Artificial intelligence (AI) -- the capability of a machine to mimic human thinking and behavior -- is one of the biggest growth trends today. Spending on AI systems will increase by more than two and a half times between 2019 and 2023, from $37.5 billion to $97.9 billion, for a compound annual growth rate of 28.4%, according to estimates by research firm IDC. Other sources are projecting even more torrid growth rates.

There are two broad ways you can get exposure to the AI space:

- Invest in companies that are selling AI products (such as chips) and services (such as cloud computing);

- Invest in companies that are using AI technology to improve their products and services and/or increase efficiencies.

With this background in mind, let's look at which AI stocks are performing the best so far this year (through Nov. 25) and which one is my choice for best AI stock for 2020.

Image source: Getty Images.

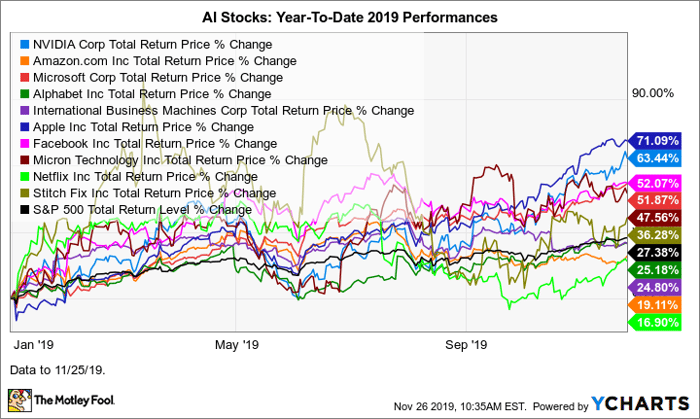

AI stocks' 2019 performances so far

The following chart isn't meant to be all-inclusive, as that would be impossible, and the chart has limits on the number of metrics. Notable among the companies missing are Advanced Micro Devices and Intel. They were left out largely because NVIDIA is currently the leader in supplying AI chips. While there are things to like about shares of both of these companies, NVIDIA stock is the better play on AI, in my view.

Data by YCharts.

Graphics processing unit (GPU) specialist NVIDIA (NASDAQ: NVDA), e-commerce and cloud computing service titan Amazon, computer software and cloud computer service giant Microsoft, Google parent and cloud computing service provider Alphabet, old technology guard and multifaceted AI player IBM, and Micron Technology, which makes computer memory chips and related storage products, would best be put in the first category above. They produce and sell AI-related products and/or services. They're all also probably using AI internally, with Amazon and Alphabet being notably heavy users of the tech to improve their products.

iPhone maker Apple (NASDAQ: AAPL), social media leader Facebook (NASDAQ: FB), video-streaming king Netflix, and Stitch Fix, an online personal styling service provider, would best be categorized in the second group since they're either primarily or solely using AI to improve their products and services.

The 3 best-performing AI stocks of 2019 so far

Now let's look at some basic stats for the three best performers of this group.

Data sources: YCharts (returns) and Yahoo! Finance (all else). P/E = price-to-earnings ratio. EPS = earnings per share. Data as of Nov. 25, 2019.

On a valuation basis alone, Facebook stock looks the most compelling when we take earnings growth estimates into account. Then would come Apple and then NVIDIA. However, there are other factors to consider, with the biggie being that projected earnings growth is just that, projected.

There's a good argument to be made that NVIDIA has a great shot at exceeding analysts' earnings estimates. Why? Because it has a fantastic record of doing so, and all one needs to do is listen to enough quarterly earnings calls with Wall Street analysts to realize why this is so: A fair number of them don't seem to have a strong grasp of the company's operations and products. (I'm not knocking, as most analysts don't have technical backgrounds, and they cover a lot of companies.)

Facebook stock probably has the potential to continue to be a long-term winner. But it's relatively high regulatory risk profile makes it not a good fit for all investors. Moreover, it will likely have to keep spending a ton of money to help prevent "bad actors" from using its site for various nefarious purposes. Indeed, this is one of the major internal functions for which the company is using AI. It also uses the tech to recognize and tag uploaded images, among other things.

Apple uses AI internally in various ways, with the most consumer-facing one being powering its voice assistant Siri. It's the best of these three stocks for more conservative investors, as it has a great long-term track record and pays a modest dividend. NVIDIA, however, is probably the better choice for growth-oriented investors who are comfortable with a moderate risk level.

Image source: Getty Images.

NVIDIA: The best AI stock for 2020

NVIDIA is the leading supplier of graphics cards for computing gaming, with AMD a relatively distant second. In the last several years, it's transformed itself into a major AI player, or more specifically, a force to be reckoned with in the fast-growing deep-learning category of AI. Its GPUs are the gold standard for AI training in data centers, and it's now making inroads into AI inferencing. (Inferencing involves a machine or device applying what it's learned in its training to new data. It can be done in data centers or "at the edge" -- meaning at the location of the machine or device that's collecting the data.)

NVIDIA is in the relatively early stages of profiting from many gigantic growth trends, including AI, esports, driverless vehicles, virtual reality (VR), smart cities, drones, and more. (There is some overlap in these categories, as AI is involved to some degree in most of NVIDIA's products.) There are no pure plays on AI, to my knowledge, but NVIDIA would probably come the closest.

Find out why Apple is one of the 10 best stocks to buy now

Motley Fool co-founders Tom and David Gardner have spent more than a decade beating the market. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

Tom and David just revealed their ten top stock picks for investors to buy right now. Apple is on the list -- but there are nine others you may be overlooking.

Click here to get access to the full list!

*Stock Advisor returns as of June 1, 2019

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Beth McKenna owns shares of NVIDIA. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Apple, Facebook, Microsoft, Netflix, NVIDIA, and Stitch Fix. The Motley Fool is short shares of IBM. The Motley Fool recommends Intel and recommends the following options: long January 2020 $200 calls on IBM, short January 2020 $200 puts on IBM, long January 2021 $85 calls on Microsoft, short January 2020 $155 calls on IBM, and short January 2020 $50 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.