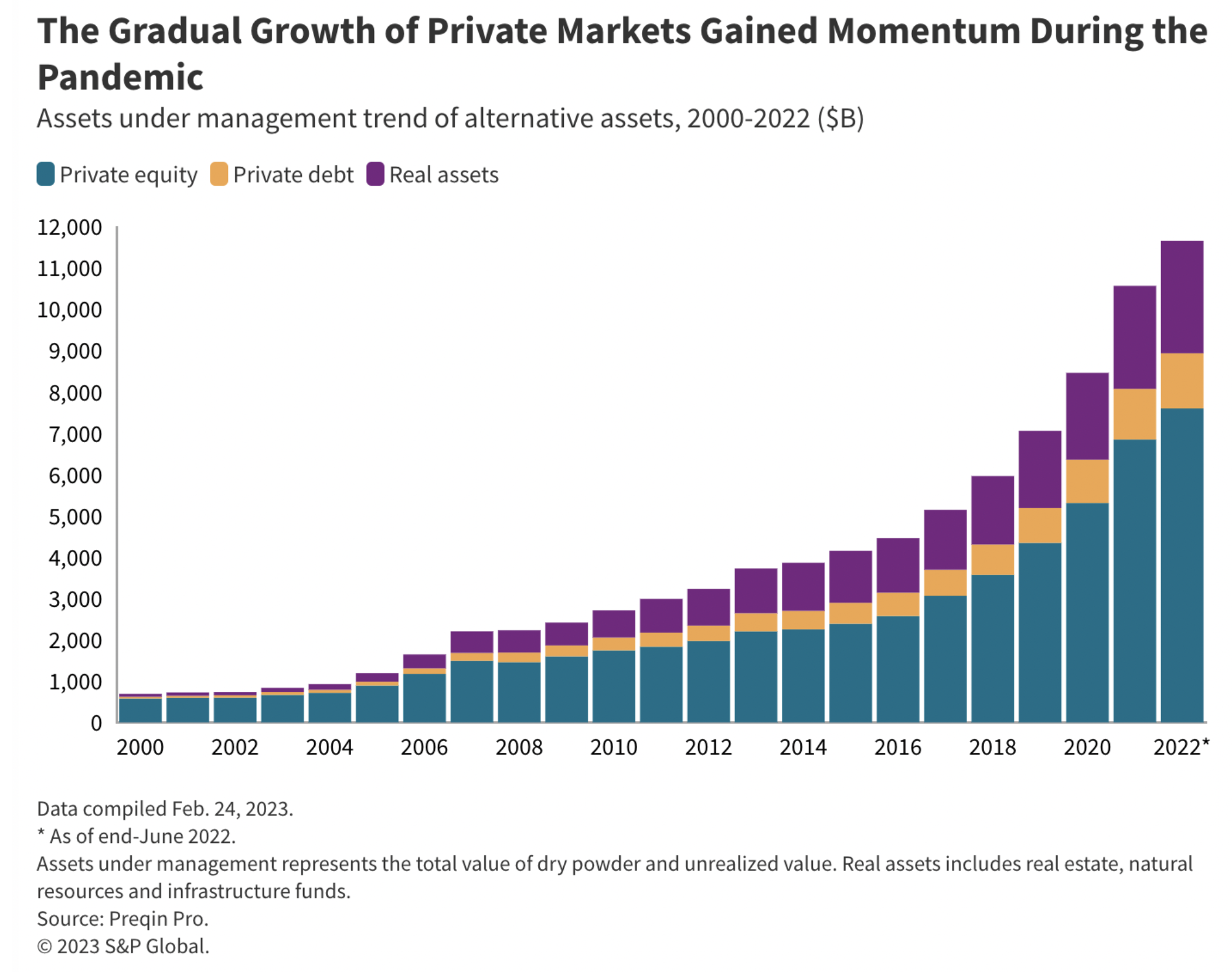

In the past decade, private markets have grown substantially, establishing themselves as a vital component of capital markets. From 2010 to 2022, there was a significant increase in the assets under management (AUM) for private equity and private debt funds, with private equity AUM of $1.7 trillion growing by approximately 4.3 times to $7.6 trillion and private debt AUM of $300 billion growing to $1.3 trillion. In pursuit of greater performance, lower volatility, and uncorrelated returns, investors have increasingly ventured into private markets in recent years.

The extraordinary magnitude of the capital raised through private offerings gives insight into the broader trends and dynamics shaping the capital markets. It highlights the rise of alternative financing options and the evolving landscape of investment strategies. Furthermore, the exceptional capital accumulation through private offerings indicates a growing confidence among companies in their ability to attract significant investment without the burden of going public. This trend signifies a notable shift in the fundraising paradigm, suggesting that companies are increasingly leveraging the flexibility and advantages offered by private offerings to meet their capital requirements.

Investor Preferences Towards Alternative Assets

The unpredictability and volatility of public markets have made traditional investments seemingly less attractive to investors. In times of market stress, traditional portfolios solely made up of public equities and bonds might not offer adequate diversification. Private offerings present an intriguing chance for investors to broaden their portfolios to mitigate the effects of market volatility. In pursuit of diversified options and improved portfolio returns beyond the conventional public equity and debt markets, investors are increasingly inclined towards alternative investments. In 2022, data on the investment portfolios of ultra-high-net-worth individuals revealed that 50% of their assets were invested in alternative investments. Similarly, high-net-worth individuals also allocated 26% of their assets to alternative investments.

The public markets’ recent erratic fluctuations seem to have further eroded investor confidence, prompting investors to explore alternative avenues for generating additional returns. Private investment offerings, such as venture capital funds, private equity, and private credit, offer a compelling proposition with the potential of greater returns as compared to what is available in public markets. Furthermore, private investments are often shielded from the immediate market valuation swings, as they are not traded everyday on a public exchange, and therefore are less affected by day-to-day market sentiment. This potential for greater alpha and lower volatility has boosted private investment attractiveness in recent years.

The Rising Number of Accredited Individual Investors

From just the short period of 2013 to 2019, the number of accredited investor households in the U.S. increased by 33.33%. In 2020, when the U.S. Securities and Exchange Commission (SEC) expanded the definition of an “accredited investor”, the SEC calculated that approximately 16 million U.S. households representing 13% of the total population of U.S. households qualified as accredited investors. The increasing number of accredited U.S. individual investors eligible to invest in private market offerings can be primarily attributed to a rise in overall wealth.

We think it is reasonable to assume that as the number of accredited investors rises the amount of capital invested in private offerings will also increase. This trend creates an expanded opportunity for issuers to raise capital from a growing number of private market investors. As this fundraising strategy proves successful for issuers, we also expect investors to have the benefit of an increased supply of private market offerings to choose from.

Final Thoughts

The growing interest in private offerings and the allocation of investors towards alternative assets represents a significant development in the capital markets landscape. With companies increasingly relying on private offerings and investors seeking diversification and higher potential returns through alternative investments, this trend is reshaping the future of capital markets in an exciting way.

About the Authors

Cole Shephard is the founding partner of the alternative asset manager, Legacy Group, and the founder and a board member at the Green Coffee Company. As a former PwC alum working in accounting, advisory and consulting solutions across the United States, Bermuda, Hong Kong and Beijing, Cole is an expert in emerging markets and understanding the capital movements of high-net-worth investors.

Adam Jason is a partner at Legacy Group and a board member at the Green Coffee Company. He is an attorney specialized in corporate finance, governance, securities regulation and international business transactions. He has advised Fortune 500 companies and investment banks, including JP Morgan, Morgan Stanley, Citibank and Goldman Sachs, through initial public offerings (IPOs) and offerings of debt and equity securities exceeding an aggregate of $10 billion.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.