Few companies started off 2024 with a bang like Super Micro Computer (NASDAQ: SMCI). It rose more than 300% until it peaked in March. After a combination of missed expectations and accounting fraud allegations, the stock tumbled into negative territory in the latter half of 2024. However, Supermicro (as it's often called) appears to be clear of those allegations, which sets the stock up for 2025 in much the same way to when it entered 2024.

So, could Supermicro go on another monster run to start the new year?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Supermicro's investing thesis is still sound from a business perspective

First, let's take a look back at Supermicro's stock as it entered 2024. There were a lot of signs pointing toward Supermicro having a ton of success because it makes components for computing servers as well as assembling full technology racks. This business got a huge boost as artificial intelligence (AI) spending ramped up, and Supermicro was seen to benefit from a similar demand boost that powered Nvidia's (NASDAQ: NVDA) stock higher.

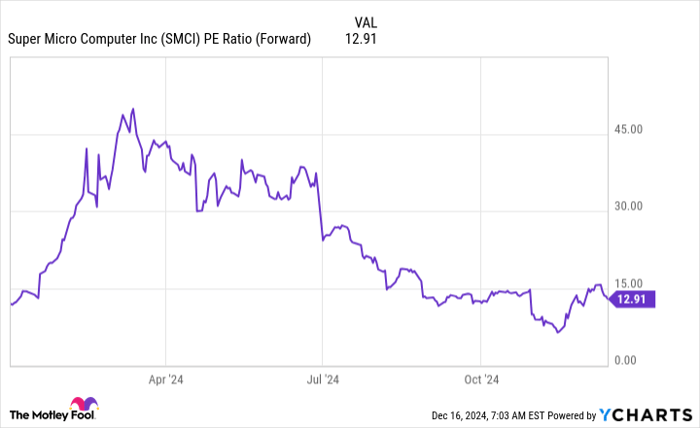

Furthermore, Supermciro's stock wasn't all that expensive. It entered 2024 trading at a mere 12 times forward earnings. So, it was primed for upside from a valuation standpoint as well.

In the first half of the year, Supermicro pretty much nailed those expectations, which caused the stock to soar. However, after its gross margin started to narrow and its valuation got a bit frothy, the stock started to fall.

But nothing made it fall faster than its supposed accounting issues.

After short-seller Hindenburg Research published a report claiming Supermicro committed accounting fraud allegations, and Supermicro's management team delayed filing its end-of-year form 10-K, the stock nose dived. While investors didn't know what to expect, the optics didn't look good. In another blow for Supermicro, its auditor resigned, saying it couldn't trust what management was telling it.

To most investors (including myself), this all but confirmed that Supermicro was cooking its books. But that turned out not to be the case.

A special committee led by a forensic accounting firm found no wrongdoing by Supermicro but recommended replacing the chief financial officer, which it is now in the process of doing. After that report was published, the stock quickly climbed back into positive territory and now finds itself in a familiar position heading into 2025.

Supermicro trades at a similar valuation as in early 2024

The stock now trades for 12.9 times forward earnings -- nearly the same as the valuation as it entered 2024.

SMCI PE Ratio (Forward) data by YCharts

It also has the same tailwinds: AI computing servers are in red-hot demand. Plus, Supermicro's liquid-cooled technology is much more efficient than its competitor's air-cooled versions. Using Supermicro's liquid-cooled racks provides up to 40% energy savings and 80% space savings, drastically reducing the cost of building out a server room.

Wall Street also expects solid growth for fiscal year 2025 (ending June 31, 2025), with revenue forecast to rise nearly 70%. But is that enough to persuade investors who got burned to invest in Supermicro again? I'd say no.

Many investors (including large institutions) steer clear of a company for many years after accounting fraud allegations, regardless of whether they are true or not. There are far too many other attractive investing options available to take on excess risk by investing in Supermicro. As a result, I doubt if Supermicro will repeat 2024's performance in 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $334,266!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,976!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $479,727!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.