While not a mind-blowing move, it is good to see that the Sage Therapeutics, Inc. (NASDAQ:SAGE) share price has gained 19% in the last three months. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 74% in that time. So it sure is nice to see a bit of an improvement. But the more important question is whether the underlying business can justify a higher price still.

On a more encouraging note the company has added US$140m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Given that Sage Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Sage Therapeutics saw its revenue grow by 42% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 20% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

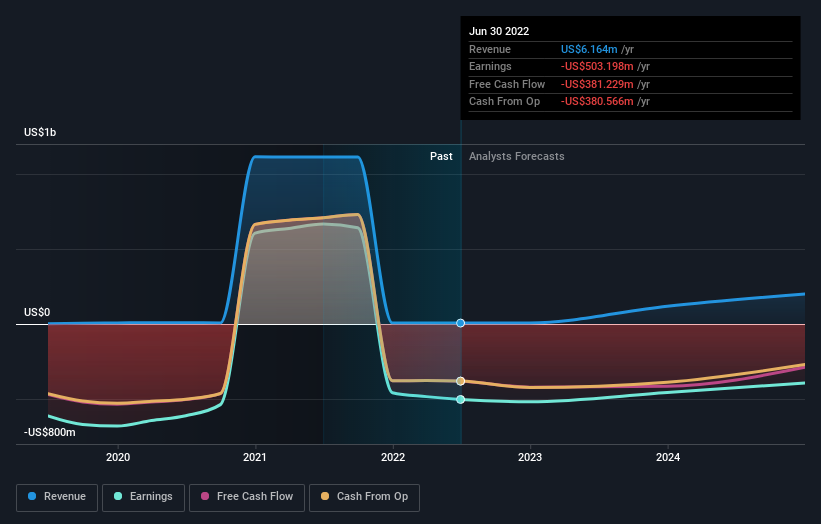

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Sage Therapeutics stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While it's never nice to take a loss, Sage Therapeutics shareholders can take comfort that their trailing twelve month loss of 7.6% wasn't as bad as the market loss of around 16%. What is more upsetting is the 6% per annum loss investors have suffered over the last half decade. While the losses are slowing we doubt many shareholders are happy with the stock. It's always interesting to track share price performance over the longer term. But to understand Sage Therapeutics better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Sage Therapeutics you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.