Stryker Corporation SYK is well poised for growth, backed by a robust robotic arm-assisted surgery platform, Mako, and a diversified product portfolio. However, pricing pressure remains a concern.

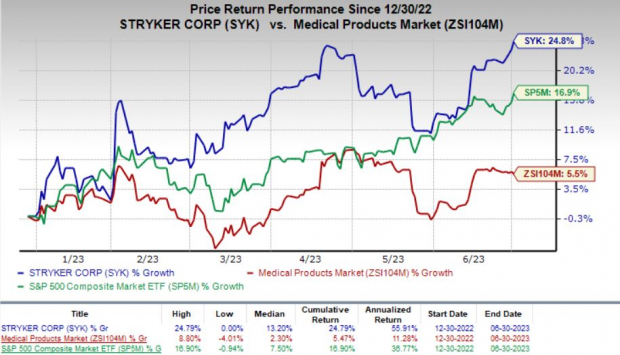

Shares of this Zacks Rank #3 (Hold) company have risen 24.8% year to date compared with the industry’s 5.5% growth. The S&P 500 Index has increased 16.9% in the same time frame.

Stryker, with a market capitalization of $115.58 billion, is one of the world’s largest medical device companies operating in the orthopedic market. It anticipates earnings to improve 9.4% in the next five years. SYK’s earnings yield of 3.3% compares favorably with the industry’s (2.3%).

Image Source: Zacks Investment Research

The company’s earnings surpassed estimates in two of the trailing four quarters and missed twice, delivering an average surprise of 1.60%.

Robust performance in the last two quarters enabled SYK’s shares to gain nearly 50% in the past year. A potential rise in demand for surgeries and a broad spectrum of products are likely to drive its share price higher.

The company reached a new 52-week high in the past few trading sessions. This, along with a favorable Zacks Rank, makes it worth retaining in one's portfolio.

Let’s delve deeper.

What’s Favoring Stryker’s Growth?

The company continues to witness strong demand for Mako and a healthy order book amid recovery in procedure-demand following the COVID-19 pandemic. This is due to the platform’s unique and promising features. These developments, in turn, enable Stryker to sustain the momentum in robotic-treatment sales.

SYK is committed to the continued expansion of Mako, whose installations touched record high during the fourth quarter. It remains confident about robust growth in Mako revenues in 2023, on the back of new launches and software upgrades.

The first-quarter results reflected the company’s efforts toward promoting the advanced surgery platform.

Stryker is focused on continued expansion of Mako and is progressing well with it in international markets. These initiatives reflect the demand for Stryker’s unique arm-assisted robotic technology.

The company also boasts a diversified product portfolio. Its wide range of products protects it against any significant sales shortfall during economic turmoil.

Stryker’s significant exposure to robotics and artificial intelligence for healthcare and Medical Mechatronics have helped it stay ahead of the curve in the MedTech space. The company’s portfolio includes Mako as well as products for hip and knee surgeries.

On its first-quarterearnings call Stryker stated that procedural volumes continue to recover in most countries after getting adversely affected last year due to COVID-19.

Although hospital staffing pressure remains in certain regions, the company expects this problem to resolve gradually. This improvement, in turn, will likely lead to higher procedures in 2023.

Per management, Stryker’s constant support for customers and focus on innovation poise it for growth as the effect of the pandemic subsides. In first-quarter 2023, its adjusted research and development expenses were 6.5% of net sales, highlighting its strong commitment to innovation. According to the company, this is likely to drive new product launches.

In September 2022, SYK launched a new Spine Guidance Software — Q Guidance System — for spine application. The Q Guidance system has shown promising launch uptake during the first quarter.

Moreover, the company’s cost-cutting initiatives to improve margins and lessen inflationary pressure look promising. The adjusted selling, general and administrative expenses during first-quarter 2023 were 35.6% of net sales, expanding 40 basis points year over year.

What’s Hurting the Stock?

An unfavorable currency rate fluctuation poses a persistent threat to Stryker’s core businesses. Foreign currency had a 2.2% unfavorable impact on sales during the first quarter. The trend is likely to continue in the second half of 2023 but at a slower pace. Stryker is also facing inflationary pressure, leading to lower margins.

Estimate Trend

The Zacks Consensus Estimate for 2023 earnings per share is pegged at $10.16, indicating year-over-year growth of 8.8%. The same for revenues is pinned at $19.95 billion, implying an 8.1% improvement year over year.

Stryker Corporation Price

Stry-ker Corporation price | Stryker Corporation Quote

Stocks to Consider

Some better-ranked stocks from the broader medical space are Hologic HOLX, Alcon ALC and Perrigo PRGO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has an estimated growth rate of 5% for fiscal 2024. The company’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 27.32%.

HOLX’s shares have risen 8.4% year to date compared with the industry’s 6.4% growth.

Alcon has an estimated long-term growth rate of 14.9%. Its earnings surpassed estimates in three of the trailing four quarters and met the same once, delivering an average surprise of 8.85%.

ALC’s shares have rallied 17.2% year to date compared with the industry’s 6.4% growth.

Perrigo’s earnings are expected to improve 24.6% in 2023. The strong momentum is likely to continue in 2024 as well. PRGO’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, delivering an average negative surprise of 0.79%.

The company’s shares have lost 1.9% year to date against the industry’s 4.8% growth.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Stryker Corporation (SYK) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.