Fintel reports that on October 5, 2023, Telsey Advisory Group maintained coverage of Costco Wholesale (NASDAQ:COST) with a Outperform recommendation.

Analyst Price Forecast Suggests 5.41% Upside

As of October 5, 2023, the average one-year price target for Costco Wholesale is 602.72. The forecasts range from a low of 469.65 to a high of $714.00. The average price target represents an increase of 5.41% from its latest reported closing price of 571.80.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Costco Wholesale is 264,846MM, an increase of 9.31%. The projected annual non-GAAP EPS is 16.30.

Costco Wholesale Declares $1.02 Dividend

On August 9, 2023 the company declared a regular quarterly dividend of $1.02 per share ($4.08 annualized). Shareholders of record as of August 25, 2023 received the payment on September 8, 2023. Previously, the company paid $1.02 per share.

At the current share price of $571.80 / share, the stock's dividend yield is 0.71%.

Looking back five years and taking a sample every week, the average dividend yield has been 0.81%, the lowest has been 0.54%, and the highest has been 1.20%. The standard deviation of yields is 0.13 (n=235).

The current dividend yield is 0.72 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.29. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.46%, demonstrating that it has increased its dividend over time.

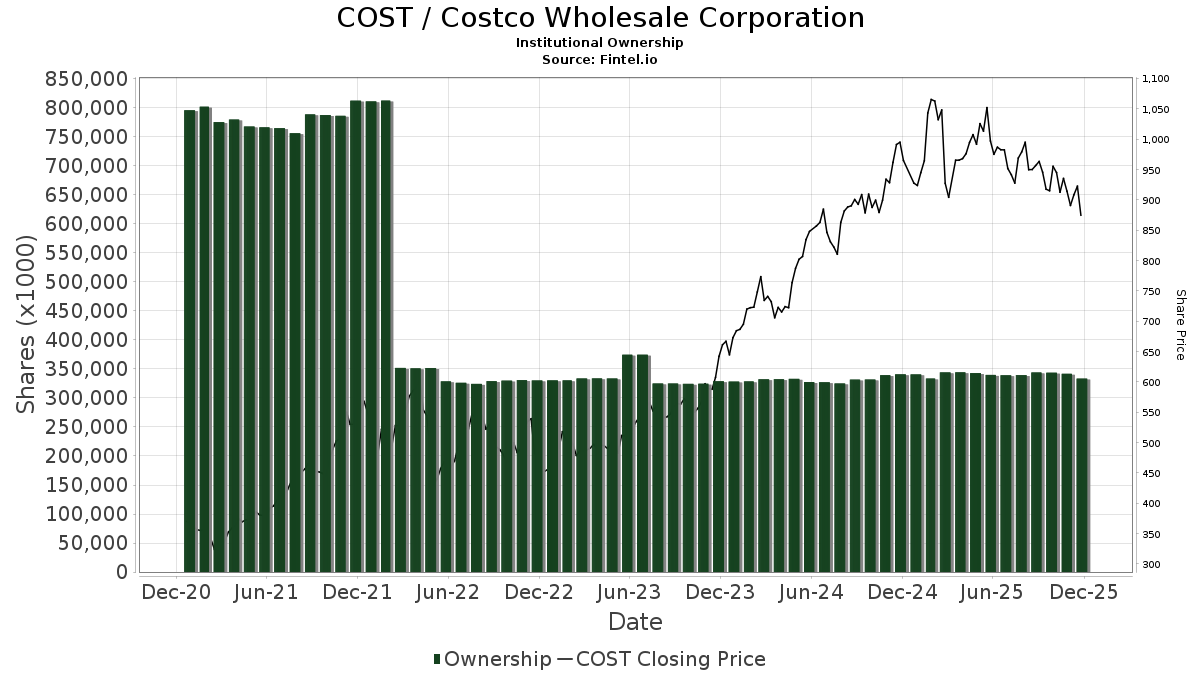

What is the Fund Sentiment?

There are 4093 funds or institutions reporting positions in Costco Wholesale. This is an increase of 58 owner(s) or 1.44% in the last quarter. Average portfolio weight of all funds dedicated to COST is 0.76%, an increase of 0.17%. Total shares owned by institutions decreased in the last three months by 13.41% to 324,410K shares.  The put/call ratio of COST is 1.21, indicating a bearish outlook.

The put/call ratio of COST is 1.21, indicating a bearish outlook.

What are Other Shareholders Doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 13,829K shares representing 3.12% ownership of the company. In it's prior filing, the firm reported owning 13,735K shares, representing an increase of 0.68%. The firm increased its portfolio allocation in COST by 0.65% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 10,559K shares representing 2.38% ownership of the company. In it's prior filing, the firm reported owning 10,354K shares, representing an increase of 1.94%. The firm increased its portfolio allocation in COST by 0.08% over the last quarter.

Geode Capital Management holds 8,430K shares representing 1.90% ownership of the company. In it's prior filing, the firm reported owning 8,210K shares, representing an increase of 2.61%. The firm increased its portfolio allocation in COST by 0.64% over the last quarter.

Bank Of America holds 7,545K shares representing 1.70% ownership of the company. In it's prior filing, the firm reported owning 8,124K shares, representing a decrease of 7.67%. The firm increased its portfolio allocation in COST by 302.68% over the last quarter.

Invesco Qqq Trust, Series 1 holds 5,940K shares representing 1.34% ownership of the company. In it's prior filing, the firm reported owning 5,834K shares, representing an increase of 1.78%. The firm decreased its portfolio allocation in COST by 5.65% over the last quarter.

Costco Wholesale Background Information

(This description is provided by the company.)

Costco Wholesale Corporation is an American multinational corporation which operates a chain of membership-only big-box retail stores. The company offers sundries, dry groceries, candies, coolers, freezers, liquor, and tobacco and deli products; appliances, electronics, health and beauty aids, hardware, garden and patio products, sporting goods, tires, toys and seasonal products, office supplies, automotive care products, postages, tickets, apparel, small appliances, furniture, domestics, housewares, special order kiosks, and jewelry; and meat, produce, service deli, and bakery products.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.