In this week's Weekly Insights we focus on Tesla vs. Nvidia positioning in autonomy, inflation expectations and signs of capitulation.

CONTENTS

Stocks and Focus Areas

- Is Tesla losing its edge?

- Nvidia's positioning as a leading Autonomous Vehicle platform

- Chinese newcomers innovating at rapid pace

Macro Datapoints

- Inflation expectations - are investors getting ahead of themselves?

-

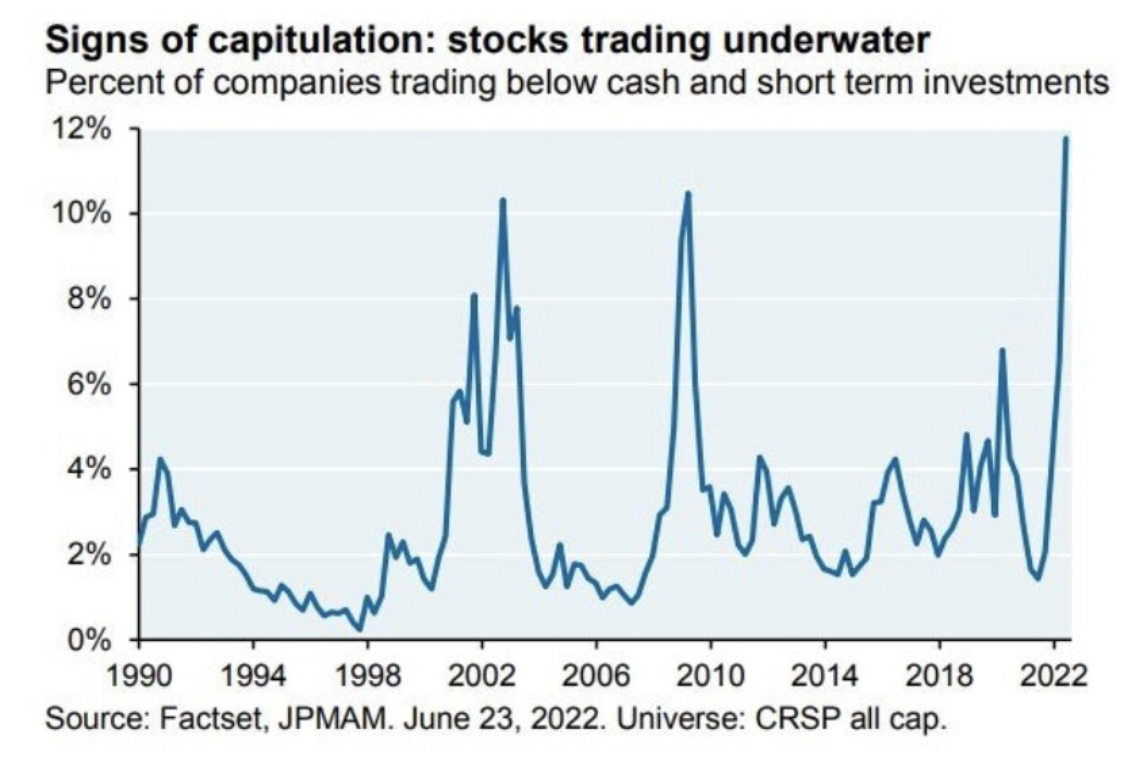

Signs of capitulation - record number of companies trading below cash and short term investments

STOCKS AND FOCUS AREAS

Tesla may not be in the autonomous driver seat

Historically, automotive manufacturers (OEMs) have been pretty mediocre business models, requiring significant capital investment (both R&D and Capex) and delivering poor returns. Many US OEMs have struggled to deliver >10% operating margin over an automotive cycle. With the emergence of EVs we see even more players and new entrants, and consequently increased competition. So the question is who is going to be able to generate returns? We believe that the value lies in software and autonomy.

The exciting part of autonomy is that it provides an opportunity for companies to transform their business models from hardware to subscription/software. Even though we believe that fully autonomous driving is still several years away, companies can start capturing the value of L2+ ADAS (driver assistance) in the next 3-5 years. However, from technological perspective autonomy presents a completely different challenge compared to electrification. According to Nvidia's CEO, Jensen Huang, "fully autonomous driving is one of the most intense machine learning applications”. We believe that it will require years of model training and iterations before it can be available for mass market production.

Does Tesla have an advantage when it comes to autonomy?

The short answer is: not really. While Tesla has been generally considered to have the first mover advantage in EVs, and was early to introduce L2+ ADAS, fully autonomous driving is a greater challenge, and the first mover position may prove to be a disadvantage.

Tesla’s autonomous driving system relies solely on cameras while competitors have been able to incorporate radar and LiDAR even for for entry level products (previously considered to be cost prohibitive). Tesla’s edge is that the company collects vast amount of data from its fleet in real time and the key challenge is to label this data in order to be able to train the neural network models. It appears that the labeling process may not be going as smoothly. Last year, the company noted that it had to build its own in-house team of ~1K employees as it was facing issues with the data labeling from third party providers. Last month the company laid-off 200 employees working in the same in-house division. Were they done labeling? or is this a red flag?

In the meantime, Chinese competitors have been on a roll with new product introductions incorporating advanced ADAS features. NIO’s introduced several models including the ET7 which has 33 high performance radars, cameras, LiDAR, ultrasonics and is powered by the Adam supercomputer (with 4 Nvidia Orin SoCs 1,000 trillion operations per second TOPS).

Chinese EV makers and the opportunity for Nvidia

Chinese automakers have been able to leverage an ecosystem of innovators (e.g. Nvidia, Qualcomm) and outsource lower value add areas (such as vehicle manufacturing, battery management). Currently, they mostly rely on Nvidia's hardware (namely DRIVE Orin SoC) and over time could leverage Nvidia's platform further. This relationship can be a win-win as it enables OEMs to innovate faster, and could establish Nvidia as a dominant AV platform.

With 100 million cars sold per year and an installed base of over 1 billion vehicles on the road, we expect this to be a significant opportunity for Nvidia. The company currently has $11bn in automotive backlog which it expects to convert over 6 years. We expect the opportunity to extend from hardware (the majority of the current backlog) to software and model training.

- Vehicle Hardware (SoC): Nvidia’s DRIVE Orin is currently used by ~25 (out of 30 major) vehicle manufacturers including all major Chinese EV producers (NIO, Li Auto, XPeng, BYD etc). EV OEMs are rolling out vehicles ranging from a single Orin SoC (254TOPs – trillion operations per second) to up to 4x Orin SoCs. We estimate the content per vehicle to be ~$300. At 50% penetration implies $15bn annual opportunity (from <$200mm in 2021)

- Vehicle Software: Hyperion, an end-to-end platform connecting cameras, sensors, radars, and LiDAR. Mercedes and Jaguar were the early adaptors with model introductions coming in 2024. Hyperion is open and can accelerate the AV time to market by giving manufacturers the ability to leverage Nvidia’s own development work and providing ongoing upgrades (e.g., Hyperion 9 is expected to come in 2026 and feature 14 cameras, 9 radars, one lidar and 12 ultrasonic sensors).

- Supercomputer/model training: While Drive Orin serves as the brain and Hyperion as the nervous system inside the car, model training occurs outside of the car and is yet another opportunity for Nvidia. Most manufacturers are building their own data centers using Nvidia’s hardware (e.g. NIO is using Nvidia’s HGX with eight A100 Tensor Core GPUs). But in the future, Nvidia will be able to enhance its customers capabilities, with the Aos supercomputer which the company plans to leverage for model training. Aos is expected to be >4x faster than the world’s fastest supercomputer and 4x faster than Nvidia’s current Selene supercomputer. It is expected to be able to scale to 18.4 Exaflops of AI computing (32 petaflops per DGX system) and consists of 4,608 next-gen Hopper H100 GPUs (8x H100 GPUs per DGX; 576x DGX systems or 18 DGX Super PODS).

MACRO DATAPOINTS

Inflation has been the main focus of the market with CPI data expected later this week. We believe that the market may have gotten an bit too excited about the end of inflation. While we are already experiencing a sharp pull back in commodities, weak housing data, etc., there may be a lag to when this ultimately shows up in the inflation numbers. The market expectation is for inflation to average 2.3% over the next 10 years while the recent CPI prints have been >8%.

What does this mean for the market?

Between Fed uncertainty and weak corporate earnings we expect more near term downside and volatility for the market this summer. However sharp pull backs present opportunities to add to high conviction ideas.

There are more stocks currently trading below cash and short term investments today compared to both the 2008/09 recession and the 2000 tech bubble. While there remain significant risks, this is undoubtedly a time with some outsized opportunities.

For more research visit out website spear-invest.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.