Stock Dilution

What is Stock Dilution?

Stock dilution occurs when a company issues additional shares, resulting in a decrease in the ownership percentage of existing shareholders.

The reduction in ownership can significantly impact the value of shareholders' investments and the financial statements of the company.

It can happen through stock offerings or the exercise of stock options, which increases the total number of shares available and diminishes the ownership percentage of existing shareholders.

Essentially, each existing share represents a smaller portion of the company. Companies may engage in stock dilution to raise capital for expansion or to repay debts.

Investors pay close attention to stock dilution as it can impact the value of their investments and alter the ownership structure of the company.

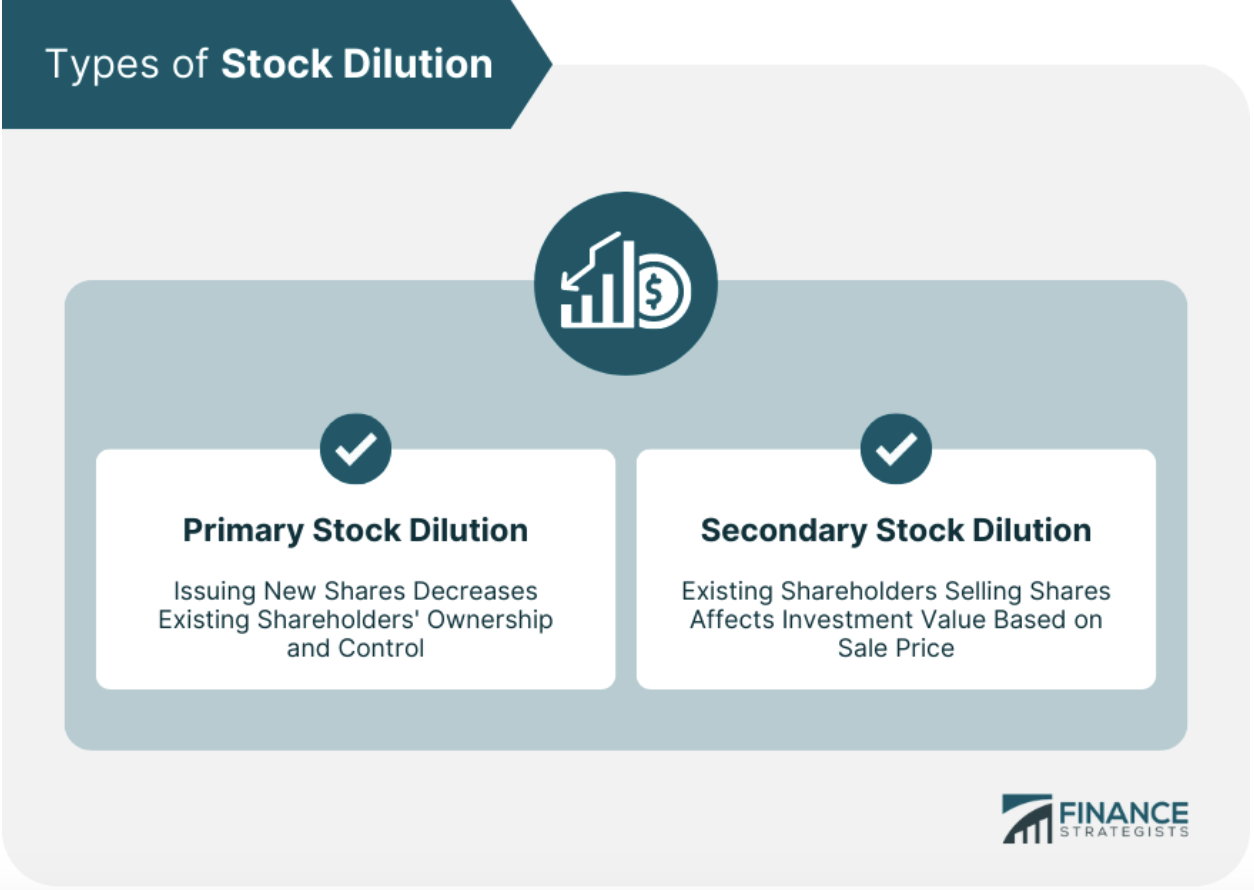

Types of Stock Dilution

Below are the types of stock dilution:

Primary Stock Dilution

Primary stock dilution occurs when a company issues new shares to raise additional capital. The issuance of new shares can provide additional capital that can be used for growth and expansion.

However, this additional capital comes at a cost: the dilution of existing shareholders. As new shares are issued, the percentage of ownership of each existing shareholder decreases.

This can lead to a decrease in the value of their investment, as well as a loss of control over the company's operations.

Secondary Stock Dilution

Secondary stock dilution occurs when existing shareholders sell their shares to new investors. The impact of secondary stock dilution on the value of a shareholder's investment depends on the price at which the shares are sold.

If the shares are sold at a higher price than their original purchase price, the shareholder can make a profit.

However, if the shares are sold at a lower price than their original purchase price, the shareholder can experience a loss.

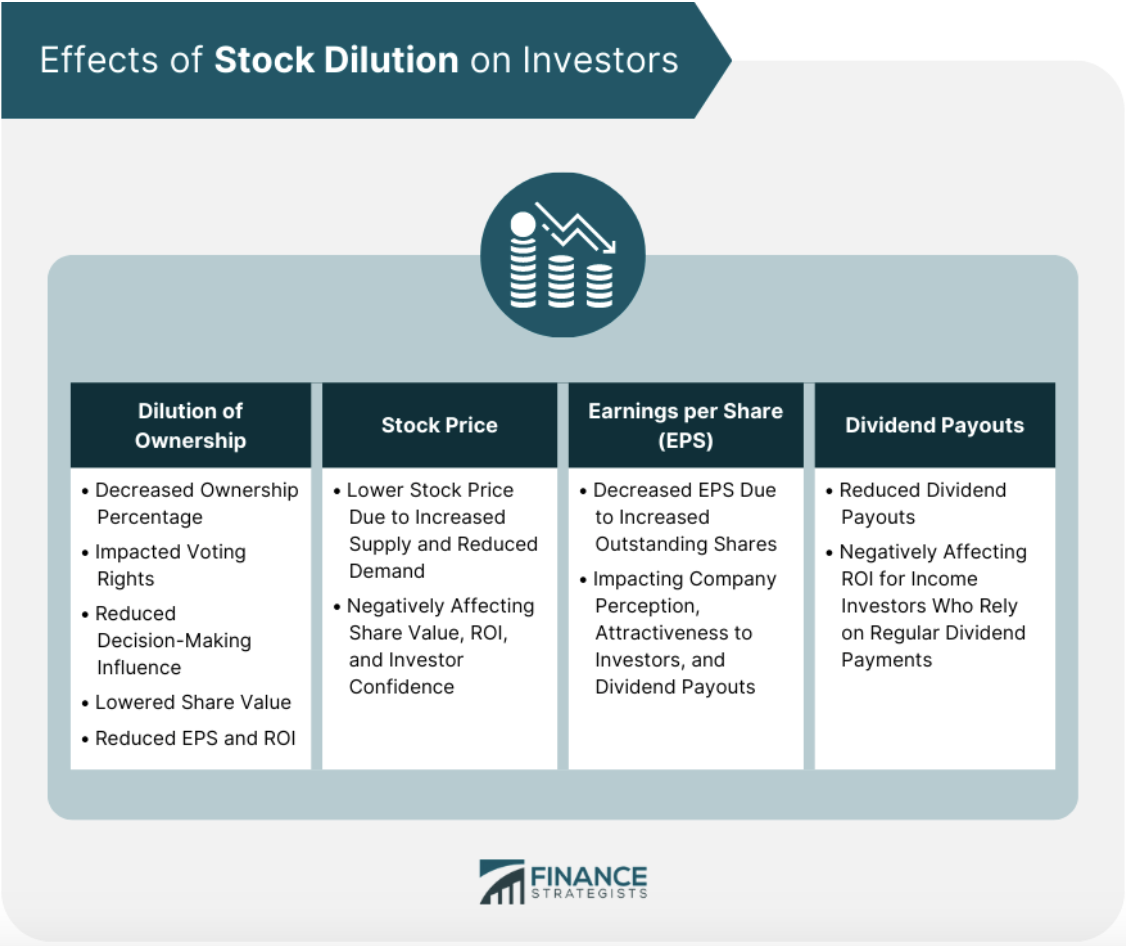

Effects of Stock Dilution on Investors

Stock dilution can have several effects on investors, depending on the extent of the dilution and the circumstances surrounding the issuance of new shares.

Dilution of Ownership

As new shares are issued, the percentage of ownership of each existing shareholder decreases, leading to a dilution of ownership.

This can impact an investor's voting rights, as well as their ability to influence the decision-making process of the company.

Dilution of ownership can also impact the value of an investor's shares, as the total value of the company is now divided among a greater number of shareholders.

This can reduce the Earnings Per Share and, consequently, the return on investment for shareholders.

Stock Price

Stock dilution can lead to downward spiral in stock price.

Since the total value of the company is now divided among a greater number of shareholders, stock dilution can lower the value of existing shares.

This can negatively impact the company's ability to raise additional capital, leading to a decline in investor confidence, and in turn may lower stock prices further.

Earnings Per Share (EPS)

The EPS can decrease as a result of stock dilution, leading to a lower return on investment.

This is because the EPS calculation takes into account the number of outstanding shares, and as new shares are issued, the denominator of the calculation increases.

This can lead to a decrease in the EPS, which can impact the perception of the company and its attractiveness to investors.

A lower EPS can also lead to a decrease in dividend payouts, which can further reduce the return on investment for shareholders.

Dividend Payouts

Dividend payouts may decrease as the number of outstanding shares increases, which can impact the attractiveness of the company to income investors.

This is because dividend payments are usually calculated on a per-share basis, and as the number of shares increases, the total amount of dividends paid out may decrease.

This can negatively impact the return on investment for income investors, who rely on regular dividend payments to generate income.

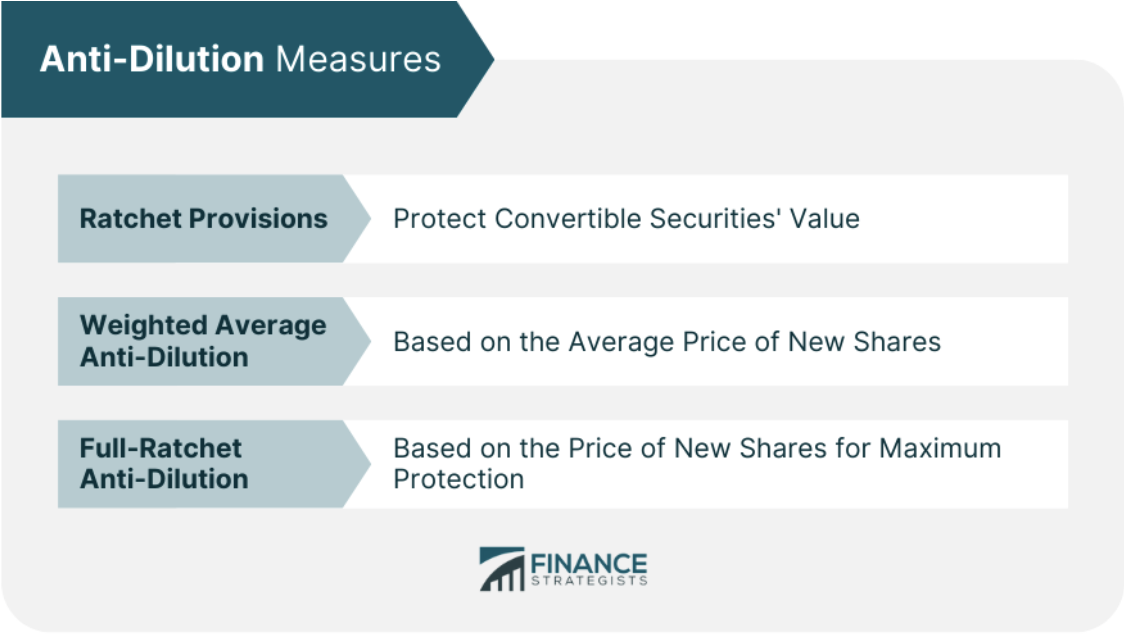

Anti-Dilution Measures

Anti-dilution measures are used to protect existing shareholders from the negative effects of stock dilution.

These measures can take several forms, including ratchet provisions, weighted average anti-dilution, and full-ratchet anti-dilution.

- Ratchet Provisions adjust the conversion price of convertible securities in the event of a subsequent issuance of shares at a lower price. This protects the value of the convertible securities, ensuring that existing shareholders are not unfairly diluted.

- Weighted Average Anti-Dilution adjusts the conversion price of convertible securities based on the average price of the new shares issued. This ensures that existing shareholders are not unfairly diluted if the new shares are issued at a lower price.

- Full-Ratchet Anti-Dilution adjusts the conversion price of convertible securities based on the price of the new shares issued. It provides maximum protection to existing shareholders, preventing their dilution even with new shares issued at lower prices.

Final Thoughts

Stock dilution is the reduction in existing shareholders' ownership percentage through the issuance of additional shares, carrying both risks and benefits for investors and companies.

Investors should be aware of the potential dilution of ownership and the subsequent impact on control and influence over company decisions.

Furthermore, the value of existing shares may decrease due to the spreading of earnings and ownership across a larger number of shares.

On the other hand, stock dilution can benefit companies by providing a capital infusion for growth initiatives, attracting new investors, and enabling flexibility for acquisitions.

However, misalignment of interests between existing shareholders and management may arise.

Anti-dilution measures can be implemented to protect existing shareholders from unfair dilution. Investors should carefully evaluate the risks and benefits associated with stock dilution before making investment decisions.

Understanding the effects of stock dilution on financial statements is essential, including its impact on balance sheets, income statements, and financial ratios.

FAQs

What is stock dilution, and how does it impact investors?

Stock dilution refers to a reduction in the ownership percentage of a shareholder in a company as a result of the issuance of new shares. It can impact investors by diluting their ownership, reducing the stock price, impacting earnings per share, and decreasing dividend payouts.

What are the different types of stock dilution?

The two primary types of stock dilution are primary and secondary. Primary stock dilution occurs when a company issues new shares to raise additional capital, while secondary stock dilution occurs when existing shareholders sell their shares to new investors.

What are anti-dilution measures, and how do they work?

Anti-dilution measures are used to protect existing shareholders from the negative effects of stock dilution. They can take several forms, including ratchet provisions, weighted average anti-dilution, and full-ratchet anti-dilution, and work by adjusting the conversion price of convertible securities to ensure that existing shareholders are not unfairly diluted.

How does stock dilution impact a company's financial statements?

Stock dilution can impact a company's financial statements by increasing the equity portion of the balance sheet, decreasing the value of existing shares, reducing earnings per share, and impacting ratios such as return on equity and price-to-earnings ratio.

Why is it important to understand stock dilution?

Understanding stock dilution is crucial for investors, business owners, financial analysts, and accounting professionals. It helps to make informed investment decisions, manage a company's finances effectively, comply with regulatory requirements, and protect existing shareholders from the negative effects of stock dilution.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.