By Callie Cox

Bull markets are strong periods of consistently rising prices in the stock market. But that doesn’t mean prices only go up. Selloffs from 1 to 19% can happen in bulls – and they often do, because ups and downs are normal.

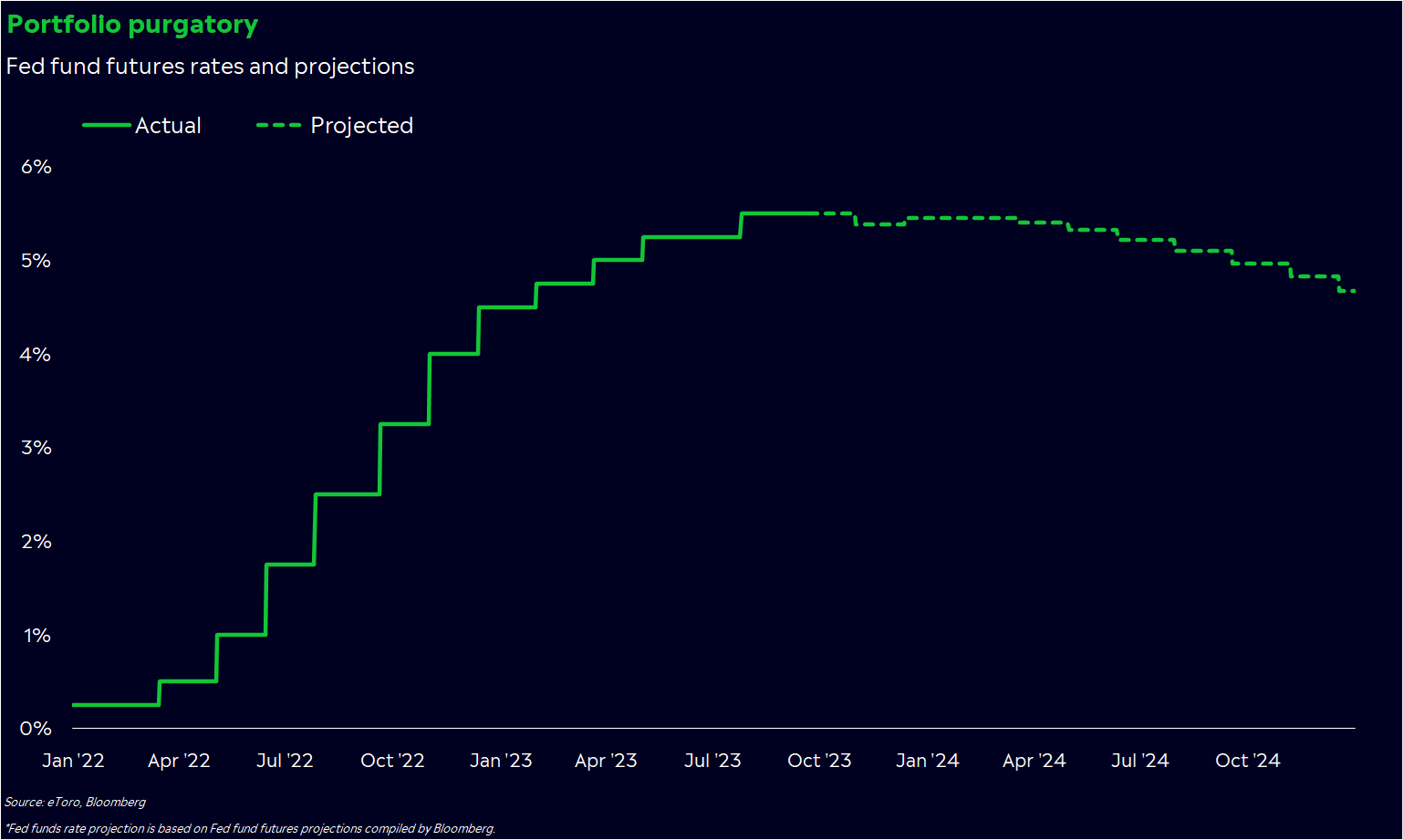

Add in high interest rates, and the environment feels unmanageable, even though we’ve technically had a banner year for investors. Unfortunately, dramatic ups and downs could be our new reality in both stocks and crypto — a push and pull between chasing gains and suffering from the fallout of high interest rates and slowing growth.

It feels like we’re stuck in portfolio purgatory, and you may have to get creative.

Some awkward truths

We’re over halfway through 2023, and chances are, your portfolio is probably in a better spot than it was 10 months ago. But it hasn’t been an easy year by any measure. Banking issues, regulatory uncertainty, political drama, bad breadth complaints…the list of worries is long.

Interest rates are still climbing, too. The Fed has made it clear that they’re not willing to let up on rates until inflation is closer to 2% year-over-year — not the 4% inflation that we’re still struggling with.

High rates have forced us to grapple with some awkward truths. Most bull markets have started at the lowest point of recessions, with the Fed delivering at least one rate cut. In fact, six out of the last seven bull markets started as the Fed lowered rates. Today, the chance of a recession is still significant, and the Fed is likely still in hiking mode.

A skeptical bull

If you’re buying stocks while gritting your teeth, you’re not alone. This environment doesn’t fit the mold of a typical bull. And it doesn’t exactly feel good, either.

But it’s worked, mainly because many investors have shared the same sentiment. Professional managers have retreated into bonds and cash for most of this year, so strong rallies have forced them to chase gains. Individual investors have held on more, but even they have piled into cash and money markets. People aren’t enthusiastically buying into this bull.

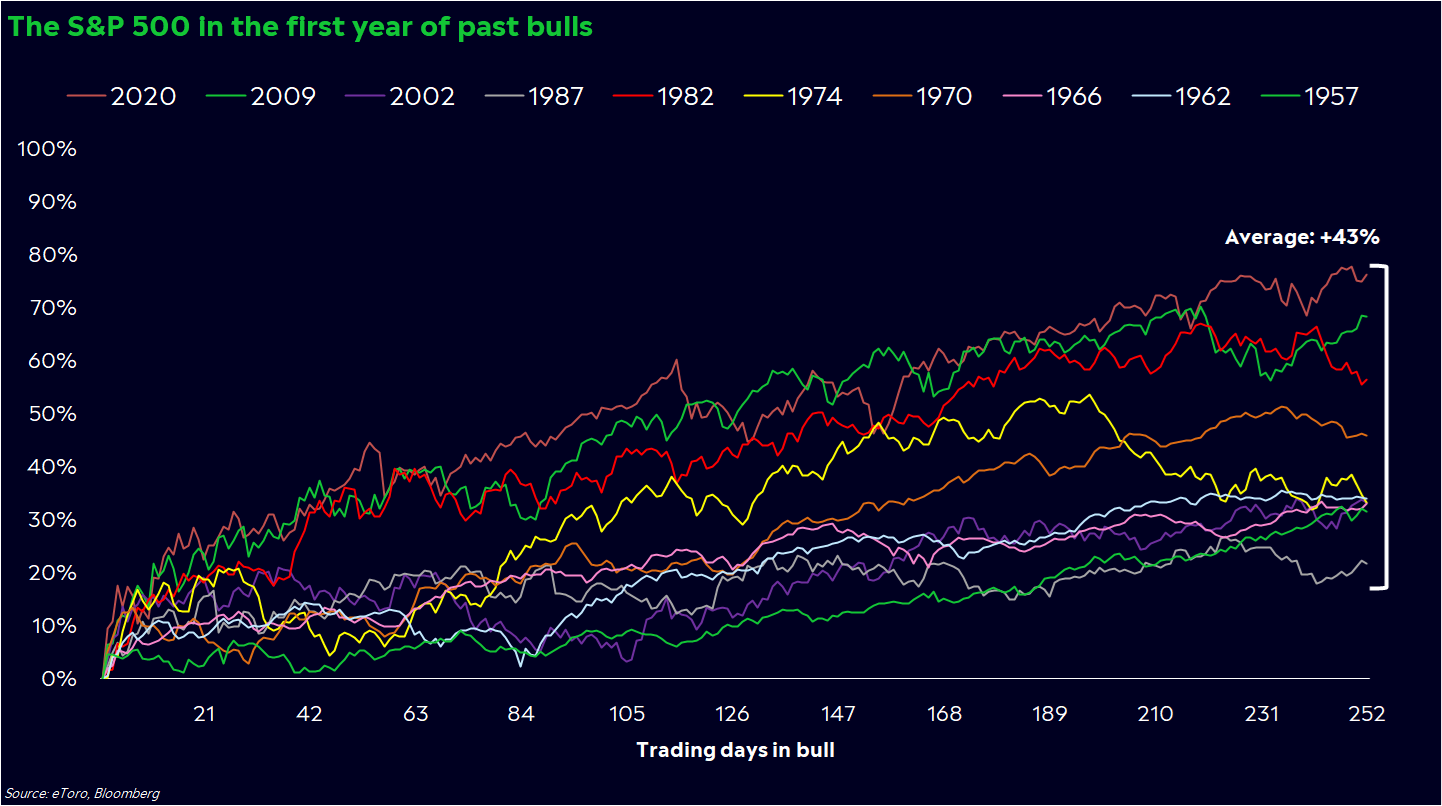

Still, part of this skepticism is normal. Bull markets rarely feel like bull markets at first. Since 1950, the S&P 500 has rallied an average of 43% in the first year of bull markets.

But in seven of those bull markets, we've had at least one pullback of 5% or more in the first year. It’s rarely a straight line up, and we’ve endured three drops of 5% this year. And let’s be honest with ourselves — this bull may not look like the 11-year raging rally that defined the 2010s. The world has changed a lot over the last three years, and high rates alone could entice investors to look outside the stock market for returns.

The outlook could also be a lot different for smaller, speculative companies with sky-high borrowing costs and tight credit. Weaker companies die off, the big get bigger, and companies become more stingy with their cash. Maybe your gut feeling isn’t too far off.

So what does this mean for me?

You can be nervous about the immediate future while hopeful that the bull market will continue. Like most things in life, portfolio positioning isn’t black or white — or more appropriately, buy or sell. Here are a few complex strategies to consider if you’re nervous about this bull:

A barbell. Grab a barbell — and I’m not talking about the gym. A barbell strategy in your portfolio involves holding two opposite types of investments because you’re seeking exposure to the best- and worst-case scenarios. Yes, you’ll probably give up some returns, but in exchange for more peace of mind.

Recession-proof risk. There are different levels of risk, too. If you’re worried that high rates could force the economy into a recession, maybe it’s worth looking for companies with strong balance sheets, low debt loads, and a business model that could stand the test of time. These companies exist in all industries, even the ones that could benefit more from lower rates.

More options…literally. There aren’t many investments that can do well in both good times and bad. But if you have the stomach and risk tolerance for trading options, you might find them useful in this young bull. Buying calls and puts simultaneously — in a trade called a spread — could help you mitigate your losses if a stock falls to a certain point and allow you the chance to participate if the rally continues.

If you want to read more research and analysis from eToro, check us out here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.