Binance Smart Chain rose to prominence by taking care of the little guy.

As the DeFi summer of 2020 heated up, so did gas fees on Ethereum (ETH). This priced out many users and prevented them from participating in lucrative activities such as farming Aave, Compound and Yearn Finance tokens in the early stages.

Enter Binance Smart Chain (BSC). An EVM-compatible blockchain developed by Binance capable of hosting Ethereum-style DeFi apps, with gas fees in the range of a few cents, compared to fees of anywhere from $20 to $80 on Ethereum depending on the time of day. This was a game changer, as it allowed many users with smaller pools of capital to participate in the promised land of DeFi.

This led to Binance Smart Chain reaching an all-time high of 2.27 million daily active addresses by December 2021. But fast-forward to May 2022 and that number has dropped to less than half, a little over 1 million.

To help combat the drop in usage, Binance has announced that BSC is going to transition into a new blockchain network called BNB Chain. Being an EVM-compatible chain, BSC will continue to take center stage, but will now be supported with application-specific sidechains – similar to Avalanche and Polkadot.

It's no secret that bear markets force investors to take stock of their portfolio and question which assets still have longevity, and which topped out at the peak of the last cycle. Therefore it is key for BNB holders to question whether the new BNB Chain has what it takes to be part of the next bull market or whether it will drop back into obscurity like other well-funded "Ethereum killers of yore", such as Tron and EOS.

BNB's big problem

In recent months, Binance Smart Chain's (BSC) prominence in DeFi markets has started to dwindle.

Total value locked (TVL) is a measure of how much money is deposited on a blockchain network or specific protocol and is frequently used as a yardstick for comparing the popularity of various services. In short, you want your TVL to be bigger than your competitors.

TVL for BSC peaked in May 2021. According to data from DeFi Llama, BSC accounted for an impressive 22% of TVL across the entire DeFi market, with Ethereum taking up the lion's share at 65.73%. The next closest competitors at that point were Terra, Tron and Heco with 2–3% market share each.

By the start of January 2022, BSC had dropped to 6–7%, with experts predicting that the BNB coin – used to validate and power the network – would finish the year at around $527, essentially the same price it started at.

This drop is largely due to low-fee blockchains such as Avalanche, Polygon and Solana coming into maturity and encouraging users to switch by offering generous incentive campaigns like Avalanche's $200 million "Blizzard" program. These chains are also in the process of implementing innovative pieces of technology, such as Zero-Knowledge Proofs on Polygon and Subnets on Avalanche, which may prove to be game changing.

Worse still for BSC is that Ethereum is finally starting to deliver on its scalability promises. While The Merge might be delayed a few more months, a healthy network of Layer-2 protocols – such as Arbitrum and Optimism – are already thriving and taking back some of the user base that flocked to BSC for cheap fees. At the time of writing, gas fees on Arbitrum were $0.03 for a standard transaction, almost perfectly on par with BSC, whose fees were slightly lower.

Fast-forward to the start of May 2022 and Avalanche has started to close in on BSC with 4.6% of DeFi TVL to BSC's 6%. Meanwhile, Solana, Arbitrum and Optimism have all increased their market share since the start of the year.

The other major challenge for BSC is application support. Despite being an EVM-compatible chain, it has not received the same support that other EVM chains like Polygon, Avalanche and Fantom have. DeFi mainstays Curve (arguably the heartbeat of DeFi), Aave and Uniswap never ported over to BSC, despite going live on other competing chains. While BSC has its own equivalent services such as Pancakeswap, many of the developer teams are anonymous and lack the same level of brand recognition and trust that other services have.

As it stands, things are not looking good for BSC due to its dwindling market share and lackluster ecosystem of native applications. But given that it has the backing of the world's largest cryptocurrency exchange – and associated war chest – there is still room for BSC to turn things around and rescue the price of BNB which now sits at 54% below its all-time high.

BNB Chain's brave new world

Binance Smart Chain and some of its most prominent apps have long been criticized for essentially copying Ethereum and watering it down.

Perhaps unsurprisingly then, the solution for the next phase of Binance Smart Chain – now rebranded as a wider network called BNB Chain – is to take the best parts of its competitors and attempt to package them into something seemingly new.

Keep in mind though that blockchain development is largely based on building upon what came before, so there is nothing inherently wrong with copycat strategies. However, BNB holders may have been hoping for something truly innovative, especially if BNB is to reach its predicted price of $2,488 by the end of the decade.

At the core of BNB Chain's future are several key pillars.

BNB Chain

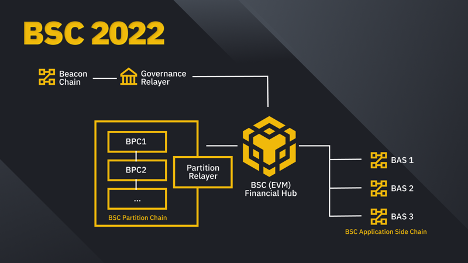

BNB Chain is a new multi-chain network that evolved from Binance Smart Chain. The new architecture borrows heavily from Ethereum and Avalanche and looks like this.

- Beacon Chain: As the name suggests, this is a Beacon Chain and it will be a base-layer used to coordinate all subsequent layers and shards. This is where validators will stake BNB and validate transactions. Validators will be given the opportunity to validate individual BPC shards (similar to how the Beacon Chain and sharding will work on Ethereum).

- BSC Partition Chains (BPC): These are essentially partitions (shards) of the core blockchain that run parallel to the Beacon Chain. Essentially, this allows BNB Chain to split the cognitive load between shards, which should massively improve scalability. This is similar to Ethereum's sharding solution.

- BSC (EVM) Financial Hub: This is the future of the Binance Smart Chain we all know and love. It will continue to run an EVM, but with an added twist – it will support BSC Application Side Chains.

- BSC Application Sidechains (BAS): These are sidechains that will support application-specific blockchains. This means apps will be able to run their own blockchain with its own set of rules and validators. This should give them more optimal functionality while still tying back to the BSC Hub and Beacon Chain. BAS appear to be comparable to subnets or parachains on Avalanche and Polkadot respectively.

Burn mechanism

Next up is the burn mechanism for BNB, which partially borrows from Ethereum's (EIP-1559) successful burn mechanic. The burn mechanic was already implemented back in the last quarter of 2021, but is important for BNB holders to know about. In short, a portion of BNB is burned (permanently removed from circulation) based on each BSC block with the goal of eventually reducing the original BNB supply by 50%. It replaces the former model that burned BNB based on Binance exchange trading volume.

$1 billion growth fund

It's no secret that Binance is the largest cryptocurrency exchange in the world and has an enormous treasury as a result. Naturally, a portion of this revenue is being deployed to help grow the BNB ecosystem including BNB Chain. As such, a new $1 billion fund has been announced to support the ecosystem's growth and will be split among growing developer talent, attracting liquidity providers and everyday users, as well as investing in dedicated BNB Chain projects and businesses.

Nothing new, but nothing bad

There is nothing inherently wrong with borrowing ideas from other, successful chains. Blockchain development is very much about building on the shoulders of giants and working cooperatively. However, the question remains whether this is enough to reverse BNB Chain's fortunes and recapture market share in the increasingly competitive market. Without that, then it feels unlikely that BNB will have as much prominence in the next bull market as it did in the last one, calling into question the fair price of the BNB coin.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.