The industrial products and basic materials sectors saw a nice spike today, particularly among U.S. stocks as their foreign counterparts fell on news of President Trump’s plan to implement a 25% tariff on imported steel and aluminum.

Along with the likelihood of higher commodity prices, U.S. manufacturers will benefit from increased demand for domestically produced metals with Trump’s tariffs making it more expensive for foreign producers.

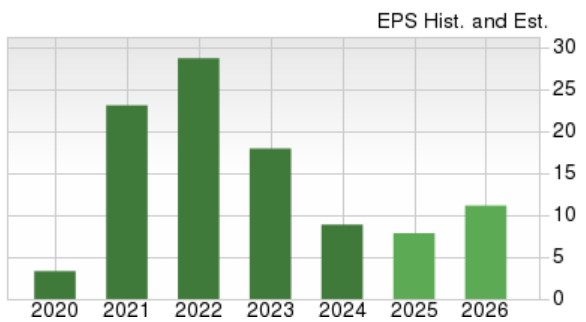

Nucor’s Market Dominance: As the largest steel producer in the United States, Nucor's NUE stock has been a Wall Street darling at times and is certainly worth keeping an eye on. Nucor’s diverse steel production and profitability has made it a favorite among hedge funds and institutional investors as well. Notably, Nucor’s annual earnings are currently expected to dip 11% this year but are projected to rebound and soar 42% in fiscal 2026 to $11.18 per share.

Image Source: Zacks Investment Research

U.S. Steel Updates: Last Friday, President Trump advised that Japanese steel producer Nippon Steel would not be allowed to acquire U.S. Steel X but would be able to invest in the company rather than take direct ownership. Vowing to protect and revitalize America’s steel industry, Trump stated U.S. Steel is in a prime position to benefit from his tariff policies as the nation’s second-largest steel producer.

Cleveland-Cliffs is a Dark Horse: Being North America’s largest producer of iron ore, Cleveland-Cliffs CLF has made several attempts to acquire U.S. Steel including a potential partnership with Nucor to do so. These attempts were deemed as “low-ball” offers and were swiftly rejected but a more favorable operating environment would certainly help Cleveland-Cliffs expand its steel production.

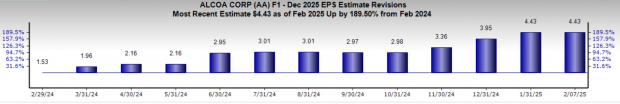

Alcoa’s Turnaround Could Gain More Steam: The rebound in aluminum prices has fueled an impressive turnaround in Alcoa’s AA operating efficiency and looks set to continue at Trump’s orders. As shown below, the trend of positive earnings estimate revisions has been compelling for Alcoa’s FY25 earnings outlook over the last year and correlates with AA shares rising over +30% during this period.

Image Source: Zacks Investment Research

Other Stocks to Watch

Two other noteworthy stocks to watch are Steel Dynamics STLD and Kaiser Aluminum KALU. Steel Dynamic’s is among the leading steel producers and metal recyclers in the U.S., with Kaiser Aluminum being a leader in semi-fabricated specialty aluminum products for industrial applications, aerospace, general engineering, and automotive markets.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Alcoa (AA) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Cleveland-Cliffs Inc. (CLF) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Kaiser Aluminum Corporation (KALU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.