A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

| "market breadth starting to tick back up but still below the late Dec high" -Piper Sandler

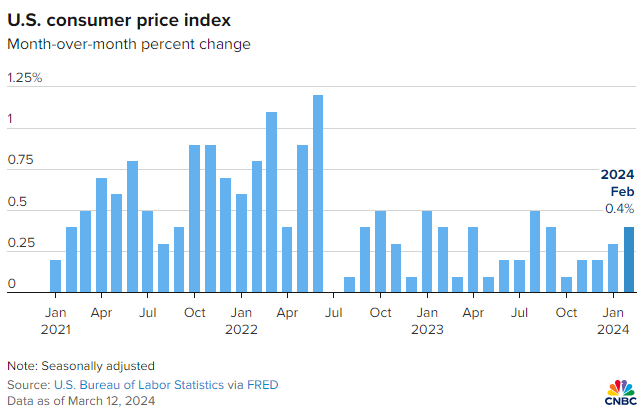

| stubborn inflation: Consumer prices +0.4% in Feb and +3.2% from a year ago -CNBC

Inflation Picks Up to 3.2% in Unexpected Turn Higher

Core prices, which exclude food & energy items in an effort to better track inflation’s underlying trend, +3.8% from a year earlier -WSJ

"inflation concerns were heightened by the New York Fed’s latest Survey of Consumer Expectations, which showed medium- and long-term expectations rising again in February" -DB's Jim Reid

* source: CNBC

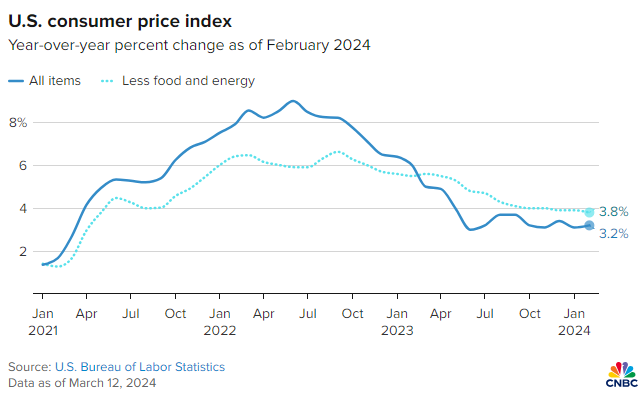

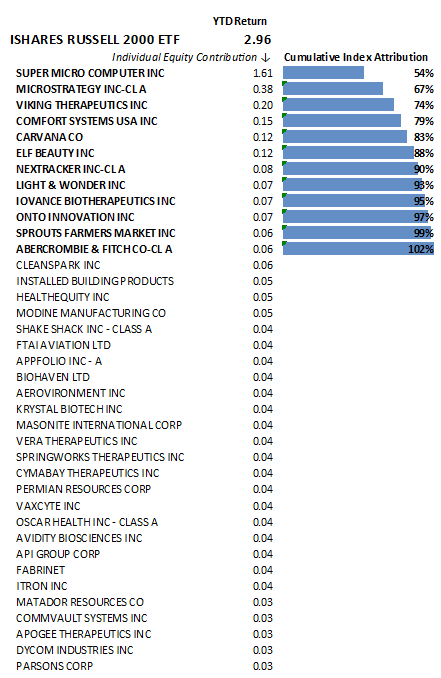

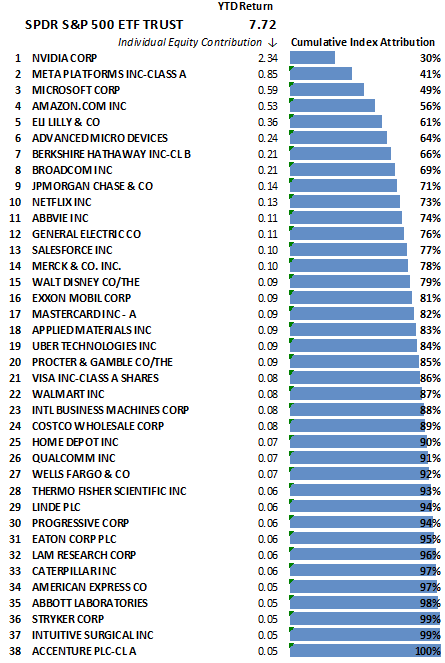

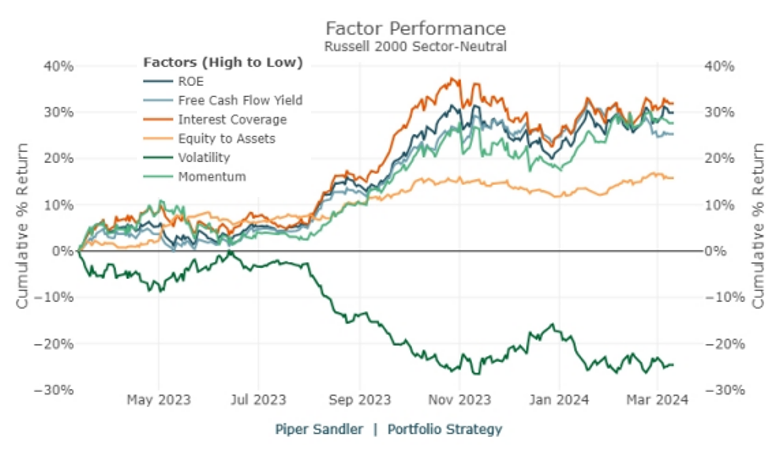

| Concentration risk: "The S&P 500 gets all the attention with regards to return concentration with NVDA’s 30% contribution YTD, but the Russell 2000 has far more concentrated returns in 2024, despite a far LESS concentrated market."

-Piper Sandler, Michael Kantrowitz

* source: Piper Sandler, Michael Kantrowitz

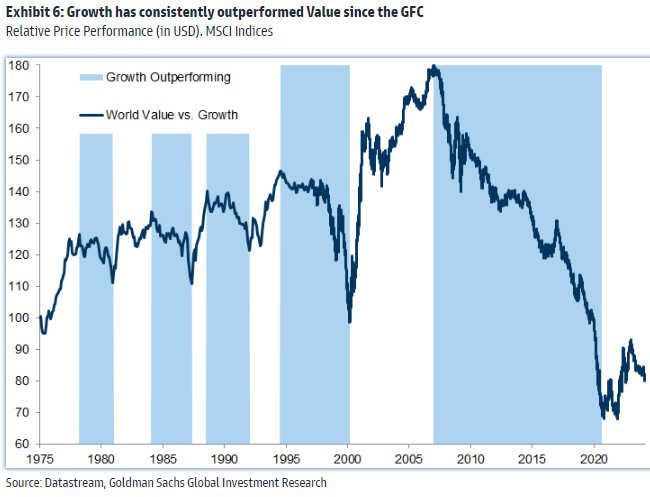

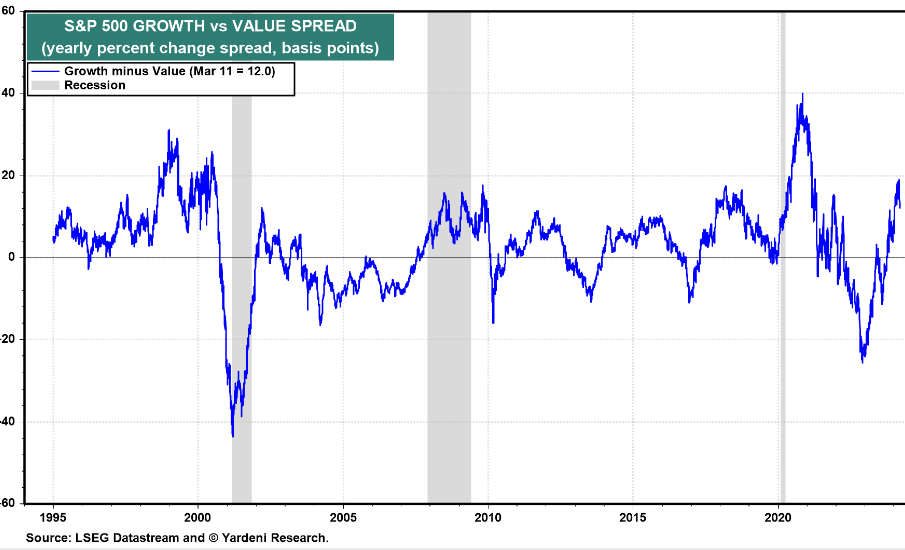

| Will value stocks make a comeback? will higher interest rates usher in outperformance of value stocks?

* source: Goldman Sachs Global Investment Research

* source: Yardeni Research

| #QualityMatters | The Small Cap Quality Momentum Trade Continues: the momentum factor looks just like profitability, interest coverage, free cash flow yield and strong balance sheets - all quality factors

* source: Piper Sandler

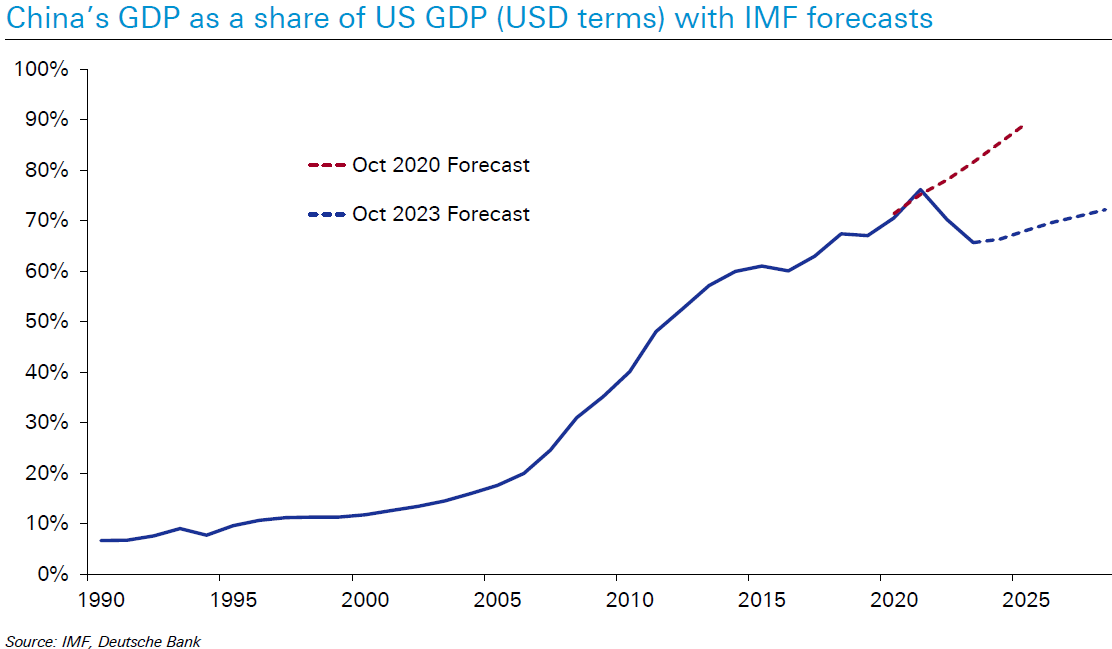

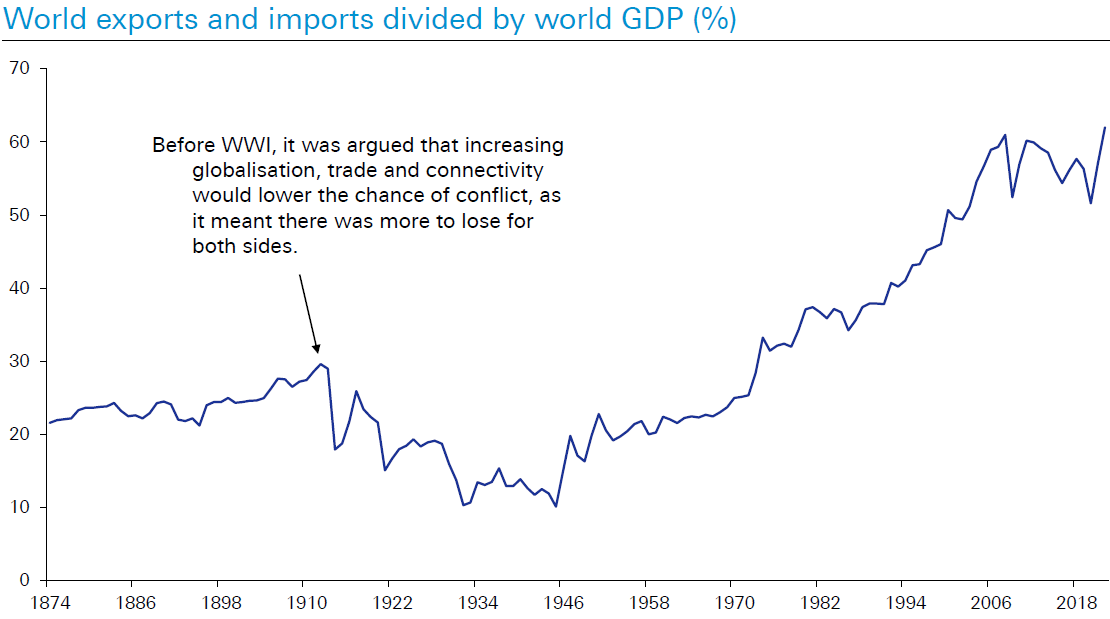

| Food for thought | from Deutsche Bank's Geopolitics: 2000 years of long long-term charts

"Slowing growth in China, and faster growth in the US has likely slowed this"

We live in a more interconnected world...

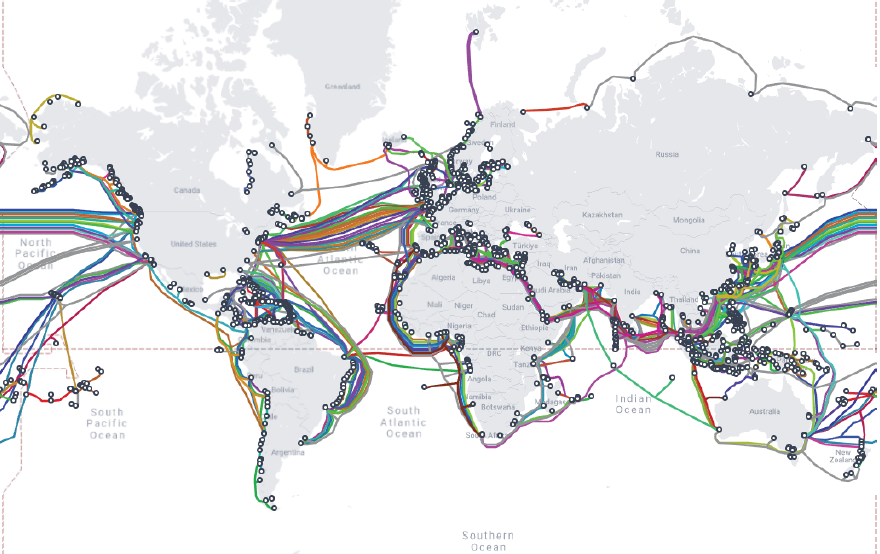

Global submarine data cables = 21st century global connectivity

* source: Deutsche Bank

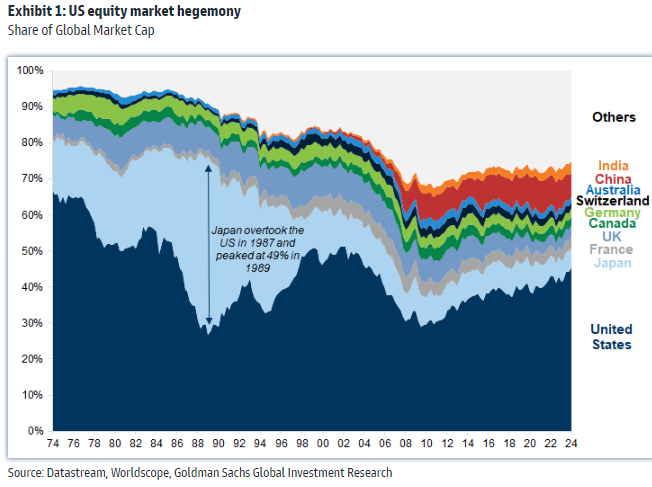

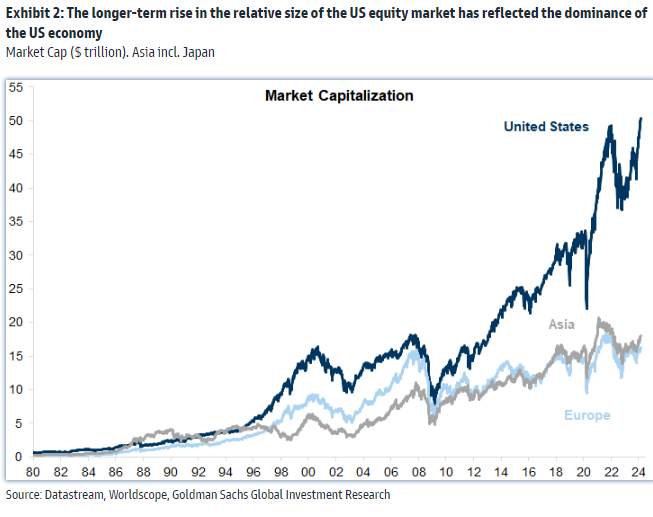

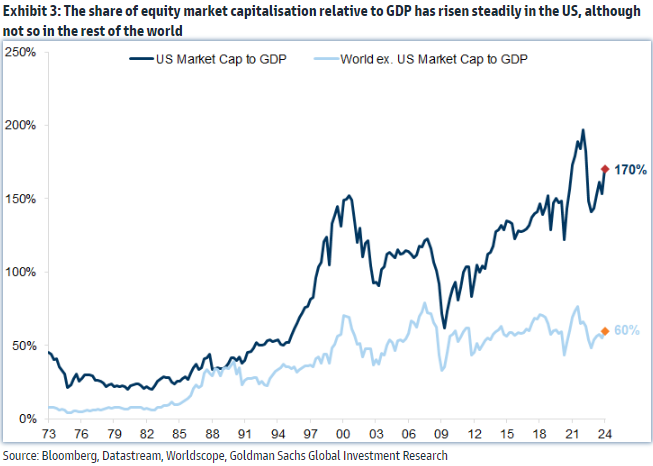

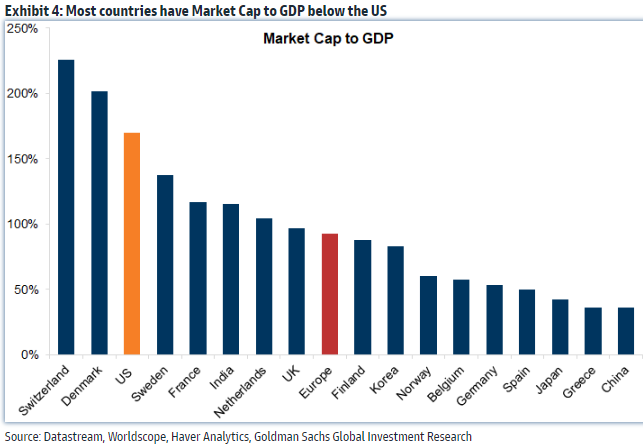

| Food for thought | "The US equity market has seen an extraordinary rise in value since the global financial crisis (GFC), strongly outpacing that of other major markets, and taking its share of the global equity market to 50%."

* source: Goldman Sachs Global Investment Research

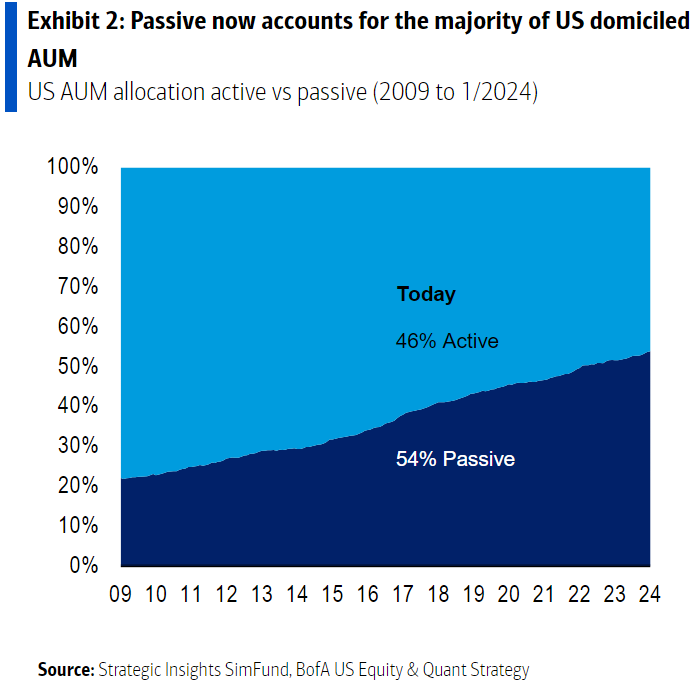

| Passive/indexers market share continues to grow...

* source: BofA

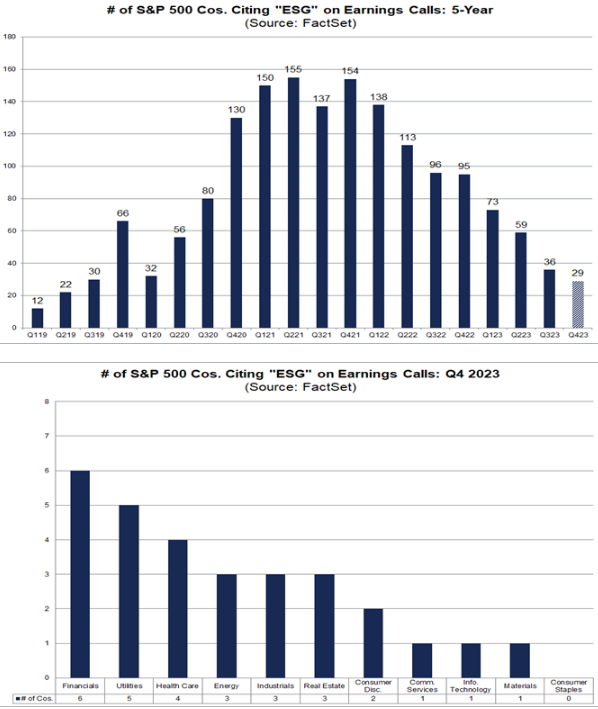

| Lowest number of S&P500 companies citing “ESG” on earnings calls since Q2 2019

* source: Factset Insight

1) KEY TAKEAWAYS

1) Equities MIXED | Oil + Dollar + TYields HIGHER | Golder LOWER

"Private equity groups globally are sitting on a record 28,000 unsold companies worth more than $3tn, as a sharp slowdown in dealmaking creates a crunch for investors looking to sell assets." -FT

DJ +0.2% S&P500 +0.5% Nasdaq +0.6% R2K -0.1% Cdn TSX -0.4%

Stoxx Europe 600 +0.4% APAC stocks MIXED, 10YR TYield = 4.149%

Dollar HIGHER, Gold $2,153, WTI +0%, $78; Brent +0%, $82, Bitcoin $72,276

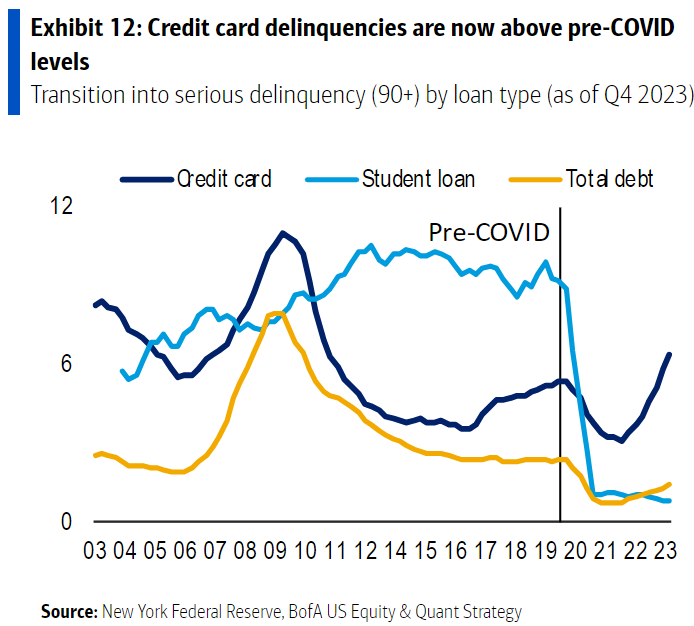

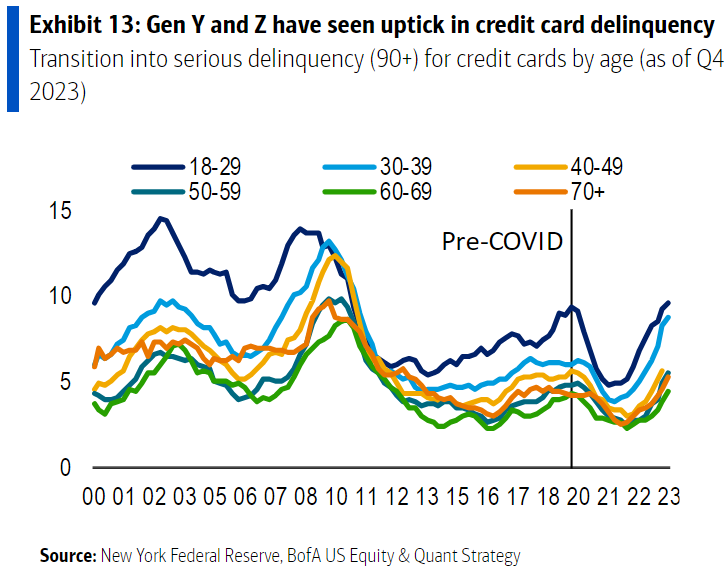

2) Credit card delinquencies rising - Gen Y and Z biggest contributors...

* source: BofA

3) THIS WEEK:

"The US CPI and retail sales reports will be the key data releases.

In Europe, the focus will be on the monthly GDP and labour market indicators in the UK.

Over in Asia, investors will also pay attention to the 1-yr MLF rate announcement

in China as well as signals from wage talks in Japan."

-Deutsche Bank

* source: Barclays' Emmanuel Cau

2) MARKETS, MACRO, CORPORATE NEWS

- US CPI won’t inspire fed to cut rates, Bloomberg Economics says-BBG

- Trump pledges to get tough with tariffs again if elected-CNBC

- UK jobs market shows signs of cooling in relief for BOE-BBG

- Australia business conditions improve in Feb, prices rise-RTRS

- BOJ considering March hike with outcome too close to call, sources say-BBG

- BOJ chief Ueda slightly tones down optimism on economy-RTRS

- BOJ to offer guidance on bond buying pace upon ending YCC-RTRS

- ECB is leaning toward keeping banks' minimum reserve level at 1%-BBG

- BoE's Mann: long way for inflation pressures to be consistent 2% target-RTRS

- Nvidia ETF that delivers double gains sees record flows-BBG

- BofA strategists boost S&P 500 profit forecast to join top bulls-BBG

- Options traders’ unease focuses on CPI more than Fed, Citi says-BBG

- Chinese stocks gain 20% from lows, fueling market bottom calls-BBG

- Crypto product inflows soar to record high, CoinShares says-BBG

- US will ‘do whatever it takes’ to curb China tech, Raimondo says-BBG

- House to move ahead with bill targeting TikTok as Trump flips to oppose it-NYT

- US steel unions urge Joe Biden to open probe into Chinese shipbuilding-FT

- United States faces 'increasingly fragile world order,' spy chiefs say-RTRS

- Tension between Israel and US is rising with Gaza death toll-BBG

- F.A.A. audit of Boeing’s 737 Max production found dozens of issues-NYT

- FTC’s Kroger-Albertsons merger suit set for trial in August-BBG

- Siemens’s €3 billion motor unit said to draw Nidec, KPS bids-BBG

- Mercedes-Benz boss calls for Brussels to cut tariffs on Chinese EVs-FT

- Tesla will take some time for production at German factory fully resume-RTRS

- National Bank of Canada weighs options for Cambodian unit-BBG

- PSC Insurance rides sector growth as Goldman fields inbound interest-AFR

- China's champion gymnast Li Ning considers taking company private-RTRS

- Oracle set for biggest gain since 2021 on cloud revenue growth-BBG

- Advance Auto Parts reaches deal with Dan Loeb’s Third Point, Saddle Pointfor three board seats-CNBC

Oil/Energy Headlines: 1) Oil prices stall after funds complete short covering-RTRS2) OPEC, IEA at most divided on oil demand since at least 2008-RTRS 3) Russia’s crude shipments rebound to the highest level this year-BBG 4) Thai refiners expect oil product demand to pick up further, refining margins to narrow in 2024-PLATTS 5) Russia’s Sokol crude backlog clears slowly as cargoes head to China-BBG

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.