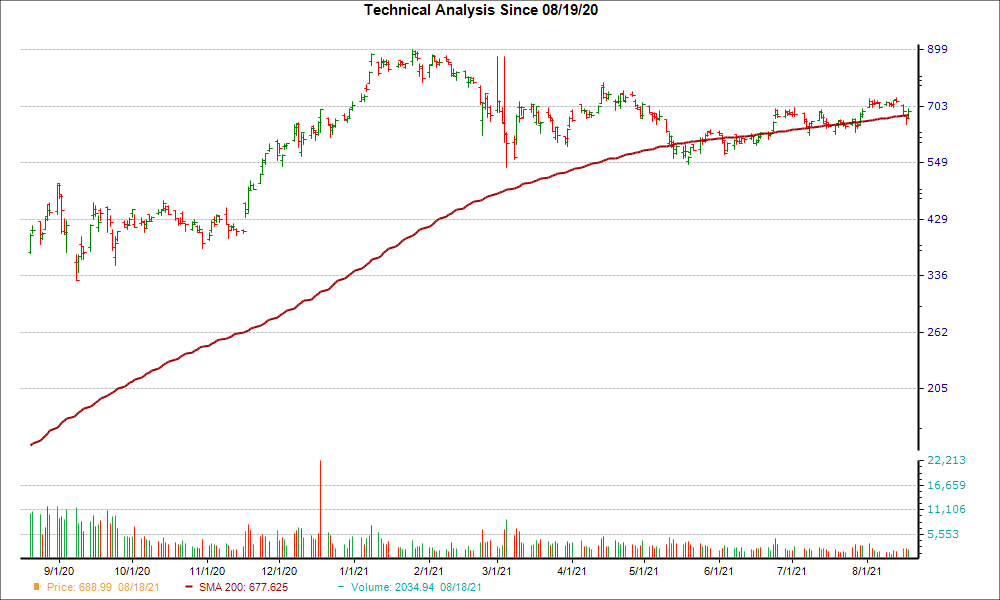

Tesla (TSLA) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, TSLA broke through the 200-day moving average, which suggests a long-term bullish trend.

The 200-day simple moving average is widely-used by traders and analysts, and helps establish market trends for stocks, commodities, indexes, and other financial instruments over the long term. The indicator moves higher or lower together with longer-term price moves, serving as a support or resistance level.

Shares of TSLA have been moving higher over the past four weeks, up 5.1%. Plus, the company is currently a Zacks Rank #3 (Hold) stock, suggesting that TSLA could be poised for a continued surge.

The bullish case only gets stronger once investors take into account TSLA's positive earnings estimate revisions. There have been 9 higher compared to none lower for the current fiscal year, and the consensus estimate has moved up as well.

Given this move in earnings estimate revisions and the positive technical factor, investors may want to keep their eye on TSLA for more gains in the near future.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $2.4 trillion by 2028 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Recommendations from previous editions of this report have produced gains of +205%, +258% and +477%. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.