Fintel reports that on August 2, 2023, Susquehanna maintained coverage of International Game Technology (NYSE:IGT) with a Positive recommendation.

Analyst Price Forecast Suggests 11.75% Upside

As of August 2, 2023, the average one-year price target for International Game Technology is 35.88. The forecasts range from a low of 27.88 to a high of $51.45. The average price target represents an increase of 11.75% from its latest reported closing price of 32.11.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for International Game Technology is 4,150MM, a decrease of 2.79%. The projected annual non-GAAP EPS is 1.49.

What is the Fund Sentiment?

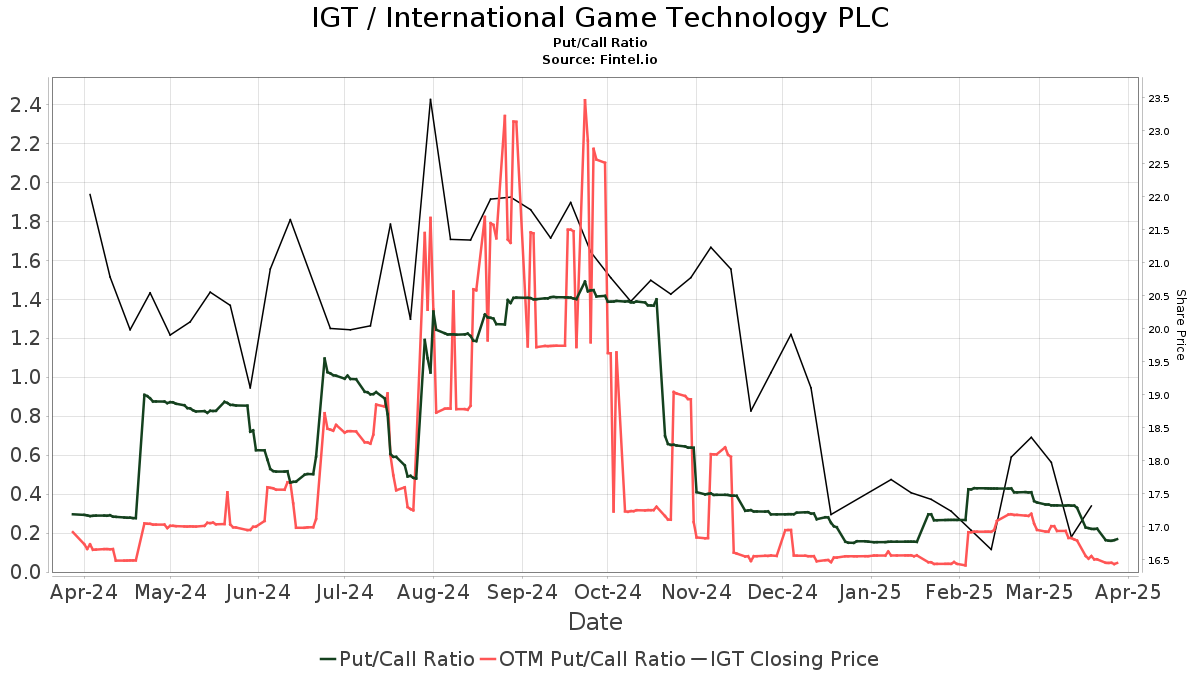

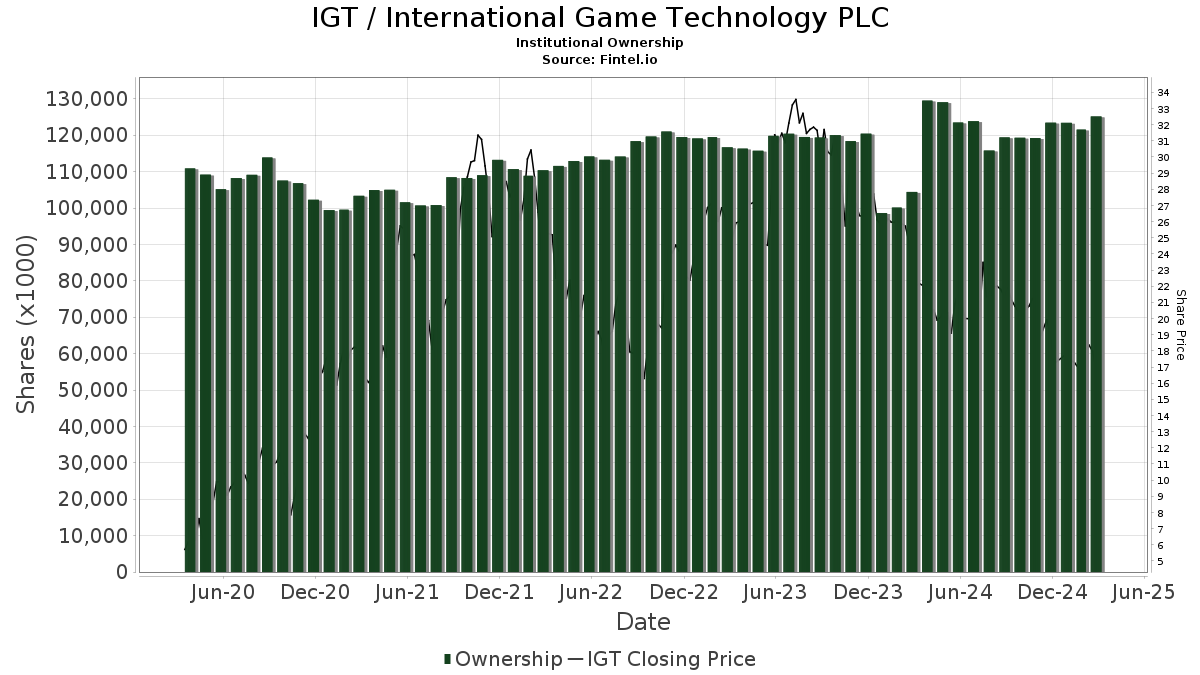

There are 502 funds or institutions reporting positions in International Game Technology. This is an increase of 14 owner(s) or 2.87% in the last quarter. Average portfolio weight of all funds dedicated to IGT is 0.27%, a decrease of 18.56%. Total shares owned by institutions increased in the last three months by 3.29% to 119,512K shares.  The put/call ratio of IGT is 0.41, indicating a bullish outlook.

The put/call ratio of IGT is 0.41, indicating a bullish outlook.

What are Other Shareholders Doing?

Massachusetts Financial Services holds 10,360K shares representing 5.17% ownership of the company. In it's prior filing, the firm reported owning 10,330K shares, representing an increase of 0.29%. The firm increased its portfolio allocation in IGT by 16.19% over the last quarter.

Bank of New York Mellon holds 7,527K shares representing 3.76% ownership of the company. In it's prior filing, the firm reported owning 6,662K shares, representing an increase of 11.49%. The firm decreased its portfolio allocation in IGT by 85.28% over the last quarter.

Lazard Asset Management holds 7,137K shares representing 3.56% ownership of the company. In it's prior filing, the firm reported owning 7,788K shares, representing a decrease of 9.12%. The firm increased its portfolio allocation in IGT by 3.02% over the last quarter.

Boston Partners holds 6,743K shares representing 3.37% ownership of the company. In it's prior filing, the firm reported owning 7,025K shares, representing a decrease of 4.18%. The firm decreased its portfolio allocation in IGT by 55.34% over the last quarter.

MVCAX - MFS Mid Cap Value Fund A holds 4,730K shares representing 2.36% ownership of the company. In it's prior filing, the firm reported owning 2,672K shares, representing an increase of 43.51%. The firm increased its portfolio allocation in IGT by 172.58% over the last quarter.

International Game Technology Background Information

(This description is provided by the company.)

IGT is the global leader in gaming. We deliver entertaining and responsible gaming experiences for players across all channels and regulated segments, from Gaming Machines and Lotteries to Sports Betting and Digital. Leveraging a wealth of compelling content, substantial investment in innovation, player insights, operational expertise, and leading-edge technology, its solutions deliver unrivaled gaming experiences that engage players and drive growth. The Company has a well-established local presence and relationships with governments and regulators in more than 100 countries around the world, and creates value by adhering to the highest standards of service, integrity, and responsibility. IGT has approximately 11,000 employees.

Additional reading:

- INTERNATIONAL GAME TECHNOLOGY PLC REPORTS SECOND QUARTER 2023 RESULTS

- Period ended June 30, 2023 Cautionary Statement Regarding Forward-Looking Statements This presentation may contain forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning Internatio

- IGT Statement on Passing of Fabio Cairoli, IGT CEO Global Lottery LONDON – July 10, 2023 – International Game Technology PLC (“IGT”) (NYSE: IGT) today released the following statement regarding the passing of Fabio Cairoli, IGT CEO Global Lottery: “I

- NEWS RELEASE IGT to Explore Strategic Alternatives for its Global Gaming and PlayDigital Segments to Drive Long-Term Sustainable Value IGT announces review of strategic alternatives for Global Gaming and PlayDigital to enhance shareholder value LONDO

- NEWS RELEASE IGT Secures Exclusive Wheel of Fortune Licensing Rights for Gaming, Lottery, iGaming and iLottery via 10-Year Agreement LONDON – June 5, 2023 – International Game Technology PLC (“IGT”) (NYSE: IGT) announced today that it has signed a te

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20is%20a%20Great%20Momentum%20Stock%20to%20Buy%20%7C%20Nasdaq&_biz_n=3&rnd=286054&cdn_o=a&_biz_z=1743623340994)

%20Positive%20Recommendation%20%7C%20Nasdaq&_biz_n=5&rnd=439747&cdn_o=a&_biz_z=1743623340995)

%20Positive%20Recommendation%20%7C%20Nasdaq&rnd=743902&cdn_o=a&_biz_z=1743623340999)

%20Positive%20Recommendation%20%7C%20Nasdaq&_biz_n=5&rnd=439747&cdn_o=a&_biz_z=1743623343995)

%20Positive%20Recommendation%20%7C%20Nasdaq&_biz_n=5&rnd=439747&cdn_o=a&_biz_z=1743623343996)